AI in banking will see explosive growth, nearly doubling in just five years, from about $33 billion in 2025 to over $75 billion by 2030.

This rapid growth is driven by rising demand for customer-centric, faster, and more secure financial services.

But let’s see what AI looks like in action. Here are some of the most impactful AI implementations, with real-world AI in banking examples.

Read on to see how they deliver results and how you can do the same.

Why should banks consider AI implementation?

By adopting AI, banks can achieve faster operations, smarter customer service, sharper risk detection, and smoother compliance.

As a result, they can turn everyday processes into powerful drivers of growth, savings, and competitive edge.

Key benefits include:

-

Personalised banking experiences: AI analyses individual customer data to tailor product offers and financial advice. This way, it helps you foster deeper engagement and loyalty through customised experiences at scale.

-

Faster processing and approvals: AI automates manual processes such as document verification, reducing turnaround times. Thus, it greatly improves customer satisfaction and agility.

-

24/7 intelligent customer support: AI-powered chatbots and virtual assistants handle routine inquiries continuously without wait times, lowering operational costs and improving customer retention.

-

Enhanced fraud detection and security: AI models analyse millions of transactions in real time to detect suspicious activities with increasing accuracy over time.

-

Stronger compliance monitoring: AI helps banks stay ahead of regulations by scanning transactions and policy changes in real time. It also produces audit-ready reports that reduce compliance risk and speed regulatory response.

-

Operational cost savings: Automation of high-volume back-office tasks such as data entry, compliance verifications, and transaction processing reduces labour costs.

-

Improved decision-making and innovation: AI synthesises data for risk assessment, credit scoring, and customer insights, enabling smarter, fairer, and faster business decisions.

-

Employee augmentation and empowerment: AI can act as a 'co-pilot' by giving relationship managers real-time customer insights, helping wealth advisors craft better plans, and assisting compliance officers with complex regulations. This elevates the capabilities of your team and allows them to focus on high-value, strategic work.

If we could sum up all the benefits into a few words, it would be that AI in banking transforms traditional manual operations and generic messaging into an agile and customer-centric industry.

AI in banking examples: 5 real cases you should know about

Let’s see how some of the above benefits translate to the real-world examples of implementing AI in banking.

1. Hyper-personalised product recommendations and suggestions

-

Bank of America’s virtual assistant Erica: Erica analyses customer data such as spending patterns and bill payment behaviour to suggest relevant financial products and services. For example, it might notify a user about an upcoming bill and recommend setting up autopay or suggest a credit card to maximise cash-back rewards based on their spending habits.

-

JPMorgan Chase: The bank uses predictive analytics to analyse customers’ spending and lifestyle data, enabling it to offer highly personalised credit card and loan offers at the optimal time. Thus, it increases cross-selling and upselling success.

-

Wealthfront: Although not a traditional bank, this robo-advisor uses AI to suggest hyper-personalised investment recommendations based on users’ financial goals, such as saving for a vacation or emergency funds.

-

Fargo: AI analyses transactions and account details to provide personalised insights and recommendations, such as reminders to transfer funds or alerts on unusual spending, aiding customers in managing their finances.

-

Royal Bank of Canada (RBC): RBC leverages AI to analyse transaction data and offer customised saving tips, highlight unusual spending, and provide real-time financial advice, enabling more relevant and timely product suggestions.

-

Commonwealth Bank of Australia’s (CBA) Benefactor Insights tool identifies customer life stages and sends targeted recommendations such as home insurance or refinance options right after mortgage approval.

2. Faster processing and approvals

JPMorgan Chase uses its Contract Intelligence platform (COiN) to review a great number of legal documents in seconds.

This AI-driven natural language processing reduces human error and speeds operational workflows.

JPMorgan also uses advanced AI for risk assessment and payment validation, applying large language models (LLMs) to analyse millions of transactions daily.

Their AI reduces account validation rejection rates by 15-20%, improves fraud detection accuracy, and incorporates patented bias evaluation systems to ensure ethical compliance in lending and investments.

Lloyds is building a new machine learning (ML) and Generative AI (GenAI) platform leveraging Google Cloud’s Vertex AI. This includes an algorithm which reduces the income verification step in its customers’ mortgage applications from days to seconds.

In addition, Lloyds has successfully initiated over 80 new ML use cases and launched over 18 GenAI systems into production.

