Cash inflow is the heartbeat of any bank, but too often, the focus stays on outflows, risks, and compliance.

As a result, they miss critical insights into liquidity trends, customer behaviour, and revenue opportunities.

And when inflows are misunderstood or overlooked, it’s not just the balance sheet that suffers but also decision-making, product innovation, and ultimately, customer trust.

Read on to learn more about the importance of the cash inflow and how to use it to increase revenue and deliver more personalised services.

Understanding the cash inflow

When we talk about cash inflows, the first association is most likely customer deposits.

While deposits remain a crucial source of liquidity, they’re just one part of a much broader and more dynamic picture.

The definition of cash inflow is changing as technology, regulation, and customer behaviour influence the way money enters the banking system.

For banks, this means looking beyond traditional streams and understanding the diverse sources of inflow that fuel day-to-day operations and long-term growth.

What are the 4 main sources of inflows?

Let’s check the major sources of inflows in more detail.

Customer deposits and payments

Customer deposits and payments remain the cornerstone, but they’re changing form.

Real-time payments, instant credit transfers, and peer-to-peer wallets are now major contributors, driven by regulatory pushes such as SEPA Instant in Europe.

From January 2025, Eurozone banks and PSPs had to accept SEPA Instant payments at no cost.

The bigger shift comes in October 2025, when sending these payments will also cost the same as standard SEPA transfers.

Loan repayments

Loan repayments are another significant inflow, and their importance is growing.

With a global loan growth forecast of around 6% in 2025 compared to 2% in 2024, careful management of repayment timing and default risk is essential to maintain stable and predictable liquidity.

Interest income and fees

Meanwhile, interest income, fees, and non-interest revenues are taking on a more strategic role.

As central banks begin to ease rates later in 2025, margins are likely to compress, pushing banks to rely more on stable inflows such as transaction fees, advisory charges, and service commissions.

Tracking these inflows allows banks to identify stable revenue sources and spot new opportunities.

Interbank transactions and investments

Banks frequently generate inflows from overnight lending, repurchase agreements (repos), and securities investments.

Advanced analytics allow banks to monitor these flows in real time, providing a clearer picture of liquidity across the institution.

| Cash inflow patterns for retail vs. corporate customers |

| Aspect | Retail Customers | Corporate Customers |

| Nature of cash inflows | Primarily consumer payments for goods and services, often smaller amounts, but frequent. | Larger transaction volumes, including receivables from clients, financing, and international transfers. |

| Volatility and predictability | Influenced by consumer spending patterns, which are more volatile due to economic conditions such as inflation and interest rates. Retail inflows may decline due to reduced consumer budgets. | Corporate inflows tend to be more predictable due to contractual payment terms, but can be impacted by supply chain and market disruptions. |

| Technology usage | Increasing use of AI-driven cash flow management and automation to speed invoice processing and manage inventory finances, helping with liquidity challenges. | Advanced cash management tools focusing on liquidity ratios, cross-border settlements, and real-time liquidity access to manage multinational cash flows. |

| Cash flow challenges | Declining consumer spending impacts inflows, causing tighter liquidity and requiring retailers to adopt cost-control and cash management innovations. | Need to maintain high liquidity as a buffer during economic uncertainties, with a focus on currency fluctuation and financing risk management. |

| Cash inflow monitoring | Real-time cash flow tracking, linked to POS systems and online transactions, helps retailers quickly adjust pricing and stock levels. | Corporates use integrated treasury management systems to monitor inflows from multiple accounts and geographies for strategic decision-making. |

| Economic impact and strategy | Retailers face pressure from inflation and reduced spending, requiring agile cash flow forecasting and cost negotiation strategies. | Corporates emphasise liquidity maintenance for operational resilience, often holding high liquid assets to weather downturns. |

Retail customers experience more frequent but smaller cash inflows, heavily influenced by consumer behaviour and economic pressures.

On the other hand, corporate customers handle larger cash inflows with more predictable payment cycles but focus heavily on liquidity management, cross-border transactions, and maintaining a cash buffer.

What role do digital channels play for cash inflows?

The rise of digital channels doesn’t only have an enormous effect on cash inflows but also on their frequency, timing, and predictability.

-

Real-time payments are now the norm rather than the exception. Account-to-account services and embedded finance solutions bring a constant flow of micro-transactions into banks, replacing the traditional batch-settlement model with a 24/7 inflow stream.

-

Open banking APIs allow banks and authorised 3rd parties to pull transaction-level data in real time. Rather than waiting for end-of-day batch summaries, banks can see inflows as they happen. Europe’s regulatory push regarding financial data access, with evolving rules following PSD2, is accelerating this trend. As a result, this enables richer segmentation, including which customers, which channels, and what frequency, as well as real-time anomaly detection and more agile liquidity forecasting.

