Strands has positioned itself as a prominent fintech provider with superior AI-powered solutions in digital banking and financial management.

Businesses may, though, turn to alternatives with changing needs, such as increased scalability, cost-effectiveness, or accelerated deployment.

Although Strands performs well in delivering individualised customer journeys and utilising innovative technologies such as machine learning and Web3, certain enterprises may seek solutions with more aligning business objectives or offering distinguishable functionalities. Whether due to strategic changes or a need for increased flexibility, here’s our pick for 5 Strands alternatives you can try out.

5 Strands alternatives worth trying out

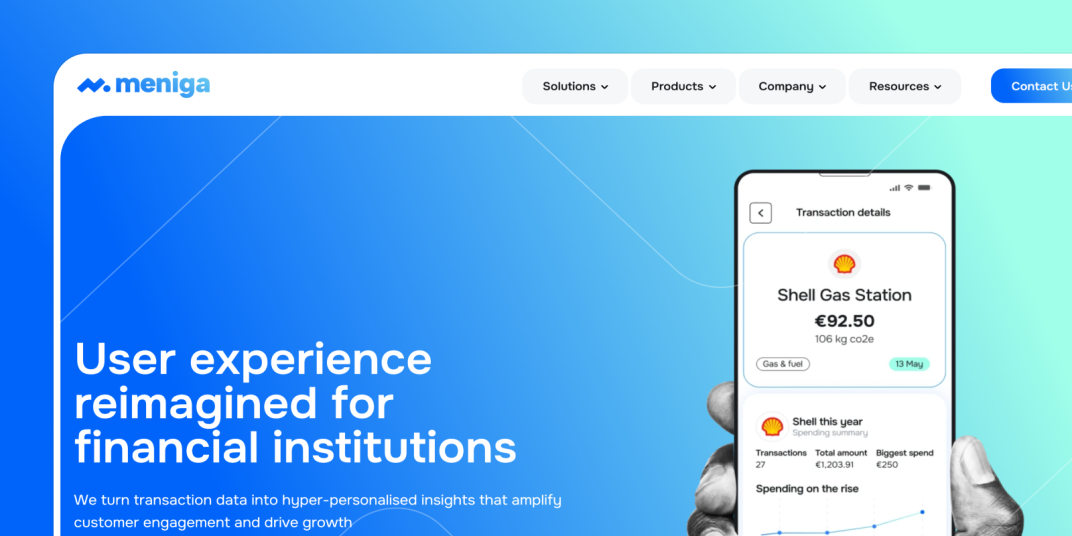

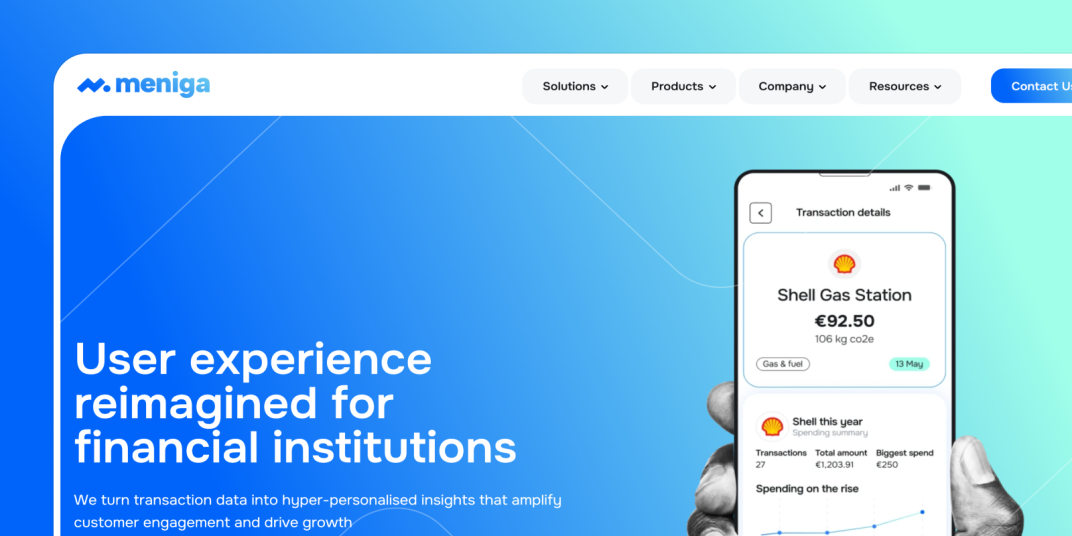

1. Meniga

Meniga is a comprehensive digital banking solution that transforms raw transaction data into actionable, personalised insights. This empowers banks to deliver more engaging, customer-centric services.

