4 key strategies for bank customer engagement

Mastering customer engagement is essential for building loyalty, driving revenue, and turning everyday transactions into meaningful relationships.

Here are the top strategies that can make it happen.

1. Use personalisation at scale

According to recent industry data, nearly 77% of banking leaders believe that personalisation directly drives higher retention and loyalty.

Yet, there’s a striking gap between intention and execution.

While the majority of banks list personalisation as a top priority, only about one in five customers feel they receive truly personalised financial guidance.

The next generation of personalisation is moving beyond basic segmentation or generic recommendations.

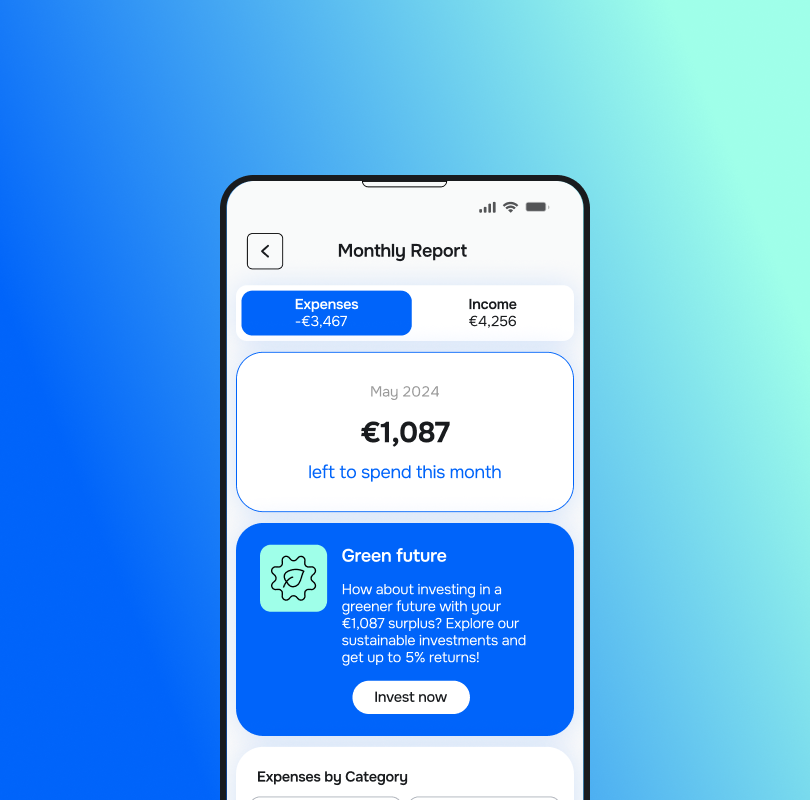

Modern banks should adopt real-time, context-aware personalisation, using behavioural, transactional, and life-event data to anticipate customer needs.

For example, customers nearing their credit limit may receive instant notifications offering short-term credit top-ups or expense management advice, even before they request assistance.

This ‘proactive banking’ model creates value and deepens trust.

At the same time, personalisation must go above mere numbers.

If you want to leverage personalisation fully, you should understand the importance of emotional and behavioural personalisation.

Using analytics to detect financial stress, saving motivation, or spending moods leads to tailored communication.

A simple change in tone or message timing can dramatically increase engagement.

But with great personalisation comes great responsibility.

The role of data privacy and security

Customers are more aware of how their data is being used, and transparency has become a key trust factor.

If you can explain your algorithms and give customers clear control over data preferences, you’ll be on the right track regarding ethical AI, which is becoming a competitive differentiator.

Here’s a quick reminder of the current main use cases of AI in Banking:

| AI use case | Description |

| AI-powered chatbots | Conversational AI chatbots provide 24/7 personalised support, answer queries instantly, guide product choices, and escalate when needed, improving satisfaction and engagement. |

| Personalised recommendations | AI analyses customer data to offer tailored product suggestions, relevant promotions, and financial advice, increasing interaction and loyalty. |

| Predictive analytics for engagement timing | AI determines optimal moments to send personalised notifications or offers, improving message open rates and customer lifetime value. |

| Emotion and sentiment analysis | AI analyses customer tone and emotions during interactions, enabling empathetic response tuning that enhances experience quality and reduces churn. |

| Automated lifecycle campaigns | AI automates personalised communication across the customer journey, from onboarding to retention, sustaining ongoing engagement beyond initial signup. |

2. Incorporate omnichannel support

Customers expect a truly seamless experience across every interaction point.

