Autonomous finance explained: Benefits for banks and customers

Autonomous finance represents a big shift in the way money is managed, transitioning from reactive processes to intelligent, self-directed systems that actively work to enhance financial outcomes.

Instead of just following commands or sending bill reminders, these next-generation solutions leverage:

As a result, they can automatically optimise savings, adjust credit limits based on income trends, and much more.

At its core, autonomous finance is self-learning and self-improving.

These systems continuously refine their decisions with minimal human input, delivering greater speed, accuracy, and adaptability.

Built on enterprise-wide data platforms, they provide live insights and interoperability across systems.

Thus, finance teams can move from transactional tasks to strategic advisors, making finance faster, more accurate, and adaptive to changing conditions.

Not only is autonomous finance an automated function, but it’s also intelligent, agile, and future-ready.

7 tips to support autonomous finance in banks and financial institutions

Achieving the full potential of autonomous finance requires careful planning and a strategic approach.

Here are practical tips to help banks and financial institutions implement it efficiently.

1. Modernise and future-proof your data infrastructure

A strong data foundation is the basis of autonomous finance.

You should start by investing in robust, scalable data platforms, such as modern data lakes, cloud-native warehouses, or hybrid architectures.

These solutions can centralise financial data from multiple, siloed sources into a single, unified environment.

However, centralisation is only the beginning.

For an autonomous finance to be effective, your data must be clean, consistent, and trustworthy.

-

Remove duplicates: Make sure there’s only one version of each customer, account, or transaction.

-

Fill in missing details: For example, every payment record should have an amount, date, and account number.

-

Use common formats: Dates, currency codes, and customer IDs should follow a standard format across the bank.

Therefore, implement automated data cleansing, normalisation, and validation pipelines to eliminate duplication, fill gaps, and maintain high-quality datasets.

Inconsistent data leads to inaccurate risk models, poor fraud detection, and compliance issues.

Quick tip:

Don’t wait until the end of the process to check data. Validate it as soon as it enters the system.

If a serious error appears, such as a missing account number, stop the process until it’s fixed.

Measure how accurate and complete your data is, and alert teams when something falls below your standards.

Doing so will prevent bad data from flowing into regulatory reports, credit risk models, or automated decision systems.

