Overdraft fees continue to represent one of the most persistent sources of friction in personal banking.

Together with nonsufficient funds (NSF) fees, they cost customers $6.7 billion in 2024.

This challenge has intensified as customer expectations for transparency and proactive support grow.

A mistimed transaction or delayed deposit can quickly result in penalties, affecting both the customer's finances and their confidence in their financial institution.

Predictive AI offers a tangible remedy through real-time alerts, proactive nudges, or automated account adjustments while simultaneously increasing customer satisfaction and retention.

Read on to learn more about AI in overdraft protection so that your bank can reduce financial stress and enhance loyalty positions.

What is predictive AI in finance: Definition and benefits

Predictive AI in finance leverages machine learning, statistical algorithms, and data mining to help banks:

-

Anticipate future events in a customer’s financial behaviour

-

Evaluate market trends,

-

Assess risks,

-

Optimise investment strategies,

-

Forecast cash flows, and

-

Personalise customer experiences.

This may include real-time or near-real-time analytics, anomaly detection, pattern recognition (transaction rhythms, income vs. spending flows), user notification systems or automated corrective interventions.

How does predictive AI work?

It collects large volumes of structured and unstructured data from multiple sources such as transactions, market data, customer profiles, and behaviour patterns.

| Data source | Description |

| Transactional data | Detailed records of deposits, withdrawals, payments, purchases, and transfers that reveal spending patterns and cash flow behaviour. |

| Customer profile data | Demographics, credit scores, employment status, income levels, and financial history are used to assess risk and financial capacity. |

| Market data | Real-time and historical prices, interest rates, exchange rates, and economic indicators for forecasting market trends and asset prices. |

| Behavioural data | Interaction logs, including website visits, app usage, customer service calls, and social media sentiment, to understand engagement and risk factors. |

| Account balances and liquidity | Snapshots and trends in account balances and liquidity positions to predict overdrafts and cash shortages. |

| Credit Bureau and alternative data | Credit reports and non-traditional data, such as utility and rental payment history, to enhance credit risk models. |

| Fraud and compliance data | Records from fraud detection and regulatory compliance systems to identify anomalies and mitigate risks. |

| Macroeconomic data | Inflation rates, unemployment figures, GDP growth, and other economic metrics impacting financial behaviours and risks. |

AI models identify trends, patterns, and correlations within the historical data using machine learning training.

The trained models then forecast future financial events, such as credit risk, overdraft likelihood, asset performance, or fraudulent activity, in real time.

These insights enable banks and financial firms to make informed, proactive decisions which:

Predictive AI also automates routine tasks, such as compliance checks and anomaly detection, freeing human teams to focus on strategy and complex analysis.

How can your bank leverage predictive AI in overdraft protection?

AI-powered systems predict when users are likely to overdraft and send timely alerts, often via simple, tailored messages that encourage better financial decisions.

1. Predict low‐balance or short-fall likelihood

One of the most valuable applications of predictive AI in banking is the ability to anticipate when a customer’s balance is heading toward zero.

These models take a much broader view of a customer’s financial patterns than looking at the current account balance.

For example, the system learns the rhythm of recurring income, such as when a paycheck or government benefit is deposited into an account.

It matches that against predictable outflows, including rent, mortgage payments, utilities, and subscription services.

Additionally, the AI evaluates day-to-day spending behaviours, including variable expenses such as groceries, fuel, and discretionary purchases.

By layering these data points, the system generates a near-term forecast of cash flow.

If the model sees that upcoming debits and spending trends are likely to push the balance negative within a certain number of days, it proactively sets alerts or triggers.

The result is not a vague warning, but a personalised, time-sensitive prediction.

This shift fundamentally changes the customer experience.

Instead of being surprised by an overdraft after it happens, customers gain advance visibility and the opportunity to act.

They could adjust spending, move funds, or reschedule a bill.

In practice, it transforms overdraft management from a reactive penalty into a proactive partnership, one that enhances both financial well-being and trust in the bank.

