Transaction data enrichment is incredibly important to financial institutions, fintechs, and service providers who seek to deliver more value to their customers with clearer, more actionable financial information.

From improved categorisation to behavior-based insights, these transaction data enrichment tools are paving the way to turn raw transaction data into valuable, structured information.

Before we dive in, here's a quick overview of the top transaction data enrichment tools and what each one brings to the table.

| Transaction Data Enrichment Tool | Description | Standout Feature |

| Meniga | Meniga helps banks turn transaction data into personalised experiences with clear categories, subscription insights, and merchant information – all powered by real-time processing and scalable APIs. | Combining deep transaction enrichment with hyper-personalised insights and engagement tools, enabling banks to understand customer behavior and act on it. |

| Fiserv | Fiserv provides scalable, real-time transaction data enrichment that enhances clarity, standardises formatting, assigns categories, and integrates smoothly with its digital banking tools. | Native integration with Fiserv's broader digital banking and payments infrastructure. |

| Yapily | Yapily simplifies access to financial data across European banks with transaction enrichment features like categorisation, merchant ID, data normalisation, and risk assessment. | Strong emphasis on API-first, open banking connectivity with robust financial behavior analysis. |

| Salt Edge | Salt Edge enables open banking connectivity through a unified API, offering transaction enrichment, risk profiling, compliance tools, and account aggregation across 5,000+ institutions. | Wide global coverage with built-in compliance and partner access for companies without open banking licenses. |

| Plaid | Plaid offers secure data access and enrichment with merchant details, categorisation, and behavior insights, making it a flexible platform for developers and financial institutions. | Developer-friendly API ecosystem with support for a wide range of financial data types beyond transactions. |

Meniga specialises in enhancing digital banking experiences for financial institutions.

The platform focuses on transforming raw transaction data into meaningful, personalised insights, enabling banks to offer more engaging and user-centric services.

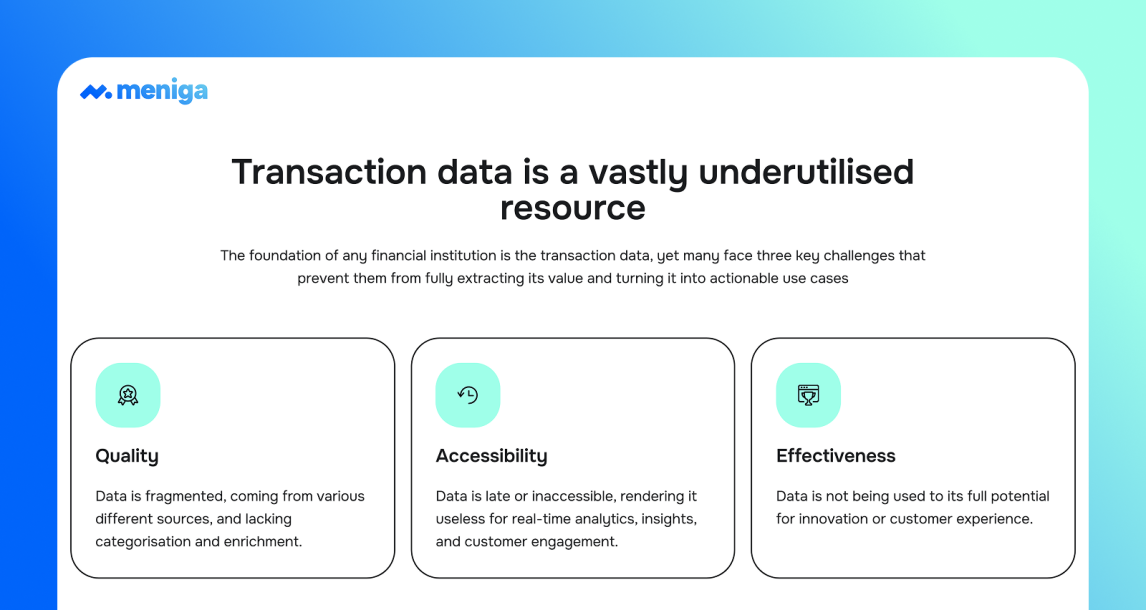

Raw data alone doesn’t provide enough context for meaningful insights or engagement.