Worth knowing

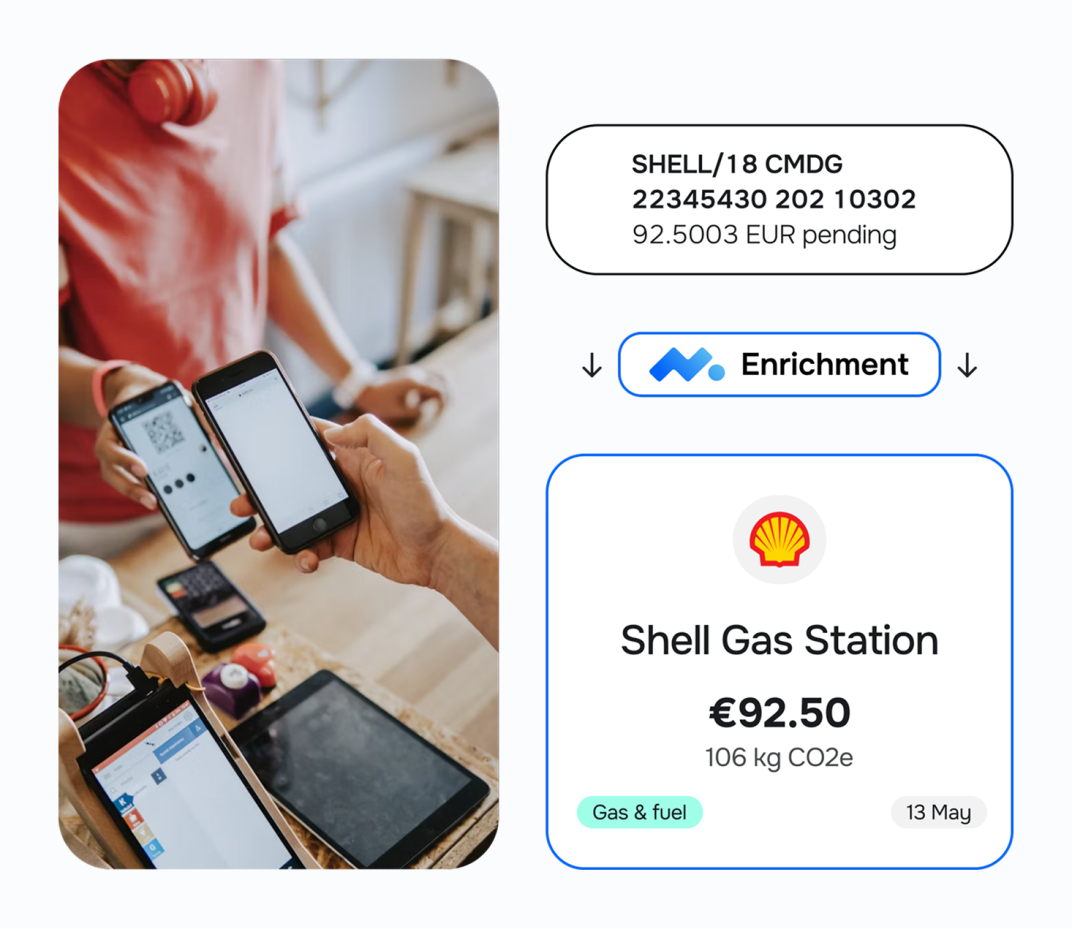

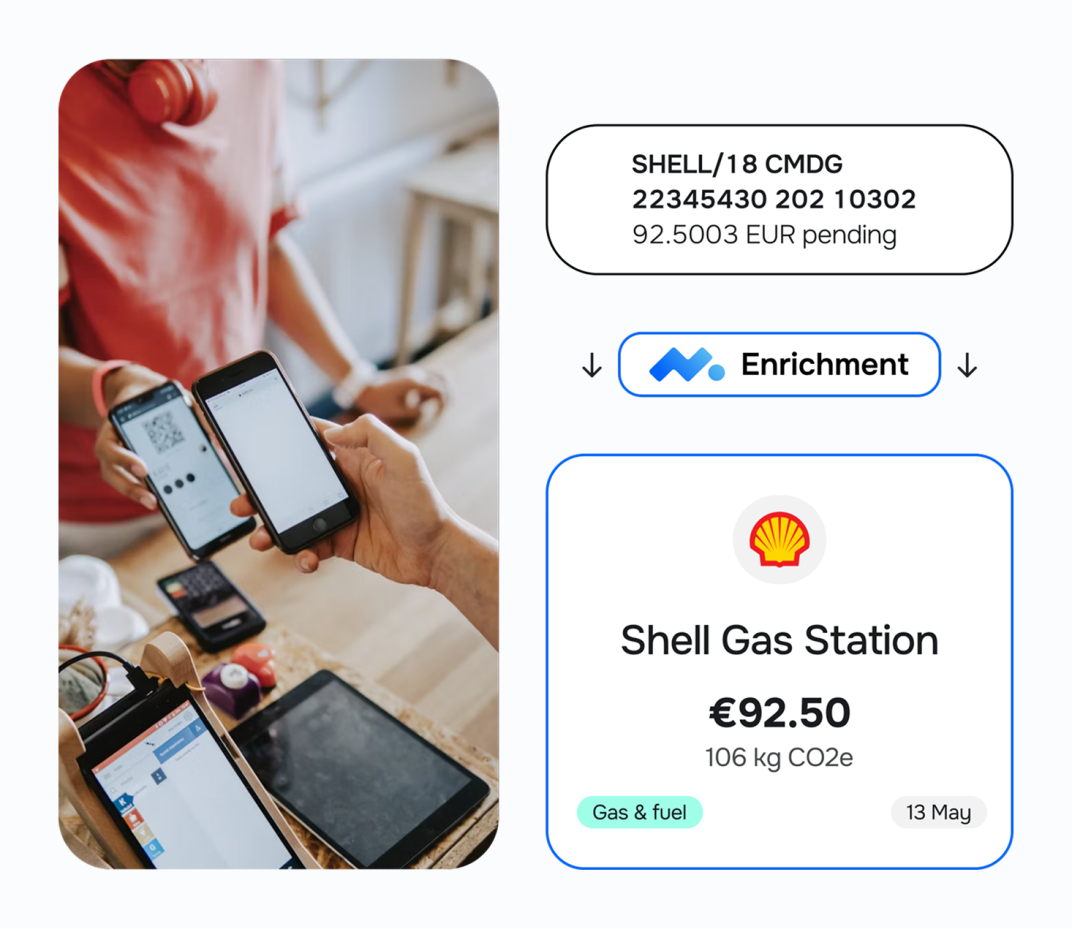

By aggregating data from multiple sources, including internal systems and open banking APIs, Meniga creates a unified financial view.

Our Enrichment Engine organises transactions and enhances them with rich, contextual details, such as merchant mapping, including logos, clean descriptions, analytics, subscription identification, and more.

The system makes the data more valuable for both you and your customers.

Through intelligent categorisation powered by machine learning, the system continuously learns from user behaviour and community feedback, ensuring accuracy improves with every interaction.

2. Adopt scalable cloud infrastructure

Cloud adoption in financial services has reached new heights: 91% of institutions use cloud services, with many opting for multi-cloud setups to boost resilience.

Moving to the cloud helps banks shift from costly hardware investments to a flexible, pay-as-you-go model.

You can use automation, such as container orchestration and automated testing, to minimise human errors that can prolong operational disruptions.

It reduces the burden of maintaining physical infrastructure, and it also allows IT resources to focus on innovation instead of routine upkeep.

Cloud platforms provide banks with the agility to scale resources up or down instantly, ensuring smooth operations even during peak demand periods, such as tax season or major payment cycles.

They also enable real-time transaction processing and faster decision-making, which were previously limited by traditional on-premises systems.

When it comes to data security, modern cloud solutions come with built-in security features, including automated updates, AI-driven threat detection, advanced encryption, and comprehensive monitoring.

Fun fact:

Did you know that institutions using mature cloud security programs experience 65% fewer incidents than those relying on traditional setups?