-

Digital-only and challenger banks, which now hold nearly 4% of total euro-area assets, rely heavily on retail deposits and agile infrastructure, often accounting for approximately 80% of their funding, creating more frequent but also more volatile inflow patterns.

-

Tokenised money is another aspect. By representing deposits on blockchain-based rails, banks can enable faster, programmable inflows that integrate seamlessly with digital ecosystems.

Why is tracking the cash inflow important for banks?

Tracking the cash inflow influences liquidity, risk management, operational efficiency, revenue optimisation, and customer trust.

| Reason | Description | Impact |

| Liquidity and risk management | Real-time tracking allows banks to anticipate funding needs and respond to shifts quickly. | Ensures regulatory compliance, prevents liquidity shortfalls, and reduces risk exposure. |

| Operational efficiency | Accurate inflow data improves forecasting, reserve allocation, and cross-department coordination. | Minimises capital misallocation and enhances day-to-day operations. |

| Strategic decision-making | Analysing inflow patterns by source, channel, and customer segment informs product and business strategies. | Supports innovation, targeted offerings, and competitive advantage. |

| Revenue management | Inflow trends help identify underperforming services and opportunities for new revenue streams. | Optimises pricing, boosts non-interest income, and uncovers growth opportunities. |

| Customer trust and experience | Tracking inflows enables faster approvals, personalised services, and reliable transaction processing. | Strengthens customer relationships and loyalty. |

1. Strengthening liquidity and risk management

Cash inflows are the key to maintaining adequate liquidity.

Real-time monitoring allows banks to anticipate funding needs, respond to sudden shifts, and meet regulatory requirements more effectively.

With regulators tightening liquidity coverage requirements and stress-testing models becoming more sophisticated, banks that track inflows at a granular level are better equipped to stay compliant and resilient.

Proactive inflow tracking reduces exposure to unexpected shortfalls and ensures resilience during market volatility.

