Be a trusted financial advisor through the COVID recession

In the aftermath of COVID-19 many families and small businesses will be facing a fight for financial survival. What will you do to help your customers when they need you the most? You will undoubtedly be providing your customers with your essential products and services – credit extensions, loan repayment relief, emergency financial advice, refinancing advice and so on.

Don't forget that one of the most important things you can do is to give your customers the tools to be able to help themselves. Once you’ve solved their urgent issues, many of your customers will need to plan for the different financial life and build substantially different financial habits. And you can help them.

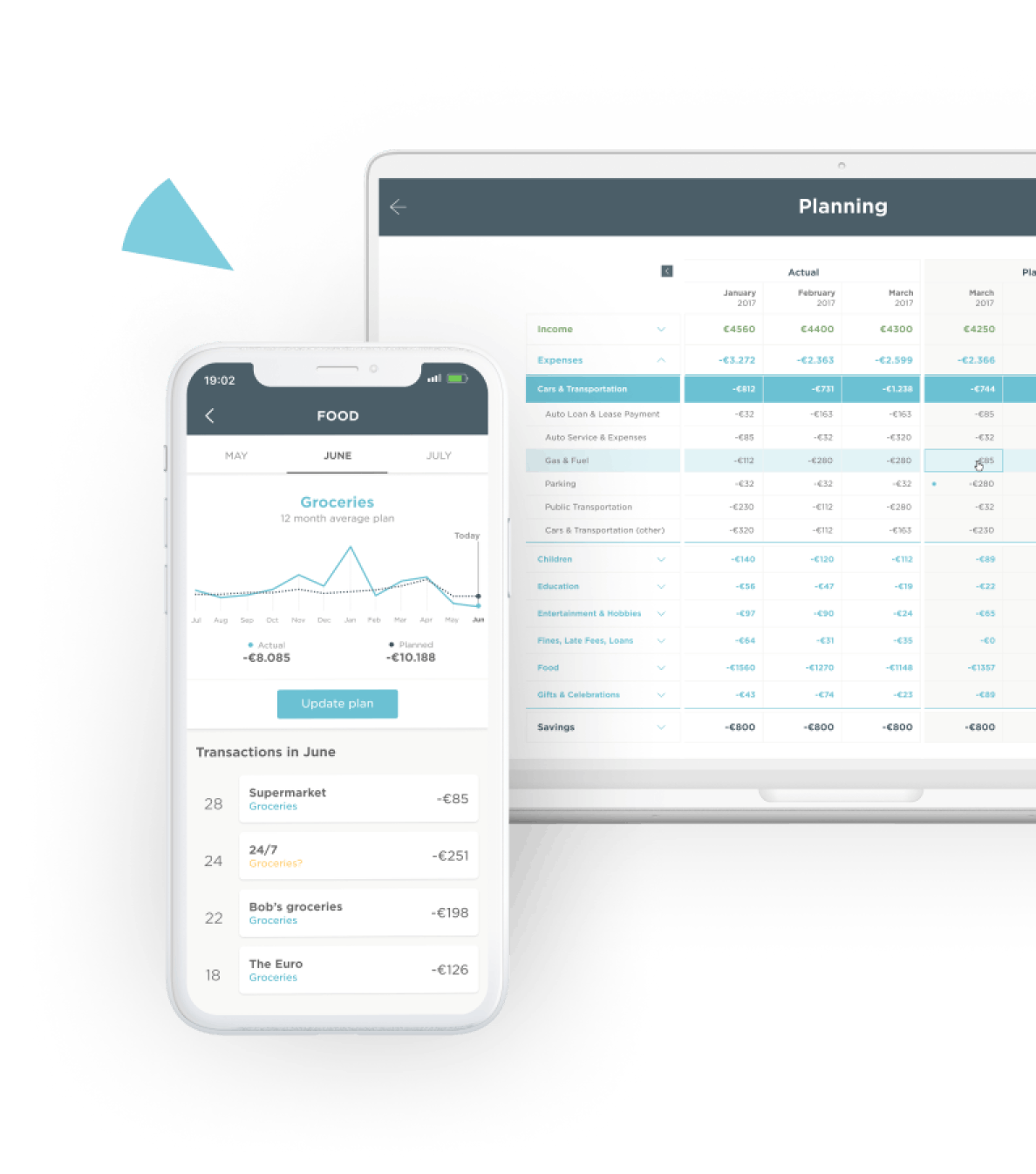

Advanced Financial Planning

It‘s not anyones favourite activity – but now we need it to survive. An effective budgeting tool needs to to be simple and intuitive with a high degree of automation