Whether they’re using a mobile app, visiting a branch, or chatting with an online agent, they want the journey to feel cohesive, one continuous relationship rather than fragmented encounters.

In practice, omnichannel banking means a customer can start a loan application on their phone, continue on a laptop, and finalise it in-branch, all without re-entering information or losing context.

A unified customer profile ensures that every channel ‘knows’ who the customer is, what they’ve done, and what they might need next.

Banks that synchronise mobile, web, and in-branch experiences consistently outperform those operating in silos, with cross-sell opportunities expanding significantly.

However, execution remains challenging.

Legacy systems, fragmented data, and inconsistent security frameworks continue to be pain points.

In fact, over 60% of BFSI marketers admit that cross-channel coordination is their biggest obstacle.

To overcome this, you should opt for digital banking solution providers that enable the connection of data, automation, and analytics across touchpoints.

And even with all technology, creating a truly beneficial omnichannel experience is about designing with empathy.

Every interaction should feel intuitive, responsive, and consistent, regardless of the channel.

How can Meniga help you modernise your legacy system without an overhaul?

Meniga provides scalable, integration-ready solutions designed to enhance and modernise digital banking environments, regardless of existing system architecture.

Our solution enables you to adopt open-source technologies and a modular architecture, allowing you to lower IT costs, prevent future upgrade expenses, and accelerate time to market.

Meniga also enables your bank to launch hyper-personalised experiences and campaigns across any channel, ensuring a consistent, seamless UX.

