Carbon Conscious Banking

Environmental trends & business opportunities in Digital Banking

Good for the planet, good for business

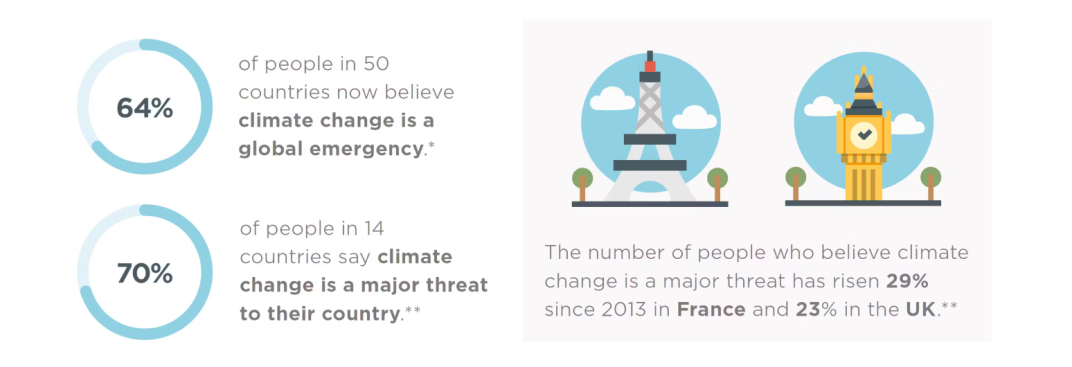

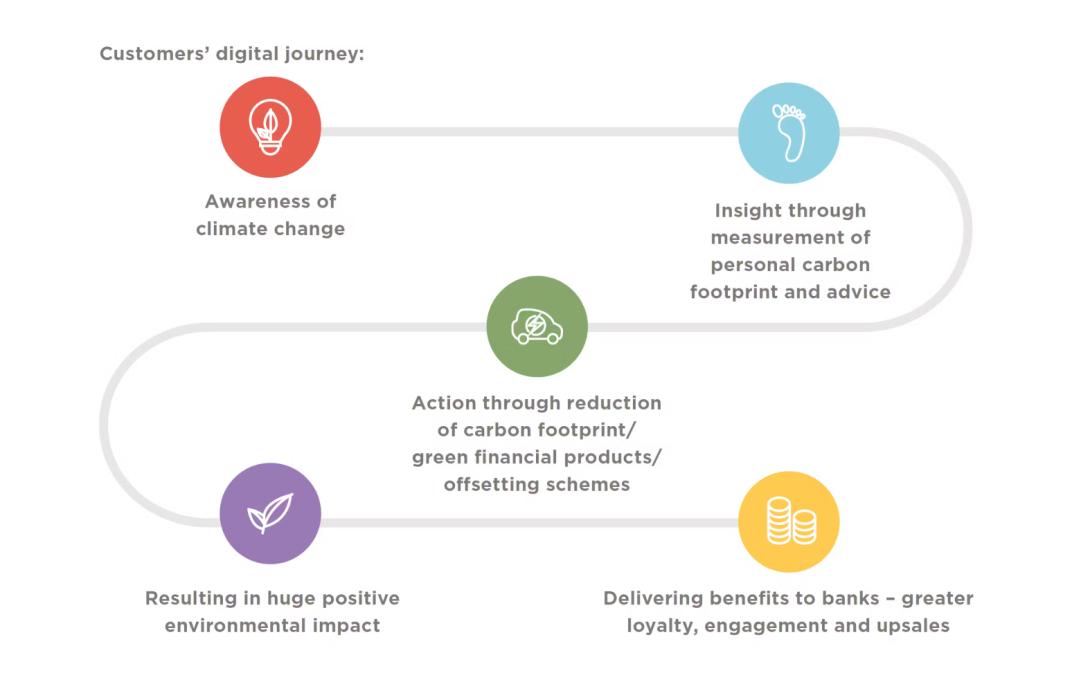

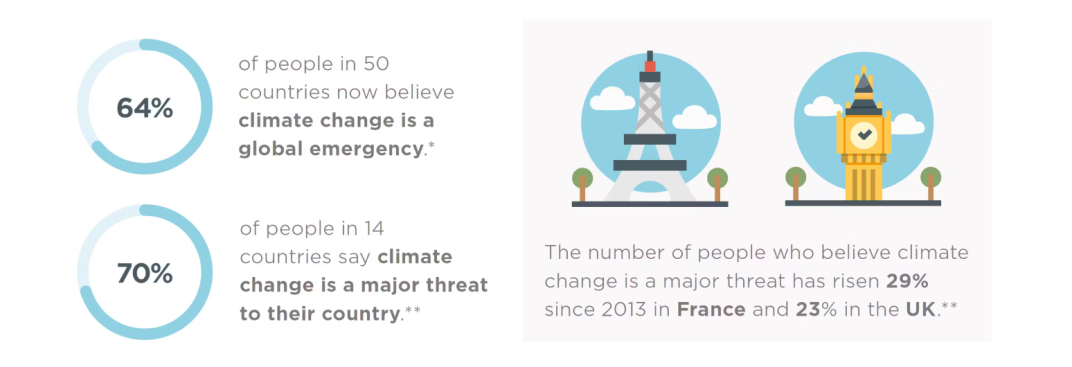

Global concern about climate change is rising. Consumers increasingly want to understand the impact they have on the environment, take action and make meaningful change.