- Automatic generation of budget as a starting point

- Simple way to edit and plan inspired by spending averages

- Omnichannel progress tracking and budget adjustments

Financial Fitness

in a Post-Covid

Economy

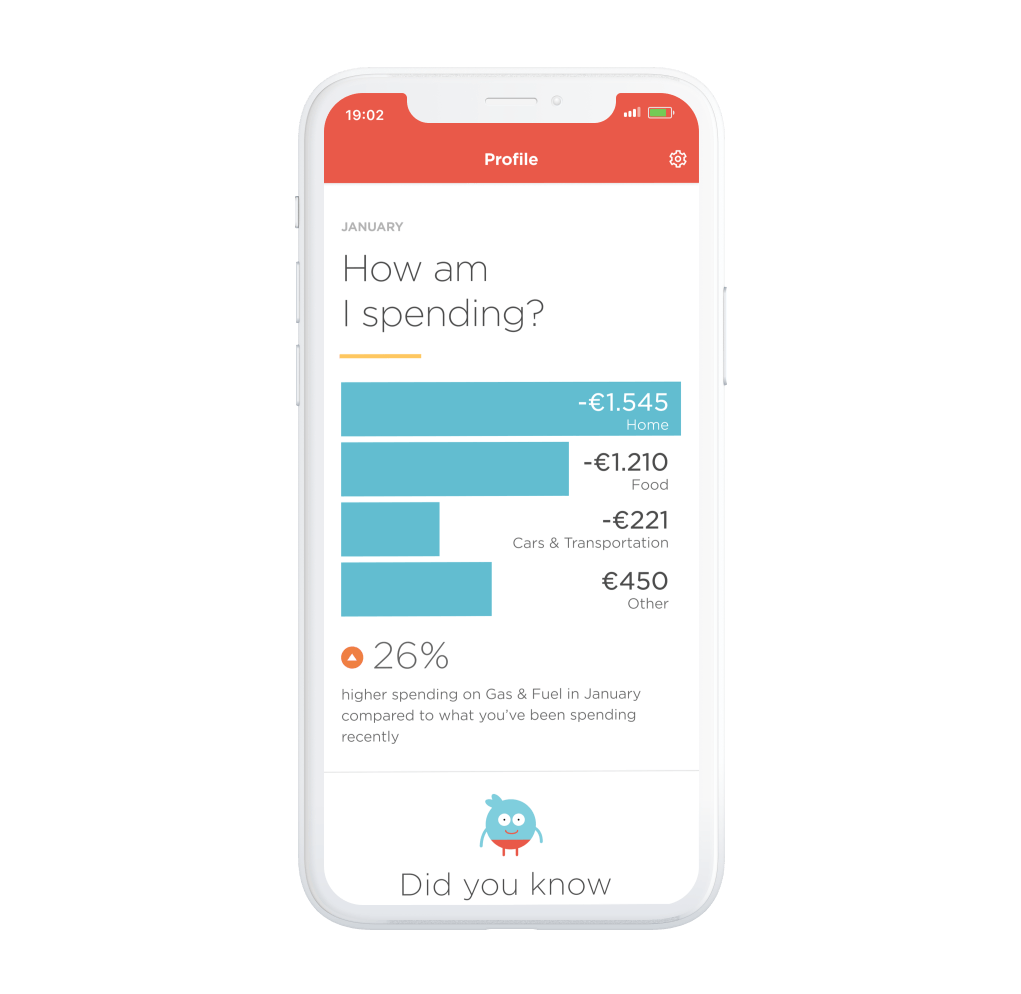

Spending Insights at Your fingertips

Help people to identify the simple stuff that makes big impact and encourage them to act. Finding the low-hanging fruit to get you started and the everyday things that keeps you going

