See how Meniga can help your digital bank

einforces positive financial habits

+ Seamlessly saves money for customers

Enable automated smart banking

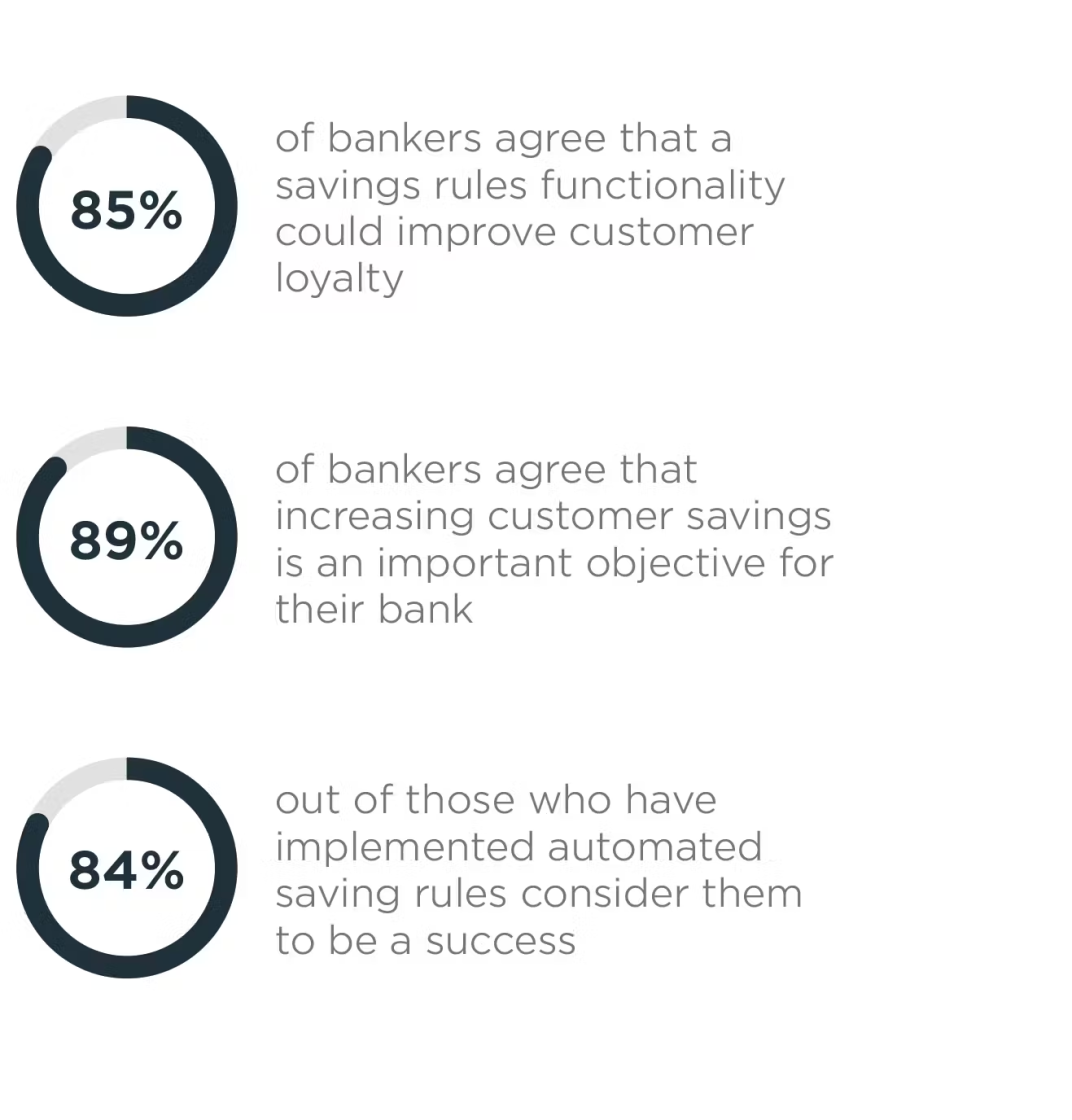

Meniga Smart Money Rules helps your banking customers save money.

Automated rules seamlessly set money aside and enable customers to leverage their savings in many ways meaningful to them.

Banks employ this flexible automation engine to drive loyalty and engagement by allowing different customer segments to nurture their finances.

For Saving Rookies

Help banking customers that struggle with saving take their first steps to become habitual savers. Give them easy and fun ways to build financial security.

For Experienced Savers

Reinforce healthy financial habits. Help them leverage the money they have set aside, e.g., by supporting a good cause, automatically maintaining account balances or investing.

For Banks

Help customers accumulate their savings and to make a habit of it. Cross-sell products and drive engagement by nudging them to leverage their savings.