So, Meniga solves this by enriching transaction data, helping you improve customer experience, delivering personalised insights, and supporting financial literacy.

Here are the key features of Meniga’s transaction data enrichment platform:

1. Merchant Details and Categorisation

Meniga standardises merchant information by providing accurate names, logos, locations, and website URLs. This replaces unclear transaction strings with recognisable merchant details, making statements easier to understand.

Benefit: Fewer support inquiries and better customer trust in the app’s accuracy.

2. Subscription Identification

The platform automatically detects and tracks recurring payments such as streaming services, gym memberships, and software subscriptions. It also monitors changes in pricing or activity.

Benefit: Enables you to help customers manage regular expenses and identify unused or forgotten subscriptions.

3. Hyper-Personalised Insights

Meniga applies machine learning to generate tailored insights for each customer. These include budgeting suggestions, savings prompts, and product recommendations based on transaction behavior.

Benefit: It supports better financial decisions and increases the relevance of digital banking services.

4. Improved Categorisation Accuracy

Accurate categorisation is essential for budgeting tools and spending analysis. Meniga enhances categorisation using AI models that continuously learn and adapt to customer behavior.

Benefit: Reduces manual corrections and improves the reliability of financial overviews.

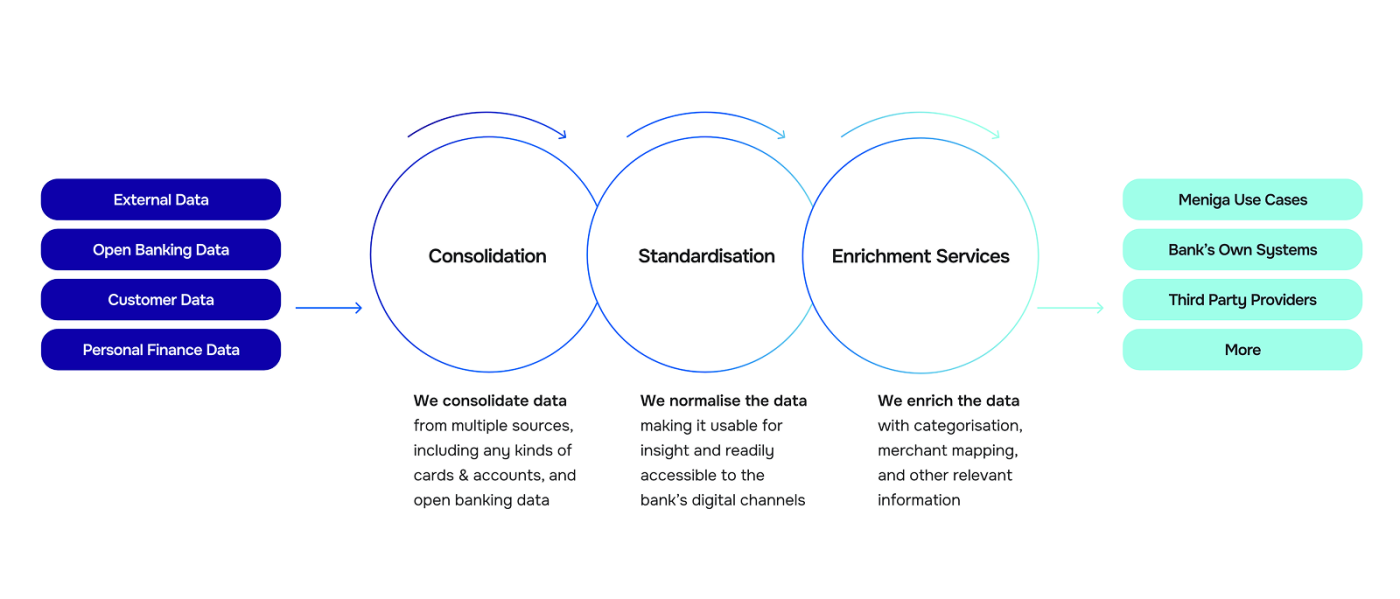

5. Data Aggregation

Meniga consolidates data from internal banking systems and open banking APIs to offer a full picture of a customer’s financial activity.