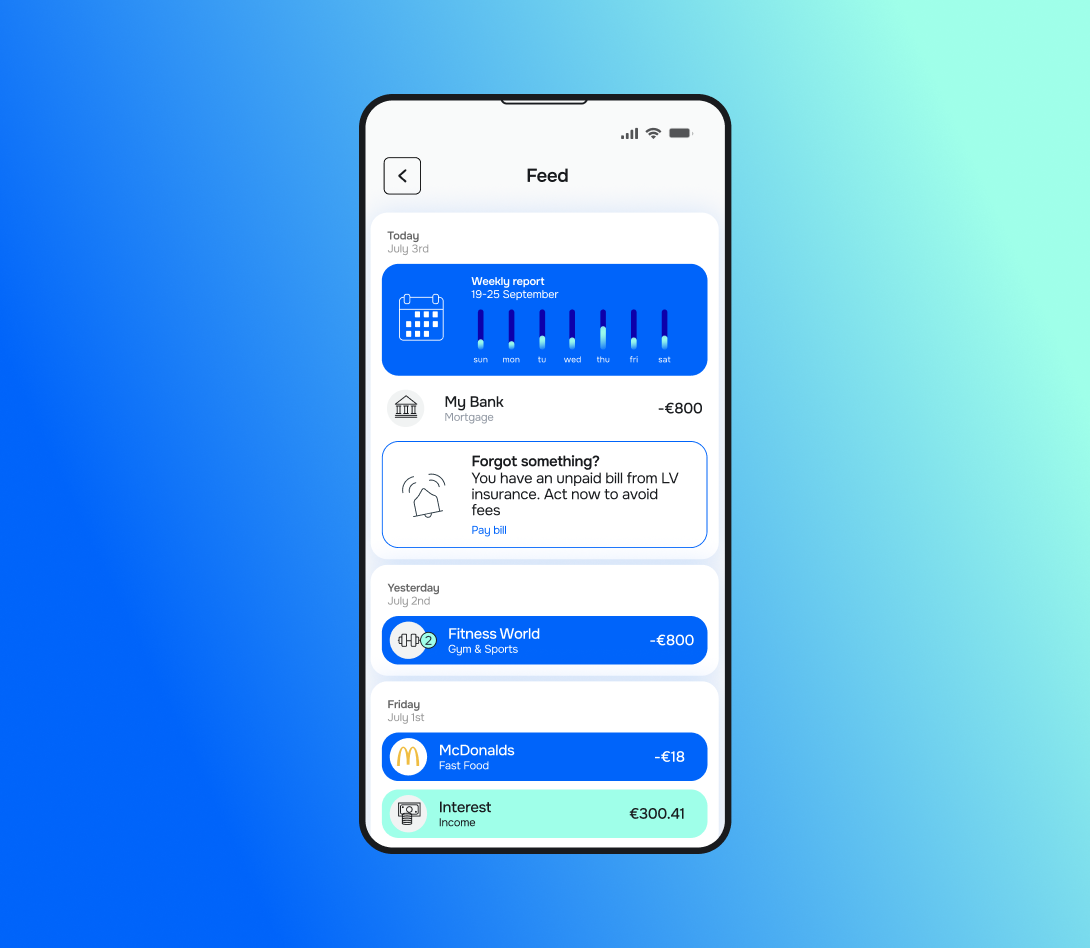

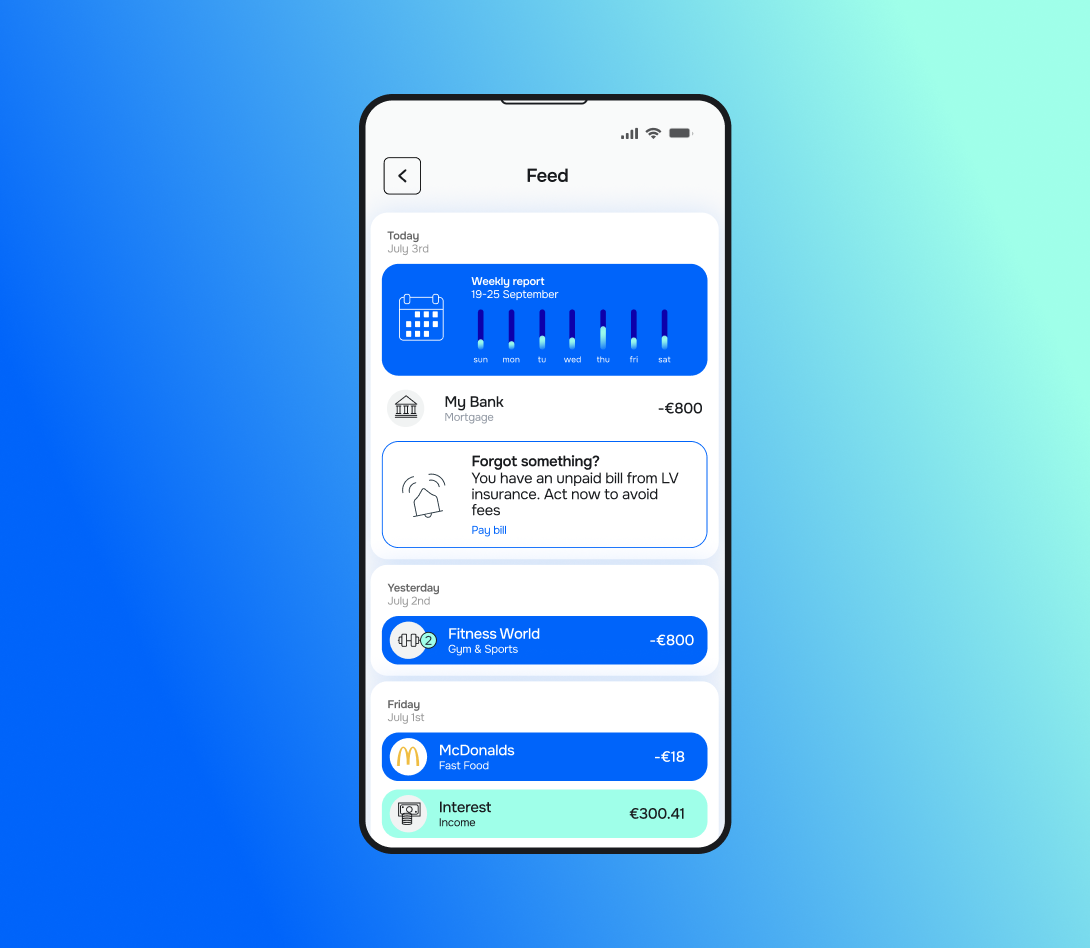

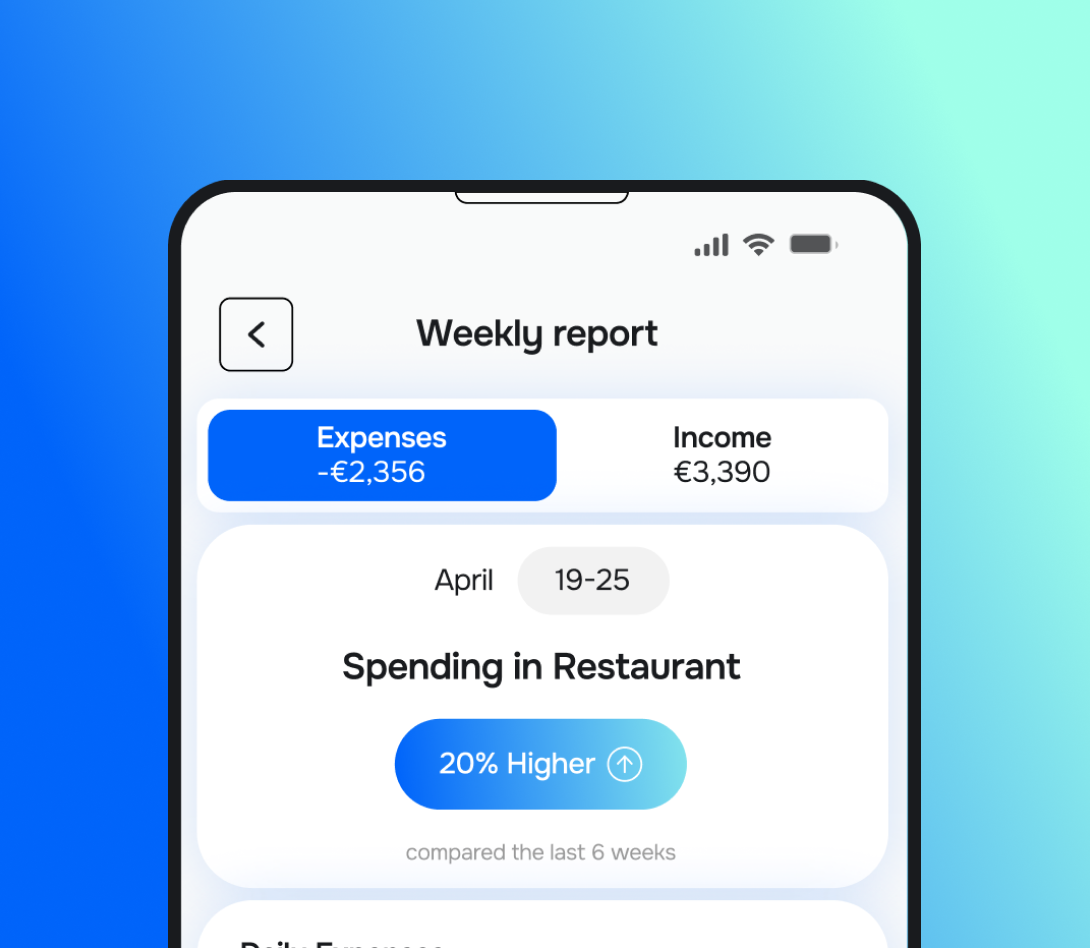

2. Use behavioural nudges and alerts

Predictive AI doesn’t only identify when a balance is at risk, but it also delivers the right message in the right way at the right time.

Once an AI model forecasts a likely overdraft, the next critical step is communicating this insight to the customer through notifications.

These can take the form of push messages in a mobile app, emails, or even SMS alerts. And this is where things get really interesting due to message framing.

Simple messages are clear, concise, and easy to understand.

These messages significantly outperform complex ones because they reduce the cognitive load on users, making it easier to act on the alert.

Furthermore, messages framed negatively, such as ‘Avoid overdraft fees,' lead to more substantial reductions in overdrafts of about 9%, compared to positively framed messages, such as ‘Save money,’ which are slightly less effective.

Negative framing draws attention by emphasising potential losses, which motivates customers to take timely action.

As a result, they reduce overdraft events more successfully than positive or neutral framing.

Just as importantly, customers begin to perceive their bank not as a fee collector but as a financial ally looking out for them.

In a banking environment, where obtaining loyalty is a lengthy process, these timely nudges provide a powerful signal of customer care.

More insights to take into account

Did you know that both of the above message types work best among users with mid-to-high incomes and fair-to-good credit scores, who are more likely to respond to the nudges?

However, financially vulnerable users show less responsiveness, indicating that messaging alone may not be sufficient for those facing deeper, systemic financial challenges.