3. Provide financial education and empowerment

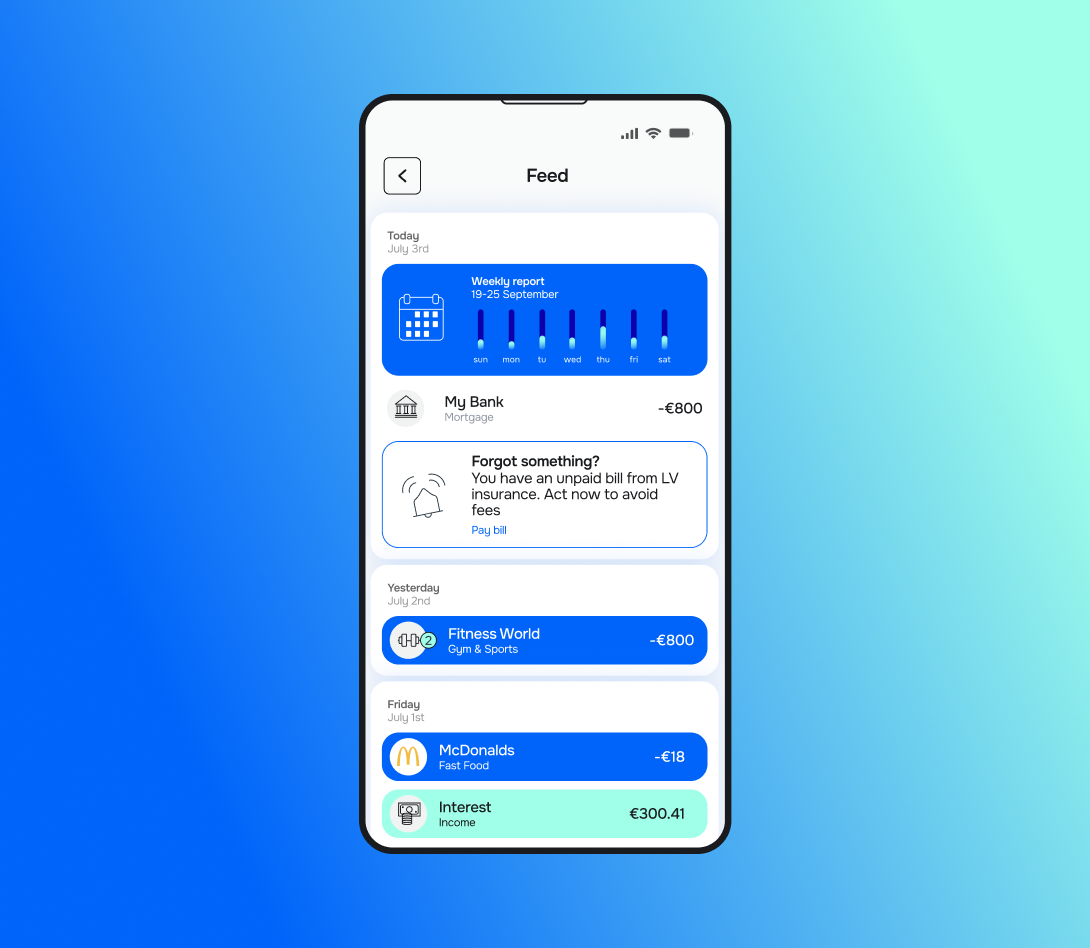

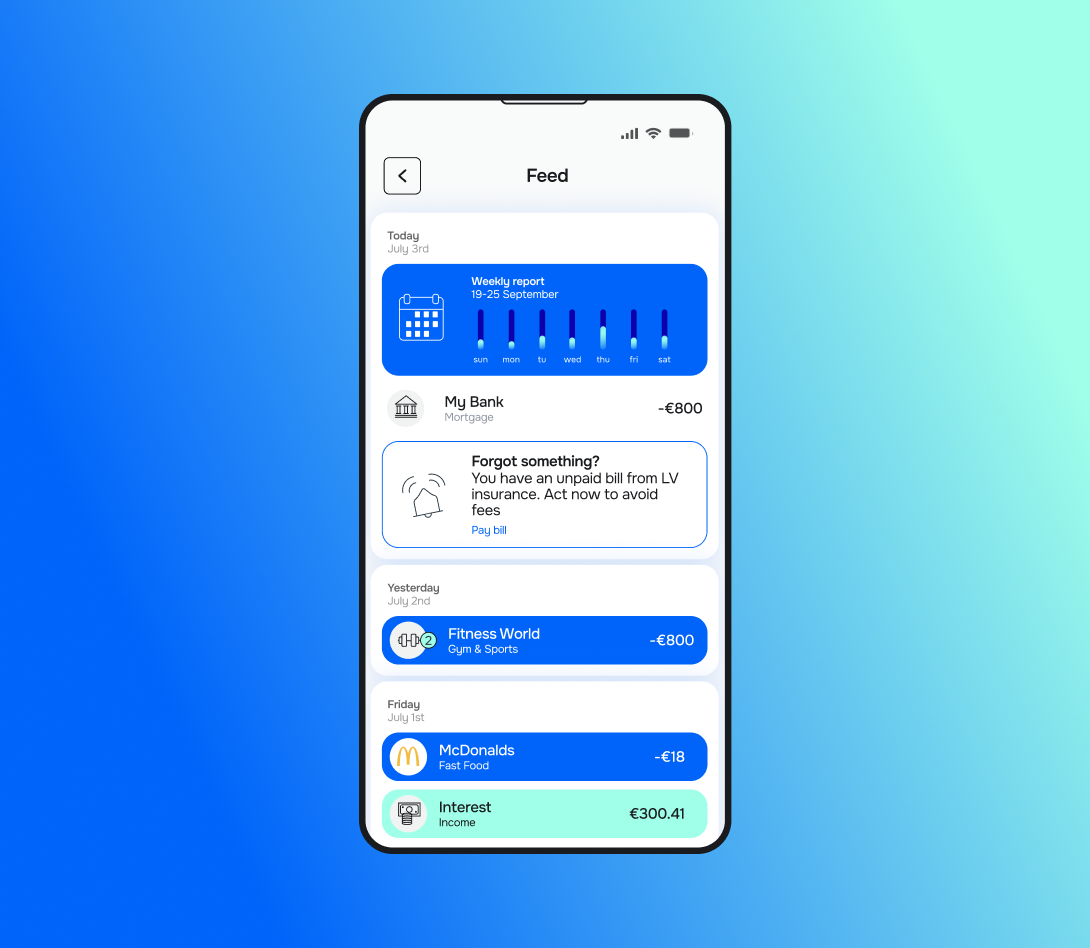

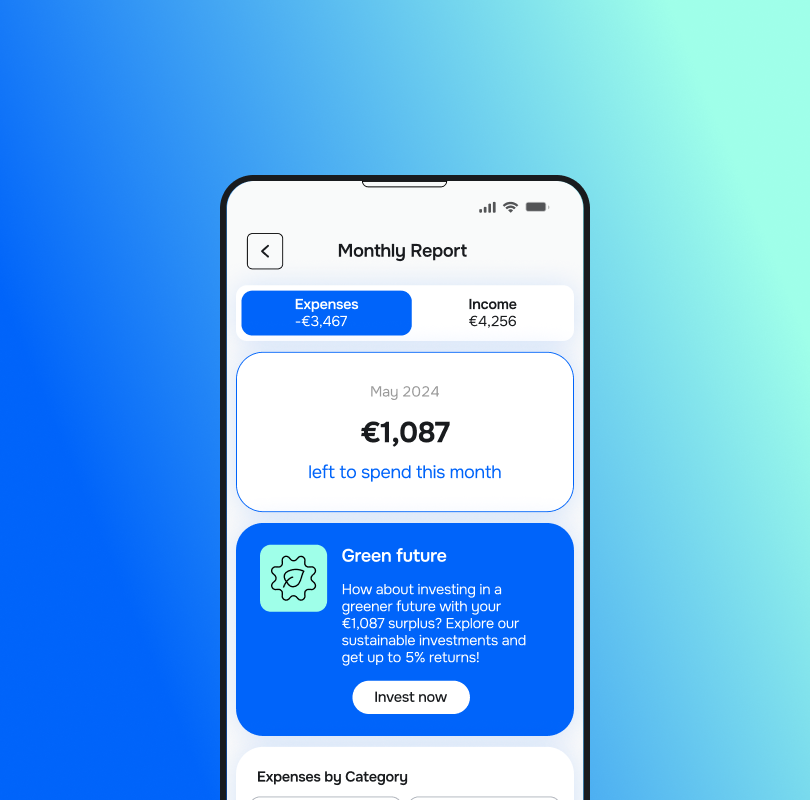

Bank customers want guidance, not just transaction management. Embedding personalised financial coaching directly into digital journeys is especially effective.

Instead of static ‘tips’ pages, you can deliver contextual micro-lessons: quick, actionable insights triggered by real-time behaviour.

For example, a budgeting notification might appear when spending exceeds the average, or an investment explainer could surface when a customer explores mutual funds.