Their main aim is to safeguard sensitive financial data while meeting strict compliance standards.

| Compliance-focused checklist for banks modernising data infrastructure |

| Category | Best practices | Why is it important |

| Regulatory alignment | -

Map all relevant regulations (Basel III, GDPR, CCPA, PCI DSS, local laws) -

Perform impact assessments before changes. | Avoid non-compliance penalties and ensure smooth audits. |

| Data security and encryption | Apply: -

End-to-end encryption (at rest and in transit), -

Tokenisation/anonymisation for sensitive data, Enforce MFA with role-based access control. | Protect customer trust and reduce risk of data breaches. |

| Auditability and lineage | Maintain full audit trails and track data lineage from source to destination for transparency and compliance. | Enables traceability and accountability for regulators and internal governance. |

| Data quality and integrity | Implement validation rules, regular quality audits, and error-handling processes to ensure accuracy. | Prevents incorrect financial reporting and faulty AI-driven decisions. |

| Privacy and consent Management | Track customer consent, comply with “Right to be Forgotten,” and enable data portability under privacy regulations. | Builds customer trust and avoids privacy-related regulatory fines. |

| AI/ML model governance | Establish a model risk management framework, document inputs and decision logic for explainability. | Ensures transparency, fairness, and regulatory approval for AI-driven processes. |

| Third-party risk management | Validate vendors’ compliance certifications (SOC 2, ISO 27001), and enforce data-sharing agreements with monitoring. | Prevents data leaks and ensures partners meet security and compliance standards. |

| Incident response and resilience | Develop a breach response plan with regulatory reporting timelines and test disaster recovery regularly. | Reduces downtime, limits financial losses, and ensures regulatory reporting. |

