Banks and fintechs face a growing challenge: how to keep customers truly engaged. Consequently, the challenge can lead to declining app usage, low product adoption, and missed opportunities for cross-selling and loyalty.

Thus, many financial institutions still struggle to deliver meaningful, consistent engagement across channels.

That’s where digital banking engagement platforms come in.

These solutions combine data analytics, AI-driven personalisation, and seamless integration to help banks connect with customers on a deeper level.

Read on to learn more about our 10 top picks to see which one aligns best with your needs and can help you turn everyday banking into lasting relationships.

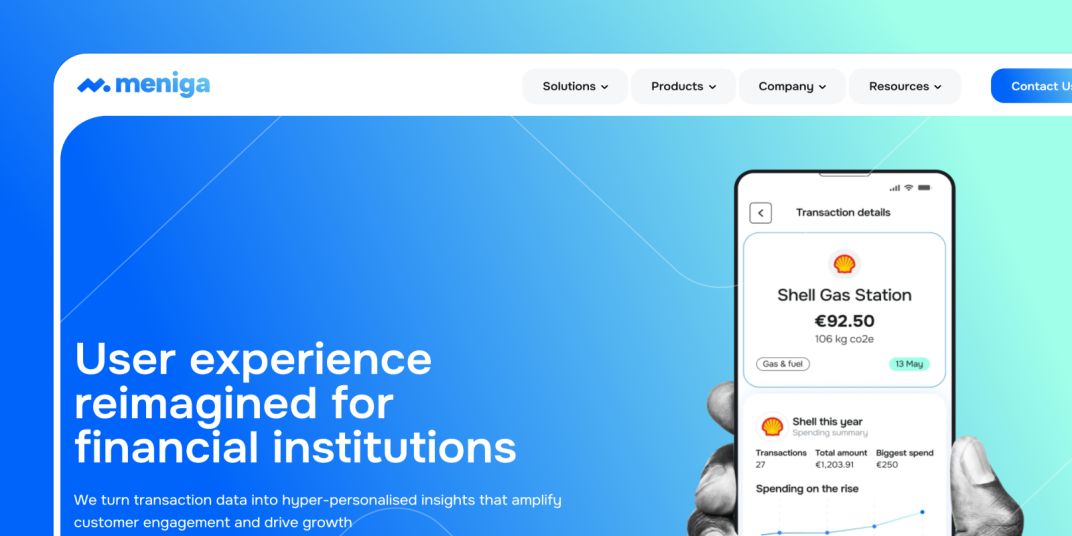

1. Meniga

Meniga is a comprehensive digital banking platform that converts transaction data into personalised, actionable insights, empowering banks to deliver more engaging, customer-focused experiences.

Our three core components, Data Consolidation and Enrichment, Hyper-Personalised Insights, and PMF Experiences, work together to enhance and modernise the bank’s digital ecosystem.

Our platform is built to be flexible and scalable, integrating smoothly with your existing core systems, so you can enhance your digital channels without a full infrastructure overhaul.

Key features:

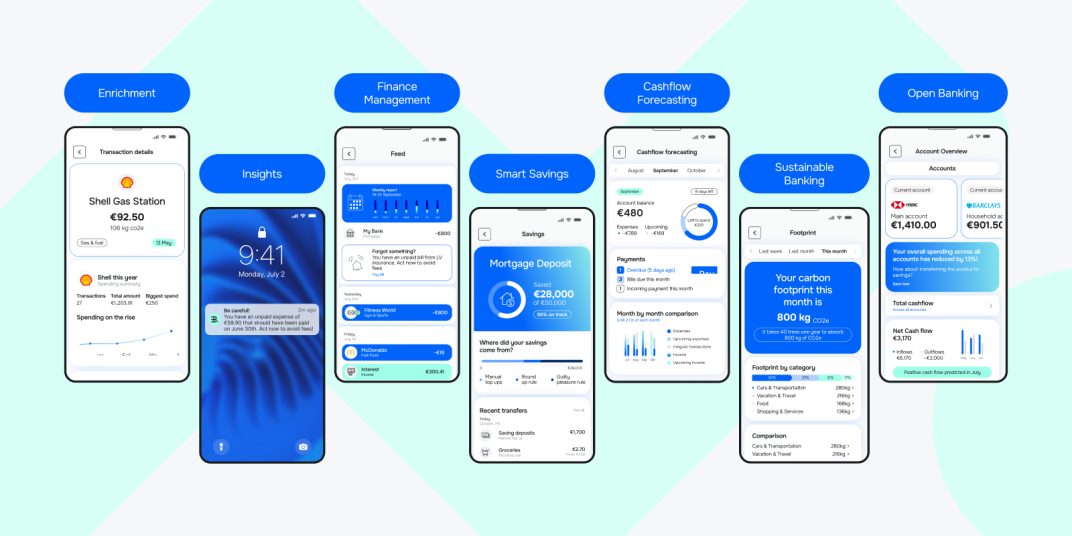

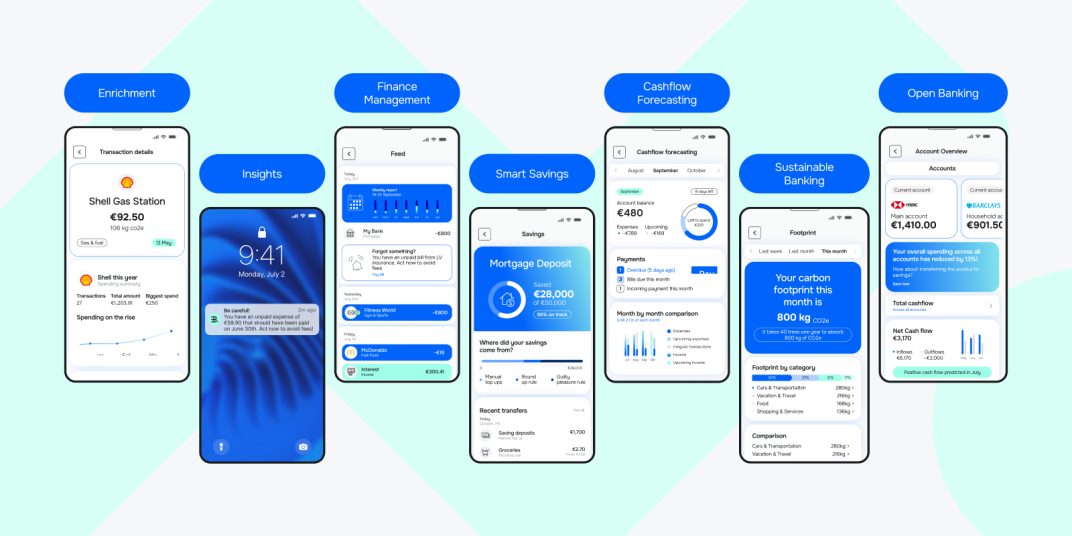

1. Meniga’s Enrichment Engine

The Engine integrates internal, open banking, and third-party data to provide a unified, enriched view of each customer’s financial behaviour, creating the foundation for personalised and customer-centric banking.

It automatically categorises transactions with high precision, allowing institutions to use their own category structures or Meniga’s fully localised categories.

In addition, it enriches the transactional data with merchant information, carbon footprint estimations, and other information.

Building on this foundation, Meniga delivers ready-made Financial Experiences such as budgeting tools, carbon footprint tracking, gamified savings, and cashflow forecasting.

These features offer instant user value while generating behavioural insights that continuously enhance and tailor the experience, growing smarter with every interaction.