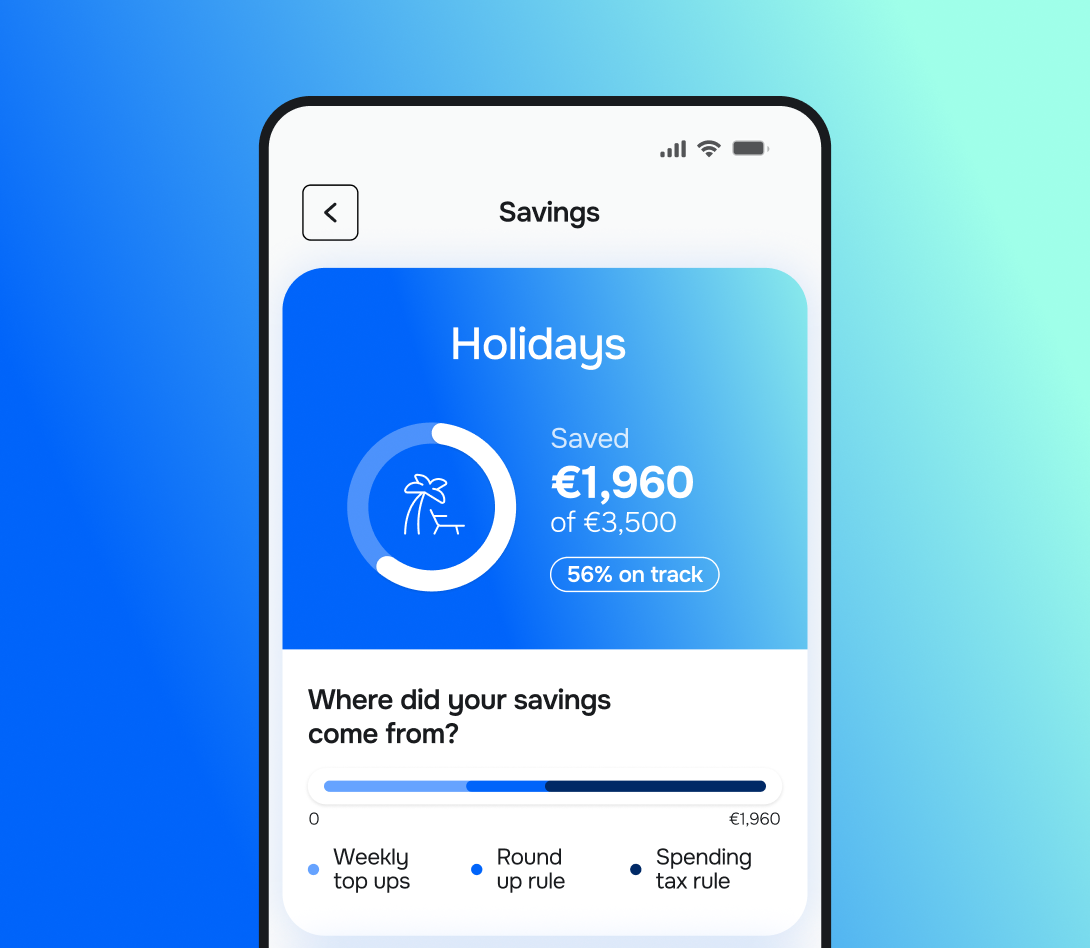

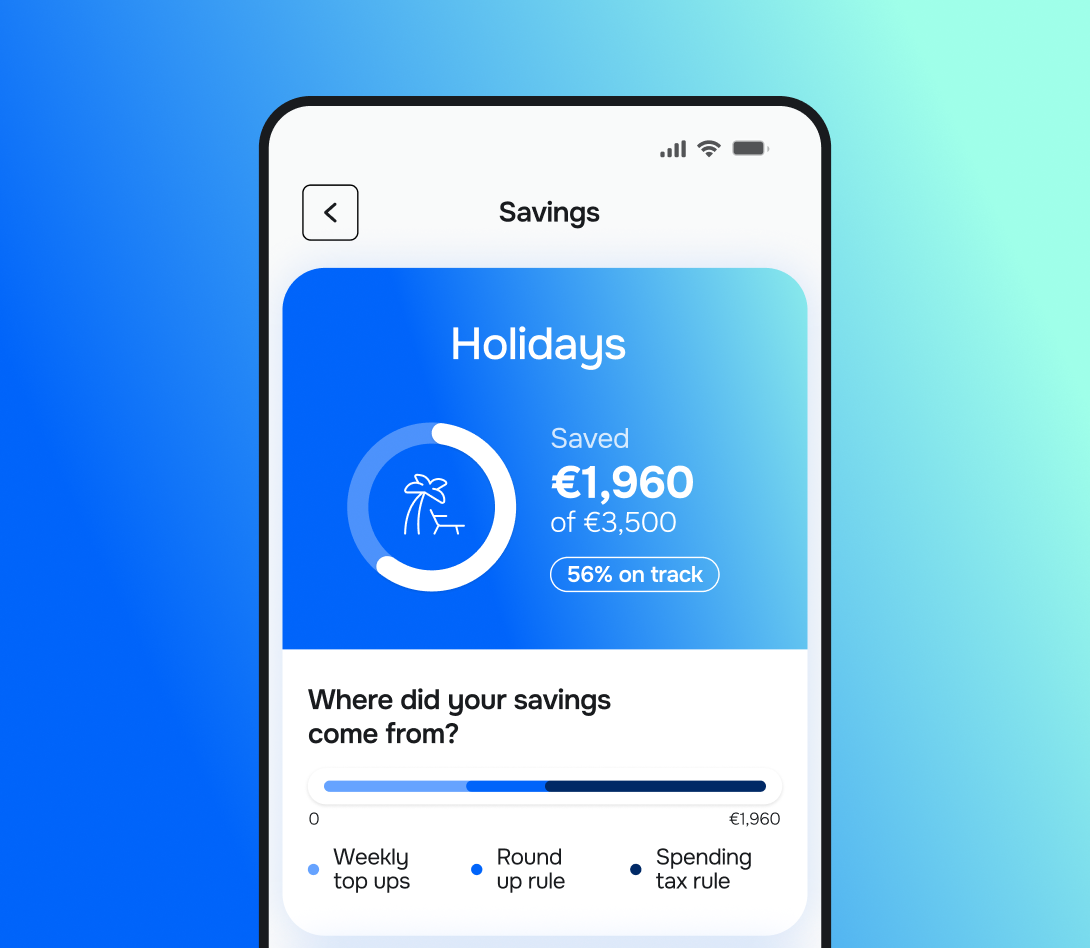

Gamification is also driving engagement. Mobile banking apps incorporate progress tracking, challenges, and reward badges that make financial management feel interactive rather than intimidating.

Celebrating milestones, such as hitting a savings goal or reducing debt, can make financial growth emotionally rewarding.

With Meniga’s Smart Savings tool, you can provide your customers with gamified rules, ranging from rounding up transactions to the nearest € to taxing certain categories to saving a percentage of customers’ income.

These rules help customers set money aside and automatically grow their savings.

💡 Worth knowing:

Try integrating education into the experience itself, not treating it as an add-on.

For example, when a customer applies for a mortgage, the application flow might include sidebars that explain repayment options, interest rate mechanics, and long-term financial implications.

As a result, this approach fosters confidence and transparency, reinforcing trust in the brand.