2. Boosting operational efficiency

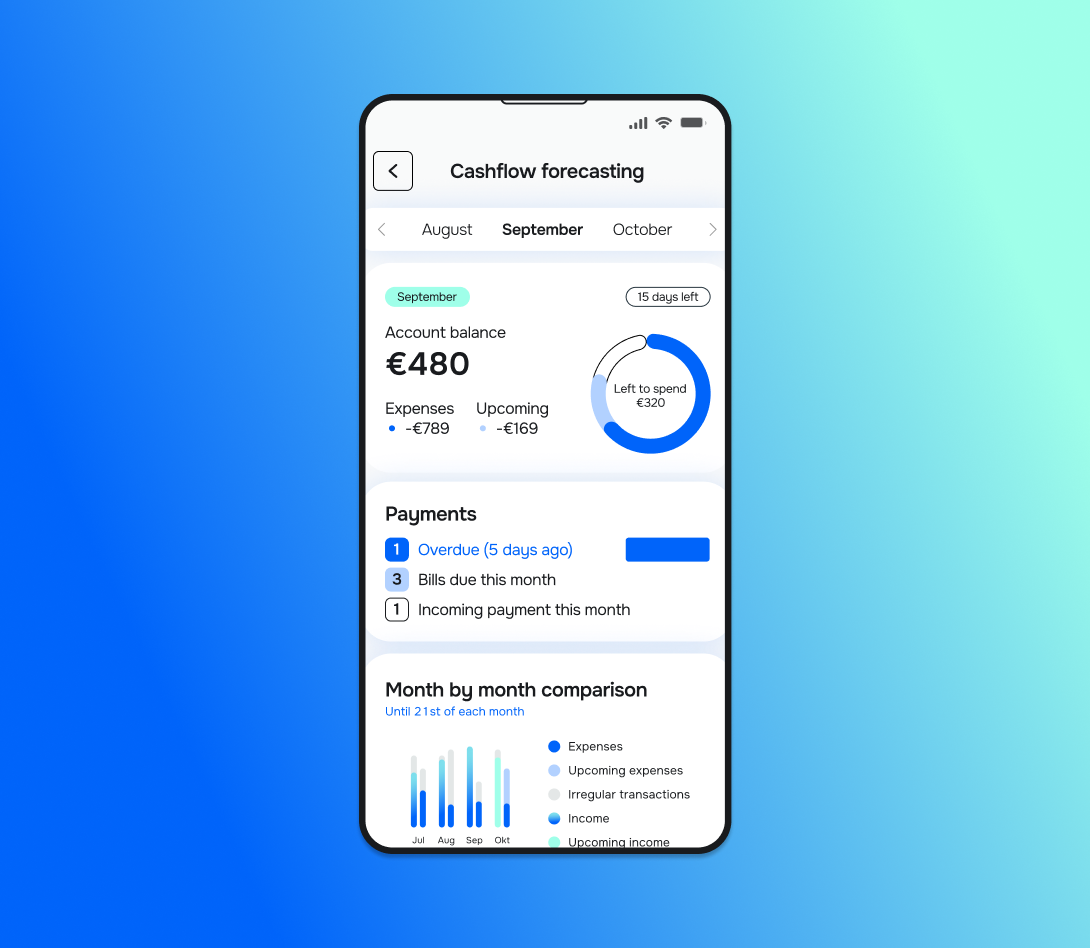

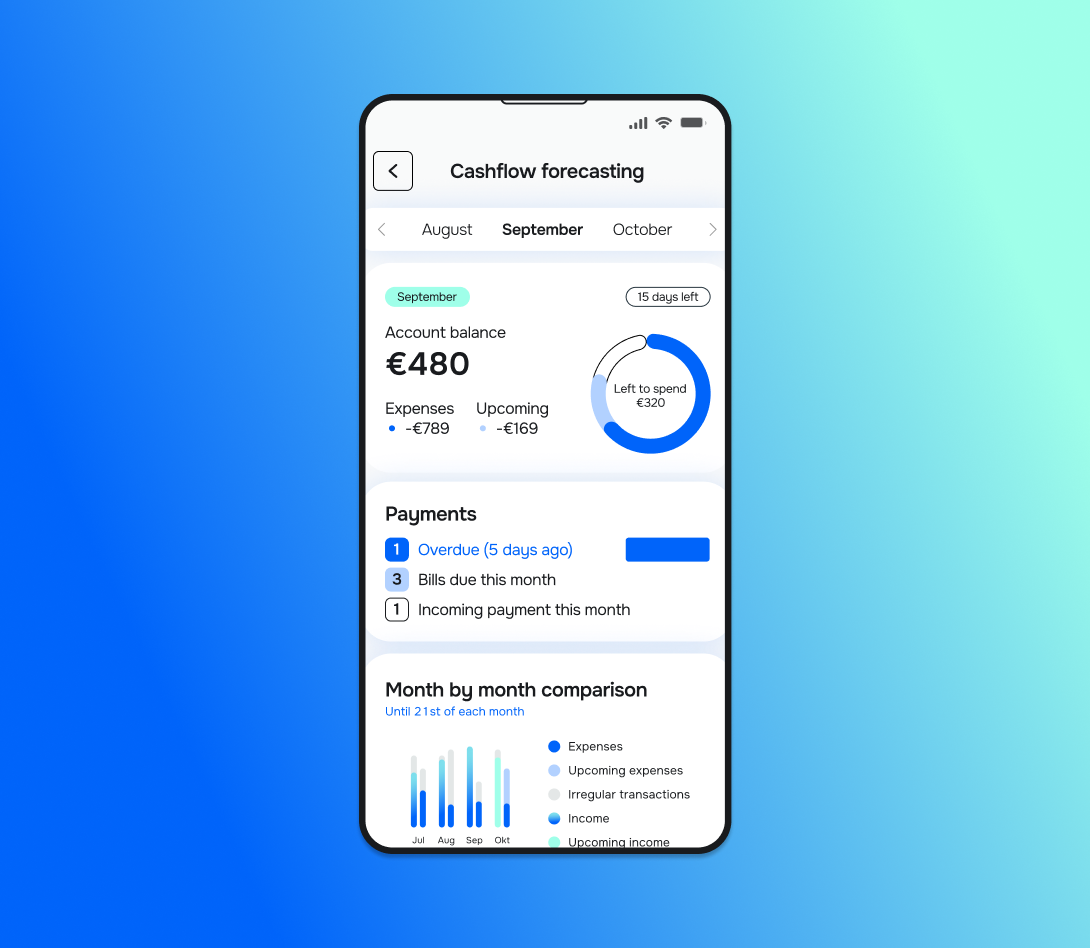

When banks track inflows in real time, treasury teams can forecast cash positions more accurately, optimise reserve allocations, and improve cross-departmental coordination. It also reduces the risk of over- or under-estimating cash positions, mistakes that can either tie up capital unnecessarily or expose the bank to shortfalls.

3. Improving strategic decision-making and innovation

Cash inflow data helps with long-term strategy.

