5 AI-driven customer engagement tools you should know about

Before we explore each tool in greater detail, here’s a quick breakdown of our top choices.

| AI-driven customer engagement tool | Key features | Strengths | Target users/market | AI capabilities |

| Meniga | AI-driven hyper-personalised insights, transaction enrichment, automated savings, and financial wellness tools | Real-time personalised insights, gamification, and strong data analytics | Banks and large financial institutions aiming for a personalised digital banking experience | AI-powered insights, transaction categorisation, Smart savings, Cash flow forecasting, Conversational Financial Assistant |

| Backbase | Unified customer journey across touchpoints | Omnichannel orchestration | Global banks with diverse customer channels | AI workflow automation |

| Temenos Infinity | AI-driven personalisation, self-service, and integration with core banking | Combines AI personalisation with operations | Large and mid-sized retail banks | AI-driven personalised experience |

| Q2 | Engagement analytics | Strong analytics | Regional and community banks | AI-driven engagement scoring, personalisation |

| Fiserv | Payment integration, mobile optimisation | Mobile experience, payment-centric | Banks focusing on retail and payments | Mobile AI, transaction analysis, fraud detection |

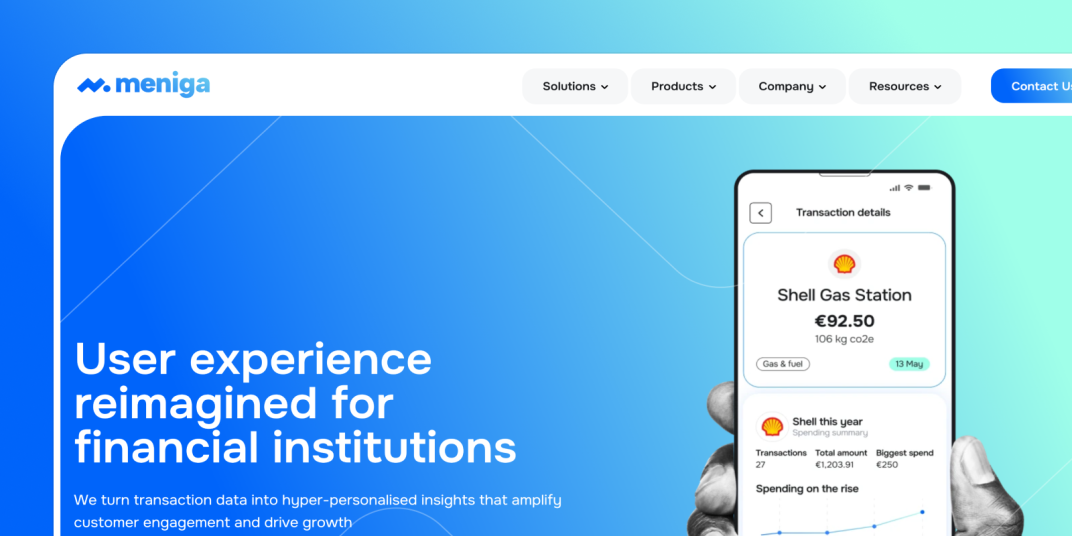

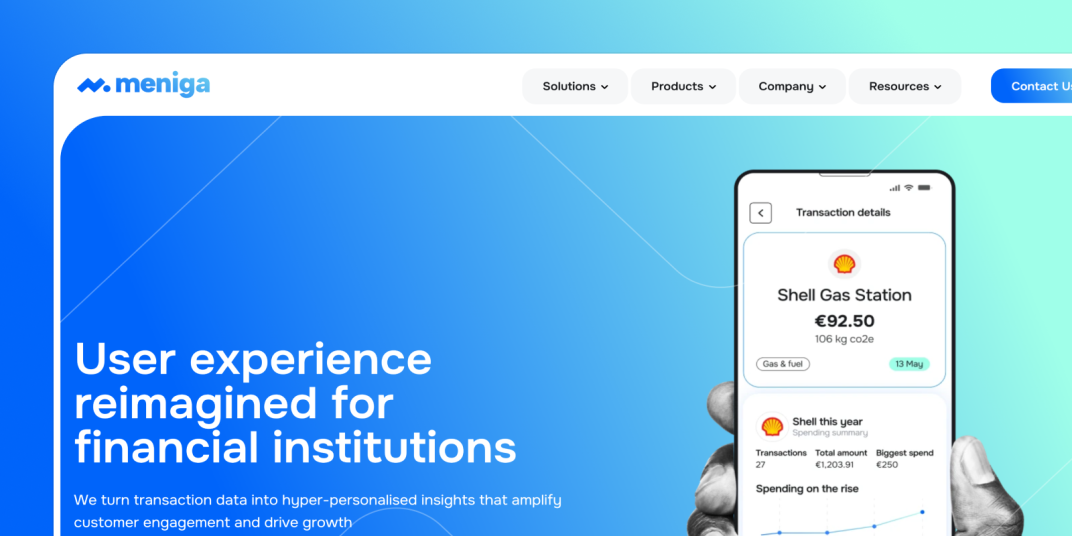

1. Meniga

Meniga enables banks to turn everyday raw transaction data into powerful, actionable insights that drive engagement and loyalty.

Our three core pillars, Data Consolidation and Enrichment, Hyper-Personalised Insights, and Next-Gen PFM Experiences, help banks and financial institutions modernise digital banking capabilities and keep up with fast-moving Neobanks.

Our modular design allows seamless integration with bank systems, making it suitable for banks looking for an advanced data-driven customer engagement platform without an overhaul.

Key features:

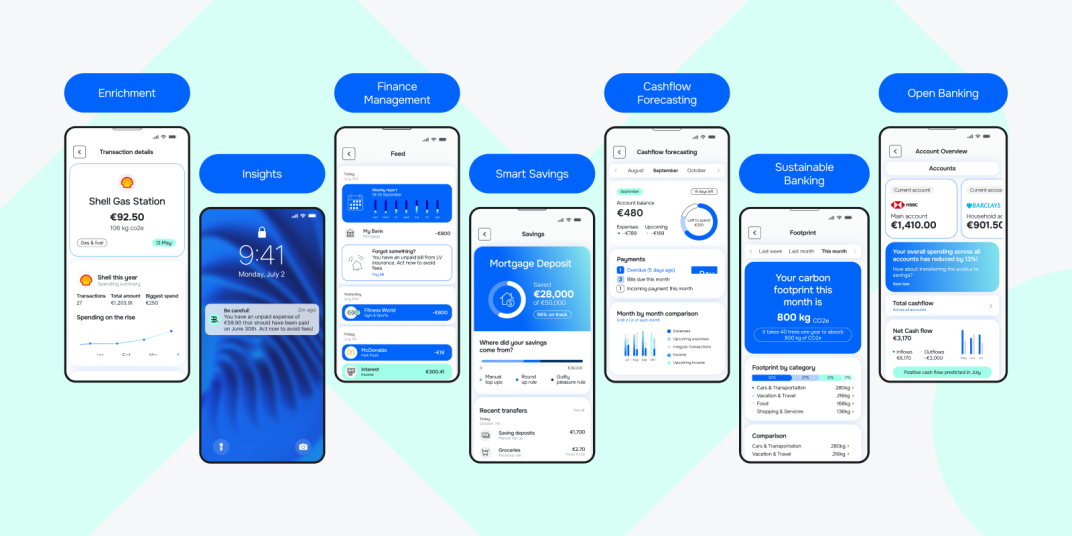

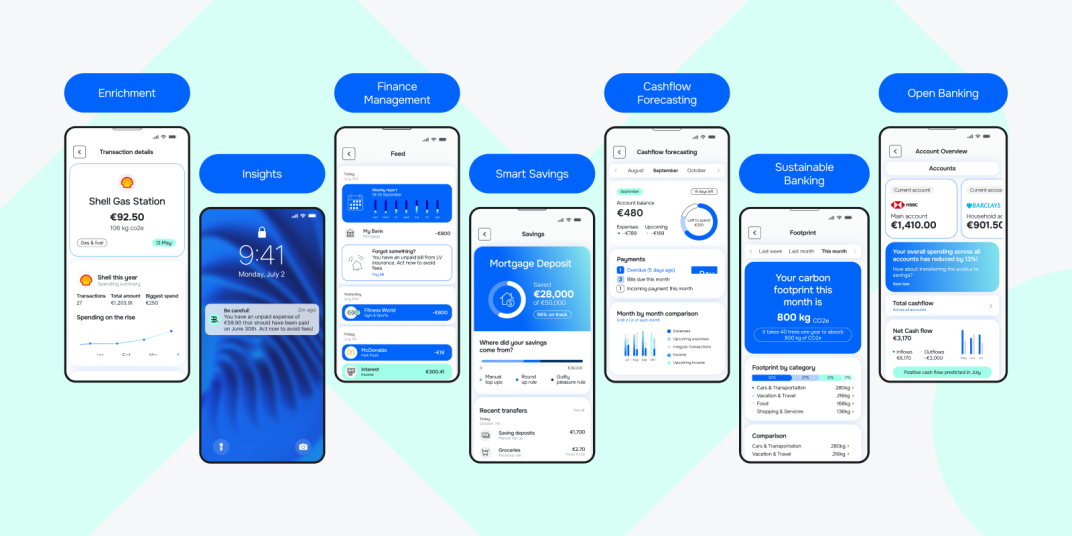

1. Meniga’s Enrichment Engine

At the heart of our platform lies the Engine that brings together internal, open banking, and third-party information to form a unified, intelligent view of each customer.

Transactions are automatically categorised with high precision using either a bank’s taxonomy or Meniga’s localised category sets, and enriched with details such as merchant data and carbon footprint estimates. Our categorisation is strengthened with ML algorithms, which increase accuracy over time.

Leveraging this foundation, we deliver out-of-the-box Financial Experiences including budgeting, carbon tracking, gamified savings, and cashflow forecasting.

Each experience creates instant value for customers while capturing behavioural insights that continuously refine and personalise the journey, ensuring engagement grows smarter with every interaction.

2. Insights Platform

Insights is an award-winning, AI-powered solution that transforms how banks engage with customers, delivering real-time, hyper-personalised experiences that go far beyond traditional notifications.

Built on advanced behavioural and transactional analytics, it enables banks to create rich, ultra-specific customer segments such as Likely to Invest or Starting a Family. These segments drive timely, event-based communications across internal and external systems, ensuring every interaction feels relevant and human.

In addition, banks can use our Insights Platform to launch personalised, dynamic interfaces for their users, ensuring that no banking journey is the same.

With Insights, banks can cut through the noise with truly contextual, one-to-one messaging.

By combining behavioural intelligence with predictive modelling, Insights gives banks a deeper understanding of every customer and the ability to act instantly.

Business users can easily launch individualised notifications, in-app stories, and interactive experiences that feel personal, relevant, and engaging, every single time.