Applying Meniga Solutions

Meniga enables banks to modernise infrastructure without disruptive overhauls, ensuring continuity while unlocking new efficiencies. Our solutions adapt to your current setup, whether on-premise, hybrid, or fully cloud-based, giving you flexibility to evolve at your own pace.

By working with Meniga, financial institutions can:

-

Lower IT and operational costs through streamlined resource management and open-source technologies.

-

Reduce complexity and risk of future upgrades with a modular, integration-ready system.

-

Accelerate innovation by bringing new digital products and services to market faster, while staying compliant and secure.

3. Build AI and Machine Learning integration layers

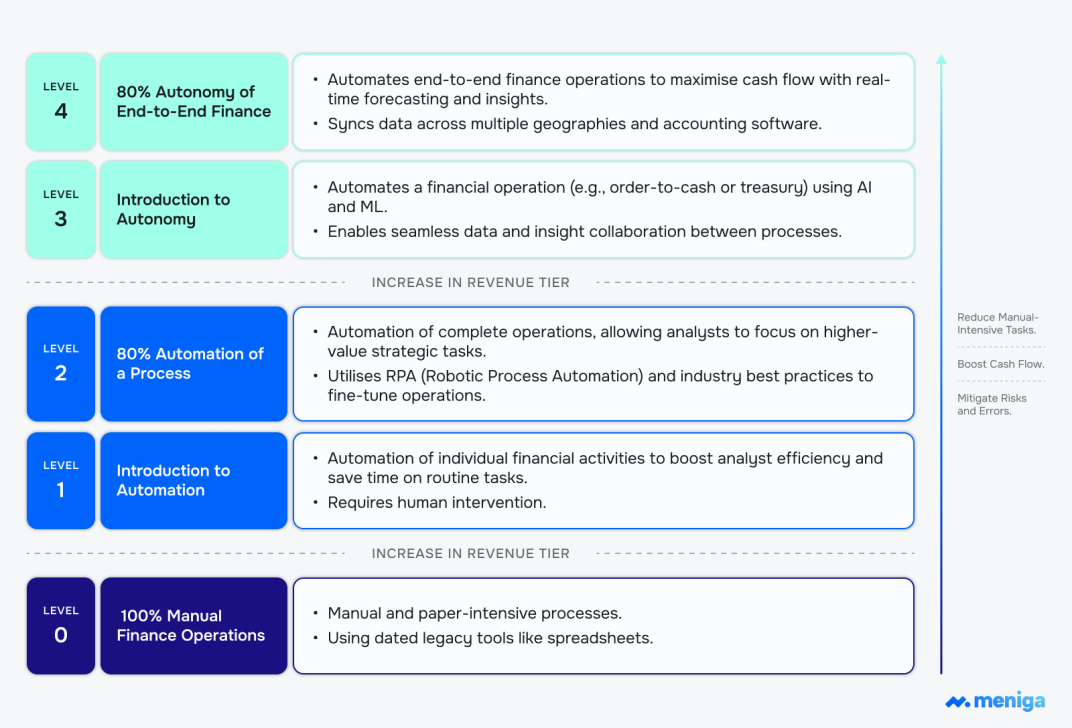

Banks should combine AI/ML with RPA to create systems that automate tasks while also learning, adapting, and making intelligent decisions. This approach is often implemented by a finance software development company to enhance core banking operations.