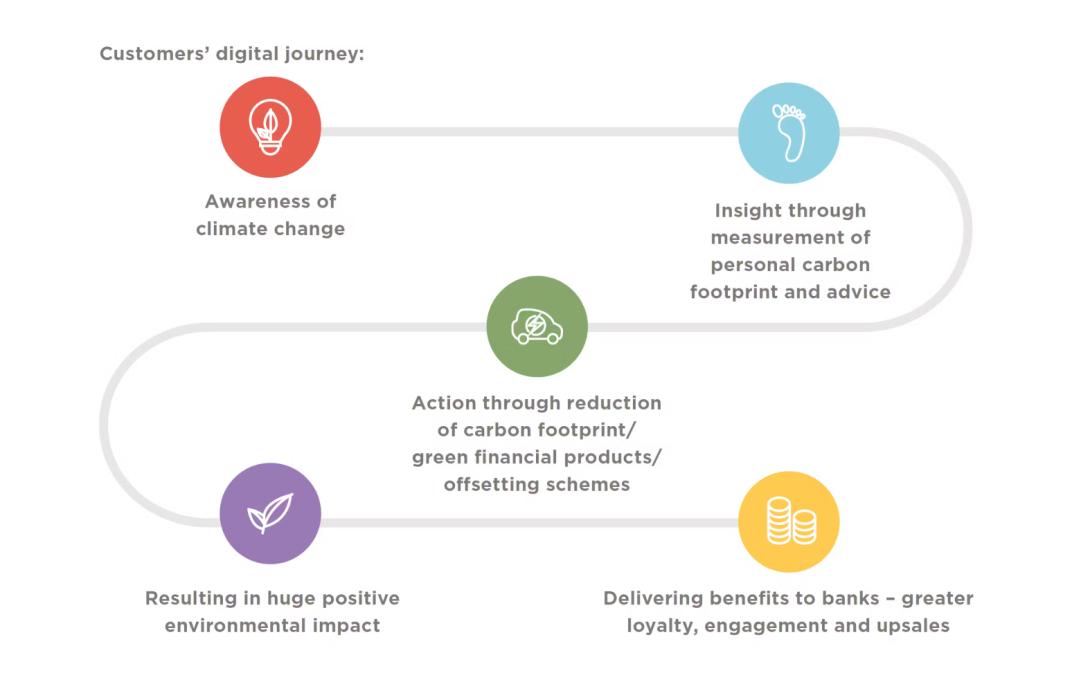

Through digital banking solutions, banks have a real opportunity to serve these tangible demands of the carbon conscious consumer. They are in the perfect position to take the lead on making an impact in the fight to protect our planet, as they build a customer journey around carbon footprinting and green financial products.