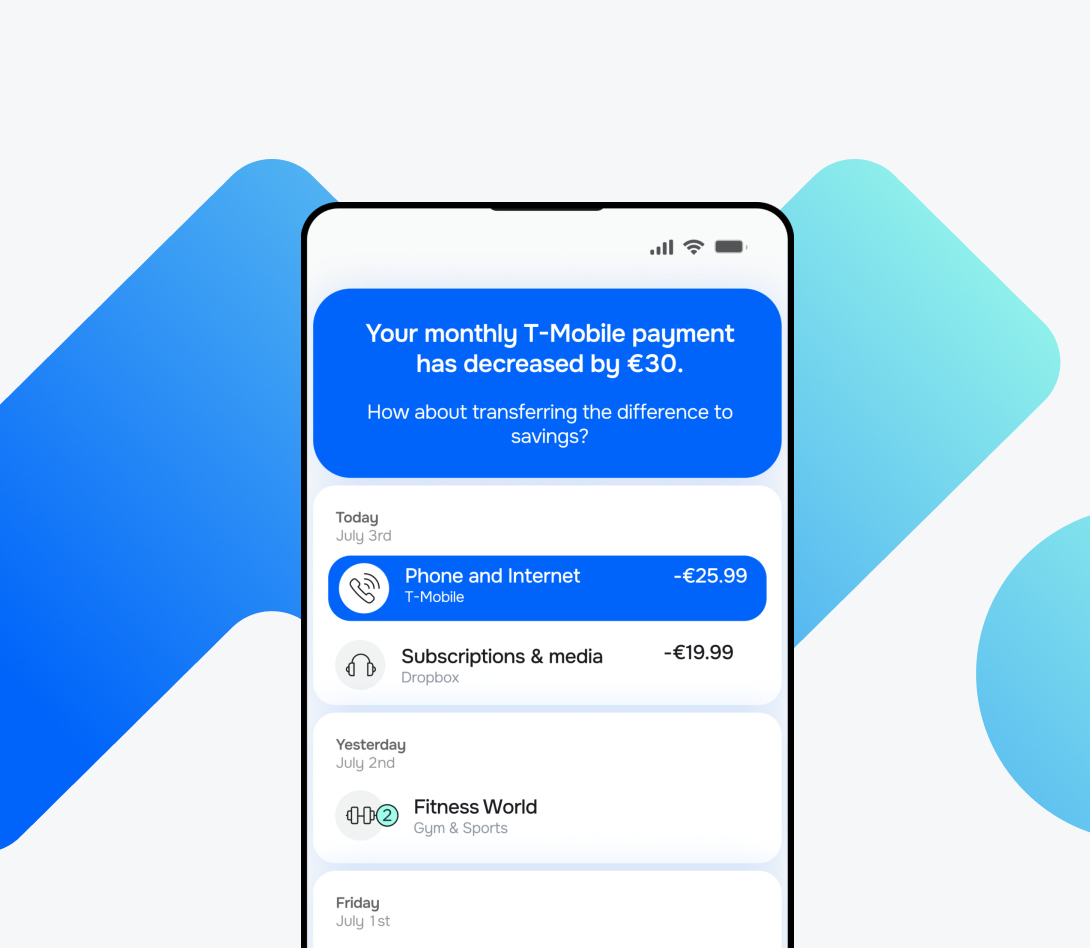

2. Insights Platform

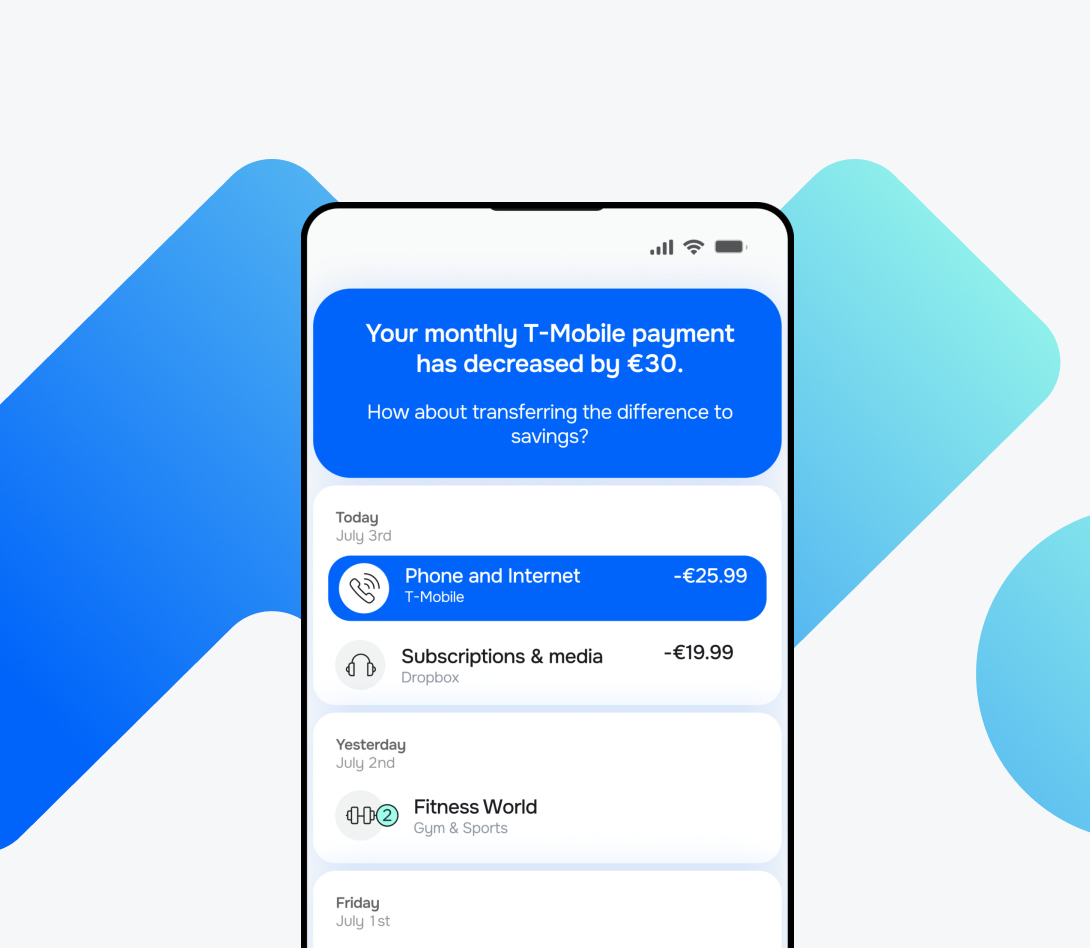

Our Insights is an award-winning AI-driven solution that delivers real-time, hyper-personalised messages tailored to each customer’s unique context, moving far beyond traditional banking notifications.

With Insights, you can:

-

Build rich, ultra-specific customer segments, like Likely to Invest, Starting a Family, based on transactional and behavioural data.

-

Trigger timely, event-based communications across internal and external banking systems.

-

Cut through noise with contextual, one-to-one messaging.

-

Gain deep customer understanding and intelligence through feedback loops, in-app behaviour, and predictive modelling.

-

Identify and act on opportunities instantly with real-time data processing.

The platform empowers business users to send individualised notifications, proactive in-app insights, Instagram-esque stories, and even dynamic user interfaces.

3. AI-powered Cashflow Forecasting

The tool provides customers with a clear, past and future view of their finances to support smarter money management.

Recurring income and expenses are automatically highlighted, offering instant insight into spending patterns.

In addition, real-time alerts warn of low balances, potential overdrafts, and upcoming bills, enabling proactive financial decisions.

Personalised recommendations based on cash positions guide customers on the best times to save or spend to reach their financial goals.