The solution is built around three core products:

Together, these components modernise and elevate the digital banking experience.

Key features

1. Data Consolidation & Enrichment

Meniga enables you to consolidate transaction data from both internal and external sources, enhancing it with valuable context to better serve your customers.

-

Categorisation: AI-powered models adapt to user behaviour over time, improving categorisation accuracy and delivering clearer financial overviews.

-

Merchant Details: Enhance transaction clarity by enriching entries with standardised merchant names, logos, locations, and URLs – ultimately reducing support queries.

-

Subscription Identification: Identify and track recurring payments to help users manage their subscriptions and optimise monthly spending.

With a unified, enriched dataset, you gain a complete picture of customer finances and habits, allowing you to unlock the full value of transaction data.

2. Hyper-Personalised Insights

Address common challenges in digital banking, such as unused data, limited personalisation, and siloed systems, by delivering contextual, real-time insights to every individual.

-

Move beyond generic communication with micro-segmentation that pinpoints behaviours and patterns.

-

Real-time processing lets you act on opportunities the moment they arise.

-

An intuitive interface gives your team direct access to insights, eliminating the need for IT intervention.

This module integrates seamlessly with our Financial Management tools, providing customers with:

-

A visual activity feed

-

Categorised transactions and spending reports

-

Personalised financial insights

-

Budgeting and planning tools

3. Cash Flow Forecasting

Powered by machine learning, this feature offers forward-looking predictions and financial health indicators:

-

Analyse balance history and forecast future cash flow.

-

Highlight recurring income and expenses.

-

Send proactive alerts to help users avoid overdrafts and missed payments.

-

Recommend when it's safe to save or spend based on liquidity and upcoming transactions.

Boosting financial literacy helps users make more informed decisions and avoid unnecessary costs.

4. Open Banking Connectivity

Meniga simplifies open banking integration by offering seamless connectivity through leading aggregators. With a single, consistent API across regions, your bank can streamline operations and improve scalability.

Benefits include:

-

Greater ROI on current systems

-

Stronger acquisition and retention

-

A better, unified digital banking experience.

5. Smart Savings

This module helps users grow their savings effortlessly, while increasing deposits for banks.

-

Savings Goals: Let users set up goal-oriented savings pots for specific targets (e.g., holidays, a car, a home) with visual and gamified elements.

-

Automated Rules: Users can define rules that transfer money into savings automatically – for instance, rounding up purchases or allocating a percentage of their salary.

2. Finacle

Finacle is a digital banking solution suite developed by Infosys that is designed to help financial institutions of all sizes enhance their banking services.

It provides cloud-native and SaaS-based platforms that enable banks to engage customers, innovate offerings, improve operational efficiency, and drive digital transformation.

With a functionally rich and composable architecture, Finacle supports retail, corporate, and wealth management banking needs.

Key features

1. Core features

-

Core banking: Supports retail, corporate, and Islamic banking operations with robust functionality for deposits, lending, leasing, and trade finance.

-

Omnichannel banking: Provides a unified experience across digital and physical channels, improving customer engagement.

-

Payments and treasury: Comprehensive solutions for payment processing and treasury management, including capital markets and liquidity management.

-

Wealth management: Tools for managing investments and advisory services for high-net-worth clients.

-

Islamic banking: Sharia-compliant banking modules tailored to meet specific regulatory requirements.

2. Advanced capabilities

-

Artificial Intelligence and analytics: Embedded AI-driven insights for personalised customer interactions and data-driven decision-making.

-

Blockchain solutions: Enables secure, transparent transactions for trade finance, payments, and other banking operations.