The benefits to banks catering to this customer base are clear: increased customer loyalty and digital engagement; and up-sales of green financial products.

The Carbon Conscious Consumer of Today

From fringe to mainstream

A decade ago, any mention of environmentalists or climate change activists would have conjured up images of hemp necklaces and protestors chained to trees. Those days are long gone. The issue of climate change is at the forefront of politics, embedded in pop culture, the media and in our homes. What was once a fringe movement is now mainstream.

Enter the Carbon Conscious Consumer

Widely adopted environmental actions to reduce one’s carbon footprint – such as recycling, shopping locally and ‘Meat Free Mondays’ – makes it evident that there is an ever-growing customer segment who put environmental concerns at the centre of their life choices and purchase decisions.

More than half of EU consumers (57%) base purchasing decisions on environmental concerns.* Some twothirds (66%) are willing to pay more for sustainable brands.**

However, most of these environmentally friendly actions have an ambiguous impact in terms of the good they do. Other than having the satisfaction that they are “doing the right thing”, most people lack the tools to quantify, understand and measure the impact of their actions.

Climate change and Covid-19

Far from diverting attention away from the issue of climate change, the Covid-19 pandemic has heightened global anxiety by serving as a stark reminder of the fragility of Planet Earth. Climate change has become the number one concern.

Far from diverting attention away from the issue of climate change, the Covid-19 pandemic has heightened global anxiety by serving as a stark reminder of the fragility of Planet Earth. Climate change has become the number one concern.

What do carbon conscious consumers want?

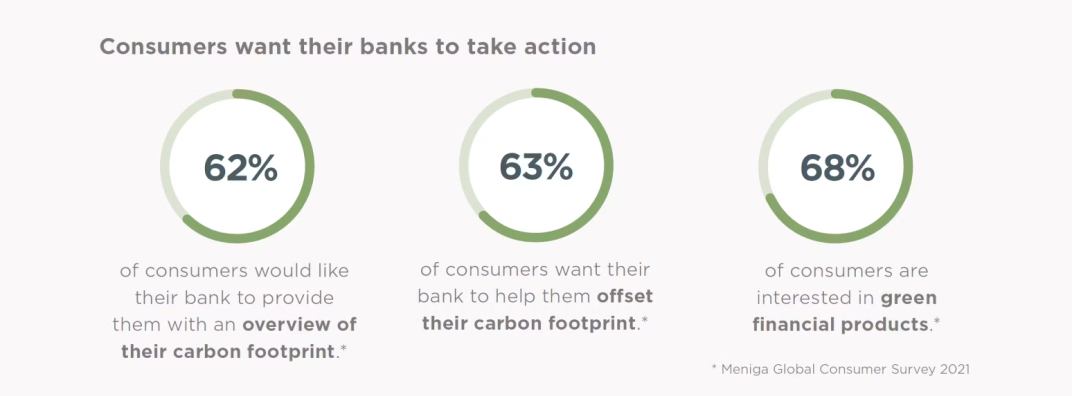

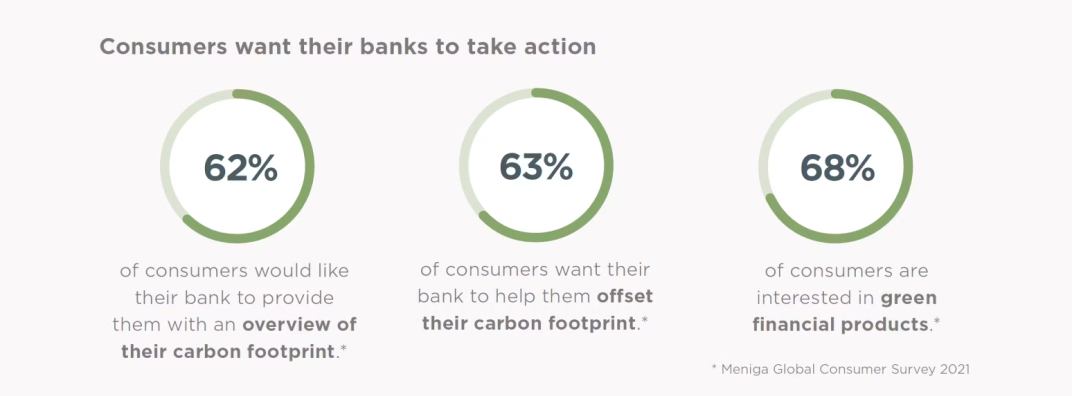

As carbon consciousness makes its way mainstream, consumer demand is skyrocketing for new tools to understand and address the environmental challenges we are facing.