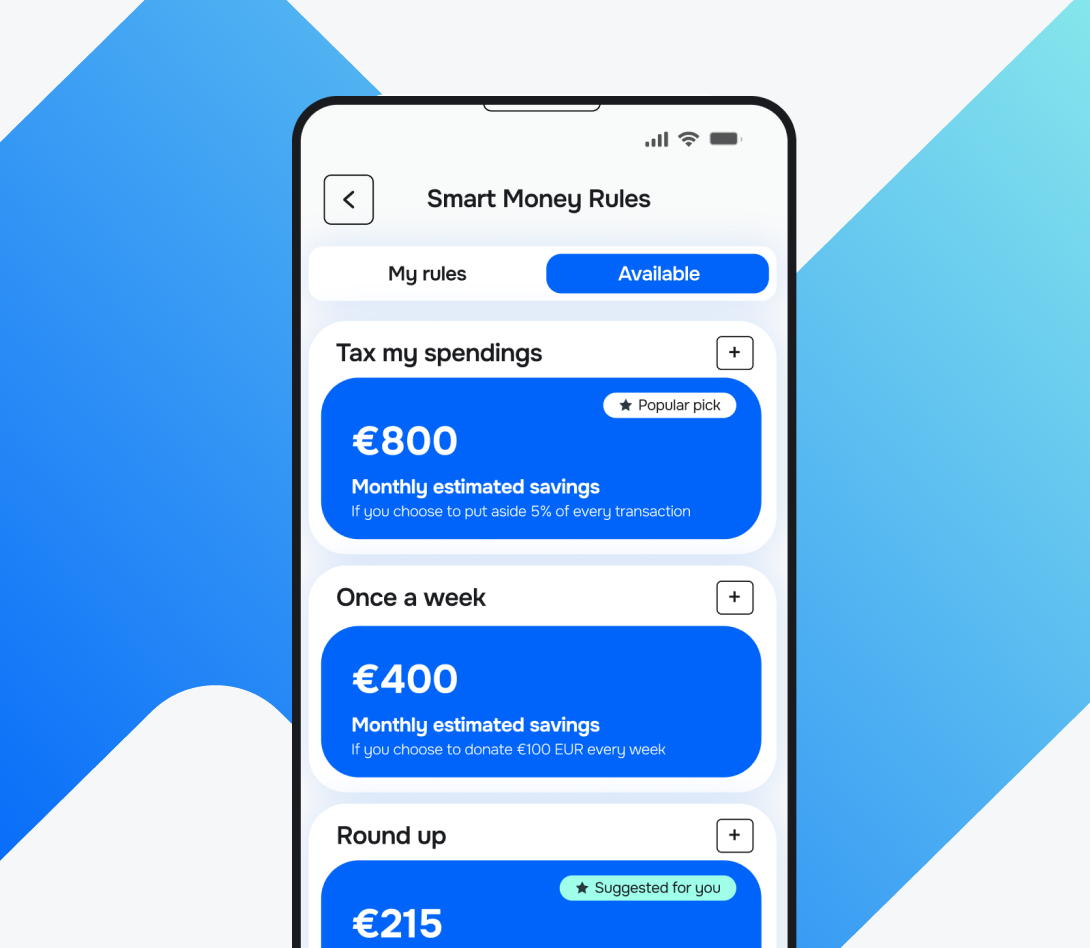

3. Provide automated suggestions and interventions

While predictive insights and alerts are useful, many customers want more than just a warning. They want actionable solutions.

This is where predictive AI steps in with automated suggestions and interventions to prevent overdrafts before they happen.

The process typically begins with the system detecting a high likelihood of a shortfall.

Instead of simply sending a notification, the AI can recommend concrete steps, such as:

-

Moving money from a linked savings account,

-

Rescheduling a discretionary transfer, or

-

Deferring a subscription payment until after the next paycheck.

Some institutions also provide the option to temporarily freeze nonessential spending categories, such as streaming services or dining out, when cash flow appears particularly tight.

For customers who prefer a ‘set-it-and-forget-it’ approach, these suggestions can be taken further.

With explicit permission, the system may make small automated transfers between accounts or activate a buffer overdraft line.

As a result, you can transform the experience from reactive customer effort to proactive financial management.