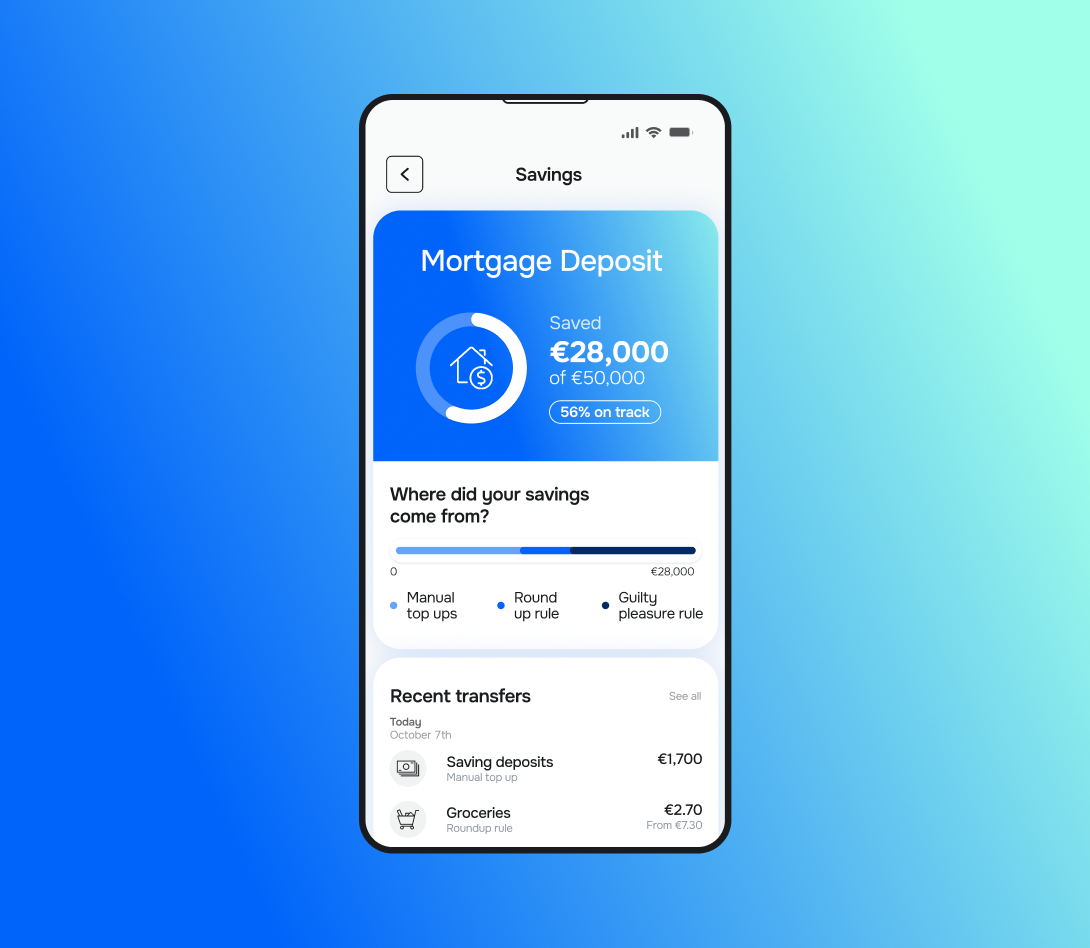

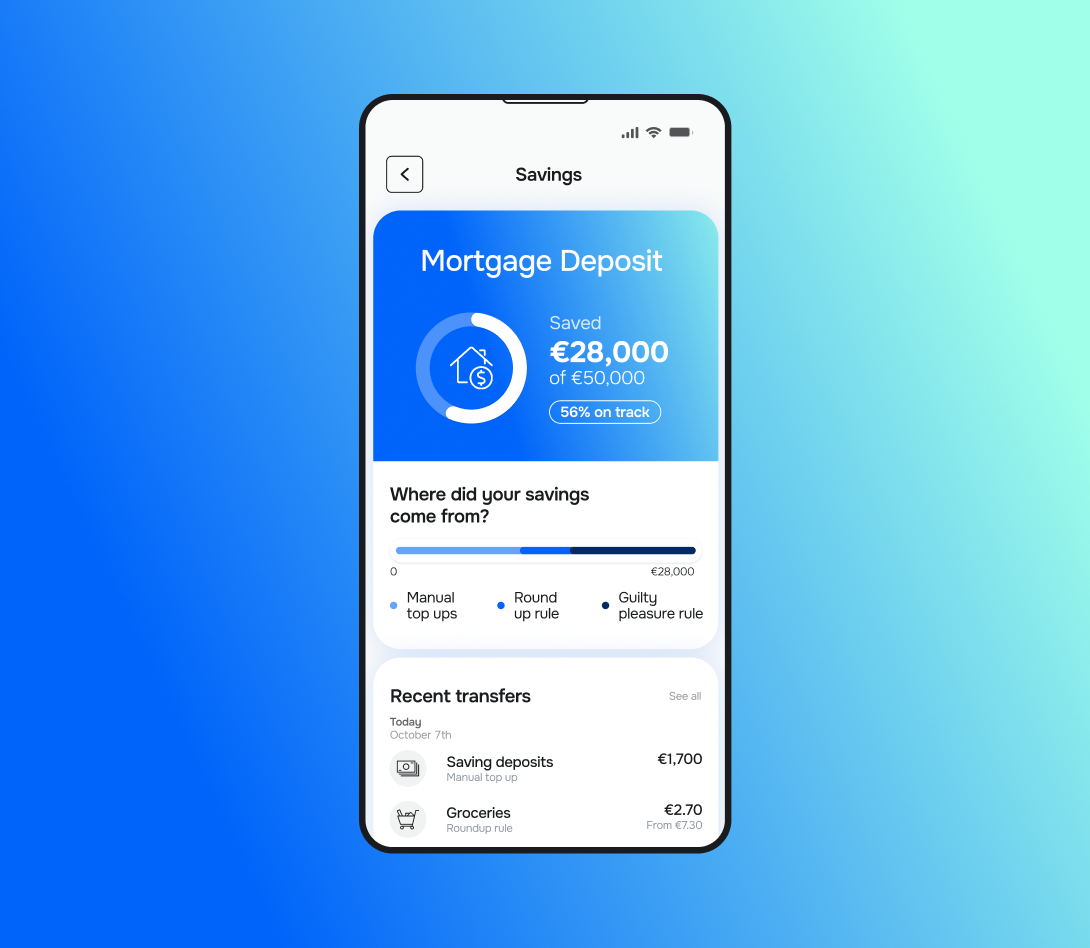

4. Smart Savings

Meniga provides intelligent savings tools that help customers effortlessly grow their savings while boosting deposits for banks.

Key features include:

-

Gamified Savings Goals: Users can set up dedicated savings pots for specific targets like a car, vacation, or even a home.

-

Automated Savings Rules: Customers can create rules that automatically transfer funds to savings based on criteria such as spending categories or a percentage of their salary.

Meniga: Key takeaways

Overall, Meniga offers a wide range of solutions to help:

-

Offer hyper-personalised products and experiences that truly meet your customers’ needs.

-

Drive sustainable revenue with smarter digital sales.

-

Close the gap with neobanks by offering ready-to-use financial wellness tools that enhance customer engagement.

-

Modernise legacy systems and speed up digital transformation.

2. Velmie

Velmie is a modular, cloud-native digital banking platform that helps banks, fintechs, and financial institutions deliver an enhanced customer experience and improve the organisation’s performance.

The platform uses AI to analyse transaction data and provide real-time spending breakdowns and personalised financial recommendations.

Key features:

-

White label capabilities: Enable you to issue custom-branded cards, provide savings and lending services, support both local and international transfers, and digitally onboard customers.

-

Omnichannel engagement: Velmie supports engagement across multiple channels, including mobile apps (iOS and Android), web interfaces, ATMs, and social media platforms.

-

AI-powered self-service and automation: The platform enables the automation of onboarding, customer support, fraud detection, credit scoring, and predictive analytics.

-

Business banking platform: Features a modular architecture that allows customisation of services, including payments, lending, foreign exchange, cryptocurrency transactions, and invoice factoring.