Carbon Conscious Consumers want:

1. Awareness

To understand their impact on the environment. This involves measuring their everyday activities and purchases through the use of a carbon footprint calculator.

2. Action

A way to take action to reduce their impact. This includes tools to change their behaviour, buy green products, and offset their carbon footprint.

What is a carbon footprint?

‘Carbon footprinting’ has become a modern-day buzzword, but what does it actually mean?

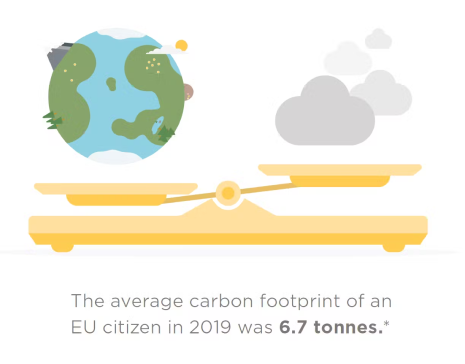

An individual’s carbon footprint is an estimation of the total greenhouse gases emitted by the activities they undertake, and the products they buy and consume.

It is not an exact science, no matter how deep you dig into an individual’s consumption habits. Nor is there a single standard for calculating carbon footprints (although recognized methodologies are slowly emerging).

The main objective of carbon footprint calculators is to create awareness and motivate positive action.

It is important to strike a balance between accuracy and usability. Some carbon calculators are too simplistic to be meaningful, while others are too complex to be practical.

The best way to strike this balance is to first recognize that our footprints are dominated by a few areas, such as food, travel, energy and transportation, and then focus on obtaining accurate measurements of these.

So, how can banks provide a better way forward for the carbon conscious consumer?

The opportunity for banks

Banks have a real and present opportunity to provide the ideal solution for the carbon conscious consumer.

As custodians of personal financial data, banks are in a unique position to build a compelling digital journey for their customers, encompassing carbon footprinting, green financial products, and offsetting services.