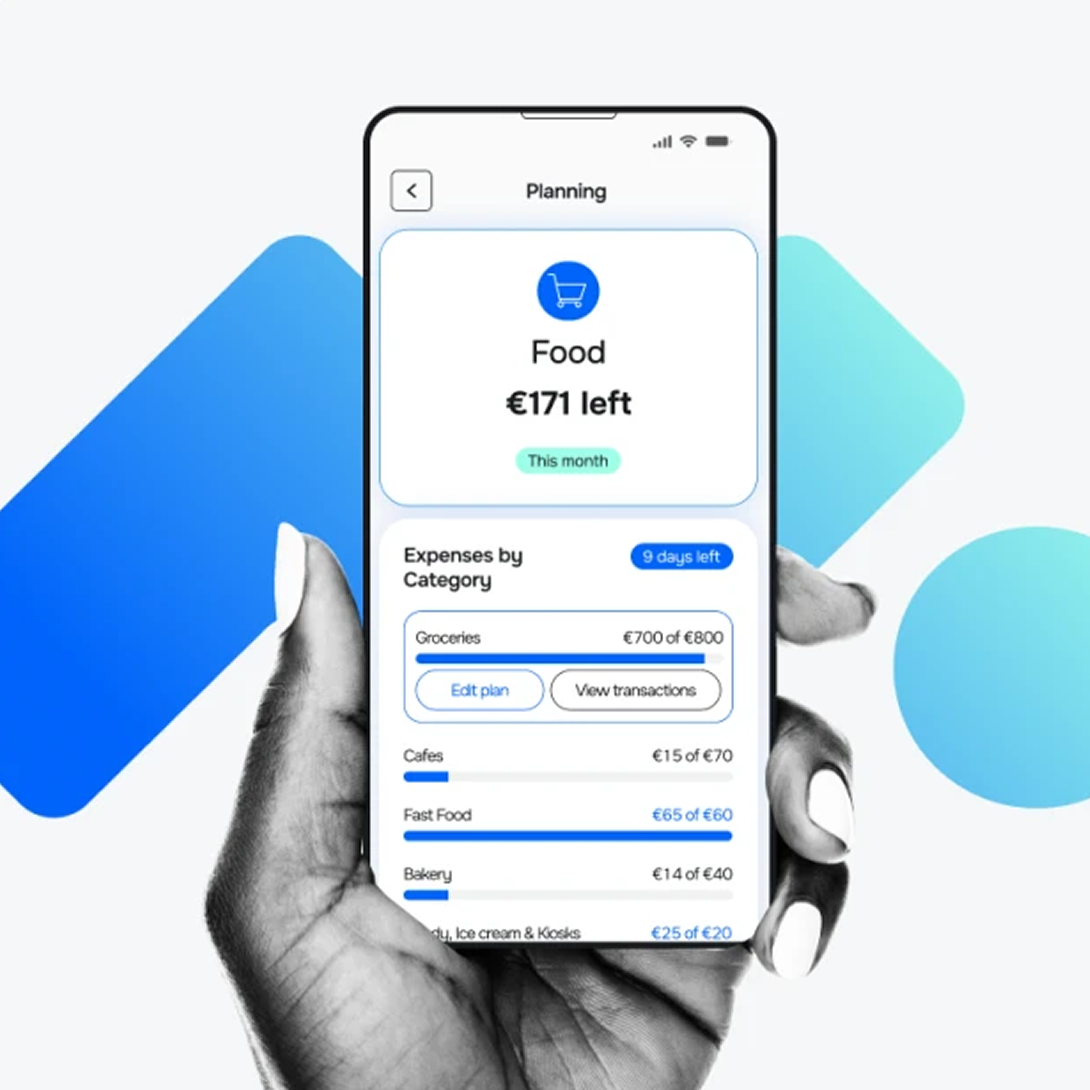

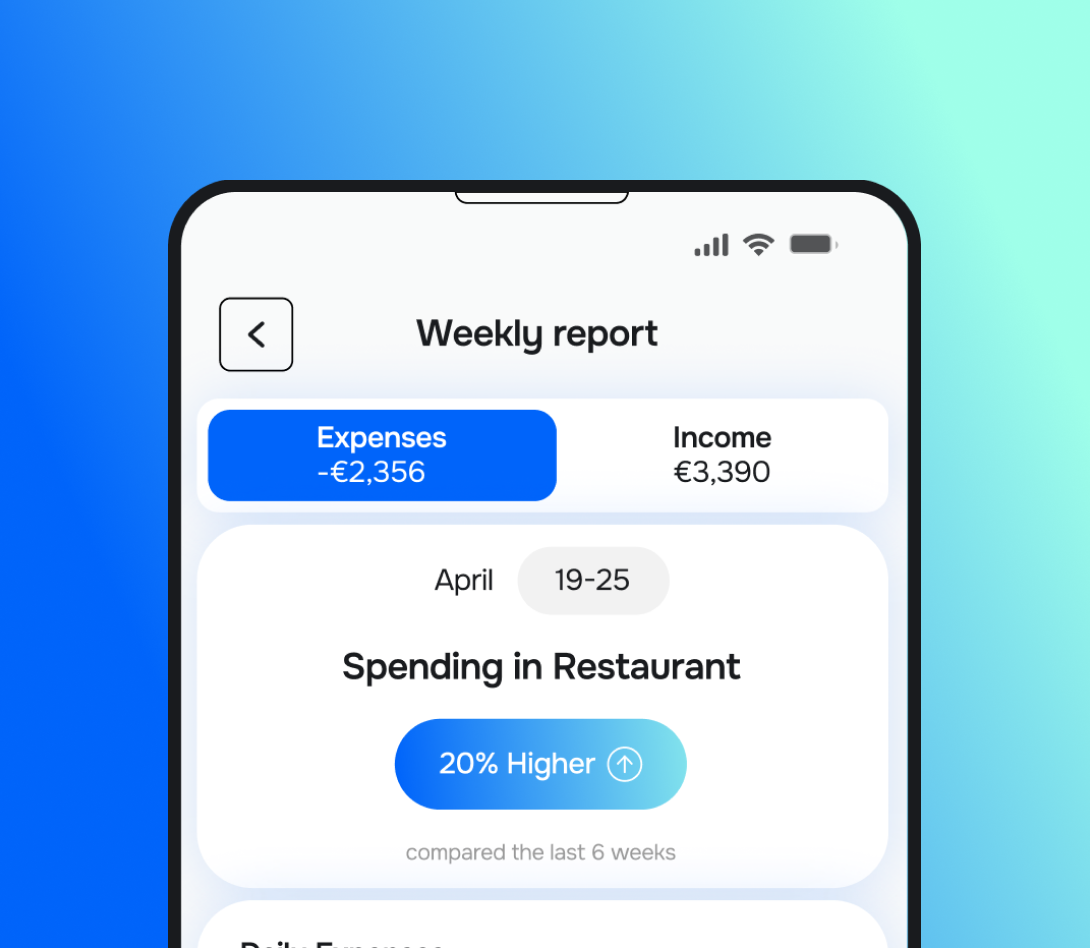

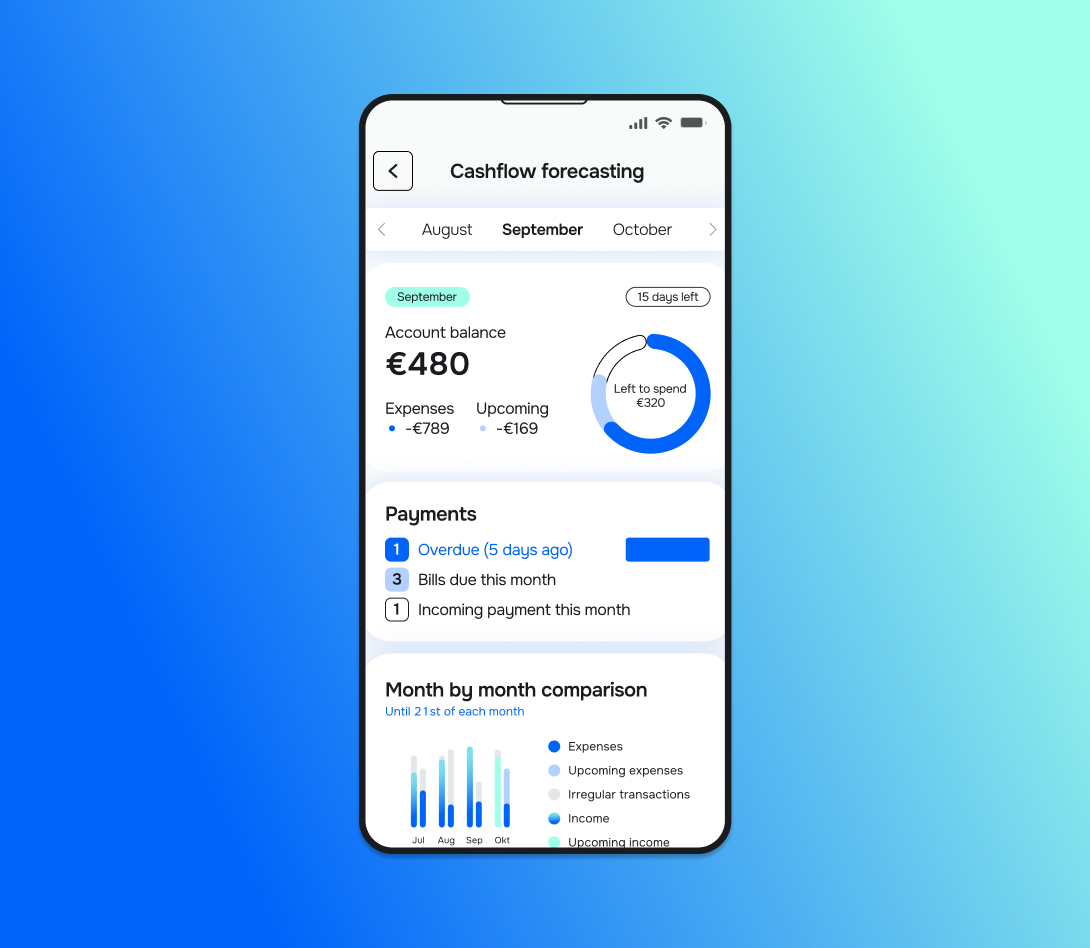