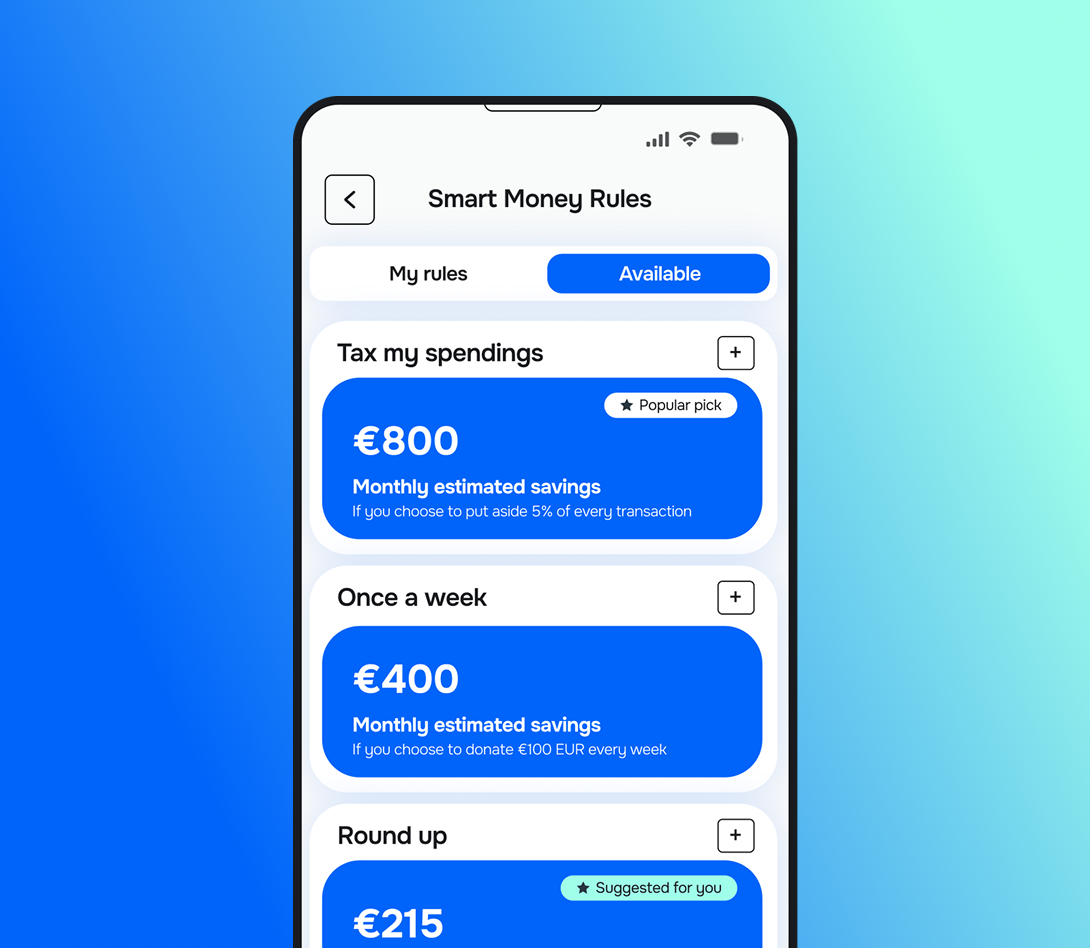

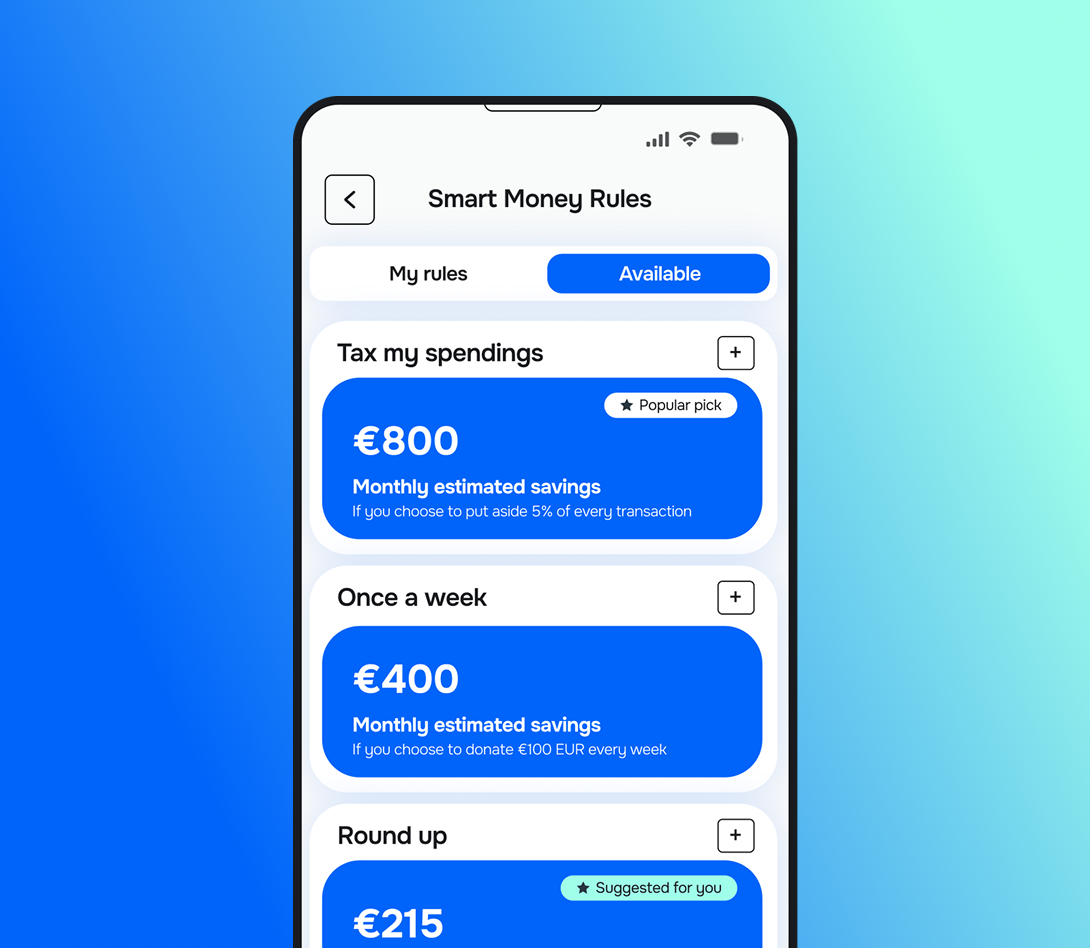

3. Smart Savings

We offer intelligent, automated savings tools that make it easy for customers to build healthy financial habits while helping banks increase deposits and engagement. Through Gamified Savings Goals, customers can create dedicated pots for personal objectives, such as a new car, a dream vacation, or a home purchase.