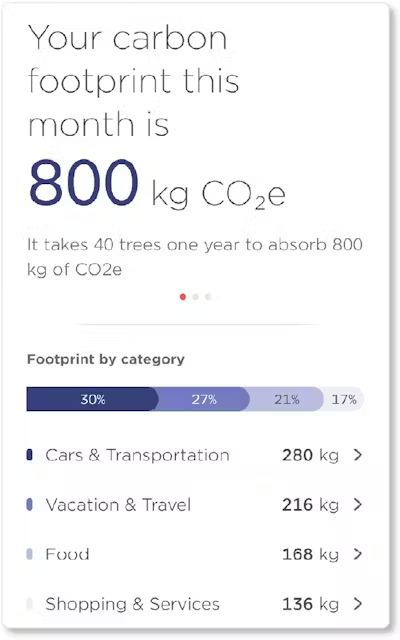

Carbon footprinting

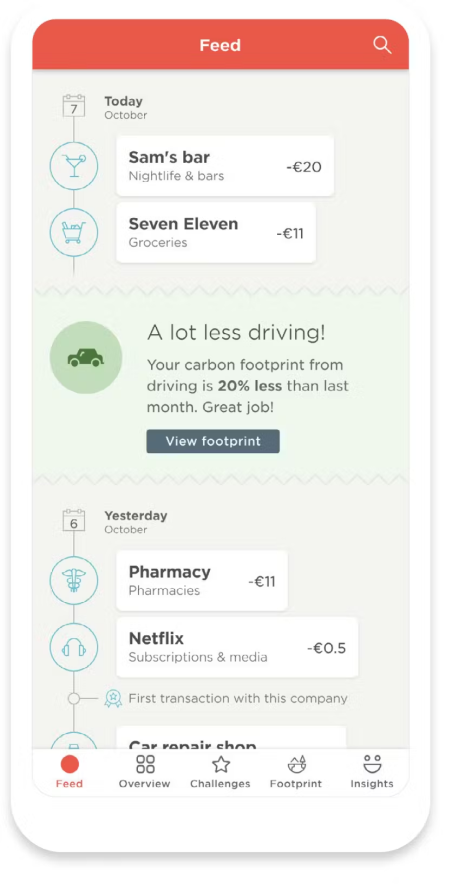

By integrating carbon footprinting and carbon profiling into the everyday banking experience, banks can make a huge contribution to the mainstreaming of carbon awareness.

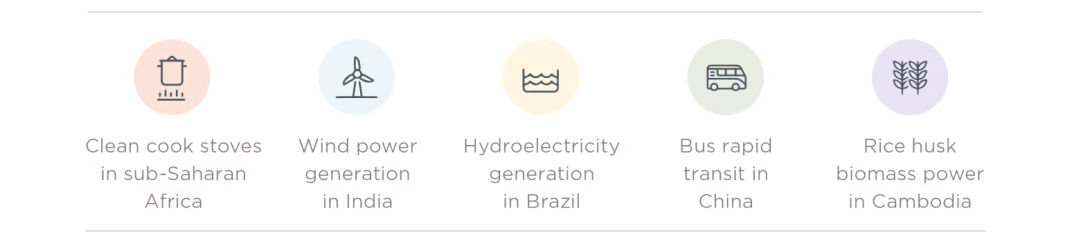

Carbon offsetting

By incorporating carbon offsetting and other green initiatives and products in their digital banking provision, banks can also help their customers transition from awareness to action.

88% of bankers across Europe think banks should play an important role in increasing awareness of the impact of consumption on climate change.

The potential positive environmental impact is huge. Imagine if just one-third of the banking population tracked their footprints and banks helped them reduce it by an average of 20%? Or convinced half of them to offset their consumption by supporting environmental projects in the developing world? That would represent a huge carbon saving.

Integrating such services is not only the responsible thing to do, but is also a tremendous business opportunity. Banks gain clear benefits, including building customer loyalty, deepening digital engagement, and driving financial product up-sales.