-

API banking: Open APIs allow integration with third-party services and ecosystems to foster co-innovation.

-

Fraud management and Compliance: Advanced tools to detect fraud, ensure risk management, and maintain regulatory compliance.

3. Technology and architecture

-

Cloud-native and SaaS-based: Offers deployment flexibility on private, public, or hybrid clouds with Kubernetes orchestration for scalability.

-

Composable design: Modular architecture allows banks to choose specific components based on their business needs.

-

Massive scalability: Proven capability to handle high volumes of accounts and transactions (e.g., supporting over 900 million accounts in a single deployment).

4. Customer-centric features

-

Personalised product bundling: Enables banks to design tailored products using pre-built templates or custom configurations.

-

Customer Relationship Management (CRM): Enhances customer onboarding, servicing, and engagement through a centralized hub.

-

Financial inclusion tools: Solutions designed to extend banking services to underserved populations.

5. Operational benefits

-

Automation and efficiency: Ubiquitous automation reduces operational costs while improving service delivery speed.

-

Real-time processing engine: Ensures faster transaction processing with minimal latency.

-

Security compliance: Adheres to global security standards to protect data at all levels – application, infrastructure, and network.

3. Backbase

Backbase offers an Engagement Banking Platform that allows banks to modernise their customer journeys and restructure their business operations around their customers.

The platform enables banks to replace or decompose legacy systems, creating a modern customer engagement architecture.

It prioritises essential customer journeys across all touchpoints, eliminating silos and empowering both customers and front-office employees.

Backbase's Model Bank accelerators provide a starting point for digital transformation, embodying industry best practices that can be configured to fit specific needs.

The platform's suite of products supports various stages of the customer lifecycle, from acquisition to retention and cross-selling.

Key features

1. Core features

-

Composable architecture: The platform is built with over 400 microservices, allowing banks to select and integrate specific components based on their needs. This modular approach enables flexibility and scalability in digital transformation efforts.

-

Customer-centric approach: Focuses on orchestrating seamless customer journeys across all touchpoints, prioritising user experience and eliminating silos between different banking channels.

-

Model bank accelerators: Provides pre-built, configurable solutions that embody industry best practices, allowing banks to jumpstart their digital transformation and accelerate time-to-market.

2. Digital banking solutions

-

Digital onboarding: Offers fully digital account opening processes, streamlining customer acquisition and improving the overall onboarding experience.

-

Digital banking apps: Enables the development and launch of top-rated banking applications, enhancing customer engagement and interaction.

-

Digital lending: Facilitates smarter and faster loan origination processes, improving efficiency and customer satisfaction.

-

Digital investing: Supports trading, robo-advisory, and portfolio management services, providing comprehensive investment solutions.

3. Operational and technical features

-

Integration and partnerships: Pre-integrated with leading core systems and fintechs, allowing banks to leverage best-in-class technologies and innovate at scale.

-

API and SDK capabilities: Open platform for rapid development and deployment of differentiating features, empowering banks to build unique value propositions.

-

Flexible deployment options: Supports various deployment models, including public cloud, private cloud, hybrid, container-based, community, and on-premise, ensuring flexibility in infrastructure choices.

4. Employee enablement

4. nCino

nCino offers a cloud banking platform built to transform financial institutions through innovation, efficiency, and customer engagement.

It streamlines the entire banking process, from loan origination to account opening and everything in between, using automation and data-driven insights.

The platform enhances transparency and collaboration across teams, improving both employee and customer experiences.

nCino also helps banks make data-informed decisions, manage risk effectively, and maintain regulatory compliance.

Key features

1. Core banking features

-

Loan origination: Automates and streamlines the entire loan lifecycle, from application to closing. This includes features for credit analysis, pricing, and documentation.

-

Account opening: Simplifies and accelerates the process of opening new deposit accounts and other banking products.

-

Customer Relationship Management (CRM): Offers a 360-degree view of customer interactions and financial profiles, enabling personalised service.

2. Advanced capabilities

-

Workflow automation: Automates repetitive tasks and processes across various banking functions, improving efficiency and reducing errors.