3. Backbase

Backbase is a unified customer engagement platform that combines AI, omnichannel experiences, and integration capabilities.

It focuses on solutions that improve banking customer journeys.

Key features:

-

Omnichannel orchestration: Provides omnichannel engagement across mobile apps, online banking, ATMs, call centres, and social channels.

-

Customer journey unification: By consolidating data and automating workflows, Backbase enables banks to unify the customer lifecycle.

-

Integration capabilities: Integrates with legacy core banking systems, middleware, and third-party fintech providers. It provides open APIs and SDKs for gradual modernisation.

AI-powered banking platform: Supports self-service, real-time customer support, intelligent automation, dynamic risk scoring, and predictive analytics.

4. Temenos Infinity

Temenos Infinity is a modular, scalable digital banking platform that combines AI-driven personalisation, automation, and core integration.

It primarily caters to retail banking.

Key features:

-

Temenos AI: Uses generative AI for data queries and explainable AI (XAI) to generate instant insights and reports, as well as tailor financial products based on real-time customer behaviour.

-

Integration capabilities: Integrates with any existing core banking system or Temenos Transact core, allowing modular modernisation.

-

Personalised customer experience: Provides omnichannel access (mobile, web, branch kiosks), real-time updates, multilingual support, and digital onboarding processes.

-

Omnichannel support and onboarding: Features compliant customer journeys and journey orchestration tools for faster onboarding and KYC/AML checks.

5. CR2

CR2 is a digital banking and payments platform that provides tools to enhance customer experiences, streamline operations, and drive financial inclusion.

Key features:

-

Integrated digital services: CR2’s platform, BankWorld, supports a wide range of banking channels, including mobile apps, internet banking, ATM networks, and card issuing and switching.