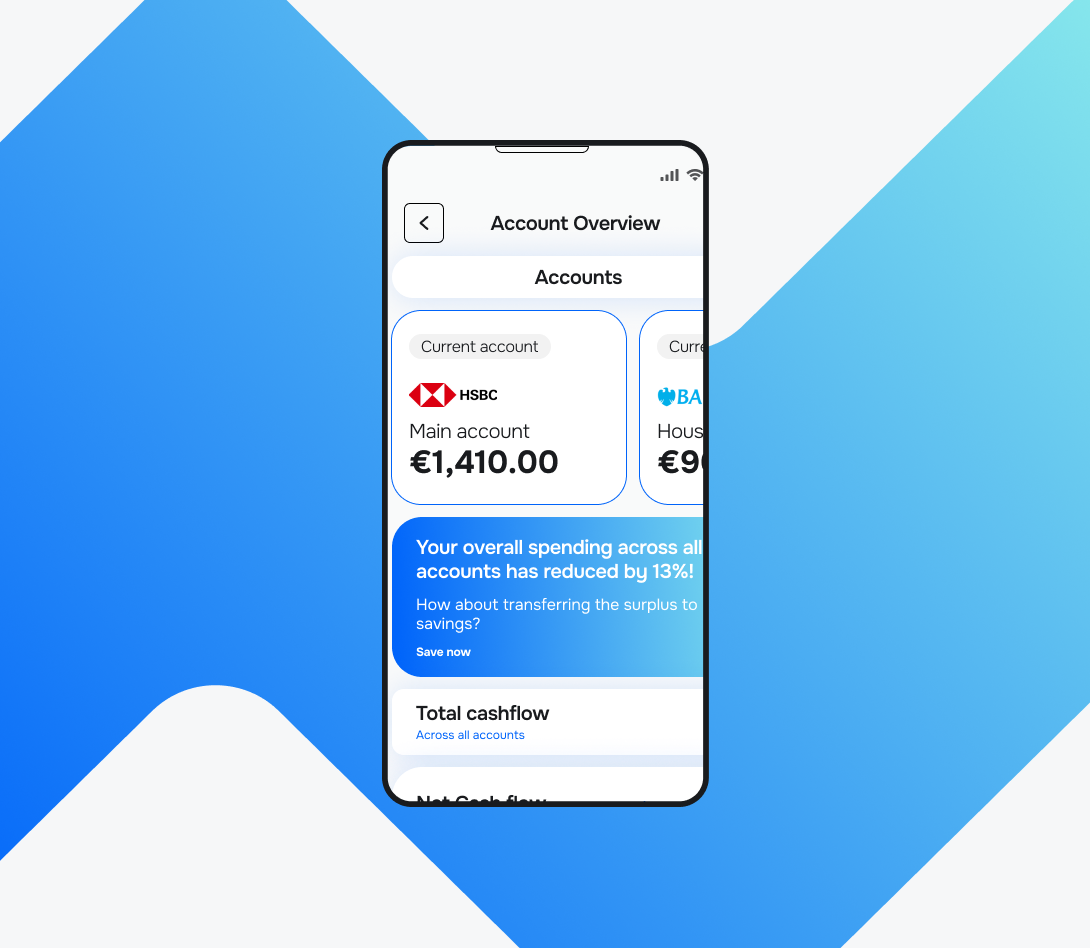

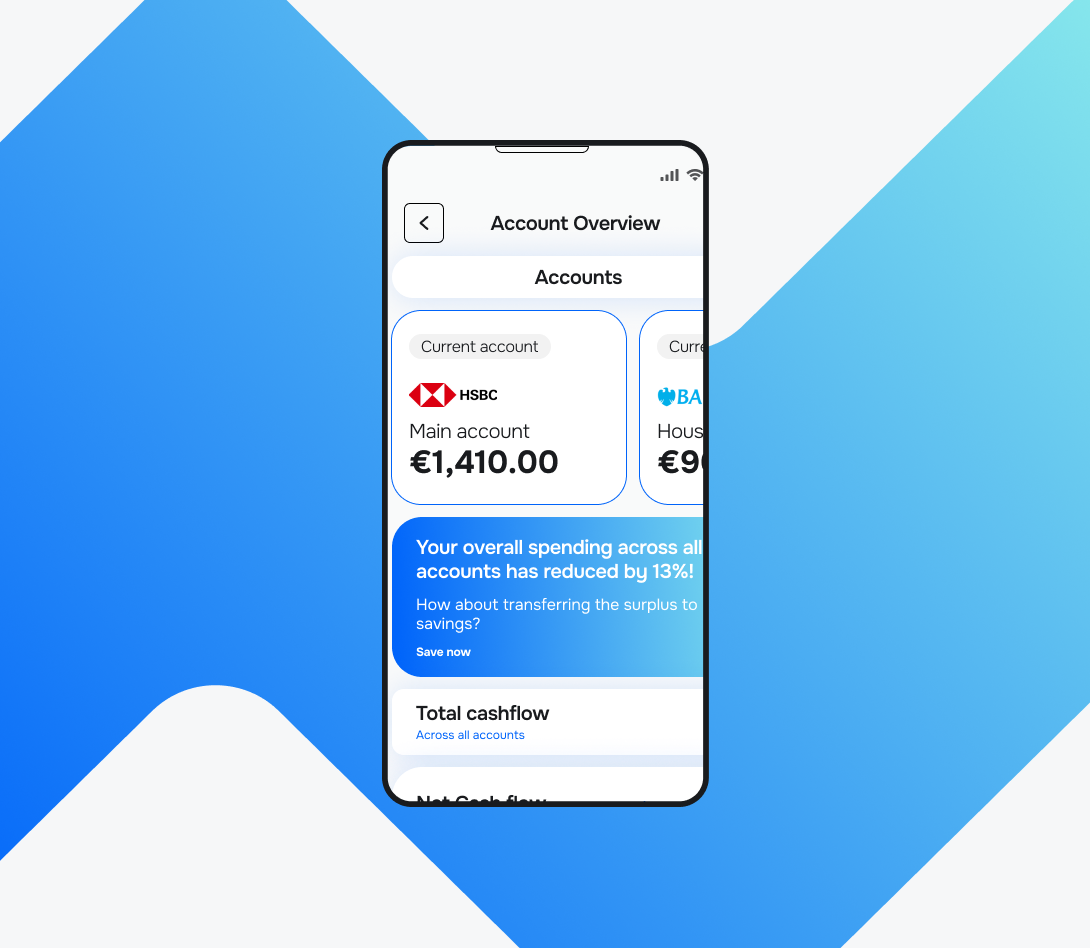

When banks analyse inflows by source, frequency, channel, and customer segment, they gain powerful insights into behaviour and demand patterns.

For example, a surge in inflows from digital wallets might signal growing demand for instant payments or embedded finance solutions.

Likewise, seasonal repayment patterns in certain loan portfolios could guide product redesign or targeted marketing efforts.

Banks that connect inflow trends to strategic decision-making can innovate more quickly, design more relevant products, and enhance their competitive edge.

4. Enhancing revenue management and growth

Tracking cash inflows closely allows banks to identify underperforming areas, spot emerging income opportunities, and optimise pricing strategies across services.

It also helps reveal new ways to monetise customer relationships.

For example, identifying clients with high transaction volumes could lead to premium service offerings, while detecting growth in cross-border inflows might justify expanding foreign exchange products.

5. Building customer trust and a better experience

The cash inflow reflects the trust customers place in their bank.

Consistent inflows from deposits, payments, and repayments are signs of confidence and engagement.

When banks track and understand these patterns, they can respond with tailored solutions that improve the customer experience.