Another feature, Automated Savings Rules, takes the effort out of saving by automatically moving money based on chosen triggers, such as spending behaviour or a percentage of salary, turning everyday transactions into effortless progress toward financial goals.

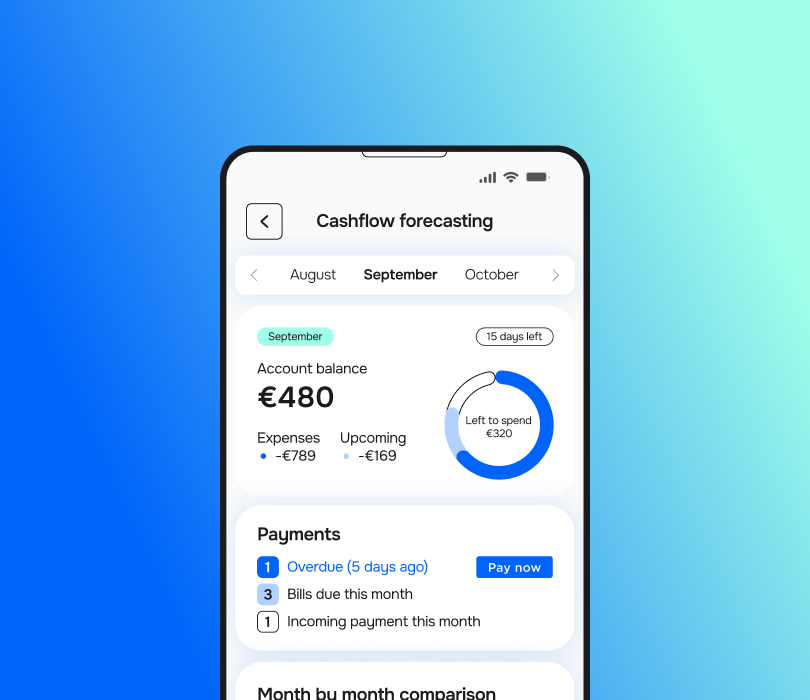

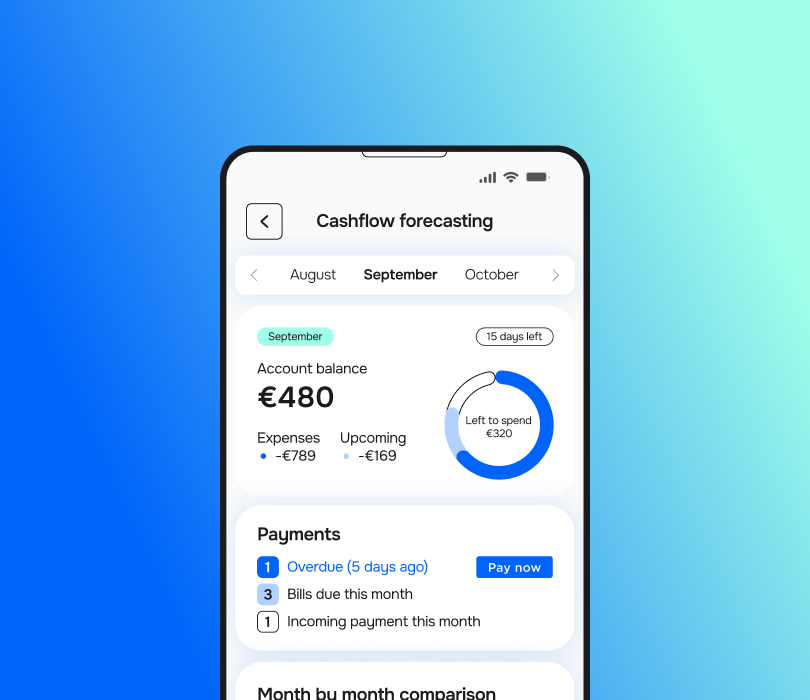

4. AI-powered Cashflow Forecasting

AI-powered Cashflow Forecasting gives customers a complete, intuitive view of both their past and future finances, helping them make smarter, more confident financial decisions.

The tool automatically identifies and forecasts recurring income and expenses, revealing clear patterns in spending and saving behaviour.

Real-time alerts notify users of low balances, potential overdrafts, and upcoming bills, empowering them to act before issues arise.