Meniga Carbon Insight

Balancing accuracy and usability

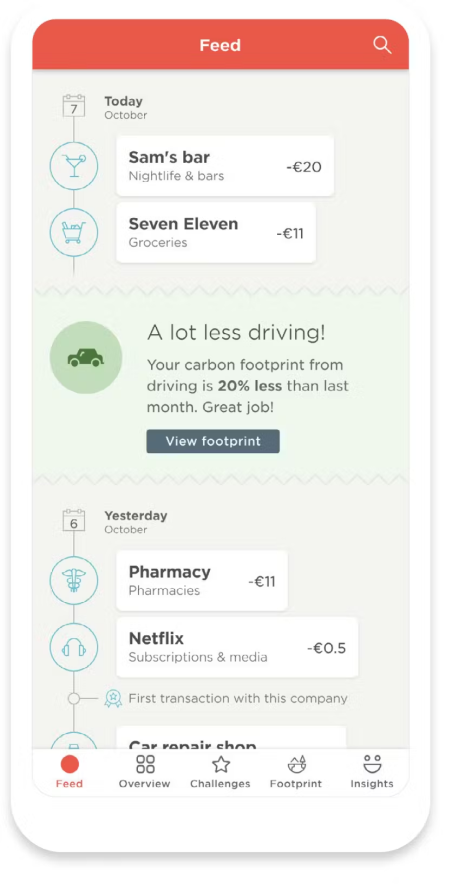

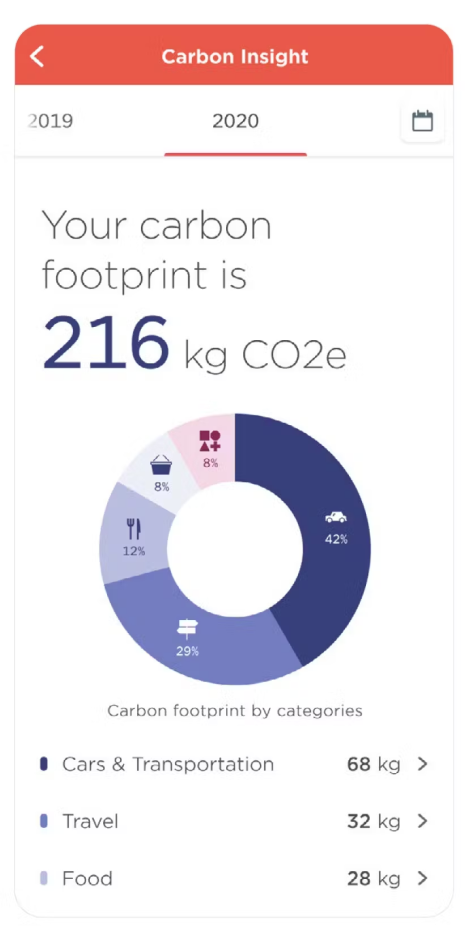

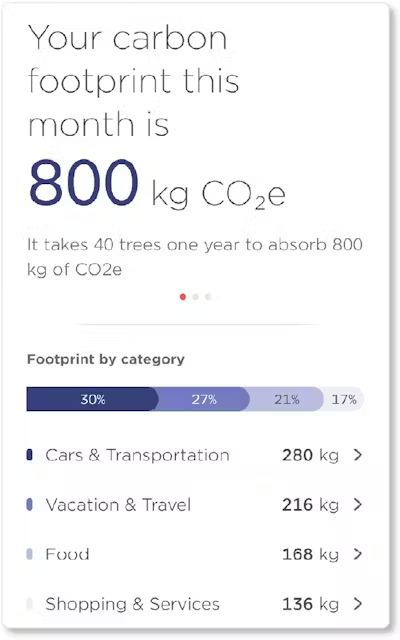

Meniga Carbon Insight is a white-label solution that makes it simple and cost-effective for banks to embark upon the journey of empowering their customers to act on climate change, thus driving engagement and loyalty.

It is an API-based toolkit to facilitate mainstream personal carbon footprint awareness via digital banking through a seamless and easy-to-use service.

The service calculates customers’ carbon footprints based on their spending patterns and empowers them to act via internationally recognized offsetting programs.

Integrated with your bank’s other digital channels, it enables your customers to progress to other green products such as mortgages or car loans.