-

Mobile-first experience: The platform is designed mobile-first, with AI-driven fraud detection.

-

Smart onboarding: A 3-step onboarding process that allows you to collect and verify customer data in real time, automate compliance checks, and activate accounts through AI and automation.

-

Omnichannel engagement: Allows customers to start a transaction on one channel and complete it on another.

6. Fiserv

Fiserv provides digital banking solutions to enhance customer engagement and operational efficiency.

The platform has strong payment integration capabilities and supports real-time payments, e-commerce, merchant acquiring, card issuing, and network services.

Key features:

-

Content Next solution: Uses embedded AI tools for content management and workflow automation across loan processing, compliance review, and customer onboarding.

-

Omnichannel experience: Provides multi-device support (mobile, web, kiosks) and compliance with accessibility standards.

-

Transaction processing: Enables instant transaction processing and settlement, providing customers with real-time visibility of their accounts and transactions.

-

Customer engagement analytics: Uses aggregation, analysis and contextualised insights from data to enable personalised marketing, product recommendations.

7. Finacle Digital Engagement Studio

Finacle Digital Engagement Suite is an omnichannel platform that helps banks and financial institutions drive deeper customer engagement and agile innovation.

Its solutions focus on unifying and personalising customer experiences across all banking segments and channels.

Key features:

-

Omnichannel onboarding: The suite enables customer journeys across multiple touchpoints, including mobile apps, web, branches, call centres, and kiosks.

-

Finacle app centre: Offers access to tools and apps that help you engage customers through natural language interfaces.

-

Data and AI Suite: Helps banks integrate AI across their operations and speed up their AI journeys.

-

Unified engagement hub: Consolidates customer data and interactions across all channels with contextualised, real-time customer engagements.

8. nCino

nCino is a cloud-based banking platform that combines digital engagement with operational efficiency.

It helps financial institutions streamline workflows, improve risk management, and enhance customer experiences.

Key features:

-

Bank operating system: Unifies loan origination, enterprise content management, CRM, data analytics, and treasury operations.

-

Generative AI banking advisor: Provides tailored financial guidance and automates customer interactions across multiple channels.

-

Credit monitoring: Offers real-time, data-informed insights for proactive credit risk oversight, using automation and AI augmentation.

-

Loan origination: Digitised with automated workflows, AI-driven mortgage advisory, and document validation.

9. Q2

Q2 is a digital platform that enables financial institutions to provide a unified retail, commercial, and small business banking experience.

The platform is known for broad integrations, including connections to fintech partners, core systems, payment processors, KYC/AML, credit bureaus, and more.

Key features:

-

Omnichannel platform: Enables delivering banking experience for retail, small business, and commercial users through web, mobile, and more.

-

Configurable workflows: Allow you to tailor features and user journeys by segment, based on behavioural data.

-

Banking-as-a-Service (BaaS): Enables fintechs and brands to embed financial services and launch white-label banking products, such as digital accounts, payments, and card offerings.

-

Financial planning tools: Provides customers with tools to help them manage budgets, savings, investments, and other financial goals.

10. Alkami

Alkami supports both retail and business banking, providing solutions to enhance the customer experience, improve operational efficiency, and boost customer engagement.

It caters to US-based customers and financial institutions.

Key features:

-

Financial wellness tools: Help users manage budgets, set and track savings goals, and monitor their overall financial well-being.

-

Alkami Data Insights: Enable personalised user experiences, support deposit growth, uncover lending opportunities, and expand revenue diversification.

-

Money Movement feature: A central place for your customers to access various movement tools, including wire transfers, real-time payments, P2P, and more.

-

Full Funnel marketing: Uses AI-driven insights and automation across channels to deliver personalised, data-informed marketing campaigns.

Why opt for Meniga?

Meniga stands out for its emphasis on customer engagement and innovative financial wellness solutions.

With Meniga, you can:

-

Enhance customer satisfaction and loyalty through hyper-personalised, engaging digital experiences.

-

Make financial wellness and proactive engagement central to your digital strategy.

-

Stay compliant with regulations while maintaining speed, agility, and innovation.

-

Equip users with actionable insights that build lasting trust and engagement.

-

Collaborate with a trusted partner experienced in executing complex, large-scale integrations.