Evolving role of banks: Challenges and opportunities

Banks have been secure places to deposit money and reliable sources of credit. Their core functions revolved around holding funds, issuing loans, and facilitating transactions.

However, that’s no longer enough.

Challenges

Customers expect more than basic banking. They want real-time insights, financial guidance, and digital convenience.

The rise of fintechs and neobanks has pushed the banking industry to rethink its value proposition.

These newer players focus on user experience, personalisation, and proactive support, turning financial management into something accessible and, I’d say, even empowering.

Opportunities

Banks must move from being passive service providers to active partners in their clients’ financial lives.

What does it mean? Helping people understand their finances, plan ahead, build wealth, and navigate life’s financial milestones.

To do so, banks need to focus on 3 main areas:

1. Education

Offer simple, practical financial education to help people manage their money better. This includes:

-

Explaining basic concepts (budgeting, saving, planning, control).

-

Providing resources such as newsletters, webinars, workshops, and courses.

2. Information

Improve the transparency and usefulness of information around bank products and services, considering the 4 cornerstones of personal finance:

-

Control: Help customers understand their cash flow (expenses, incomes, future payments).

-

Savings: Promote good saving habits, provide tools for setting and tracking financial goals, and show progress visually.

-

Objectives: Encourage clients to set specific, time-bound savings and investment targets.

-

Planning: Support both the act of planning and the ongoing process, emphasising its role in reducing financial stress and improving quality of life.

For example, for credit products, offer transparency, education about risks such as penalties, compound interest, and alerts for over-indebtedness.

For savings products, encourage goal-setting, track savings progress, and motivate ongoing savings with concrete targets.

For investments, help clients ensure they have a financial buffer before investing, and align investments with long-term goals.

3. Tools

Provide and encourage the use of digital tools to help customers organise and analyse their finances, such as:

-

Expense records: Apps or modules that allow clients to track, categorise, and visualise their spending.

-

Personal finance managers: Support income and expense tracking, goal setting, savings plans, and more.

-

Proactive features: Tools that forecast saving capacities, suggest monthly savings, and help plan for irregular and annual expenses.

6 tips for improving personal finance management (PFM) you should know about

Let’s check the strategies to help clients manage their personal finances more effectively.

