What Is Conversational Banking?

Conversational banking enables customers to interact with their banks through natural, chat-like conversations via:

These interactions can handle a wide range of tasks, from checking account balances and transferring money to obtaining financial advice and resolving disputes, all in a manner that mimics human conversation.

Unlike basic chatbots, conversational banking uses advanced AI to understand context, remember past interactions, and personalise responses.

It’s fast, intuitive, and built for how customers actually want to communicate.

Key technologies behind conversational banking

Conversational banking is powered by advanced technologies that work together to deliver intuitive, accurate, and secure experiences.

1. Natural Language Processing (NLP) and generative AI

At the heart of conversational banking is artificial intelligence that can actually hold a conversation.

Thanks to advances in NLP, banking chatbots now understand everyday language, including slang, sarcasm, and industry jargon.

Generative AI models, like GPT-4.5 and beyond, craft replies on the fly.

They remember past chats, adapt to your tone, and even offer suggestions based on your financial habits.

Behind the scenes, AI also flags fraud, verifies documents, scores credit, and spots what you might need next before you ask.

2. Chatbots and voice assistants

Chatbots and voice assistants are no longer just for FAQs.

They can help customers:

Whether your customer is texting on WhatsApp or talking to a smart speaker, the experience feels instant and personal.

And when a problem is too complex, the bot seamlessly hands it off to a human, including the full chat history.

3. Multimodal AI

With multimodal AI, customers can snap a photo of a document, send a voice message, or even jump on a quick video call, all within the same flow.

This technology allows AI systems to interpret and respond to diverse data types, such as verifying identity through document images or processing handwritten forms.

Multimodal AI also incorporates sentiment analysis and emotional intelligence by analysing vocal tone or facial expressions during video interactions, allowing AI to adapt responses empathetically.

As a result, your customers get a more engaging and human-like banking experience that caters to varied customer preferences and needs.

4. Integration with core banking systems and customer data platforms

For conversational banking to deliver personalised, accurate, and secure services, it must be deeply integrated with banks’ core systems and customer data platforms.

The integration enables AI agents to access:

Real-time account information,

Such connectivity enables conversational AI to perform tasks such as balance inquiries, fund transfers, fraud alerts, and loan processing without requiring manual intervention.

It also supports compliance by ensuring that conversations adhere to regulatory requirements and that sensitive data is handled securely.

Furthermore, integration with CRM and analytics platforms enables AI systems to learn from past interactions, allowing for continuous personalisation and proactive engagement.

This backend connectivity is essential for delivering consistent omnichannel experiences and maintaining trust and security in conversational banking.

Why is conversational banking important: 5 key benefits

Conversational banking makes everyday banking faster, simpler, and more human. Here’s how it delivers real value where it counts.

1. Enhanced customer engagement and personalisation

Conversational banking enables customers to interact with their banks through natural, human-like conversations across familiar digital channels such as messaging apps, voice assistants, and mobile platforms.

As a result, it reduces friction by eliminating complex menus or forms, making banking more intuitive and accessible.