You can:

-

Use AI-powered models for predictive and prescriptive analytics, not just forecasting future outcomes but also recommending optimal actions in complex situations. You can then leverage these models in key areas such as cash applications, credit risk assessment, and fraud detection, where they can continuously update and improve as they process more data.

-

Combine RPA with machine learning and natural language skills so they can adapt to new patterns and handle exceptions dynamically. As a result, you get intelligent workflows that self-correct and improve, allowing employees to focus on high-value, strategic tasks.

-

Begin with targeted pilot programs. For example, automating credit decisions, onboarding, or fraud detection in controlled environments. Use pilot results to refine your models, verify compliance, validate workflows, and progressively expand to larger, more complex use cases.

| AI/RPA integration strategy |

| Phase | Focus area | Value for banks |

| Use AI/ML | Predictive and prescriptive analytics for fraud, credit, and ops | Proactive insights and actionable recommendations |

| Intelligent RPA | AI-enhanced bots that learn and self-correct | Streamlined operations and fewer manual interventions |

| Pilot projects | Targeted use cases such as loan processing or fraud prevention | Controlled rollout, faster feedback, safer adoption |

| Agentic AI | Autonomous decision-making systems | High efficiency with minimal human oversight |

| Cloud and AI tools | Scalable model deployment | Reliable, compliant, and flexible AI capability |

| Governance focus | Gradual integration with oversight and AI-human collaboration | Innovation that’s safe, trusted, and well-managed |

Worth knowing

Limited data access prevents banks from responding quickly to risks and opportunities, ultimately slowing decision-making and weakening competitive advantage.

With our AI-powered Insights equipped with real-time processing, you can build and deliver hyper-personalised insights within minutes and:

-

Identify and act on any opportunities immediately.

-

Understand your customers on a granular level.

-

Access and use data without IT involvement.

-

Proactively connect customers with smart, personalised banking solutions that anticipate their needs.

As a result, you can drive adoption, enhance experience, and enjoy greater ROI from existing features.

4. Establish a hybrid transaction architecture

Adopting hybrid transaction architectures means integrating autonomous AI agents with deterministic processing layers.

These layers enforce strict rules and validations, ensuring that all transactions adhere to regulatory requirements and internal policies.

They act as a safeguard, overriding AI decisions when necessary to maintain data integrity and compliance.

AI agents use advanced machine learning models to make real-time decisions, such as fraud detection and credit risk assessment. They operate with a high degree of autonomy, continuously learning and adapting to new data inputs.

Positioned between the AI agents and the deterministic processing layer, the logic layer provides an additional level of oversight and control.

It validates AI decisions, ensuring they align with business objectives and regulatory standards.

This layer maintains the integrity of core ledger updates and payment processes.

A hybrid approach ensures both flexibility and compliance in handling core financial transactions.

5. Implement observability and self-healing infrastructure

To do so, use advanced monitoring systems to continuously capture operational metrics, logs, traces, and events across all systems:

-

Applications,

-

Databases,

-

Networks, and

-

AI/ML models.

This holistic visibility provides a single source of truth for system performance, health, and anomalies.

You can also use predictive models to identify potential bottlenecks, failures, or security threats before they impact services, enabling proactive planning and intervention.

While much of the system is autonomous, human operators should still supervise critical decisions and high-risk remediation steps.

This ensures that compliance, regulatory requirements, and business priorities are in line even as automation scales.

Consider integrating orchestration tools and AI-driven workflows that can automatically resolve common issues, such as:

Self-healing infrastructure reduces downtime and ensures continuous availability for core banking operations, payments, and trading systems.

6. Enhance cybersecurity and compliance measures

While autonomous finance is promising, cybersecurity and compliance remain one of the greatest challenges currently.

As transactions move deeper into digital ecosystems, the exposure to cyberattacks and data breaches grows.

Financial institutions must safeguard AI-powered platforms and blockchain infrastructures against malicious threats that could use system weaknesses.