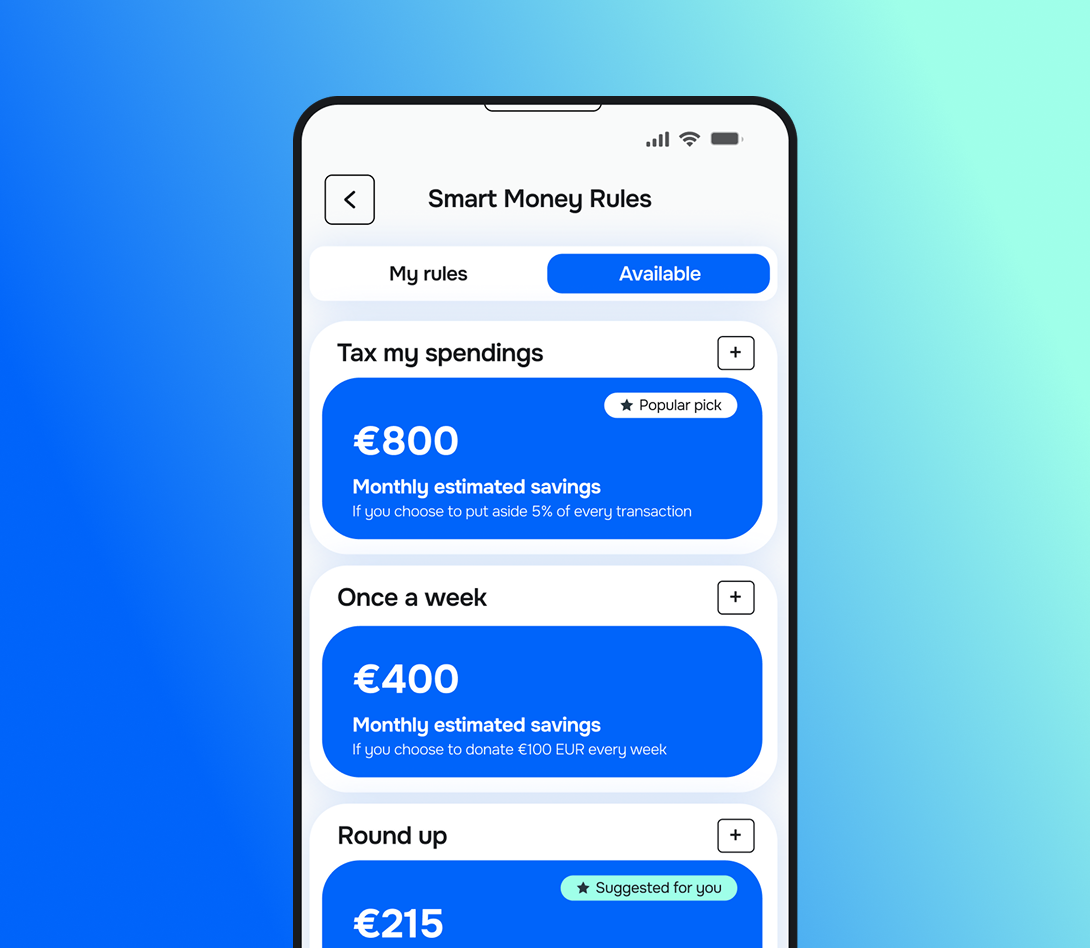

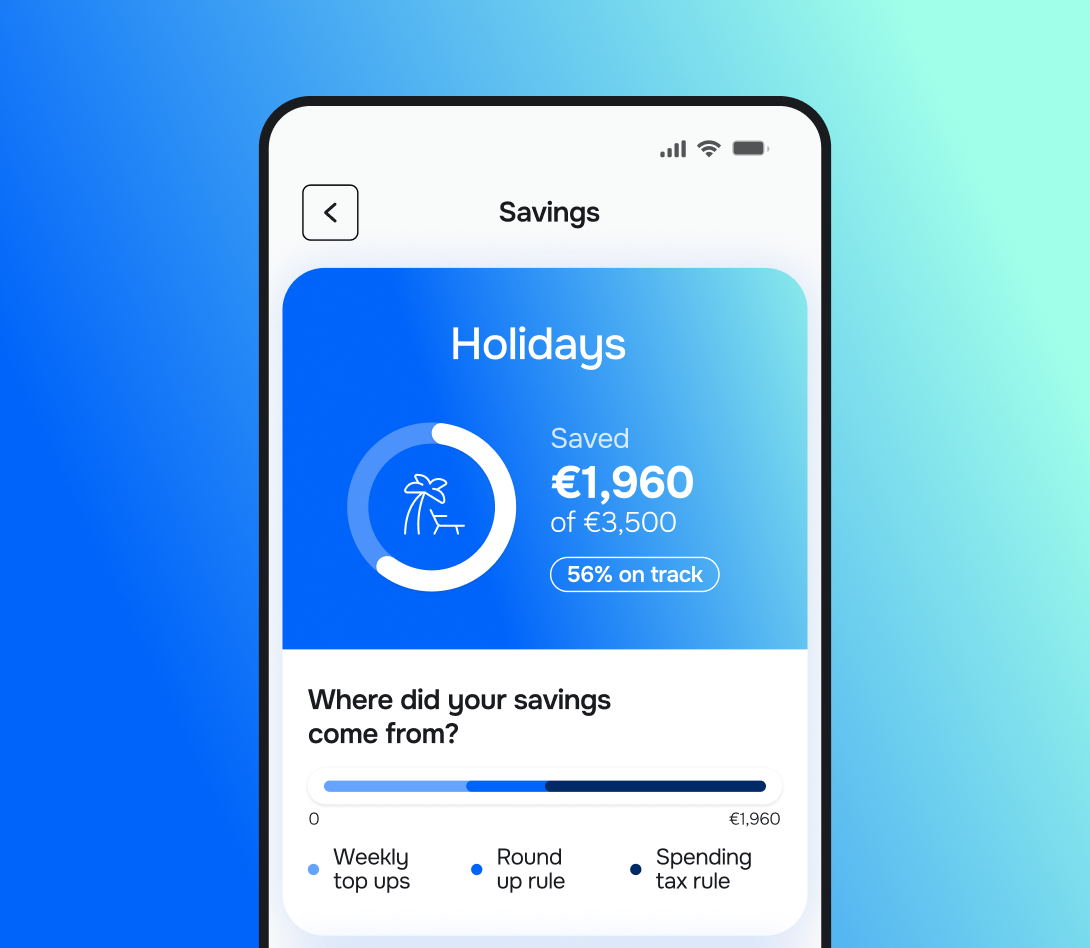

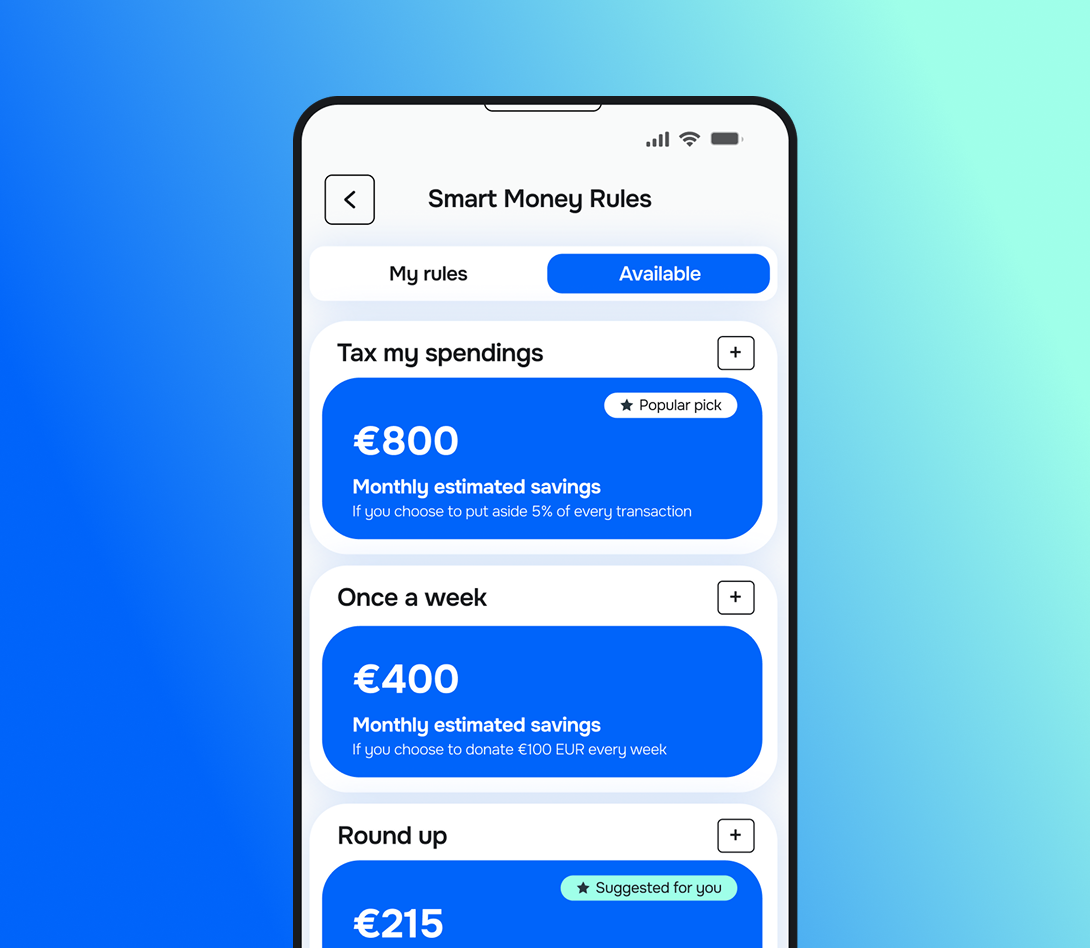

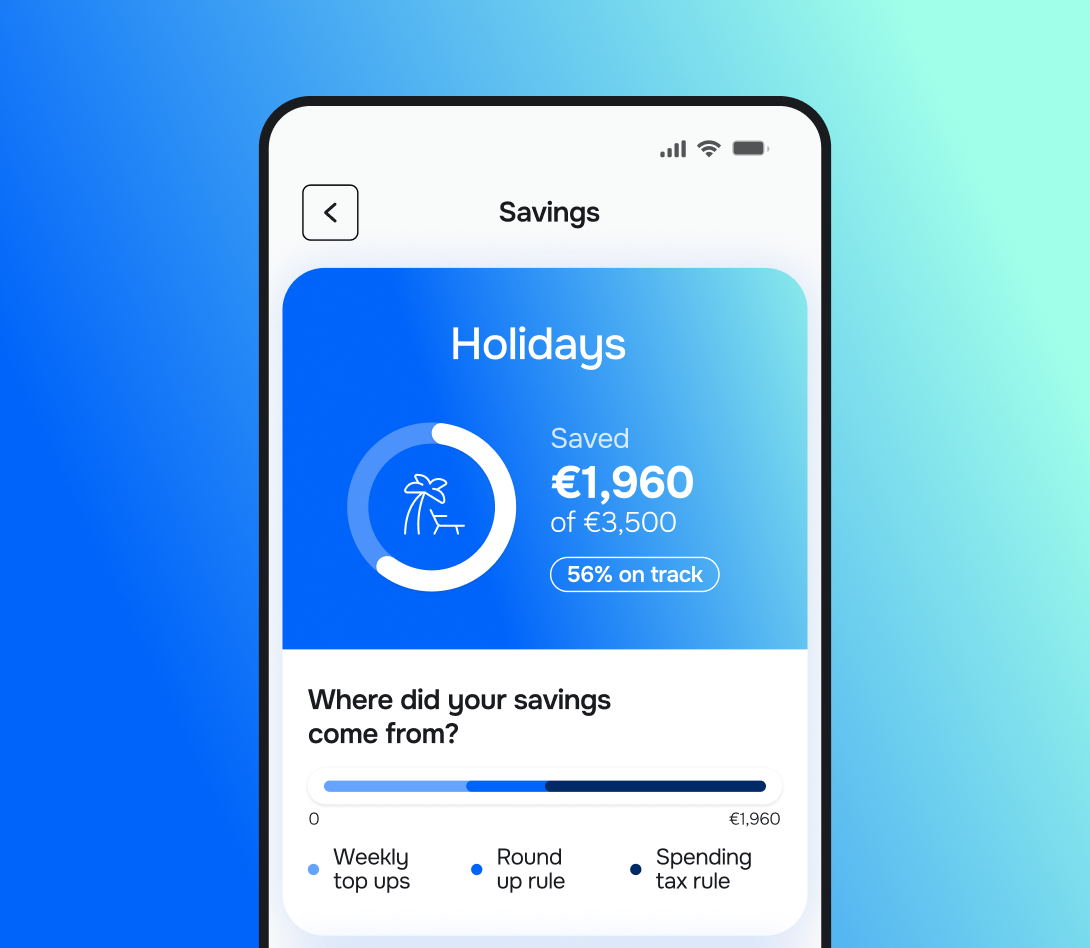

Whether it’s faster credit approvals, smarter savings recommendations, or seamless payment services, inflow insights enable more responsive and personalised banking.

And as trust deepens, inflows often follow.

How to monitor and manage cash inflows in 4 effective ways?

If cash inflows are the heartbeat of a bank, then the tools that track and interpret them are the circulatory system, ensuring that information flows where it’s needed, when it’s needed.

1. Leverage real-time analytics and intelligent dashboards

Real-time analytics platforms aggregate inflow data across channels, from branch deposits and mobile payments to loan repayments and interbank transactions, and present them in dynamic dashboards.

The benefits are clear:

-

Treasury teams gain instant visibility into liquidity positions,

-

Operations teams can respond to unusual inflow patterns as they happen, and

-

Leadership can make decisions based on live financial data rather than yesterday’s summaries.

With predictive analytics on top of these dashboards, you can use historical trends and current conditions to forecast future inflow volumes with quite remarkable accuracy.

2. Implement AI and Machine Learning for forecasting and risk detection

AI and machine learning models can sift through vast amounts of transaction data to identify patterns, predict future inflows, and detect anomalies that might indicate fraud, liquidity risk, or operational issues.