Benefit: Banks can offer a unified financial view, even across multiple accounts and providers.

6. Visual Storytelling

The platform presents transaction data in a structured, visual format to highlight spending trends, income patterns, and financial goals.

Benefit: Increases engagement and makes financial information easier to interpret.

7. Real-Time Processing

Meniga integrates directly with banking APIs to enrich transactions as they are processed, ensuring customers receive immediate, updated insights.

Benefit: Enables instant notifications, faster analysis, and timely interventions.

8. Omni-Channel Delivery

Insights and enriched data can be delivered through various channels, including mobile apps, online banking portals, and push notifications.

Benefit: Provides a consistent and seamless user experience across platforms.

9. Scalable Integration

The platform is built to support easy integration and expansion. Banks can onboard new data sources or add delivery channels without major technical changes.

Benefit: Future-ready infrastructure that supports growth and adaptability.

10. Carbon Footprint Estimation

Using spending patterns, Meniga estimates the carbon footprint of individual transactions. The estimates are based on categories like transport, travel, and retail purchases.

Benefit: Enables banks to provide sustainability tools and promote environmentally conscious behavior.

Fiserv offers solutions across payments, banking, and data management. Within its portfolio, transaction data enrichment is vital in improving how financial institutions present transaction information to customers.

Fiserv’s enrichment tools convert raw transaction strings – often filled with unclear or incomplete merchant details – into clean, contextualised data that customers can easily understand. This improves transparency, supports real-time decision-making, and enables financial institutions to deliver a more intuitive digital banking experience.

1. Merchant Name Cleanup and Standardisation

Transforms unstructured or cryptic merchant names into recognisable, standardised formats, improving readability in transaction histories.

2. Merchant Details Enrichment

Adds additional context like merchant category, location, contact details, and website URLs to help customers identify their purchases.

3. Category Assignment

Automatically assigns spending categories to transactions using AI and rule-based logic to support budgeting and personal finance tools.

4. Real-Time Enrichment

Processes and enriches transactions as they occur using machine learning and real-time APIs, ensuring up-to-date information across platforms.

5. Payment Method Identification

Identifies whether a transaction was made through a digital wallet, card processor, or third-party facilitator, offering deeper payment context.

6. Data Normalisation Across Channels

Ensures consistent transaction formatting and categorisation across mobile apps, online banking platforms, and statements.

7. Scalable Processing Capabilities

Supports high-volume enrichment across large datasets and complex financial ecosystems without compromising performance.

8. Integration with Fiserv Digital Banking Platforms

Natively integrates with other Fiserv services for a seamless experience across core banking, digital channels, and analytics tools.

Yapily is an open banking infrastructure provider that enables businesses to connect to banks across Europe through a unified API.

It focuses on simplifying access to financial data and facilitating secure payments.

Yapily's platform allows companies to retrieve financial information and initiate payments directly from customer bank accounts, fostering innovation and efficiency in financial services.

It supports various use cases, including accounting, lending, and investment management, by providing a secure and reliable connection to banking data.

1. Transaction Categorisation

Yapily automatically categorises transactions, providing businesses with structured data on income, expenses, and spending habits. This feature helps in understanding customer financial behavior and creating personalised services. The categorised data includes detailed information about transaction types, such as retail, utilities, or entertainment, making it easier to analyse spending patterns.

2. Merchant Identification

Yapily identifies merchants involved in transactions, which is crucial for providing detailed insights into customer spending. It allows businesses to gain insights into where customers are spending their money, which is useful for targeted marketing campaigns and loyalty programs. The system enriches the data by providing the merchant's name, logo, and industry, offering a clear view of transaction details.