It is no surprise then that making robust security measures is the key to preserving customer trust and system integrity.

Compliance is also one of the top concerns due to the lack of standardisation.

The industry currently operates without unified standards for data privacy, AI model governance, and blockchain protocols.

Consequently, this inconsistency leads to interoperability challenges and complicates global scalability.

Financial organisations that want to start autonomous finance solutions internationally must handle varying regulations and technical frameworks across jurisdictions.

Without harmonised standards, integration becomes cumbersome, slowing adoption and limiting the full potential of autonomous finance.

One of the solutions is to continuously improve cybersecurity defenses and ensure compliance with evolving data privacy regulations.

| Aspect | Specific measures |

| Quantum-resistant encryption | Adopt quantum-safe cryptography, such as lattice-based schemes and quantum key distribution (QKD) to protect sensitive financial data against future quantum attacks. |

| AI-powered threat detection | Use AI and machine learning for real-time detection, analysis, and response to advanced threats, phishing, and ransomware. |

| Regulatory compliance | Implement frameworks to comply with regulations like GDPR, DORA, SEC Cyber Disclosure, AMLAR, and PCI-DSS. Do continuous auditing and reporting |

| Real-time AML Monitoring | Employ AI for real-time anti-money laundering monitoring, behaviour analytics to reduce false positives, and automated suspicious activity reporting. |

| Data encryption | Encrypt sensitive Personally Identifiable Information (PII) and financial records both in transit and at rest. |

| Multi-Factor authentication | Enforce strong authentication methods to reduce unauthorised access risks. |

| Incident response & recovery | Establish robust incident response plans with continuous monitoring and automated remediation capabilities. |

| 3rd-party risk management | Continuously assess and manage risks related to vendors and service providers, ensuring they meet cybersecurity standards. |

Autonomous finance involves processing high volumes of sensitive data, so maintaining strong security and auditability is non-negotiable.

7. Upgrade ERP and integration capabilities

Optimize your core ERP systems and ensure they are integrated with new AI and automation tools efficiently.

To do so, you can:

-

Upgrade modules or transition to next-generation ERP platforms designed for automation, predictive analytics, and autonomous decision-making.

-

Ensure APIs and integration layers are robust enough to connect ERP with AI, machine learning, and robotic process automation (RPA) tools. As a result, autonomous systems can operate without data silos.

-

Adopt ERP solutions that can handle intelligent workflows, exception management, and continuous learning, making operations more adaptive and resilient.

Meniga is a flexible, scalable, and integration-friendly digital banking solution provider that enables banks to modernise without replacing core systems.

We provide:

Operational continuity: We support deployment both on-premises and on cloud platforms, giving banks the freedom to choose an approach that best suits their current infrastructure and compliance requirements.

Reduced costs and risks associated with huge transformations thanks to our modular and microservices-based solutions. Thus, you can implement new features and capabilities incrementally based on customer needs and market trends.

Speed to market: By leveraging open-source technologies and improving resource management, we help reduce IT costs. Our modular release management also cuts future upgrade expenses and accelerates time to market for digital innovations.

Customer-centric innovations: We offer AI-powered data consolidation and aggregation, as well as personalised finance management tools that drive customer engagement, seamlessly layered on top of modernised infrastructure.

What’s new?

Meniga is developing the Meniga Conversational Financial Assistant, an LLM-powered solution tailored for banks.

This innovative tool empowers customers to ask everyday questions, such as ‘How much have I spent on groceries this month?’ or ‘Can I afford a weekend getaway?’ and receive instant, accurate, and conversational responses.

Built on enriched transaction data and protected with enterprise-grade security, the assistant offers hyper-personalised financial guidance.

It not only enhances the customer experience but also reduces support costs and strengthens digital engagement, positioning your bank as a trusted, forward-thinking financial partner.

Contact us today to see how you can minimise operational disruption and accelerate digital transformation with our solutions.