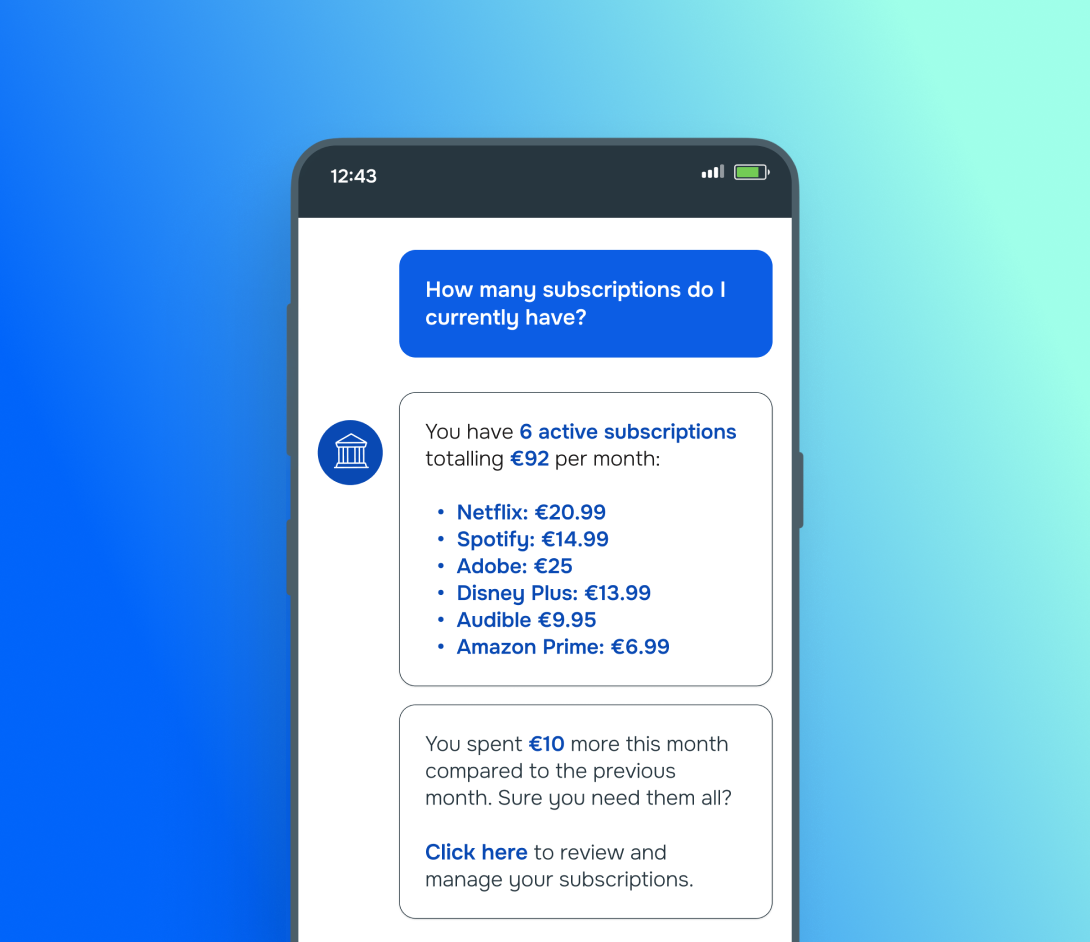

AI-driven systems analyse historical interactions, transaction data, and customer preferences to deliver highly tailored recommendations and support.