3. 24/7 intelligent customer support

Bank of America’s virtual assistant Erica answers routine questions, such as balance inquiries, transaction history, card management, and other information instantly, at any time of day.

Only last year, in 2024, customers interacted with the virtual assistant 676 million times, reflecting strong adoption since its launch 8 years ago.

Erica doesn’t use Gen or agentic AI, but combines human oversight and continuous learning, with a dedicated data science team to ensure the AI’s responses align with Bank of America’s policies and maintain accurate handling of customer queries.

Wells Fargo also has an AI-powered virtual assistant inside its mobile banking app, Fargo, which handles balance inquiries, fund transfers, and account questions without human agents.

It’s available in English and Spanish. To get started, you can choose from prompts, type, or say your question.

If it can’t answer your question, then you’re redirected to customer service.

Another example is Capital One’s AI chatbot ‘Eno.’ It can check your balance and answer questions about your account.

It also provides real-time fraud alerts and spending pattern analysis.

4. Fraud detection and security

HSBC has effectively integrated AI-driven systems to enhance its anti-money laundering (AML) efforts.

This AI system analyses large volumes of real-time transactions using machine learning to detect unusual patterns and potential illegal activities.

As a result, it significantly increases detection rates, reduces false positives, and improves compliance efficiency.

It enables real-time compliance monitoring across bank operations, reducing legal risks and operational costs while facilitating precise and prompt regulatory reporting.

5. Compliance and regulatory tasks

Citigroup uses generative AI to analyse complex regulatory documents, ensuring compliance across jurisdictions and with global financial regulations.

UBS employs AI chatbots to assist compliance officers with regulatory questions and process guidance, enhancing compliance adherence and efficiency by automating routine compliance tasks.

Why does AI implementation in banking often fail?

AI implementation in banking sometimes fails due to a combination of technical, organisational, and human factors:

1. Mismatch between technical teams and business leaders

Banks often fail because technical teams and business leaders don’t align on AI project goals and expectations.

Many underestimate the complexity of enterprise AI and mistakenly believe their existing software infrastructure can support advanced AI, leading to unrealistic project scopes and failures.

Also, AI projects can stall when employees feel threatened by the technology or when executives send mixed messages, leading to pushback and a lack of adoption.

2. Failure to meet customer expectations

Many so-called AI chatbots in banking are not really AI at all. Instead, they rely on simple rule-based systems that provide limited responses, trapping customers in frustrating loops.

Around 42% of banking customers prefer human interaction because chatbots fail to handle unexpected questions, transition to human agents smoothly, or meet AI promises.

3. Data quality issues

AI systems trained on incomplete, biased, or inconsistent data produce unreliable and contradictory outputs.

Bad data worsens problems, such as inconsistent chatbot answers and poor fraud detection.

4. Lack of proper testing and human oversight

Banks sometimes reduce risk teams and fail to maintain adequate AI governance. Without sufficient oversight and continuous testing, AI systems can develop blind spots, leading to compliance risks and operational errors.

5. High implementation costs and complexity

AI requires heavy upfront investments in infrastructure, talent, and integration, especially challenging for banks with outdated legacy systems.

The complexity and cost can lead to failed or stalled projects.

6. Ignoring ethical and compliance risks

AI models trained on biased data can lead to discriminatory outcomes in lending or product recommendations, exposing the bank to severe regulatory fines and public backlash.

Without a robust ethical framework and transparent, explainable models (Explainable AI), banks risk damaging customer trust and failing to meet compliance mandates.

How can banks transform to become truly AI-ready?