3. Data Normalisation

Yapily normalises transaction data across different banks, ensuring consistency and uniformity. This feature simplifies data processing and analysis, regardless of the bank the data originates from.

4. Spending Pattern Analysis

Yapily provides tools for analysing spending patterns, helping businesses understand how customers manage their finances. This enables companies to offer tailored financial advice, identify cross-selling opportunities, and improve customer engagement.

5. Risk Assessment

Yapily enriches transaction data to support risk assessment, enabling businesses to make informed decisions about lending and credit. By analysing transaction history, Yapily helps identify potential risks and assess creditworthiness accurately.

The risk assessment feature includes evaluating factors like income stability, debt levels, and payment behavior to provide a comprehensive risk profile.

Salt Edge is an open banking solutions provider that enables businesses to access financial data and initiate payments across thousands of banks globally.

With over a decade of experience, Salt Edge focuses on delivering tailored solutions for various industries, including banks, payment gateways, and e-commerce platforms.

It offers a single, unified API to access real-time account data from over 5,000 financial institutions in more than 50 countries.

By providing licensed and certified services, Salt Edge allows businesses to innovate without acquiring their own open banking licenses or certificates.

1. Transaction Categorisation

Assigns categories to unclear business and personal transactions, turning them into meaningful insights for companies and customers.

2. Merchant Identification

Identifies the exact merchant of a transaction and offers detailed information, which is helpful for targeted marketing campaigns and personalized analytical reports.

3. Financial Insights

Provides a comprehensive view of customers’ financial behavior in one clear report, generated using machine learning algorithms that process transactional data from all the customers’ bank accounts.

4. Data Aggregation

Connects to over 5,000 banks in 50+ countries, enabling fintechs, lenders, credit bureaus, and banks to build new services based on automatic account statement gathering.

5. Risk Assessment

Improves risk assessment and decision-making by using enriched transaction history.

Plaid Enrich is a tool that brings clarity to transaction data, making it easier to understand customer spending habits.

It transforms unstructured data into categorised data with insights, including merchant details, category, location, and counterparties.

This tool is designed for banks and fintechs of all sizes, providing the ability to create intuitive user experiences and drive customer loyalty.

By understanding spending habits, businesses can better identify leads and cross-sell opportunities.

1. Account Linking via Plaid Link

Plaid Link is a client-side component that handles the user authentication process, including credential validation and multi-factor authentication, allowing users to connect their financial accounts securely. It supports OAuth flows for institutions that require it and provides a seamless experience across web, iOS, Android, and other platforms.

2. Transaction Data Enrichment

Plaid’s Enrich feature adds detailed information to existing transaction data, making it easier to understand spending habits and financial behavior. It includes categorisation, merchant identification, and location data to provide actionable insights for budgeting tools and financial analysis.

3. API Integration

Plaid offers a comprehensive API that allows developers to integrate financial data access into their applications. The API supports various endpoints for retrieving account information, transactions, and other financial data, using JSON over HTTPS for secure communication.

4. Security and Compliance

Plaid ensures data privacy by serving its API over HTTPS TLS v1.2+ and requires up-to-date root certificates for verification. It supports compliance with financial regulations by providing tools for identity verification and fraud detection.

5. Financial Insights

Plaid offers insights into investment accounts, liabilities, and income, providing a comprehensive view of users' financial situations.

While all tools offer solid data enrichment capabilities, Meniga stands out for its deep focus on user experience, behavioral insights, and financial wellness.

It goes beyond standard categorisation by offering hyper-personalised insights, visual storytelling, carbon footprint estimation, and multi-channel delivery – features that help banks engage customers more meaningfully and support financial literacy efforts at scale.

Meniga is particularly well-suited for financial institutions that want to go beyond technical enrichment and deliver a more human-centric, impactful digital banking experience.

Ready to make transaction data work smarter?

👉 Contact us today to see the platform in action and explore how Meniga can help your institution transform raw data into a valuable customer experience.