With personalised recommendations based on current cash positions, customers receive timely guidance on when to save, spend, or adjust their plans to stay on track with their goals.

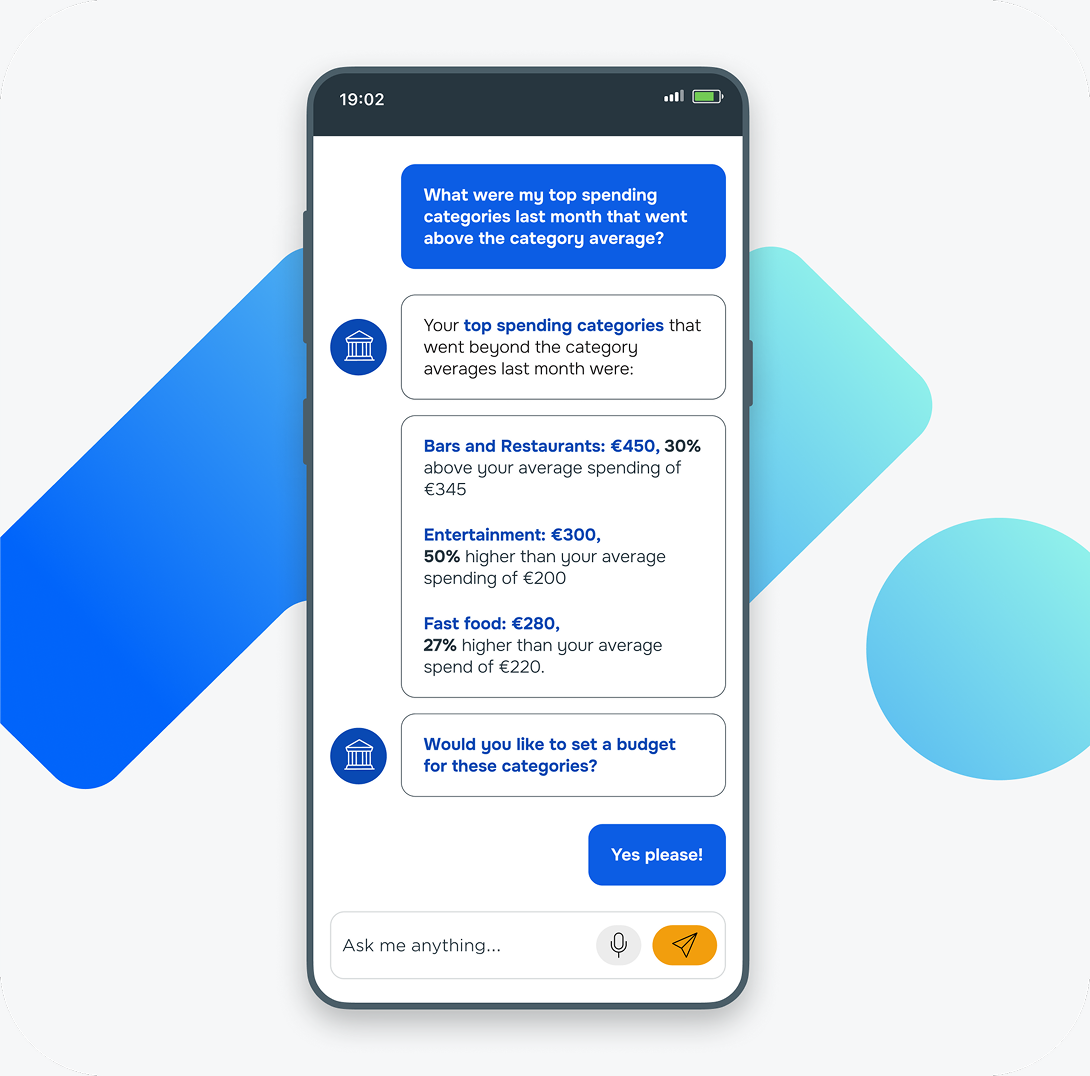

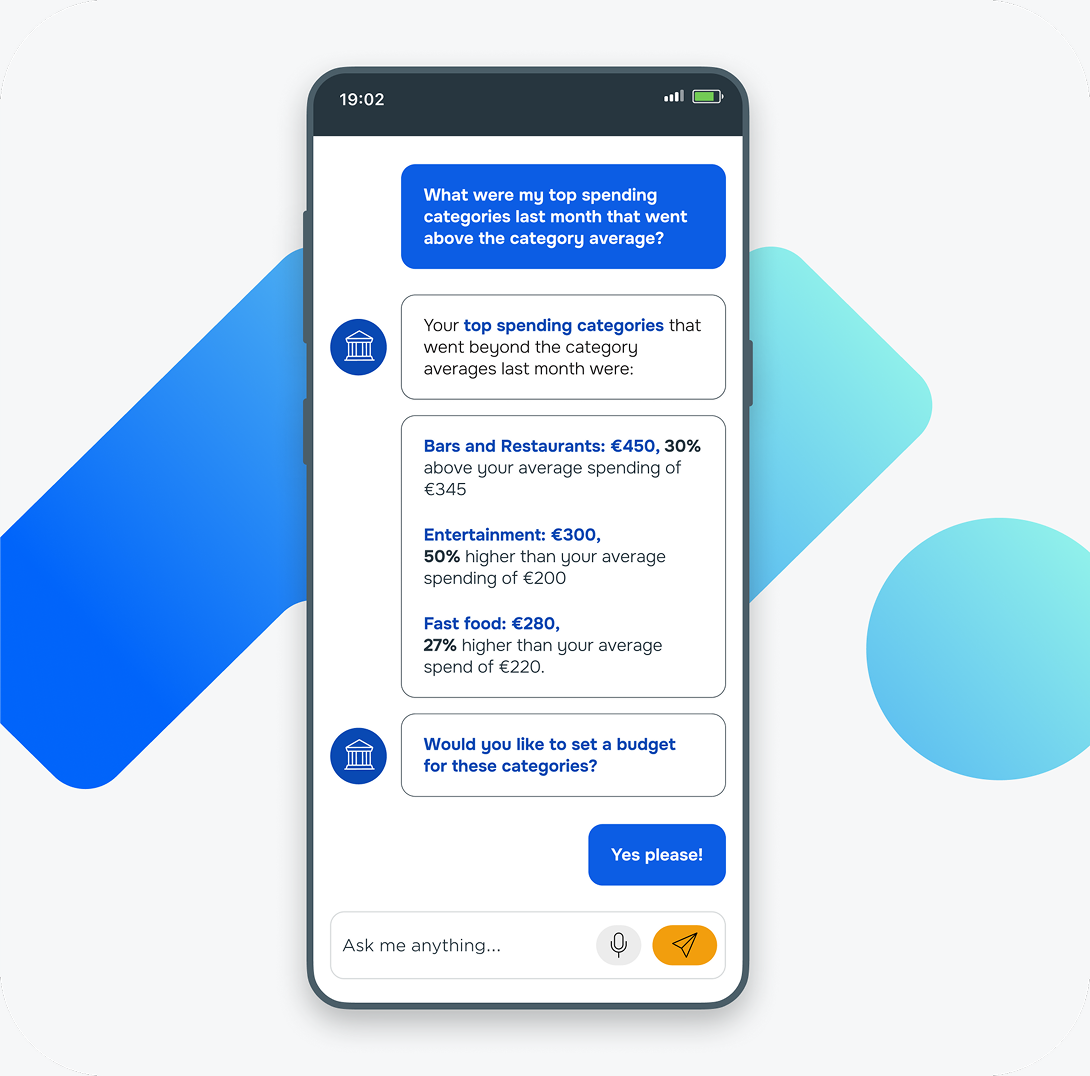

5. Conversational Financial Assistant

Our Conversational Financial Assistant is an AI solution built for banks and powered by large language models.

It allows customers to ask everyday questions in plain language, such as “What did I spend on groceries?” or “Can I afford a weekend getaway?”.

Meniga: Key takeaways

Meniga provides a comprehensive suite of solutions to help banks deliver hyper-personalised products and experiences that truly align with customer needs.

Our tools enable institutions to:

-

Drive sustainable revenue through smarter digital sales,

-

Close the gap with neobanks by offering ready-to-use financial wellness features, and

-

Modernise legacy systems to accelerate digital transformation.

2. Backbase

Backbase is a unified customer engagement platform that brings together AI, omnichannel experiences, and integration features to streamline digital banking.

Some of its AI-driven functionalities include self-service, real-time customer support, intelligent automation, dynamic risk scoring, and predictive analytics.

Key features:

1. Agentic AI

AI agents work autonomously, using built-in orchestration logic to understand context, make decisions, and execute tasks without human input.

They continuously adapt to live events, customer behaviours, and system triggers in real time.