-

Credit portfolio management: Proactively manages commercial and small business loans throughout the credit lifecycle using automation and intelligence.

-

Document management: This centralises and organises all loan-related documents, ensuring compliance and easy access.

3. Data and analytics

-

Reporting and analytics: Provides real-time insights into key performance indicators (KPIs), enabling data-driven decision-making.

-

AI and Machine Learning: Leverages AI to automate tasks, improve credit scoring, and detect fraud.

4. Compliance and security

-

Compliance management: Helps banks adhere to regulatory requirements and industry standards.

-

Risk management: Identifies and mitigates risks across the lending process.

-

Secure cloud platform: Built on Salesforce, ensuring high levels of security and reliability.

5. Integration and flexibility

-

Open API architecture: Allows seamless integration with existing banking systems and third-party applications.

-

Scalability: Cloud-based platform designed to scale with the needs of growing financial institutions.

6. Additional features

-

nCino IQ (Intelligence Quotient): Embedded AI and machine learning capabilities that enhance decision-making and automation.

-

Retail banking solutions: Streamlines processes for mortgages, auto loans, and other consumer lending products.

-

Commercial banking solutions: Supports complex lending scenarios for businesses of all sizes.

5. Kasisto

Kasisto provides an AI platform for the financial services industry, enhancing both customer and employee experiences through intelligent, compliant, and measurable solutions.

Its platform combines generative, agentic, and prescriptive AI to deliver human-like, personalised interactions, answering detailed questions and executing actions with speed and consistency.

Kasisto's AI Agent, KAI, can manage a high percentage of inbound contacts, freeing employees to focus on complex issues and high-value conversations.

The KAI Portal generates insights that reveal the effectiveness of strategies and highlight opportunities for business growth.

Key features

1. Core conversational AI features

-

Natural Language Understanding (NLU): Transforms user inputs into semantic representations (intents and slots) to accurately interpret customer inquiries.

-

AI reasoning: Determines the next interaction steps, such as calling backend services, asking for more information, or generating responses.

-

Natural Language Generation (NLG): Creates human-like responses in natural language based on semantic representations.

-

Omni-channel support: Powers virtual assistants and chatbots across mobile apps, websites, messaging platforms, and voice-enabled devices.

2. Generative AI capabilities

-

KAI-GPT: Combines Kasisto’s proprietary large language model with GPT technology for banking-specific applications. It delivers hyper-personalised conversations and handles complex inquiries with remarkable speed and accuracy.

-

KAI answers: Provides employees with instant access to answers for customer service queries, improving efficiency and satisfaction rates.

3. Customer engagement features

-

Intelligent Digital Assistants (IDAs): Automates up to 90% of customer inquiries, reducing employee workload and enabling focus on high-value tasks.

-

Customer segmentation: Allows banks to define and target customer segments based on various parameters for personalised experiences.

-

Pre-packaged banking knowledge: Speeds up deployment by leveraging pre-built financial domain expertise optimised for banking interactions.

4. Employee empowerment tools

-

AI-powered employee assist: Integrates with knowledge repositories to provide employees direct access to relevant documents and answers.

-

Data and analytics: Offers insights into performance reporting, optimisation recommendations, and actionable intelligence for both AI and human teams.

5. Scalability and integration

-

Platform tools and services: Enables customisation of features, seamless addition of new channels, and integration with existing banking infrastructure.

-

Conversational API (CAPI): Allows banks to build custom customer experiences across multiple platforms using conversational UI best practices.

Conclusion

While Strands has made a name for itself with AI-powered digital banking, banks seeking more flexibility, faster deployment, or a stronger focus on customer engagement may find Meniga a better fit.

Meniga goes beyond personalisation by combining transaction categorisation, automated savings, and carbon footprint tracking to deliver deeper customer insights and stronger brand loyalty.

With a modern, engagement-driven platform and a commitment to financial wellness and ESG initiatives, Meniga helps banks stay competitive, relevant, and customer-centric.

Ready to explore a smarter alternative?

Discover how Meniga can elevate your digital banking experience.

Get in touch with our team to see it in action today!