For example, AI-powered forecasting tools can anticipate seasonal deposit surges, repayment cycles, or shifts in payment behaviour.

As a result, you can adjust liquidity buffers, plan lending strategies, and reduce exposure to unexpected cash shortfalls.

Similarly, anomaly detection algorithms can highlight sudden drops in inflows or suspicious deposit activity, enabling faster intervention before risks escalate.

3. Integrate API-driven data and Open Banking

APIs enable banks to pull inflow data from external sources, such as payment platforms, fintech partners, and open banking ecosystems, directly into their core systems in real time.

Not only does this connectivity provide a more complete view of inflows, but it also improves speed and accuracy.

For example, integrating APIs from merchant platforms or embedded finance providers allows you to track incoming payments immediately, rather than waiting for reconciliations.

4. Use cloud infrastructure and data lakes

Cloud-based platforms and centralised data lakes enable banks to securely and cost-effectively store and process massive datasets.

This infrastructure supports advanced analytics and machine learning while enabling faster data access across departments.

A treasury team, for example, can instantly query inflow trends across retail and corporate channels while a product team uses the same data to design new offerings, all from the same integrated source.

5 best practices for optimising cash inflow management

Having the right tools is only part of the equation.

To truly benefit from the strategic value of cash inflow data, banks must incorporate best practices into their daily operations and decision-making.