4. Leverage loyalty, reward and partnership programs

Traditional points and cashback programs are still present, but a much bigger driver of loyalty is behaviour-based and rewarding good financial habits rather than simple spending.

It goes hand in hand with financial literacy, which we’ve mentioned above.

Forward-thinking banks can offer incentives for saving consistently, paying bills on time, or improving credit scores.

Besides strengthening engagement, this also aligns the bank’s goals with the customer’s financial well-being.

Some institutions are even linking rewards to sustainability, giving bonuses for choosing green loans or investing in socially responsible funds.

Tiered programs remain popular, but they’re becoming more sophisticated.

Instead of focusing purely on balance thresholds, banks are introducing engagement tiers where active participation, feedback, and digital usage contribute to higher status levels.

Exclusive perks such as priority customer service or access to financial advisors help these programs feel meaningful, not transactional.

Partnership ecosystems are expanding as well.

Banks are collaborating with fintechs, retailers, and lifestyle brands to create richer, interconnected rewards experiences.

Thus, a customer might earn bonus points for booking travel, shopping sustainably, or referring a friend, integrated within the same banking app.

What are future trends in bank customer engagement?

The next wave of customer engagement in banking is about creating human-centred experiences that combine data, empathy, and purpose.

Three main trends are leading the way.

1. Hyper-personalisation with real-time data

The future of engagement is deeply personal and instantaneous. Hyper-personalisation, powered by real-time data, allows banks to tailor every interaction to a customer’s current context, not just their historical behaviour.

This means moving from reactive engagement, ‘You spent more this month’, to predictive and proactive, ‘We noticed your balance pattern and recommend adjusting your savings goal’.

With the rise of AI-driven analytics, banks can now interpret spending habits, financial goals, and life events in real time to offer relevant advice and products.

However, success in this area depends on transparency.

Customers expect personalisation that feels empowering, not invasive.

Banks that combine smart data use with clear communication about how that will be on the right track.

Worth knowing:

We provide banks with an AI-Powered Insights Platform that enables hyper-personalisation & customer intelligence at scale.

It processes real-time behavioural and transactional data to help banks understand and respond to customers’ needs with accuracy and immediacy.

Armed with micro-segments built on behavioural intelligence, banks can create campaigns to:

-

Support customers through important life moments,

-

Detect early signals of disengagement to prevent churn, and

-

Deliver ultra-relevant product recommendations at the exact time the user needs them most.