Integrated within the AI-powered Banking Platform, these agents connect with your existing core systems, CRM, and third-party applications.

2. Data foundation

Backbase provides a unified, AI-ready data foundation that enables banks to connect, manage, and use their data within a secure architecture built for financial services.

The platform integrates information from core systems, digital channels, and fintech partners into a single environment to support real-time insights, advanced analytics, and AI-driven applications.

3. Intelligent process automation

Intelligent Process Automation solution leverages AI to automate complex workflows in areas such as onboarding, origination, servicing, compliance, and dispute management.

Autonomous AI agents handle tasks such as document processing, ID validation, and routing.

It automates and orchestrates steps in the onboarding process, including intake, triage, and case management for KYC and AML compliance.

3. Temenos Infinity

Temenos Infinity is a digital banking platform that combines cloud flexibility, AI-driven personalisation, and omnichannel engagement.

It can run on a cloud platform or as SaaS on Temenos Banking Cloud.

Key features:

1. Temenos AI

The platform applies generative AI for data querying.

It uses explainable AI (XAI) to deliver insights and reports while enabling the customisation of financial products based on real-time customer behaviour.

2. Temenos FCM AI Agent

It is an AI-enhanced compliance engine, enabling you to significantly reduce false positives when screening against global and domestic watchlists in real time.

The agent is available on-premise, in the cloud, or as SaaS via the FCM interface.

3. The Temenos Product Manager Copilot

The Copilot uses generative AI to help product managers identify new customer segments and design tailored financial products that meet local regulatory requirements.

It provides insights into customer behaviour, competitor offerings, and potential compliance issues.

4. Q2

Q2 is a cloud-based digital banking platform that focuses on enhancing customer experience and operational efficiency.

The platform supports integrations with fintech partners, core systems, payment processors, KYC/AML solutions, credit bureaus, and other third-party services.

Key features:

1. Fraud Intelligence

The tool leverages AI-powered technologies to customise security measures dynamically for each customer.

Real-time analytics enables banks to automatically collect signals from user behaviour, transaction patterns, device characteristics, and historical activities.

2. Personalisation

Uses transactional and behavioural data to understand individual account holders' needs. Banks can use these insights for fraud detection, audience segmentation, improved customer experience, and more.

3. Digital onboarding

This feature acts as a self-service and allows customers to complete the onboarding process on their own schedule.

Account holders receive a first 30-day checklist that gamifies and celebrates task completion.

Banks can create and control adaptable tasks, services, and products that contribute to a personalised onboarding journey.

5. Fiserv

Fiserv offers financial technology products, including payment processing, account processing, digital banking, risk management, and commerce solutions.

It focuses on providing solutions to enhance customer experience and operational efficiency.

Key features:

1. Content Next™

It is a cloud-based content management and workflow automation platform that embeds AI tools such as natural language search, document classification, summarisation, and automated processing.

The solution enables banks to manage permissions, roles, and workflows in a self-service fashion without relying on IT support.

2. Data and analytics:

Uses aggregation, analysis and contextualised insights from data to enable personalised marketing, product recommendations.

You can access data directly through APIs, value-added products and partners, or automated CRM solutions.

3. Create Digital

It allows you to build and customise customer experience with SDK options, fintech connections and more.

The solution provides access to self-service and collaboration features and displays real-time notifications, personal credit information and merchant transactions in one place.

FAQ

1. What is GenAI in banking?

Generative AI (GenAI) in banking is the use of advanced artificial intelligence models that can understand, generate, and personalise content or insights in real time.

It enables banks to deliver smarter, more natural customer interactions, from conversational assistants to hyper-personalised financial advice.

By analysing vast amounts of data, GenAI helps financial institutions automate processes, enhance engagement, and unlock new levels of efficiency and innovation.

2. How is AI going to change banking?

AI is transforming banking by making services faster, smarter, and more personalised.

It enables banks to offer predictive financial insights, automate routine processes, detect fraud in real time, and deliver tailored experiences that improve customer engagement.

By leveraging AI, banks can operate more efficiently, make data-driven decisions, and create innovative products that meet customer needs.

3. Are banks allowed to use AI?

Yes, banks are allowed to use AI, but they must do so within regulatory and compliance frameworks that protect customer data and ensure fairness.

AI can be applied to areas such as fraud detection, customer service, risk management, and personalised financial advice.

Institutions are expected to use AI responsibly, with transparency, robust security measures, and ongoing monitoring to maintain trust and meet legal requirements.