1. Leverage AI-driven personal financial assistance

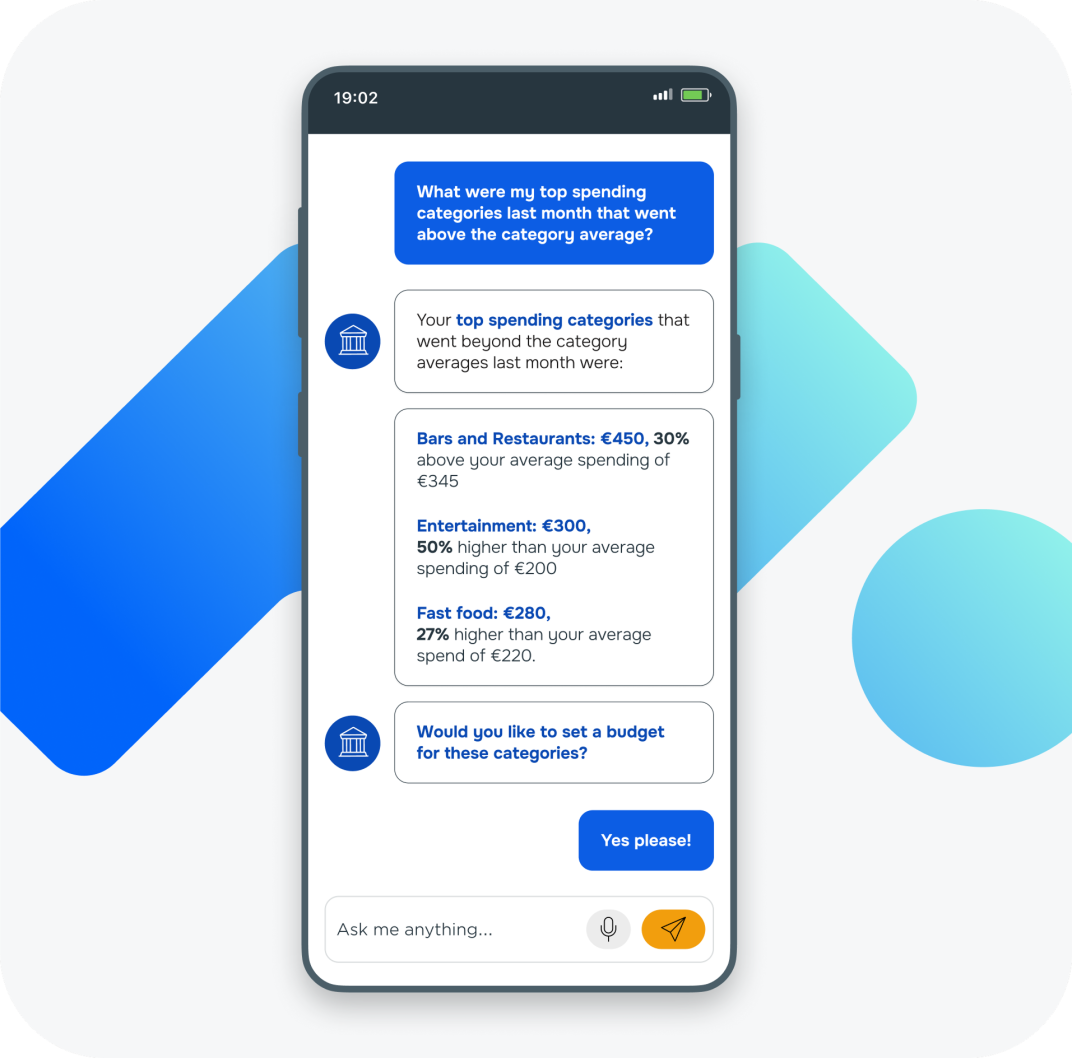

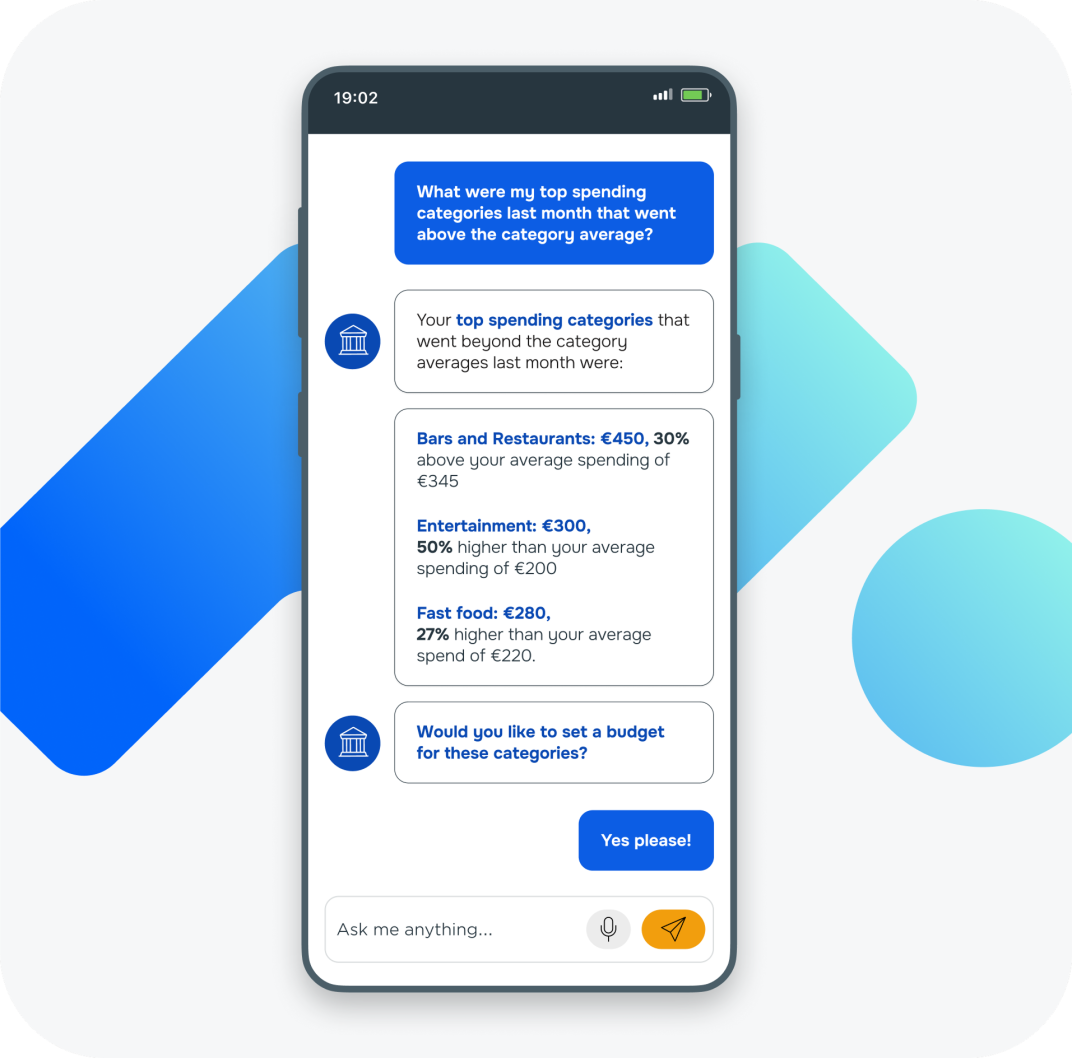

AI-powered financial assistants, also known as Conversational Banking, do more than simple balance checks or transaction alerts.

With these tools, the customer can ask questions about their finances in natural language via voice or text and receive instant, LLM-powered answers.

The financial assistant analyses each customer’s financial data in real time, such as income, expenses, debts, and spending patterns, to offer personalised, actionable advice.

For example, if a customer initiates a conversation about their loan, the assistant can automatically create a debt repayment plan based on a user’s cash flow and suggest the most efficient payoff strategy, whether it’s snowball, avalanche, or a hybrid approach.

Or, they can track progress toward specific financial goals, such as saving for a home or building an emergency fund. The tools can nudge users with reminders or adjustments if they’re behind on their plan.

What sets these assistants apart is their ability to adapt to the customer’s life stage and financial behaviour.

A student with a part-time job won’t receive the same advice as a mid-career professional planning for retirement. And that’s exactly the point.

By combining real-time data with LLM tools, you can offer the kind of proactive financial support that was once only available through a one-on-one advisor.

This way, customers feel more in control of their money, while you can position your bank as a valuable partner in long-term financial wellness.

Worth knowing

Meniga’s AI-powered Insights can integrate with any financial assistant and provide clean, real-time data to power the LLM output, ensuring accuracy and relevance. With Insights, you can:

-

Analyse behavioural data to create ultra-specific customer segments, such as Likely to Invest or Starting a Family

-

Leverage real-time events from any external or internal banking tool to ensure timely delivery

-

Provide contextual communication tailored to individuals to reduce noise

-

Micro-segment to understand your customers on a granular level

-

Process data in real time to identify and act on any opportunities immediately.

Additionally, Meniga is currently developing the Meniga Conversational Financial Assistant, a powerful LLM–driven product designed specifically for banks.

This futuristic tool enables your customers to ask natural-language questions, from “How much did I spend on groceries this month?” to “Can I afford a weekend trip?”, and receive accurate, real-time insights in a conversational format.

Trained on enriched data and built with banking-grade security, this product delivers hyper-personalised financial guidance, significantly reduces the need for customer support, and drives deeper digital engagement, ultimately positioning your bank as a trusted, forward-thinking advisor.

2. Use personalised digital tools and mobile apps

Integrated features like dynamic budgeting tools, real-time spending reports, and predictive planners help customers understand where their money is currently going and where it should be going.

These tools break down spending into categories, highlight trends over time, and even identify potential problem areas before they escalate.

Many apps also offer automated savings features, allowing customers to set rules like “round up purchases” or “save a fixed amount every payday.”