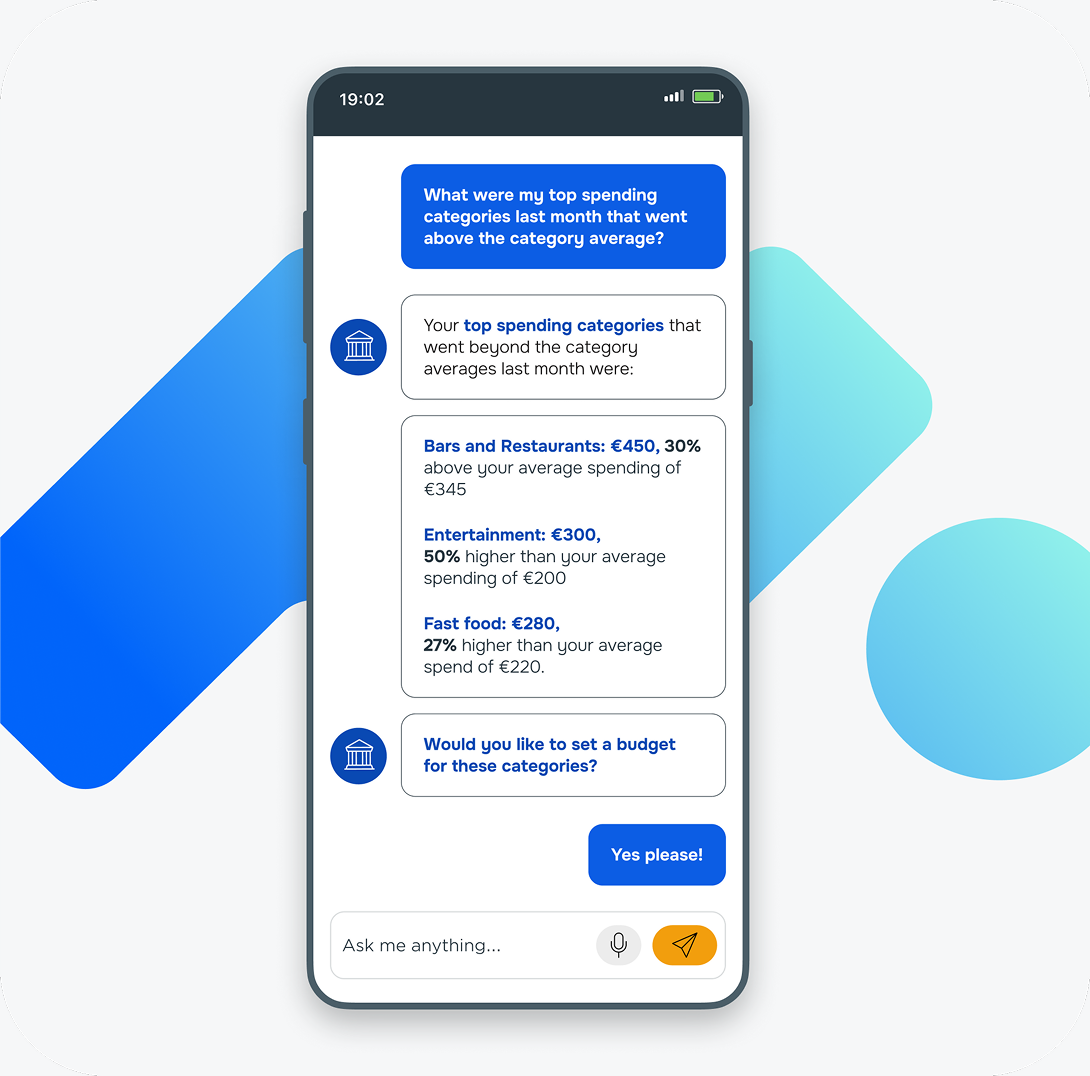

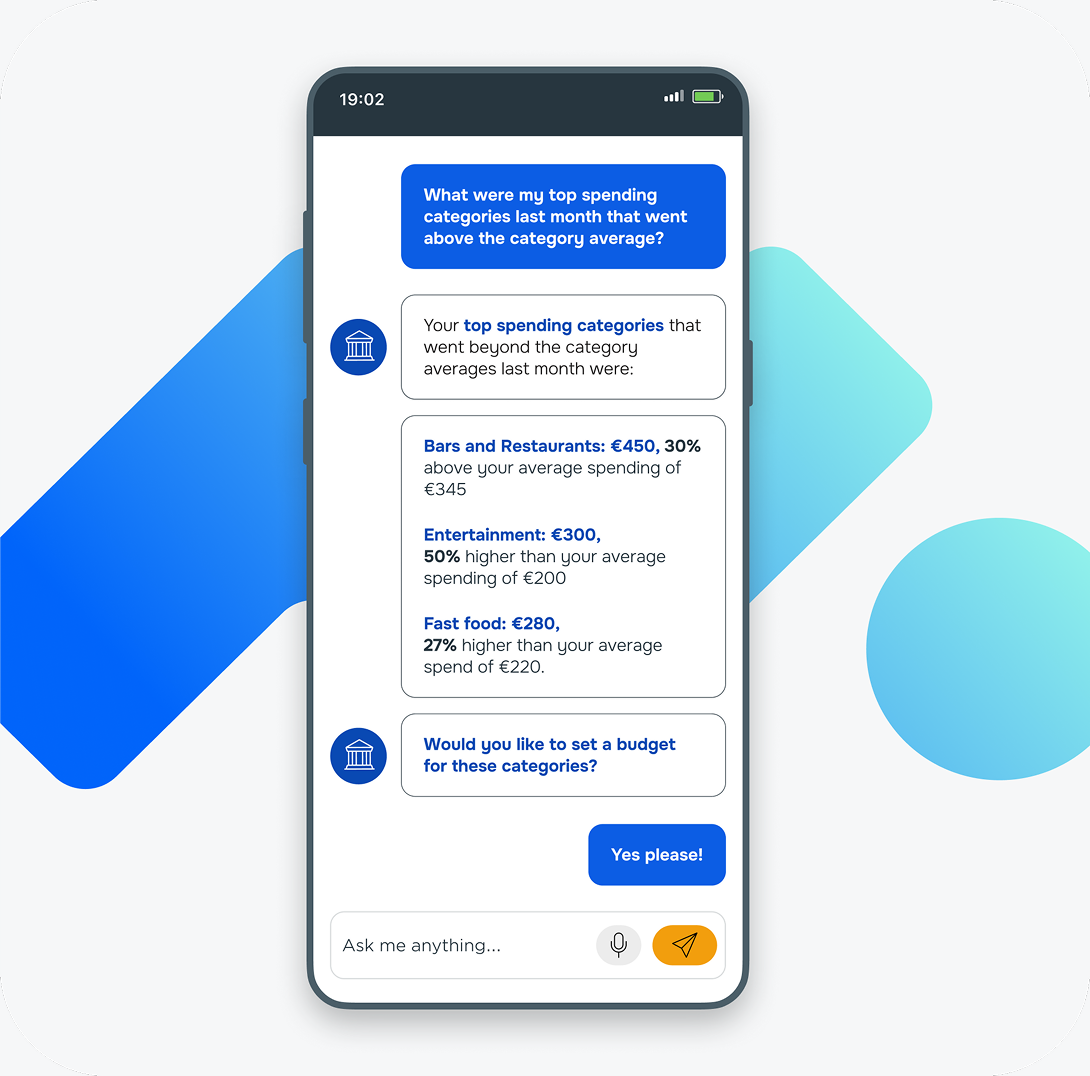

2. Voice and conversational banking

As digital interactions become more natural and frictionless, conversational banking, through voice assistants, AI-powered chatbots, and smart speakers, is redefining convenience.

A growing number of customers prefer speaking to their devices rather than typing or navigating menus.

This shift presents a huge opportunity for banks to create intuitive, human-like interactions.

Imagine checking your balance, applying for a loan, or getting personalised financial advice through a simple voice command.

The best conversational systems will blend automation with empathy.

Instead of rigid scripts, AI-driven agents will engage in contextual dialogue, understanding tone, urgency, and intent.

For banks, this means scaling support and sales at a fraction of the cost while improving accessibility for all users, including the visually impaired or digitally hesitant.

Still, voice banking must be paired with robust authentication and privacy safeguards. Customers will only embrace these interactions if they feel as secure as they are convenient.

Worth knowing

Meniga’s advanced Conversational Financial Assistant, an LLM-powered solution built specifically for banks, lets customers interact with their finances naturally, asking questions like 'How much did I spend on groceries this month?' or 'Can I afford a weekend trip?', and receive instant, accurate insights.

3. Ethical AI and transparent data usage

Customers are aware that algorithms influence their financial decisions, and they want assurance that these systems are fair, unbiased, and explainable.

The first step is to publish AI ethics frameworks, clarifying how data is collected, processed, and protected.

In the next few years, one of the most successful banks will likely be those that integrate ethical data use into the customer experience, rather than viewing it as a mere legal obligation.

Transparent, responsible AI will become a core differentiator, the new measure of brand integrity in digital banking.

How can you boost customer engagement with Meniga?

Meniga is a digital banking solution provider that combines internal and open banking data to give banks a full, 360-degree view of customers’ spending habits and financial lives.