Enhancing customer understanding

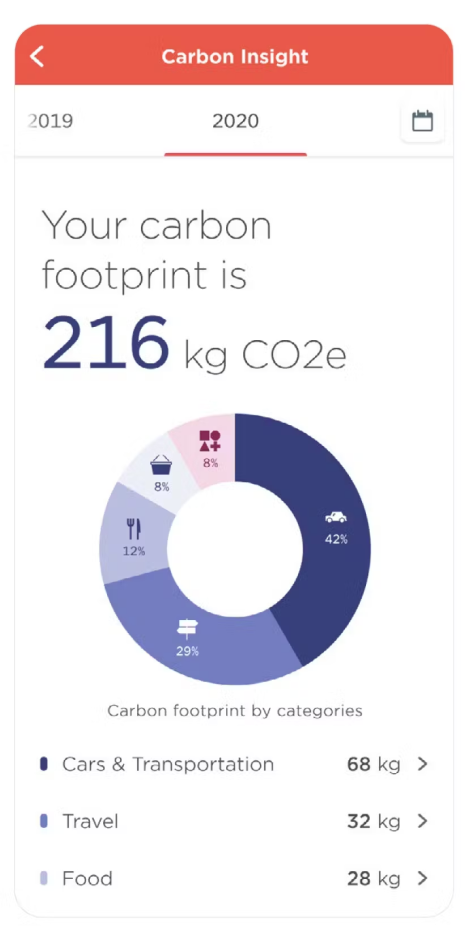

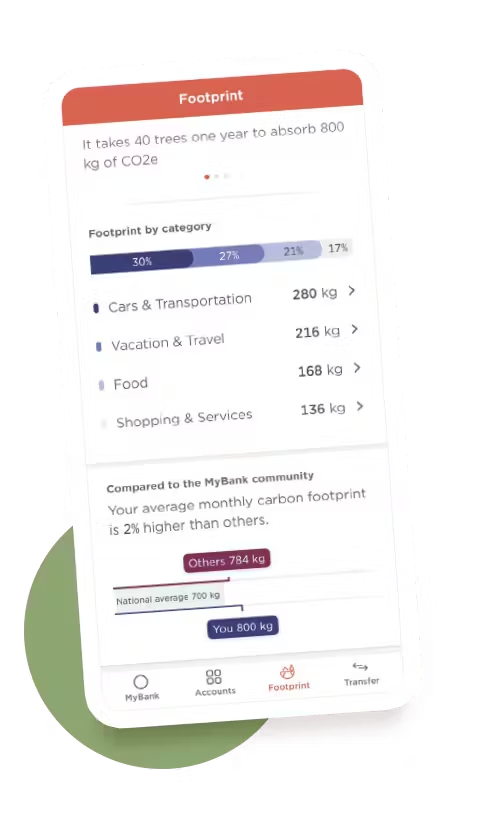

Meniga Carbon Insight does more than just calculate the footprint of each transaction. It offers customers a rich user experience around understanding and improving their footprints.

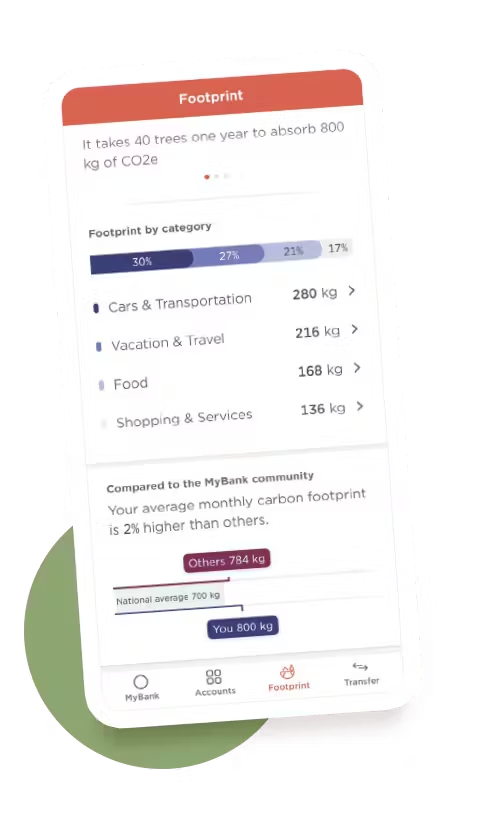

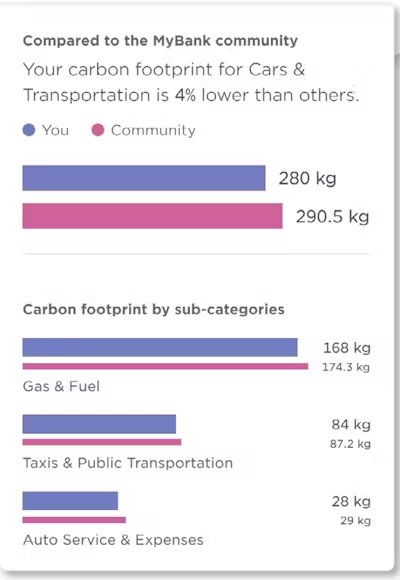

- Analyse their footprint over different time periods.

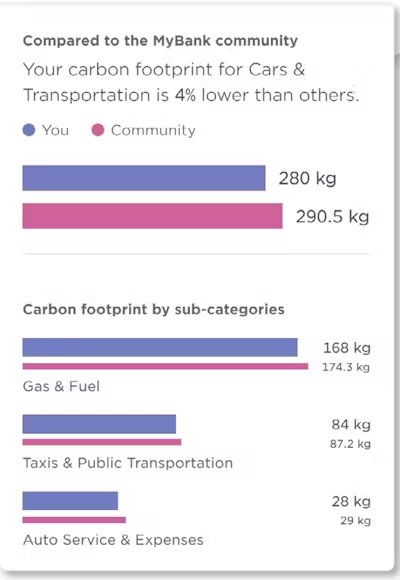

- Benchmark their footprints against those of other users.

