Banks are under pressure. Customer expectations are shifting fast, and fintech competitors are raising the bar with smarter, more intuitive financial tools.

Cash flow forecasting tools aren’t just nice-to-have features, but they’re essential for helping customers make informed decisions and stay connected to their finances. Banks that fail to offer them risk losing ground, fast

By giving customers real-time, personalised financial forecasts, you can help them plan smarter, avoid surprises, and build lasting loyalty.

Dive into our list of 10 best cash flow forecasting tools to transform the digital banking experience for your customers.

10 best cash flow forecasting tools you should know about

Here’s a quick overview of our top picks.

| Cash flow forecasting tool | Stellar feature/best for |

| Meniga | Strong AI-driven personalised insights and categorisation |

| Abacum | Time-series forecasting |

| Anaplan | Complex scenario modeling and real-time sync |

| Workday Adaptive Planning | Intuitive spreadsheet-like user interface |

| Nomentia | AI-driven multi-entity forecasting |

| GTreasury | AI-powered GSmart AI for cash forecasts |

| Kyriba | AI-enabled cash flow forecasting with integrated risk management and API connectivity |

| Asteria Smart Cash Flow | An intuitive, AI-enhanced cash flow forecasting solution |

| Cobase | Modular liquidity forecasting with multi-bank connectivity |

| Oracle | AI-powered cash forecasting with integrated ERP connectivity |

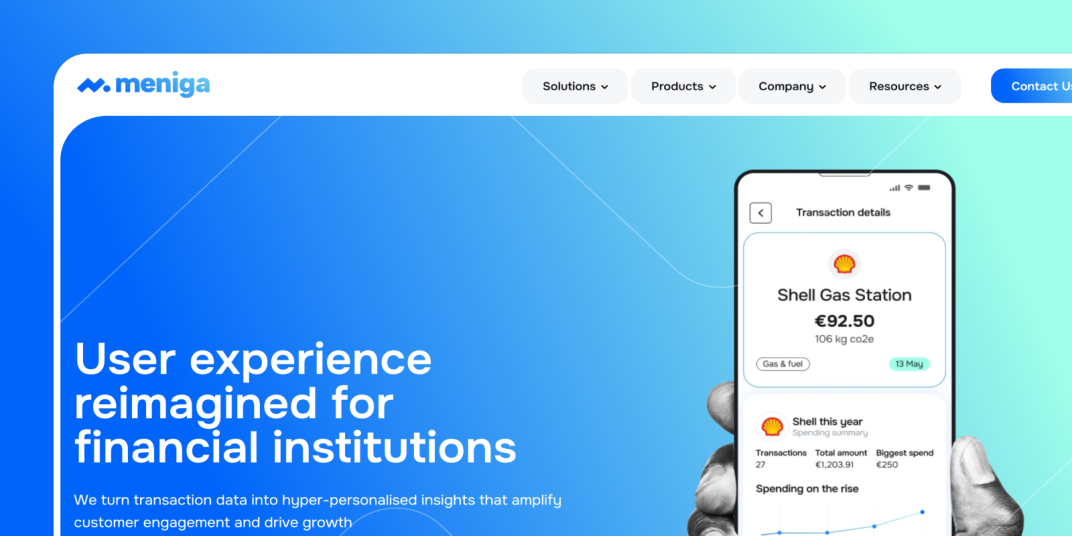

1. Meniga

Meniga provides cutting-edge digital banking solutions that empower major financial institutions to enhance their online and mobile experiences with minimal upfront cost.

With a modular platform and minimal integration friction, we enable modernisation without full infrastructure replacement.

Our solution consists of 3 core products:

1. Projected Cash Flow Management

The AI-powered Cashflow Forecasting gives your customers a clear view of their balance history and forecasts future cash flow, helping them manage their finances more effectively.

It highlights recurring income and expenses, providing valuable insights into spending patterns.

Plus, with proactive alerts, it helps customers avoid unnecessary overdraft fees and missed payments by sending timely warnings before issues arise.

Leveraging real-time liquidity data and upcoming transactions, our system notifies customers when their finances are at risk of running low and delivers personalised advice on whether to save or spend to maintain financial stability.

2. Data consolidation and enrichment

Our AI-powered Enrichment Engine solves the problem of fragmented or delayed financial data by unifying information from various sources, including open banking feeds, and enhancing it with rich contextual details such as:

-

Merchant names

-

Logos

-

Recurring payments.