Our solutions rely on AI and machine learning, which means that accuracy improves over time through user and community contributions.

With our solutions, you can:

-

Improve financial literacy by transforming meaningless transaction data strings into a visual story of your customers’ spending.

-

Give customers real-time insight into their disposable income, empowering them to make confident spending and saving decisions.

-

Deliver dynamic, context-aware content tailored to individual behaviours, cash flow, and financial goals, ensuring every message feels personal and relevant.

-

Integrate real-time signals from external systems like CRMs to offer proactive guidance exactly when it’s needed.

-

Leverage gamified savings features so customers can effortlessly grow their savings through automated rules, all while understanding when they’re safe to save or free to spend.

Enticed to learn more?

Contact us today and see how you can start transforming everyday financial interactions into smarter, more meaningful experiences.

FAQ

1. What are the four pillars of customer engagement in banking?

The four pillars of customer engagement are a blend of data, personalisation, interaction, and trust.

Personalisation ensures that every interaction feels tailored to the customer’s financial needs and lifestyle, while trust and value creation solidify long-term relationships by ensuring security, transparency, and meaningful financial outcomes for customers.

2. What are the five dimensions of customer engagement?

Five key dimensions are: cognitive, emotional, behavioural, social, and value-based. These capture how customers think about, feel toward, interact with, and derive benefits from a brand, including participation in communities or social sharing.

Together, they provide a holistic view of the depth and quality of customer relationships.

3. What is the biggest challenge in bank customer engagement?

The biggest challenge in bank customer engagement is delivering personalised, seamless experiences while maintaining trust and data privacy.

Customers expect relevant, real-time interactions across multiple channels.

However, legacy systems, fragmented data, and regulatory constraints make this challenging.

Banks must balance innovation with security and compliance to keep customers engaged and loyal.