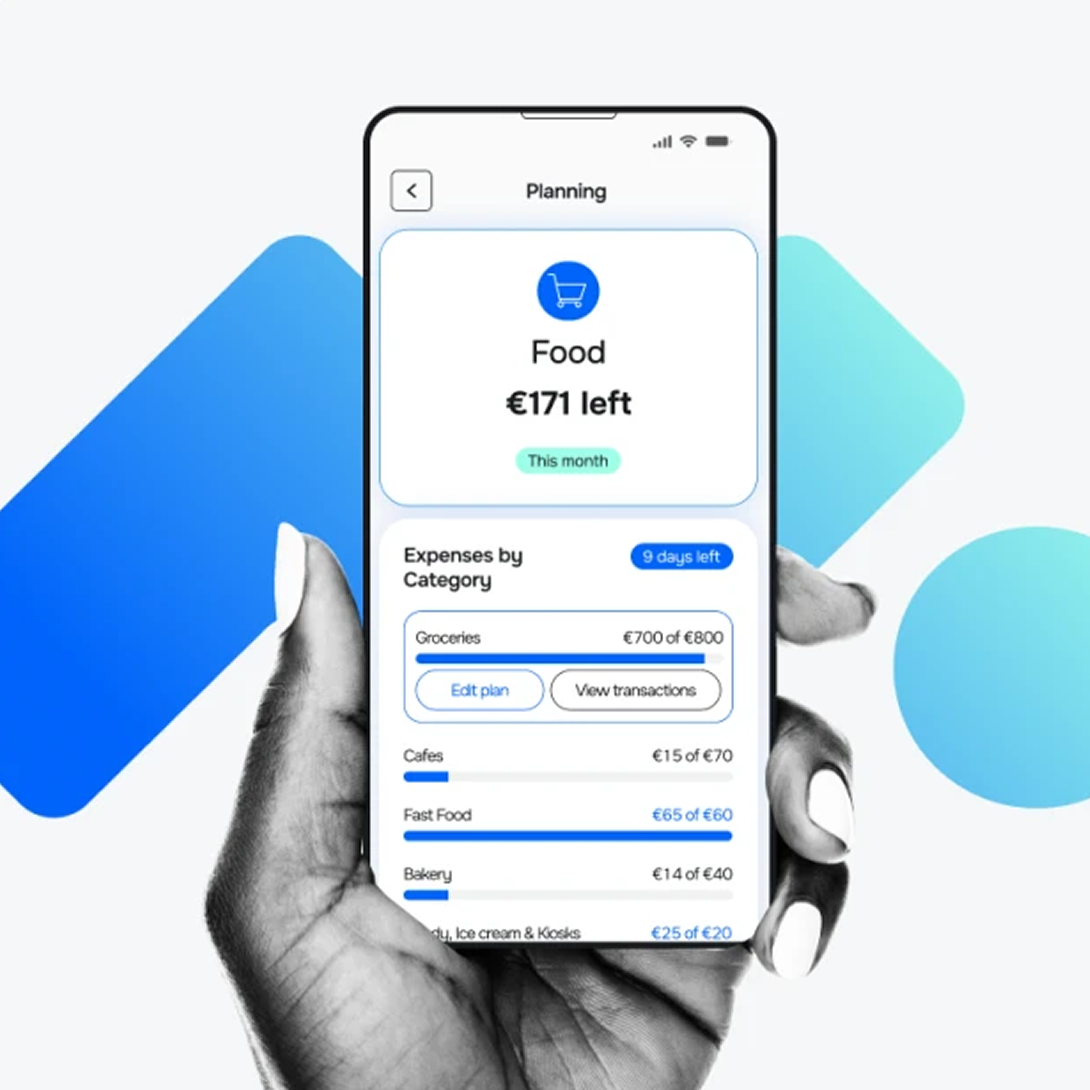

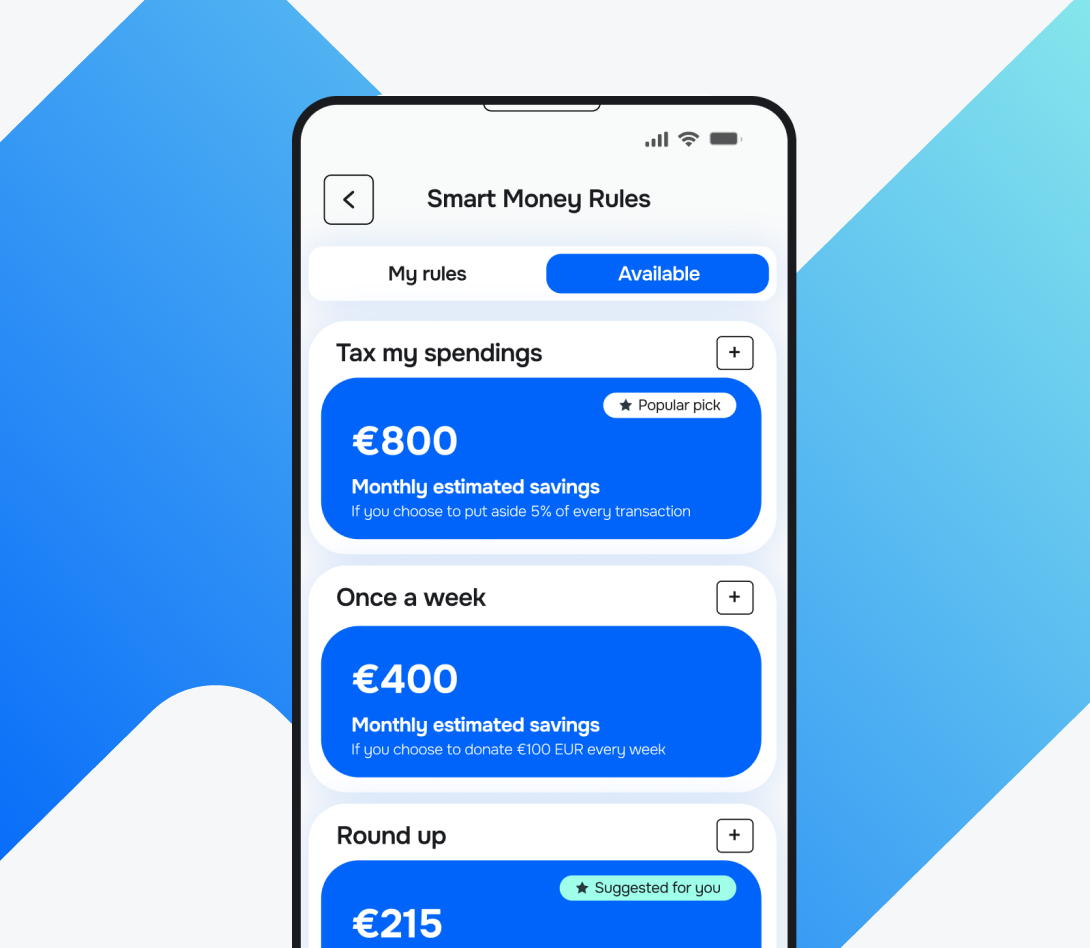

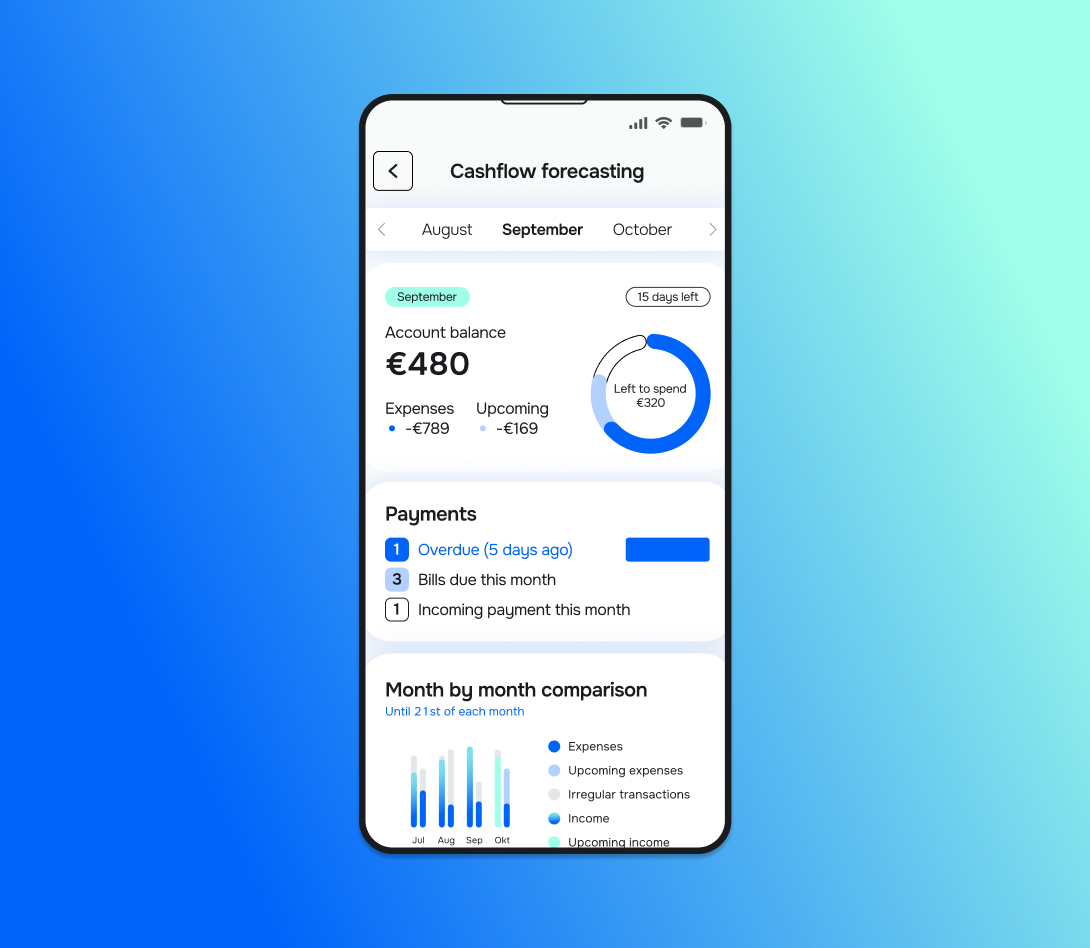

4. Leverage visual tools and forecasting in apps

Cash-flow forecasting tools integrated into mobile banking platforms move well beyond the traditional static balance display.