- Simple financial reports to build a habit of awareness

- Peer-group comparisons to identify opportunities

- Personalized nudges with actionable insights at the exact right time

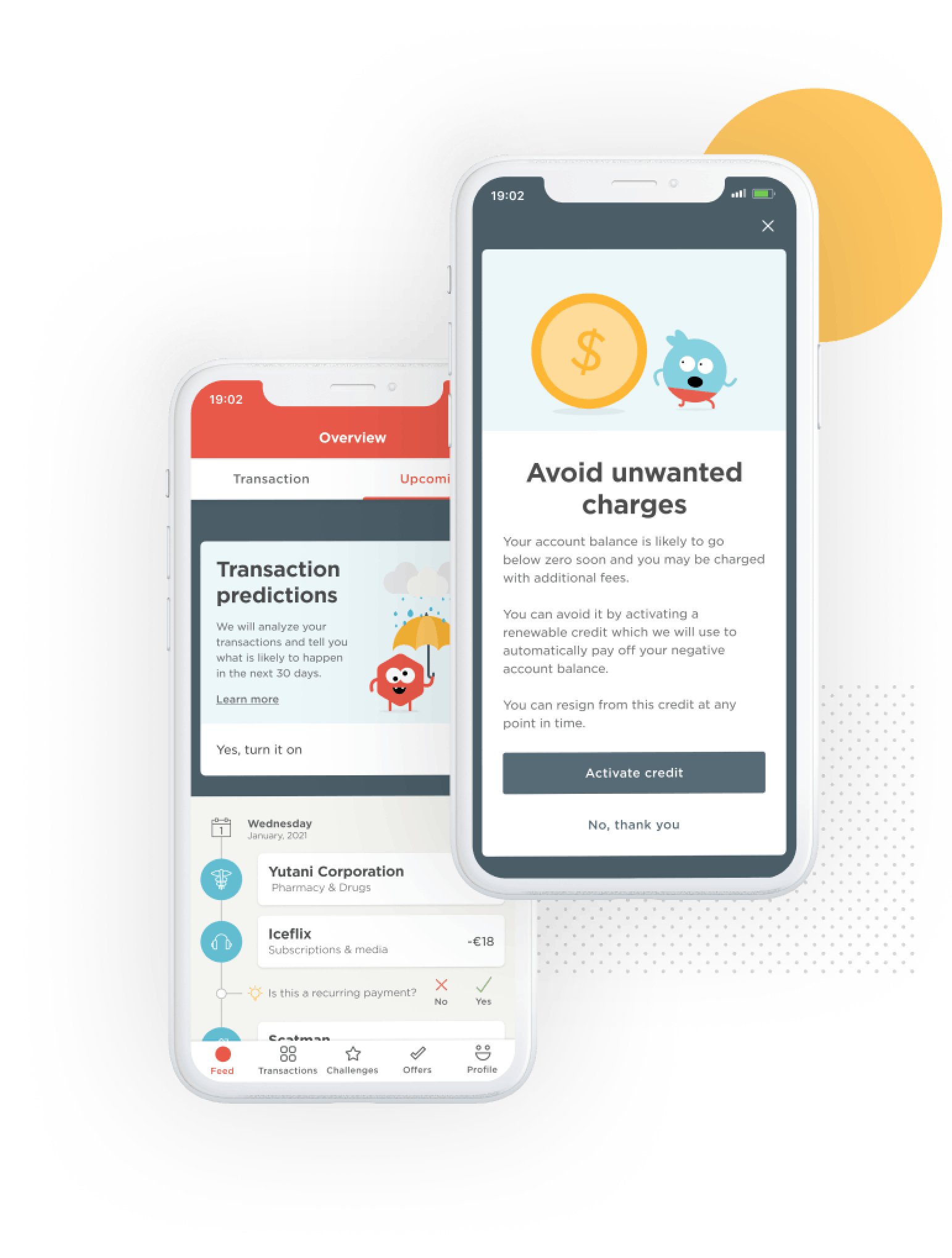

Cashflow Management & Left-To-Spend Formulas

Make it simple and easy for people to stay on top of what they can afford at any given time. Overdraft is a vicious circle and knowing your limit is key.