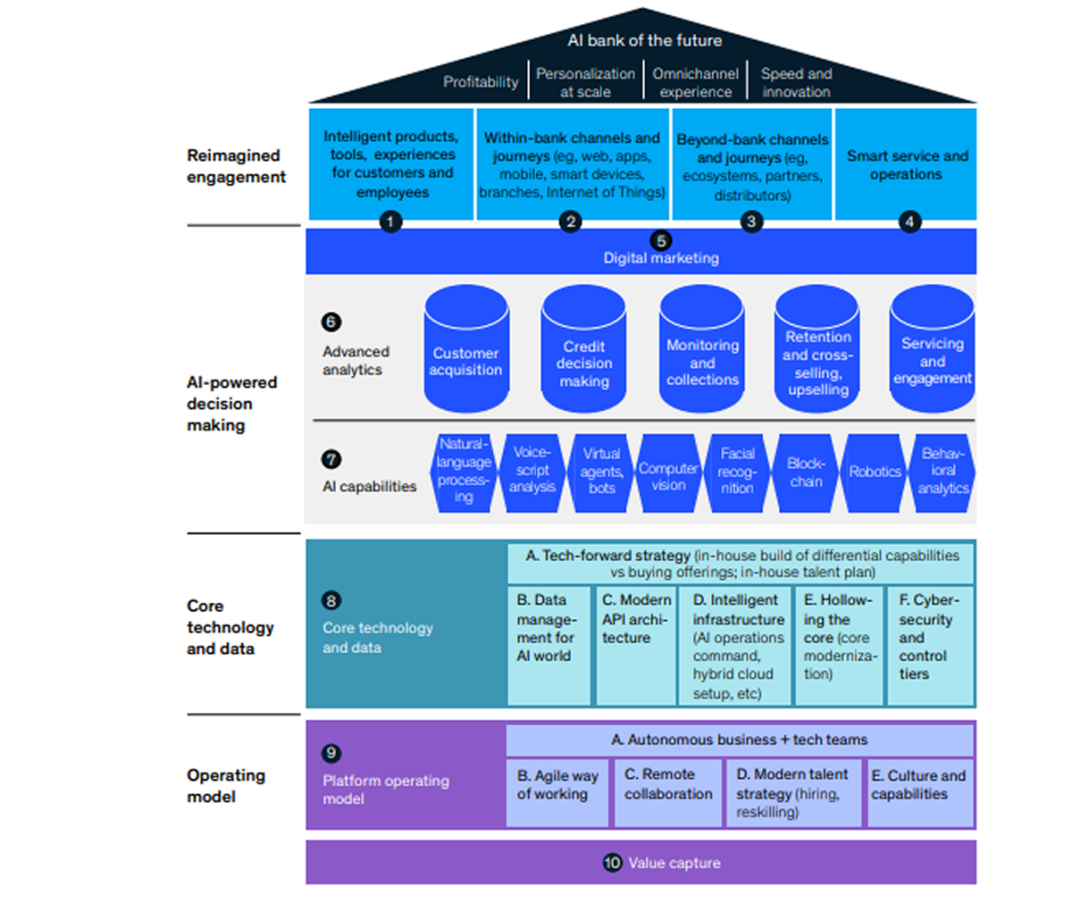

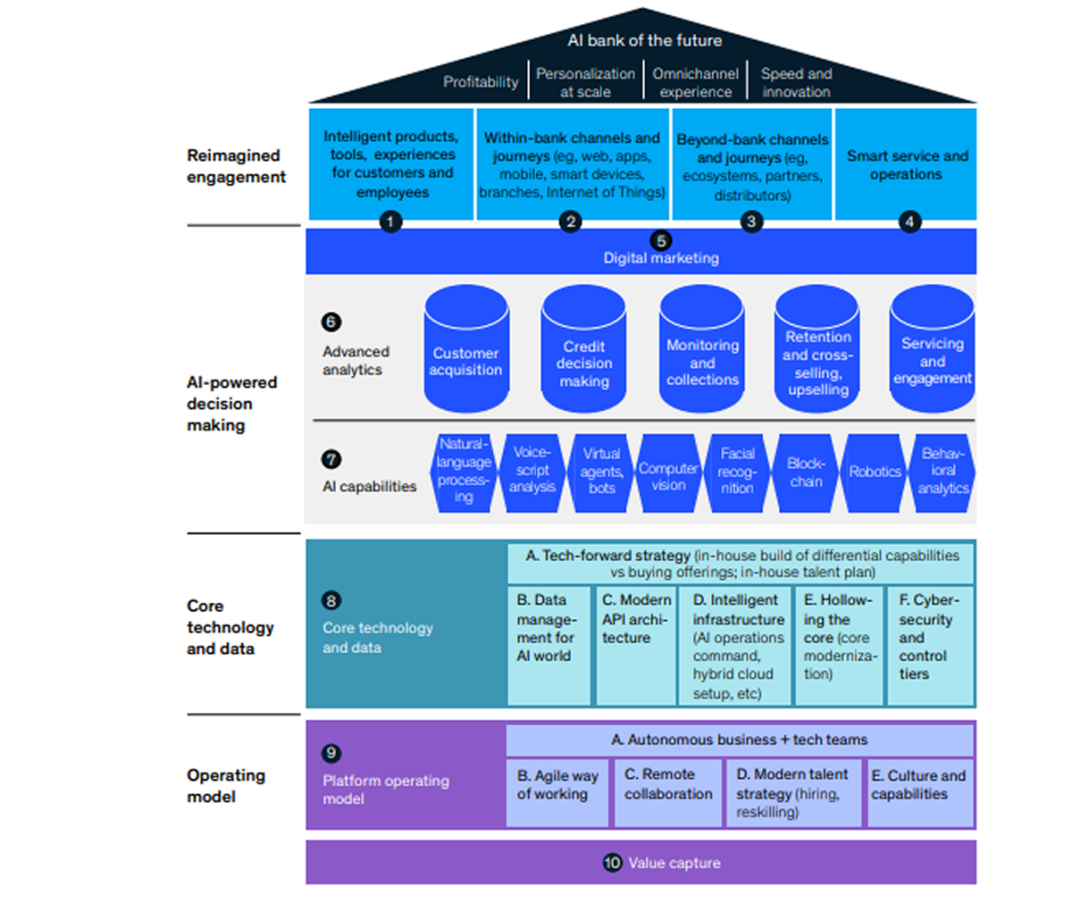

According to the McKinsey report ‘AI-bank of the future: Can banks meet the AI challenge?’, banks can transform to become AI-first institutions by addressing four integrated capability layers and related organisational changes.

1. Adopt a holistic approach across four layers

-

Engagement layer: Reimagine how banks engage customers, embedding AI-enabled personalised and seamless omnichannel experiences within and beyond the bank’s own platforms. Banks should build integrated propositions addressing customers ‘jobs to be done’ and leverage partner ecosystems for higher engagement.

-

AI-powered decision-making layer: Use advanced analytics and AI models at scale to automate and augment decisions across the customer lifecycle. This way, you can make decision-making repeatable, explainable, and embedded into business processes with continuous feedback loops.

-

Core technology and data layer: Invest heavily in scalable, flexible, and resilient technology infrastructure, including cloud platforms, modern API architecture, and strong data management to supply AI models with clean, integrated, and real-time data.

-

Operating model layer: Transition to an agile, platform-based operating model with cross-functional teams owning technology, data, and business outcomes.

Also, break down traditional siloed structures to speed innovation and deliver value continuously.

2. Key organisational and technical shifts

-

Move beyond siloed AI experiments to enterprise-wide AI roadmaps.

-

Establish end-to-end model development pipelines with governance, explainability, and ongoing performance monitoring.

-

Design customer journeys to be AI-augmented and personalised, with frictionless movement across digital and physical channels.