- Explore actionable advice on how to reduce their carbon footprint across categories.

- Improve the accuracy of the footprint with user input.

- Challenge themselves to adjust their consumption patterns to reduce their footprints and save money at the same time.

How it works

Meniga Carbon Insight empowers banks to help customers offset their carbon footprints, by providing the best estimate of their transaction footprints. It draws data from our Carbon Index, which is localised for each country and adjusts to your bank’s category tree.

- After a purchase, the product automatically uses several factors like transaction amount, spending category, and more to estimate the carbon footprint.

- Customer input along with demographic data and other external features are used to increase the accuracy of the estimate.

- Meniga Carbon Index is based on publicly available databases and the latest in environmental science.

- The system makes adjustments for airline flights, public transportation and other such expenses to maintain a reliable carbon footprint calculation.

- Meniga works with a number of scientific advisors for guidance on the evolution of the Index.

- Meniga’s Environmental Advisory Board oversees the Index. Our board members include representatives from the United Nations Framework Convention on Climate Change (UNFCCC), World Resource Institute, University of Iceland, and Accountancy Europe.

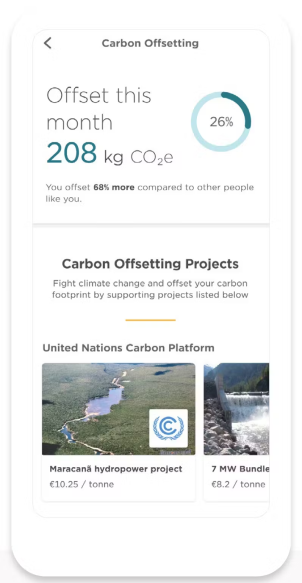

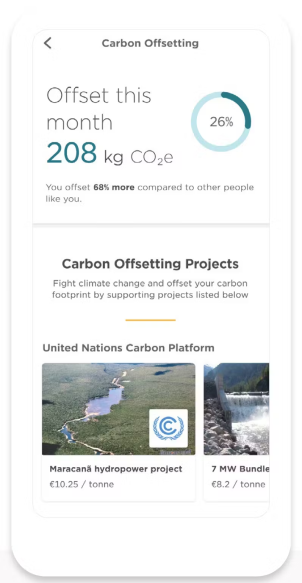

Carbon Offset Platform

Meniga collaborates with the UNFCCC, which certifies projects in developing countries that reduce, avoid or remove greenhouse gas emissions from the atmosphere. Other offsetting programs can be integrated if required.

UNFCCC projects are rewarded with Certified Emission Reductions (CER) measured in tonnes of CO₂ equivalent. People can offset their emissions by purchasing CERs.

Conclusion

Climate change has become an everyday concern and people want convenient but impactful solutions to help protect the planet.

Banks are well positioned to offer support for carbon conscious consumers, both by enabling them to understand their carbon footprint, and by offering them solutions to reduce it.

Clear demand:

Customers are increasingly concerned about their environmental impact, and turning to their banks for answers. Banks that do not meet this demand risk being left behind.

Clear benefits for banks:

Carbon footprinting and offsetting services drive digital engagement, deepen customer loyalty, and facilitate the upselling of green banking products.

Improves the digital banking experience:

By seamlessly integrating carbon footprinting services with their digital provision, banks can enhance their offer to customers.

Easy for customers to use:

Customers gain the opportunity to view their carbon footprint without having to input excessive data.

Helps banks fulfil ESG/CSR commitments:

These have expanded rapidly in recent years, and are forecast to grow further.

Driving positive change:

By using bank carbon footprint services, customers can learn about their environmental impact, change their behavior, purchase your bank’s green products, or offset their carbon emissions.