- Link standing orders and invoices and build overview of upcoming transactions

- Use AI to identify recurring transactions

- Build intuitive UX concepts to help people stay on top

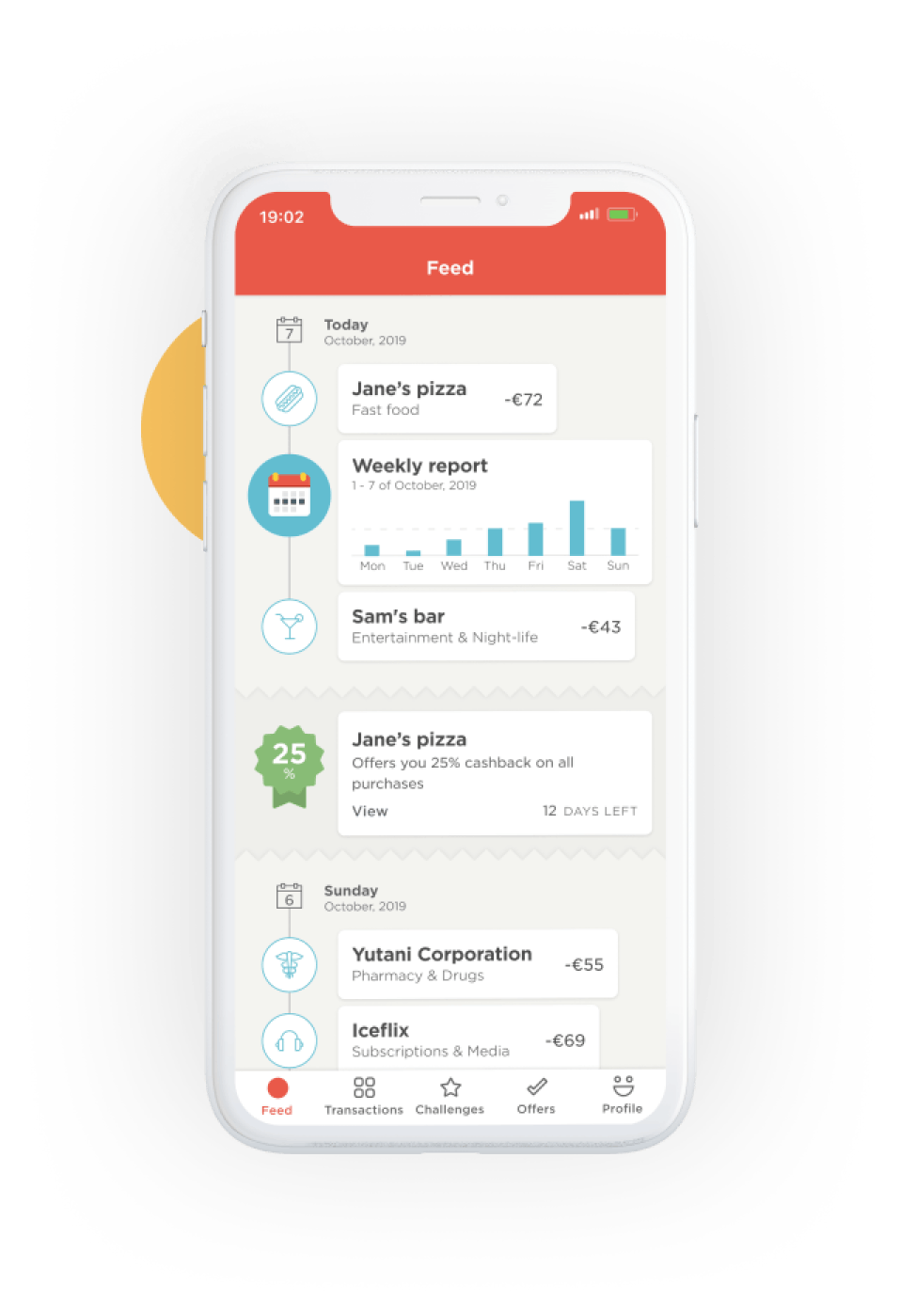

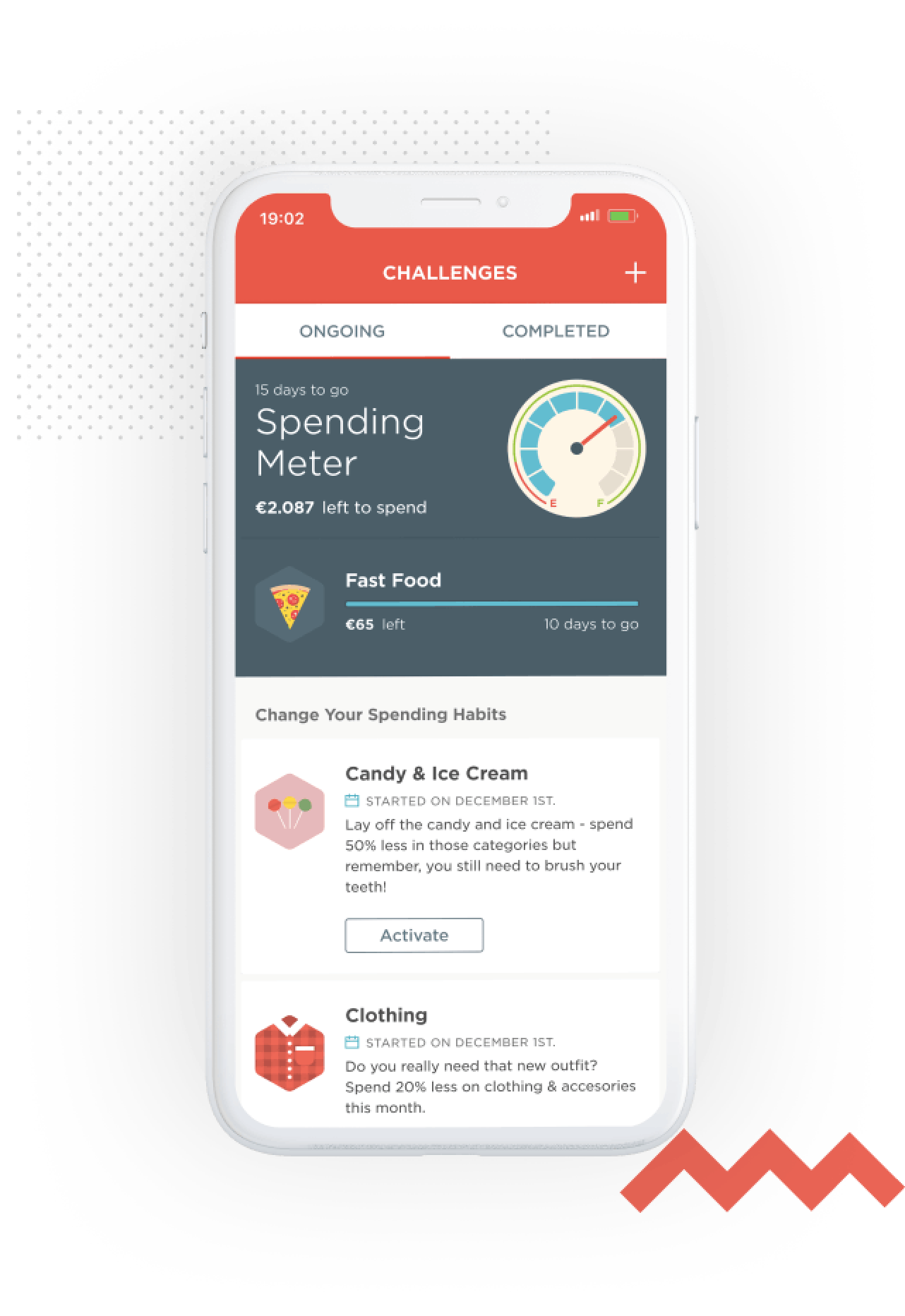

Gamified Personal Finance Fitness

Help people save by building fun and addictive personal finance habits. You would be surprised to see how fast you can cut your expenses by 20-30% if you put your mind to it.

- Category-based savings challenges

- Focus on making impact in small attainable increments

- Use community engagement to drive activity and impact

Small Business Cash-flow assistant

Now more than ever businesses need help managing cashflow. Give your business customers an instant view of company finances and enable them to take action.