By transforming raw transactions into structured, categorised data, it gives you a comprehensive view of customer spending behaviour.

This enriched insight enables more precise analytics, improved customer segmentation, and the delivery of highly personalised financial products and experiences.

What’s more, Meniga enables automatic, highly accurate categorisation of all income and expense transactions.

You can choose to use your existing category structure or adopt Meniga’s fully localised setup, whichever suits your needs best.

3. Insights platform

Our Insights platform empowers you to deliver real-time, hyper-personalised experiences that exceed basic notifications.

Driven by AI, it enables contextual communication tailored to each individual, ensuring customers receive meaningful messages rather than generic alerts.

With advanced micro-segmentation tools, you can analyse customer behaviour at a granular level and craft targeted insights that boost:

Meniga: key takeaways

Meniga offers solutions that:

-

Modernise legacy systems to drive digital transformation.

-

Deliver tailored, hyper-personalised products and solutions, such as tailored cash flow forecasting for your customers.

-

Support revenue growth with targeted digital sales, deposit growth, and more.

2. Abacum

Abacum is a cloud-based financial planning and analysis (FP&A) platform that combines AI, automation, and real-time data integration.

It caters to mid-sized to large finance teams.

Key features:

-

Scenario planning: Enables you to use custom business inputs such as sales growth, headcount, churn rate, and customer acquisition cost to create and compare multiple forecast scenarios ("what-if" analysis).

-

KPI tracking: You can track real-time revenue metrics like ARR, churn, and funnel conversions to improve forecast accuracy.

-

Automated anomaly detection and alerts: The platform uses AI to set baselines for normal financial behaviour. Thus, it identifies major changes as anomalies and alerts users.

-

Financial and management reporting: The platform centralises data and automates recurring reports for P&L, cash flow, balance sheets, and budgets.

-

Custom dashboards: You can build tailored dashboards to monitor key financial and operational metrics in real-time and improve overall visibility.

3. Anaplan

Anaplan is an AI-infused scenario planning and analysis platform that provides solutions for both short- and long-term forecasting.

It enables you to create financial models that integrate Profit & Loss (P&L), Balance Sheet (BS), and Cash Flow (CF) statements.

Key features:

-

Anaplan Intelligence suite: It includes AI-powered tools, such as CoPlanner (a conversational AI for context-aware insights), Optimiser (a mathematical optimisation tool for scenario planning), Predictive Insights, and PlanIQ (a no-code ML forecasting solution). The suite enhances forecasting accuracy by analysing large datasets and generating actionable insights.

-

Financial forecasting: Enables you to build flexible, driver-based models incorporating operational and financial inputs and create “what-if” analyses and scenario comparisons.

-

Real-time data integration and collaboration: Connects finance, sales, and operations data into a single cloud platform so your team can update assumptions and instantly see impacts.

-

3-statement modelling: The platform automatically links P&L, BS, and CF statements, ensuring real-time reconciliation.

4. Workday Adaptive Planning

Workday Adaptive Planning is a cloud-based enterprise performance management (EPM) platform that provides financial planning, budgeting, and cash flow projections solutions.

It caters to mid-sized and larger organisations.

Key features:

-

Predictive Forecaster: Analyses internal and external data thanks to machine learning to help you anticipate future trends and get more accurate forecasts.

-

Workday Assistant: Conversational AI that enables you to surface insights and get recommended actions quickly.

-

Intelligent Variance Analysis: Leverages AI to automate variance reporting and provide AI-generated explanations and commentary.

-

Driver-based planning: You can build models based on key business drivers such as sales volume, pricing, and headcount. The functionality enables you to create and compare multiple ‘what-if’ scenarios to evaluate financial impacts under different assumptions.

5. Nomentia

Nomentia is a cash flow forecasting and treasury management platform for mid-to-large enterprises and multinational corporations.

It centralises cash flow forecasts by consolidating data from multiple banks and financial systems.

Key features:

-

AI Cash flow forecasting: Nomentia aggregates cash flow data from various banking and ERP systems into a single platform, enabling treasury teams to maintain a consolidated view of cash positions across multiple accounts and entities.

-

Automated data consolidation: The platform can automatically consolidate data at various levels, including regions, divisions, sub-groups, and group-level, providing a 360 view of cash flow across the organisation.

-

Variance analysis: Compares actual cash flows against forecasts, helping you quickly identify deviations and adjust plans accordingly.