| Best practices | Description | Benefits and impact |

| Continuous, real-time monitoring | Track cash inflows as they happen instead of relying on end-of-day reports. | Enables immediate detection of anomalies and better liquidity planning. |

| Integration across functions | Share inflow insights across treasury, risk, product, and marketing teams. | Transforms inflow data into a strategic asset and improves decision-making. |

| Predictive analytics and scenario planning | Use historical trends and AI models to forecast inflows and simulate different market scenarios. | Enhances the accuracy of forecasts and prepares banks for potential liquidity fluctuations. |

| Cross-department collaboration | Encourage joint analysis and decision-making among treasury, risk, operations, and product teams. | Ensures inflow insights inform strategy, operations, and customer-facing initiatives. |

| Regular audits and model refinement | Continuously validate data inputs, refine forecasting models, and update KPIs. | Keeps inflow tracking accurate and relevant in a dynamic banking environment. |

Cash inflow management: Key takeaways

Cash inflow management isn’t a back-office function. It must be at the core of liquidity planning, risk strategy, product innovation, and customer engagement.

By embedding continuous monitoring, predictive analytics, cross-functional collaboration, and iterative improvement into their inflow practices, banks can move beyond reactive management and toward proactive value creation.

Besides safeguarding their liquidity and operational resilience, banks will also benefit from speed, personalisation, and data-driven decision-making.