- Help customers avoid last-minute liquidity problems

- Offer your customers the right credit and savings products at the right time

- Use community engagement to drive activity and impact

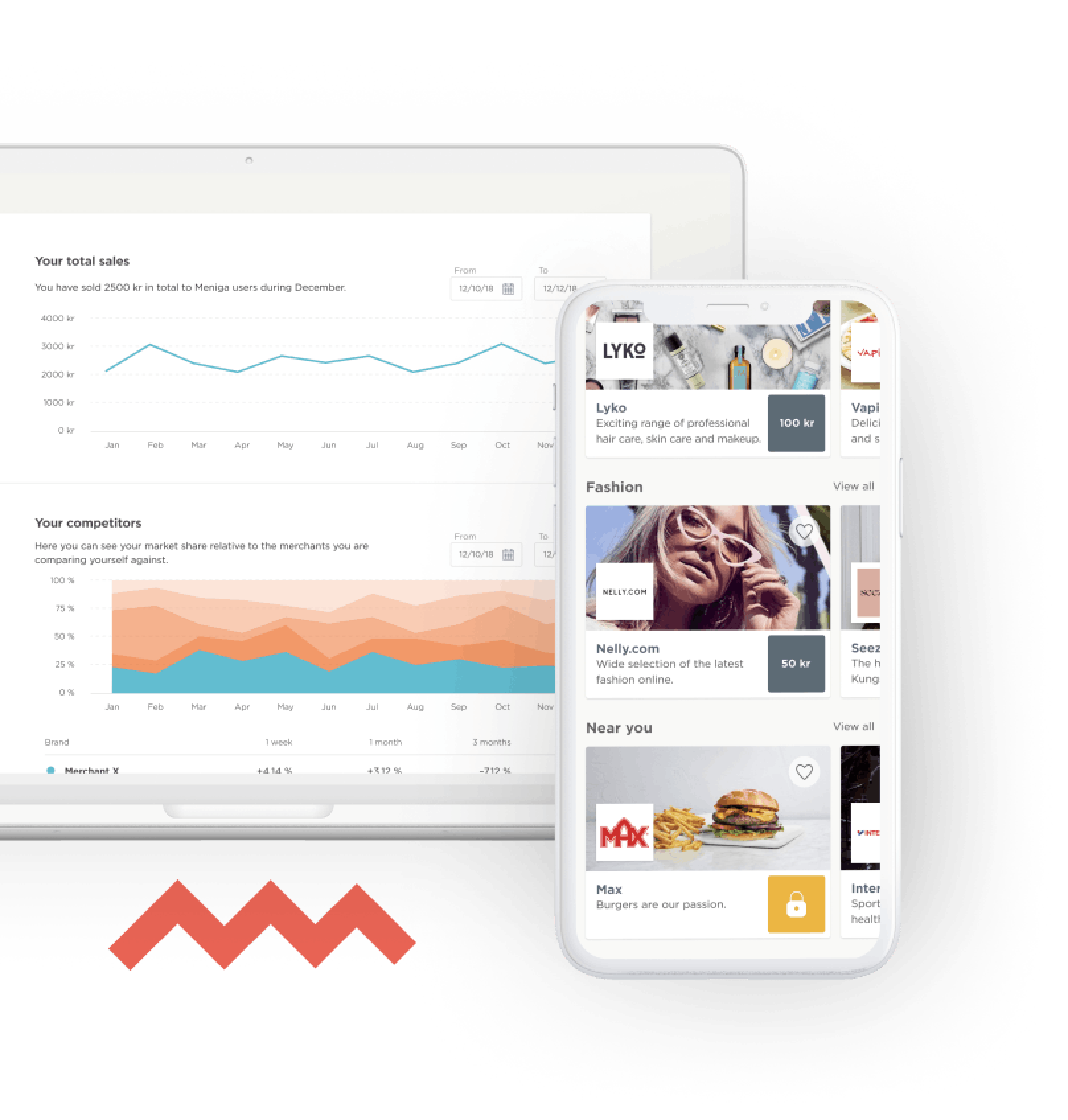

Cashback Rewards & Market Insights

Help your retail customers save up to €1.000 a year on things they actually want & need and your business customers maximise their marketing budget.