-

Modernise legacy core systems to support AI scale and agility.

-

Foster a culture that encourages test-and-learn experimentation and integrates feedback loops for iterative improvement.

-

Balance internal capability building with strategic partnerships to acquire non-core AI technologies and talent.

3. Strategic alignment and continuous investment

-

Align AI initiatives closely with the bank’s strategic goals, such as profitability, growth, customer satisfaction, and innovation.

-

Plan a two-track approach where short-term AI projects deliver measurable business value while simultaneously building lasting institutional AI capabilities.

-

Recognise that becoming AI-first is a multi-year journey requiring sustained leadership commitment and capability investment across business, technology, and analytics domains.

Properly implementing AI will enable you to achieve superior personalisation, operational efficiency, risk management, and rapid innovation cycles.

How can your bank become future-proof with Meniga?

Meniga modernises banks and makes them AI-ready by providing advanced, AI-driven Digital Banking solutions.

As a result, you can transform your bank into an agile, customer-centric, and operationally efficient institution.

Here’s how we can help:

1. Solving data challenges and enriching bank data

We address a major hurdle in AI implementation, data quality and fragmentation, through our advanced transaction enrichment technologies.

By categorising and enhancing raw banking data, we deliver accurate, meaningful customer insights that improve decision-making and customer engagement.

2. Modernising legacy systems via modular and flexible AI solutions

Many banks struggle with outdated infrastructure that slows AI adoption.