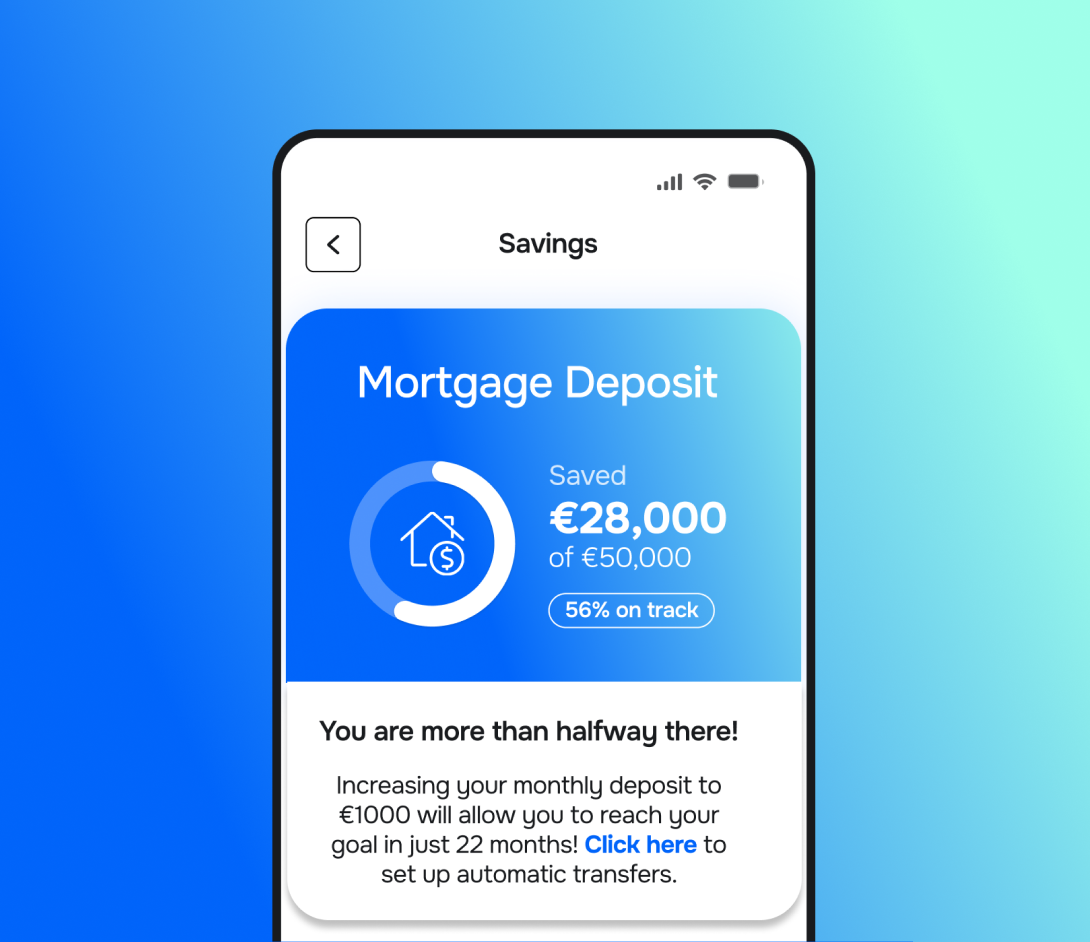

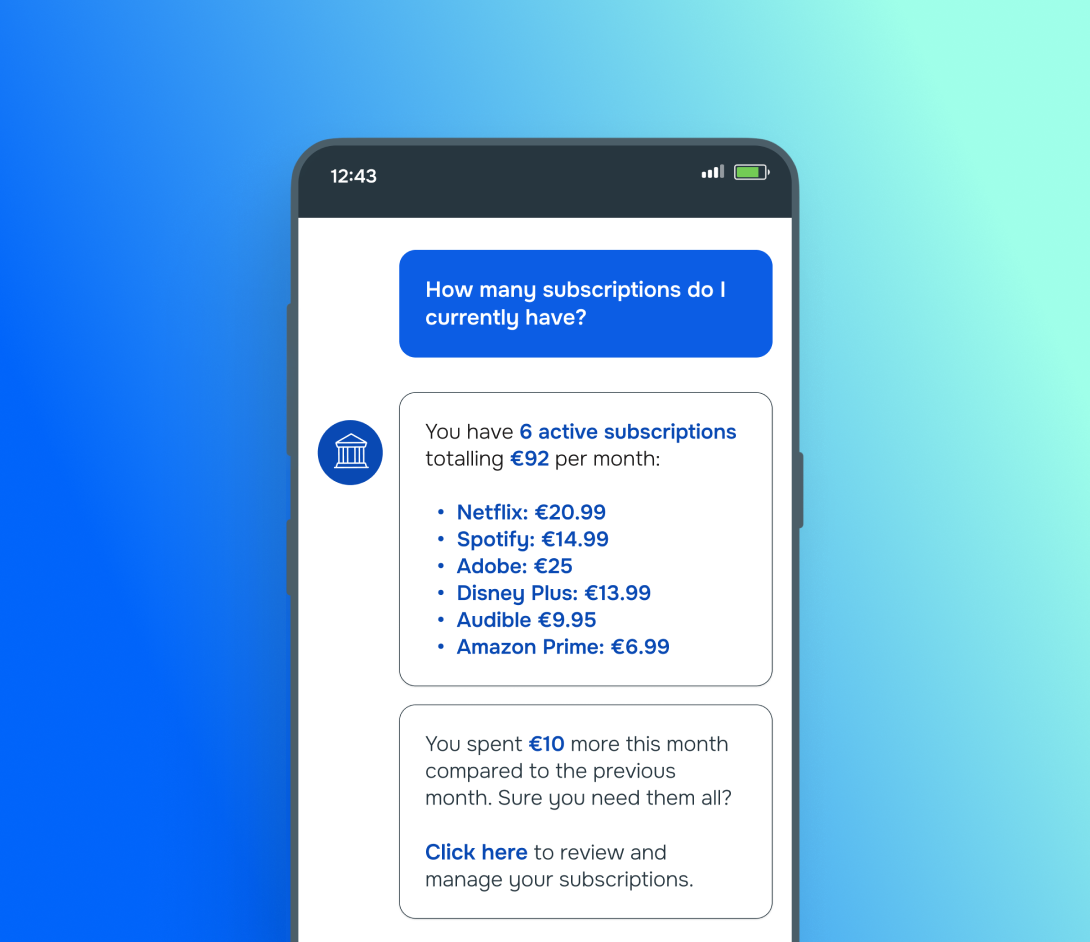

Imagine receiving proactive advice on how to save for a down payment on a house, as well as personalised product offers based on your specific spending habits.

Or, for example, getting immediate assistance with common banking tasks, such as transferring funds or paying bills, through simple conversational exchanges.