-

Scenario planning and what-if analysis: You can create multiple forecast scenarios to improve strategic planning and risk management on cash flow.

6. GTreasury

GTreasury focuses on cash flow projections by combining AI-powered forecasting with deep integration to ERP systems and banks.

It caters to larger organisations that want to improve forecast accuracy, reduce manual processes, and gain real-time clarity on their global cash positions.

Key features:

-

GSmart Forecast Insights: Uses AI to generate short- and long-term cash flow forecasts by analysing historical and transactional data.

-

Customizable cash forecast models: Enable you to customise cash flow models to meet your requirements using your cash flow categories, sub-totals, and reporting calendar.

-

Projected Cash Flow Management: Provides a real-time cash visibility by aggregating data from multiple banks and ERPs. It also enables you to model data and drill down to transaction-level and customer-level insights.

7. Asteria Smart Cash Flow

Asteria Smart Cash Flow is an AI-driven cash flow forecasting solution that helps you anticipate future cash flows, optimise working capital, and make informed financial decisions.

It caters to SMEs and provides actionable insights into their financial health and liquidity management.

Key features:

-

AI-driven customisable forecasting: AI analyses historical data, and you can adjust the forecasts to match your specific needs and plans.

-

Customer and supplier analysis: Provides an in-depth analysis of customer payment patterns and supplier delivery reliability.

-

Business Health Check: The platform continuously monitors daily financial operations to provide recommendations and an overview of your financial health.

-

White label solution: Asteria can help you deliver advanced financial insights and cash flow forecasting directly to your customers through your banking platform.

8. Kyriba

Kyriba provides solutions to help you optimise cash flow forecasting, risk management, and liquidity performance.

The platform’s API allows you to connect your processes and data to Kyriba’s network of banks, ERPs, and partners.

Key features:

-

Cash flow forecasting: AI capabilities enable scenario planning, variance analysis, and continuous forecast refinement by integrating multiple data sources.

-

Analytics and reporting: Kyriba provides integrated visual dashboards and pre-built data analytics for cash flow management, liquidity management, treasury and risk management, and other financial aspects.

-

Connectivity: Enables you to connect all your financial data to get complete visibility and control over cash, liquidity, and working capital.

-

Liquidity performance platform: Centralises treasury operations, providing real-time cash visibility across multiple bank accounts, currencies, and subsidiaries.

9. Cobase

Cobase offers a centralised hub combined with powerful treasury modules to simplify complex treasury operations.

It connects to banks and integrates with multiple ERP systems to provide you with real-time data feeds for liquidity forecasting and treasury management.

Key features:

-

Liquidity & Cash Position Forecasting: Combines ERP data, scheduled payments, and real-time bank balances to generate reliable, group-wide forecasts.

-

Balances and transactions: The functionality provides a real-time view of all balances and transactions across your bank accounts.

-

The Robo Assistant: It automates recurring tasks, monitors data quality, and identifies exceptions.

-

Reporting: You can access customisable dashboards and automated reports to view cash, payments, and bank activity. You can also folder them by entity, account, or currency.

10. Oracle

Oracle specialises in database software, with solutions spanning multiple industries, including financial services as well.

Some of its financial solutions include Future Cash Flow Analysis, treasury management, and risk management.

Key features:

-

Predictive cash forecasting: Automates and enhances short- and mid-term cash flow forecasting. It uses machine learning algorithms to analyse historical and transactional data from multiple sources.

-

Real-time dashboards: Offer consolidated views of driver assumptions, cash inflows and outflows, and forecasts by bank or project.

-

Personal finance and wealth management: Your customers can get an aggregated view of their banking activities and categorise spending. This way, they get access to insights-based personal finance management.

Why should Meniga be your optimal cash flow forecasting tool?

At Meniga, our strength lies in a strong focus on customer engagement and financial well-being.

This makes our solution a great fit for banks and fintechs that want to differentiate their digital banking apps by offering more meaningful, personalised experiences and valuable everyday financial tools.

With our solution, you can:

-

Boost customer satisfaction and retention by offering highly personalised, value-driven services.

-

Empower your customers to take control of their finances, driving deeper engagement and long-term loyalty.

-

Stand out in the market by putting financial wellbeing and meaningful engagement at the heart of your digital offering.

Contact us today to discover how to deliver smarter, more personalised banking to drive loyalty.