Our modular, customisable solutions integrate smoothly with existing banking systems, enabling scalable data consolidation, enrichment, and AI use without costly core system overhauls.

3. Enabling hyper-personalised customer engagement

Meniga’s AI-powered Insights Platform allows you to deliver hyper-personalised, real-time financial insights tailored to individual customers’ spending behaviours and financial goals.

This capability helps you shift from a transactional service provider to a trusted financial partner by offering relevant product recommendations, personalised alerts, and actionable advice that improve customer satisfaction and loyalty.

Coming soon:

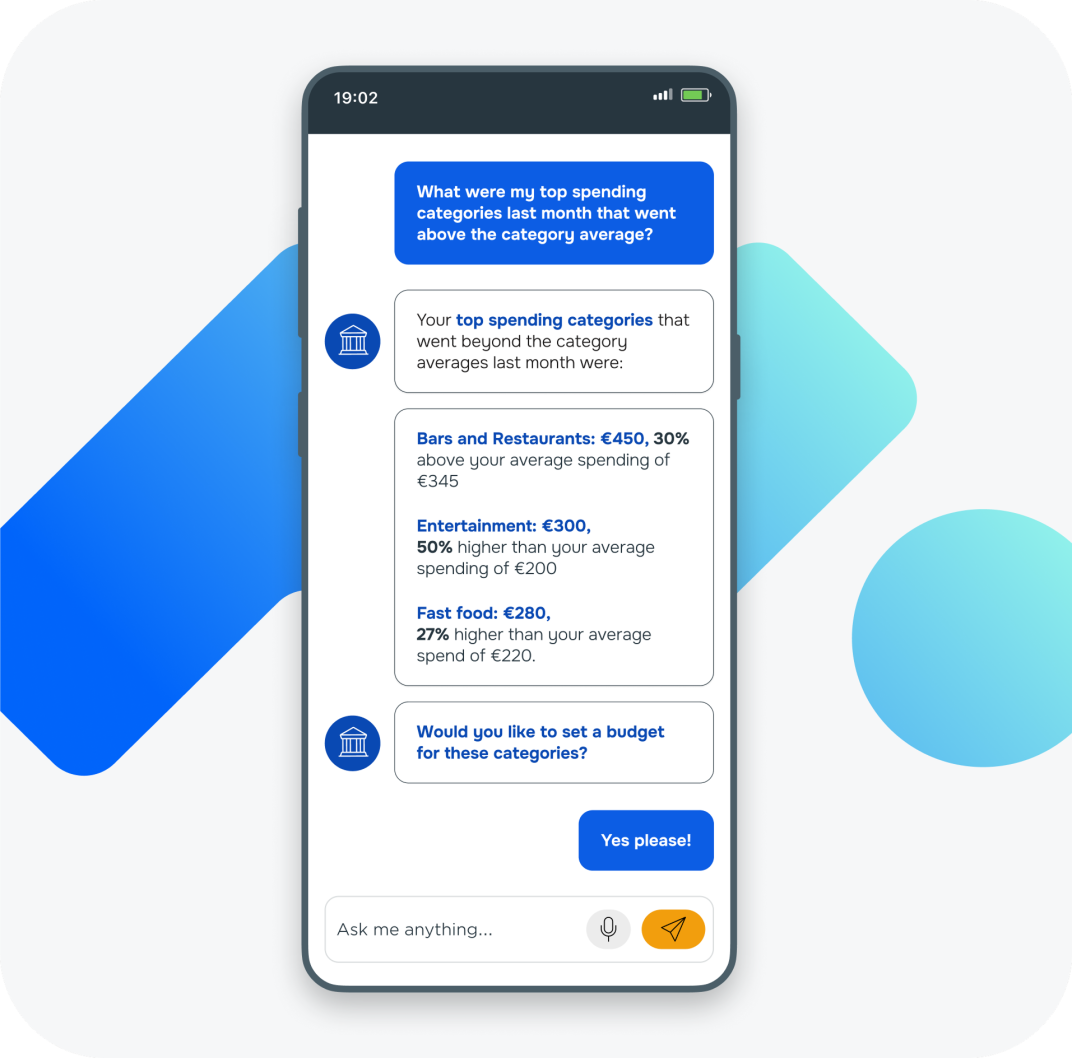

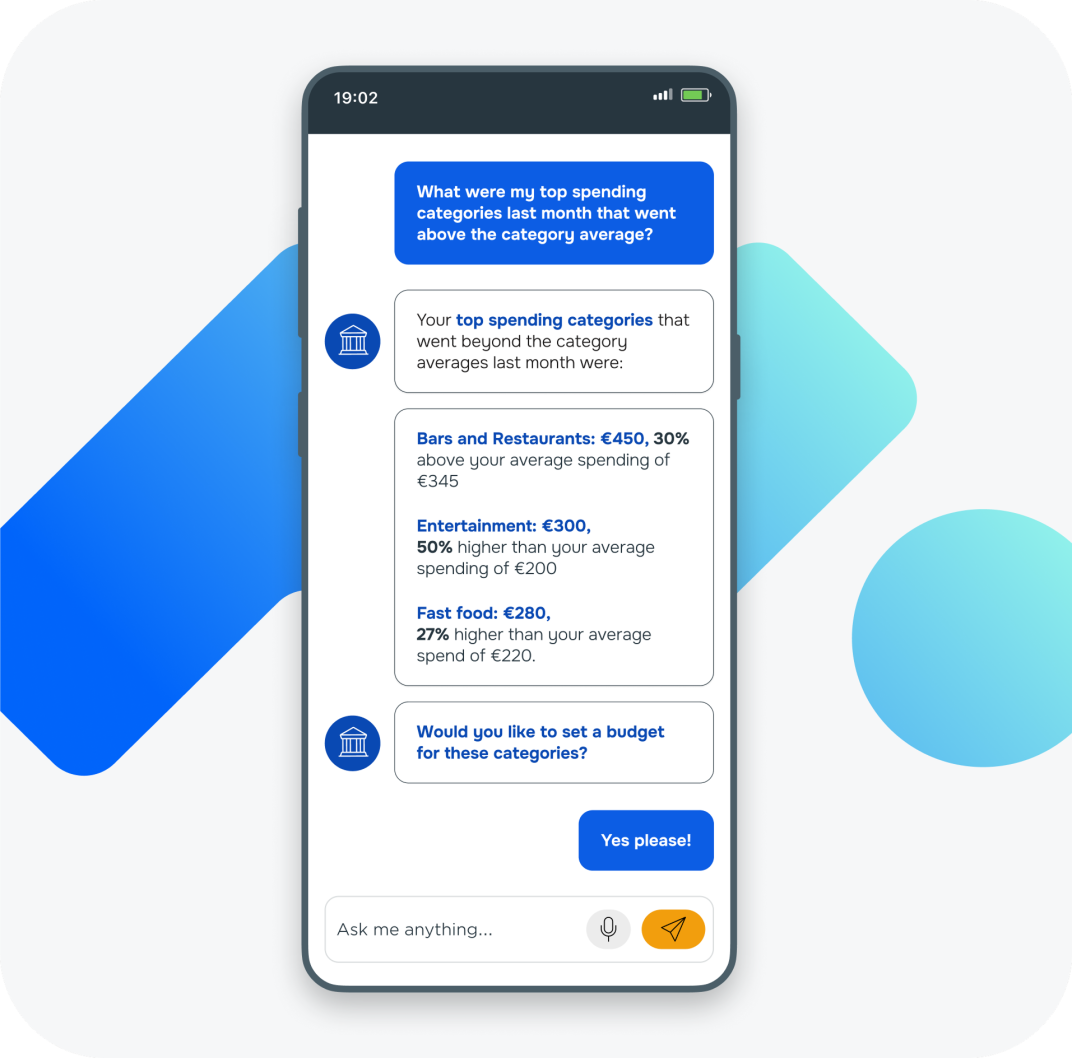

The Meniga Conversational Financial Assistant is a powerful LLM–driven product designed specifically for banks.

This futuristic tool enables your customers to ask natural-language questions, from “How much did I spend on groceries this month?” to “Can I afford a weekend trip?”, and receive accurate, real-time insights in a conversational format.

Developed with enriched data and banking-grade security, this tool offers highly personalised financial advice, minimises customer support requirements, and enhances digital engagement.

Ultimately, it helps position your bank as a trusted, innovative financial advisor.

Ready to know more?

Contact us today to learn how you can modernise your system to implement AI seamlessly.