This level of micro-personalisation fosters deeper engagement and loyalty, as customers feel understood and valued.

| Micro-personalisation: key drivers | How it builds loyalty |

| 1. Trust-based relationship building | Conversational AI maintains ongoing engagement through personalised follow-ups, satisfaction checks, and relevant content, even during periods of inactivity. |

| 2. Hyper-personalised, real-time experiences | AI dynamically tailors conversations and suggestions based on individual behaviour, preferences, and context, delivering timely, relevant support that increases satisfaction and retention. |

| 3. Emotional connection and empathy | By analysing sentiment and adjusting tone, phrasing, and style, AI creates more human-like, empathetic interactions that strengthen emotional bonds with customers. |

| 4. Proactive engagement & churn prevention | AI detects early signs of disengagement and automatically triggers personalised offers, follow-ups, or escalations, keeping customers connected and preventing churn. |

| 5. Personalised loyalty programs | Conversational AI personalises loyalty program updates, rewards, and exclusive offers, making them feel more relevant and increasing participation and repeat business. |

| 6. Transparency & ethical AI use | By giving customers control over their data and clearly explaining AI-driven actions, you build transparency and trust, essential for long-term customer loyalty. |

| 7. Seamless 24/7 personalised support | Always-on, context-aware support reduces friction and makes customers feel supported whenever they need help. |

2. Operational efficiency and cost reduction

Behind the scenes, conversational banking quietly handles thousands of everyday requests, balance checks, password resets, card replacements, and many more.

As a result, it decreases call volumes, shortens waiting times, and lowers operational costs.

Automation frees human agents to focus on complex or high-value interactions, improving overall service quality.

Additionally, conversational AI supports compliance by monitoring conversations for regulatory adherence, reducing audit risks and associated costs.

3. Streamlined processes and improved satisfaction

Let’s face it: nobody wants to jump through hoops just to transfer money, report fraud, or reset a password. Conversational banking changes that.

Customers can now handle everyday banking tasks through a simple, natural conversation, whether they’re texting a chatbot, talking to a voice assistant, or even sending an image of a document.

The interface does the heavy lifting, guiding the customer through the process in real time, without friction.

Moreover, AI doesn’t just process words but reads the room.

Emotional AI enables machines to recognise and respond to human emotions by analysing vocal tones, facial expressions, and textual cues.

In the context of banking, this technology enables AI systems to detect signs of customer frustration, urgency, or confusion, resulting in more empathetic and contextually relevant responses.

Source: arxiv.org

That kind of smart, emotionally aware interaction builds real trust and makes digital banking feel less like tech support and more like talking to a helpful human.

Another important ‘ingredient’ is flexibility.

Customers can communicate via the channel they prefer, resulting in a smoother, more human banking experience that’s easier, more intuitive, and way more satisfying.

4. Data-driven insights for banks

Every chat, voice command, or image a customer shares with their bank isn’t just a one-time interaction but a data point packed with insight.

One of the biggest perks of conversational banking is that it doesn’t just answer questions but also listens, learns, and uncovers patterns in how customers think, behave, and make financial decisions.

Through these daily interactions, you get a front-row seat to what matters most to each customer:

There is no doubt about how incredibly valuable this is.

By analysing this conversational data in real time, you can:

But conversational banking goes beyond smarter ads.

With these insights, you can anticipate needs before customers even ask.

Let’s say you send a timely credit line increase offer right before a customer makes a major purchase.

Or you offer tailored financial advice based on subtle shifts in spending habits.

Not only does this kind of proactive, personalised engagement feel convenient, but it also builds real loyalty.

And here’s the kicker: these insights fuel more than just personalisation.

They unlock faster innovation, enabling you to identify gaps in services, test new ideas quickly, and stay ahead of market shifts and neobanks, simply by listening more closely to ongoing conversations.

5. 24/7 availability and faster service

Providing round-the-clock support through conversational channels ensures that customers can access banking services at any time, from anywhere.

This kind of always-on support eliminates one of the biggest pain points in traditional banking, waiting, leading to lower abandonment rates.

When customers consistently get the help they need, they’re more likely to stay loyal. That translates into:

Satisfied customers are also more likely to explore new services, such as investments or credit options, thereby boosting product adoption.

And don’t forget that happy customers talk.

They recommend your bank to friends, leave positive reviews, and act as brand advocates.

The result?

Wrapping it up

Conversational banking is reshaping the way customers interact with financial institutions and bringing banking into everyday conversations through:

-

AI-powered chat,

-

Voice assistants, and

-

Messaging apps.

It simplifies tasks like checking balances, transferring money, or getting financial advice, all in real time and without navigating complex apps or waiting on hold.

With 24/7 accessibility, faster service, and a more personalised experience, it meets customer expectations for convenience and immediacy.

As banks strive to stay relevant in a digital-first world, conversational banking isn’t just a trend but the next logical step in making finance frictionless.