- Cashback rewards for things people want & need

- Self-service business campaign & insights portal

- Businesses pay only for performance

- Easy to understand market insights ready for action

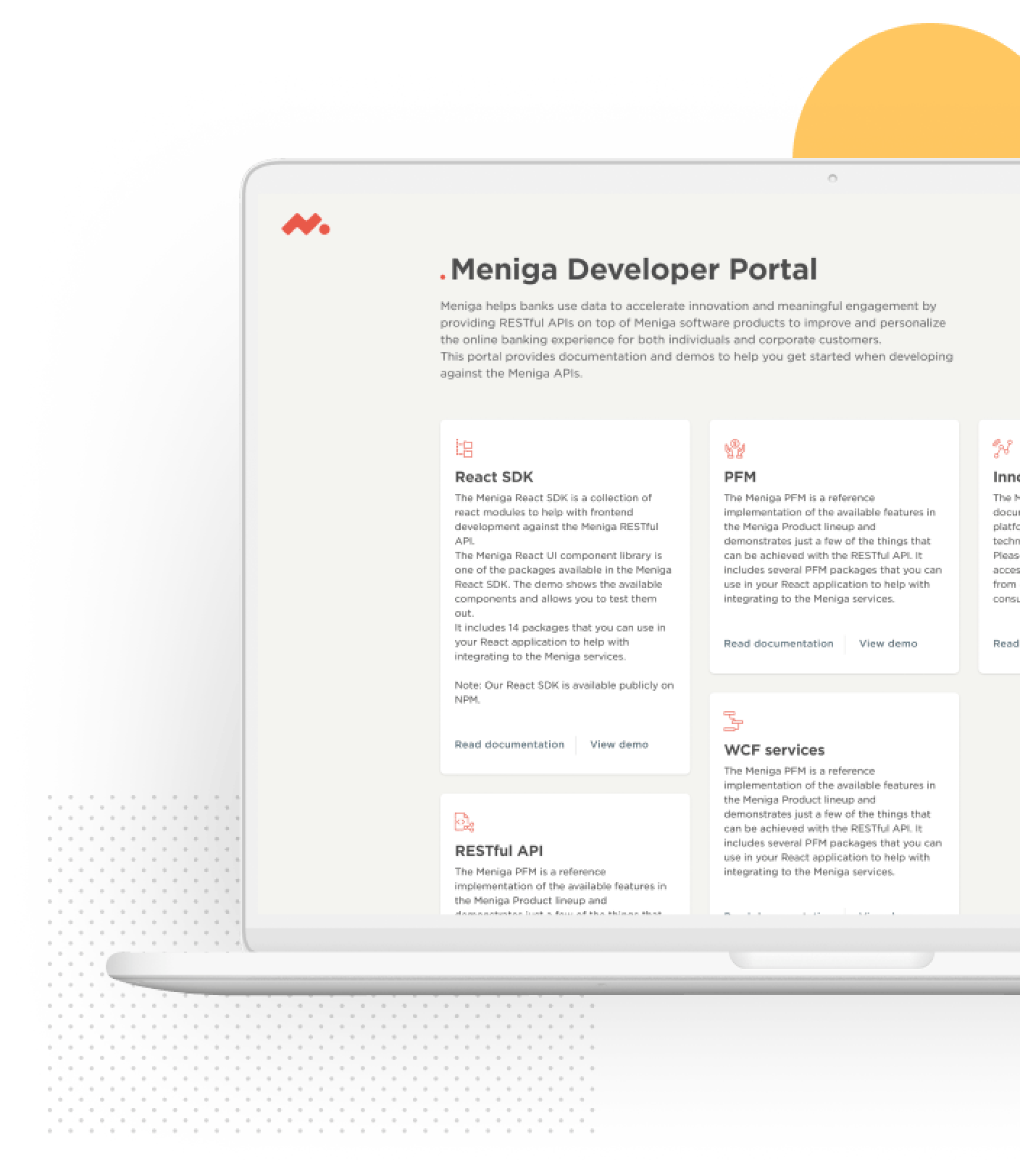

Easy implementation

Meniga has successfully delivered projects working with multiple clients around the world. We have developed a robust toolkit & flexible methodology to collaborate in any setup – and emphasis on remote execution:

- Well-documented API with SDKs, code samples and a reference front-end source code at your disposal

- Fully available SaaS option – also in a hybrid approach (i.e. initial work with Meniga hosting dev/test environments)

- 24/7 help line supporting developers working with the solution on your side

- Quick turnaround cycles

- Years of experience in remote collaboration