They offer customers a forward-looking view of their financial trajectory in the days and weeks ahead.

Rather than seeing only a snapshot of the current balance, customers see dynamic projections that take into account scheduled inflows and outflows.

For example, a customer might see that their balance will plummet next Wednesday when rent and a utility payment are processed, but then recover on Friday with an incoming paycheck.

This contextual view makes it far easier to plan spending and avoid unintentional overdrafts.

In addition, many institutions are piloting scenario-based planning features.

They enable customers to test the financial impact of potential decisions, such as purchasing airline tickets, making early credit card payments, or modifying recurring transfers, and to observe instantly how those choices would affect their projected balance.

By offering this type of simulation, you provide customers with greater control and clarity over their financial futures, eliminating guesswork.

More insights to take into account

Although 82% of banks offer real-time low-balance alerts, only 53% provide immediate overdraft notifications.

How do overdrafts impact European banks?

A 2022 EU study,‘Consumer protection in the context of overdraft facilities and overrunning,’estimated there are approximately 340 million bank accounts in the EU that have an overdraft facility.

Many European consumers have access to an overdraft facility, meaning the potential scale of overdraft fee risk is large across the EU.

The same EU study finds that interest rates and costs for overrunning vary considerably between Member States and aren’t uniform.

For example, Austria has much lower rates of approximately 3% p.a. compared to Malta’s very high rates of approximately 35%.

Consequently, the cost to consumers in some countries is much higher than in others, which may affect both the burden of overdrafts and incentives for switching and loyalty.

Also, overdraft facility usage correlates positively with unemployment rates and negatively with GDP per capita.

This suggests that overdrafts affect economies or subpopulations that are under stress the hardest, magnifying the risk to loyalty and financial well-being.

| Challenges for customers and banks in Europe | Implications |

-

Overdraft facilities are recognised in EU law under certain conditions, under the Consumer Credit Directive(CCD), but many overdraft-like arrangements are either outside its scope or unevenly regulated.

|

|

| |

|

| -

If well-implemented, alerts, predictive insights, and balance forecasting can help mitigate overdraft risk.

|

Key takeaways: Predictive AI in overdraft protection

The following characteristics are the most valuable when using predictive AI for overdraft prevention:

-

Timeliness: Alerts or forecasts need to come before the event, not after. Late alerts often miss the chance to act.

-

Simplicity and clarity: Messages that are short, clear, and have easy instructions outperform longer, jargon-filled messages.

-

Framing: Negative framing tends to be more effective than positive framing in prompting action.

-

Segmented / Personalised approach: Different customers respond differently. Income, credit status, and behavioural history matter. More sophisticated predictive systems that adjust for customer type tend to perform better.

-

Actionability: It’s not enough to say ‘You may overdraft.’ Customers need easy ways to address the risk via one-click transfer, savings buffer, or maybe linking alternative funding.

-

Seamless UI: Dashboards, forecasts, and visual cues which help users see their projected cash flow. Also, recurring-payment reminders, warnings well in advance of scheduled bills, and others.

-

Privacy and trust: Permissioned data use, transparency about what is being predicted and how, and compliance with local regulation.

3 pillars of effective overdraft prediction: Accuracy, segmentation, and governance

1. Signal quality matters

Models are only as good as the deposit and merchant labelling. Institutions that enrich transaction data get earlier and more reliable warnings.

Meniga consolidates data from a wide range of sources, including internal products such as credit cards, mortgages, and investment accounts, as well as external data accessed via open banking APIs.

By unifying these streams, banks can eliminate silos and gain a complete picture of customer behaviour across all financial relationships.

Furthermore, we refine raw transaction data by accurately classifying income and spending, standardising merchant details, and detecting recurring payments.

As a result, vague information is converted into clear, actionable insights, giving banks a sharper view of customer behaviour and opening new opportunities for meaningful engagement.

Our intelligent categorisation learns from user and community contributions to continuously improve accuracy over time.

2. Segmentation is essential

A one-size-fits-all approach to alerts causes fatigue. Best practice is to tailor frequency, channel and framing by customer segment and historical responsiveness.

3. Regulatory sensitivity

Using alternative data and behavioural segmentation can raise regulatory scrutiny, especially where outcomes diverge across demographic lines. Robust governance and explainability are now baseline requirements.

How does Meniga help banks turn predictive analytics into measurable results?

Real impact in predictive analytics doesn’t come from algorithms alone.

It requires a solid foundation: reliable, well-structured data, ethical practices, and technology that empowers customers to stay in control.

This is exactly where Meniga adds value. As a trusted digital banking partner, we enable institutions to:

-

Bring fragmented data together into a single, actionable view

-

Offer personalisation that is both transparent and responsible

-

Fit seamlessly within existing banking infrastructures

-

Equip customers with real-time insights into their disposable income, helping them make confident decisions about when to save and when to spend.

By combining these elements, we help banks transform predictive analytics from abstract insights into clear, customer-focused outcomes.

We are building the Conversational Financial Assistant, an advanced, LLM-powered solution designed specifically for banks.

With this tool, customers can interact with their finances in plain language, asking everyday questions from ‘What have I spent on groceries this month?’ to ‘Do I have room in my budget for a weekend trip?’ and receiving precise, real-time answers in return.

Powered by enriched data and safeguarded with enterprise-grade security, the assistant goes beyond simple queries.

It provides highly personalised financial guidance, reduces pressure on customer support teams, and increases digital engagement, helping position your institution as a trusted, innovative partner in your customers’ financial lives.

Curious to see how this works in practice?

Contact us today to discover how you can leverage predictive AI to achieve measurable results.