These small, consistent actions make saving effortless and more achievable.

Credit score monitoring is another standard feature, helping clients track their credit health and receive alerts for changes that could impact their financial standing.

Some platforms go even further, offering investment guidance or asset and liability overviews, giving clients a snapshot of their full financial picture in one place.

This level of personalisation turns the mobile app into a daily financial advisor, offering insights and support tailored to the customer’s goals and habits.

By offering these tools natively within their platforms, you can:

As a result, you can meet customers where they are and help them get where they want to go.

Worth knowing

Did you know that Meniga’s entire ecosystem has been developed for the specific target to create the ultimate personalised digital banking experience?

1. Meniga’s Enrichment Engine aggregates, consolidates, and enriches internal, open banking, and third-party data to give financial institutions a comprehensive view of their customers’ spending data and finances, paving the ground for personalisation.

Complementing this, Meniga’s out-of-the-box Finance Experiences, ranging from budgeting tools and carbon footprint tracking to gamified savings and cashflow forecasting, bring immediate value to the end user while feeding behavioural insights back into the system.

The more users engage with these features, the smarter and more personalised their experience becomes.

2. Meniga Insights is an AI-Powered Platform that enables Hyper-Personalised Engagement & Customer Intelligence.

It processes real-time behavioural and transactional data to help banks understand and respond to customers’ needs with accuracy and immediacy.

With this tool, your business users can trigger individualised notifications, proactive in-app insights, Instagram-esque stories, or even dynamic user interfaces.

This holistic approach enables banks to regain their role as trusted financial advisors in the digital age, replacing the human connection lost with the closure of branches with intelligent, personalised digital interactions.

The result? Greater trust, higher customer retention, increased digital sales, and long-term revenue growth.

What’s more, customers can identify, track, and analyse subscriptions to understand and optimise their recurrent spending.

This way, by providing transparent and visual merchant mapping, including brand and logos, you can increase financial literacy.

3. Embrace open banking and aggregation

By allowing secure connections to external financial institutions, banks can give customers a unified view of all their accounts: savings, checking, credit cards, loans, and even investments.

This aggregation capability turns a bank’s app or platform into a centralised financial dashboard.

Instead of juggling multiple apps or logging into different institutions, customers can track their full financial picture in one place.

As a result, they can benefit from:

Not only does aggregation bring convenience, but it also provides access to a broader data set.

You can offer smarter, more relevant insights, such as identifying redundant subscriptions, spotting spending trends across all accounts, or recommending better interest rates based on a customer’s overall debt profile.

Meniga aggregates, consolidates, and enriches internal and open banking data to give financial institutions a 360-degree view of their customers’ spending habits and finances.

By ensuring access to all customer data, you can:

-

Create new revenue streams by hyper-personalising product offers, and

-

Drive savings deposits to your bank with personalised insights or gamified savings linked to an external account.

4. Introduce financial literacy programs

Low financial literacy remains a major barrier to financial well-being, contributing to stress, poor decision-making, and long-term instability.

Recognising this, banks are coming up with comprehensive financial education initiatives and resources to empower customers at every stage of life:

-

On-demand webinars,

-

Step-by-step video tutorials powered by text to video AI to make lessons more engaging and easier to follow,

-

Interactive courses,

-

Newsletters, and even

-

Gamified savings challenges.

These materials are quite often integrated directly into digital banking platforms, making it easy for customers to engage with educational content in context as they manage their day-to-day finances.

What’s more, you should tailor these resources to meet the needs of specific life stages. For example:

-

Students and young adults can access content focused on budgeting basics, understanding credit, and avoiding debt issues.

-

Families might explore tools for saving for education, managing household expenses, and planning for major purchases.

-

Pre-retirees and retirees can benefit from content on pension strategies, asset drawdowns, and estate planning.

By investing in financial education, banks are doing more than fulfilling a social responsibility.

They’re helping customers build confidence, reduce financial anxiety, and make informed decisions.

And in the process, your bank can build more significant, long-term relationships based on trust and value.

Real-world impact: Gamified savings

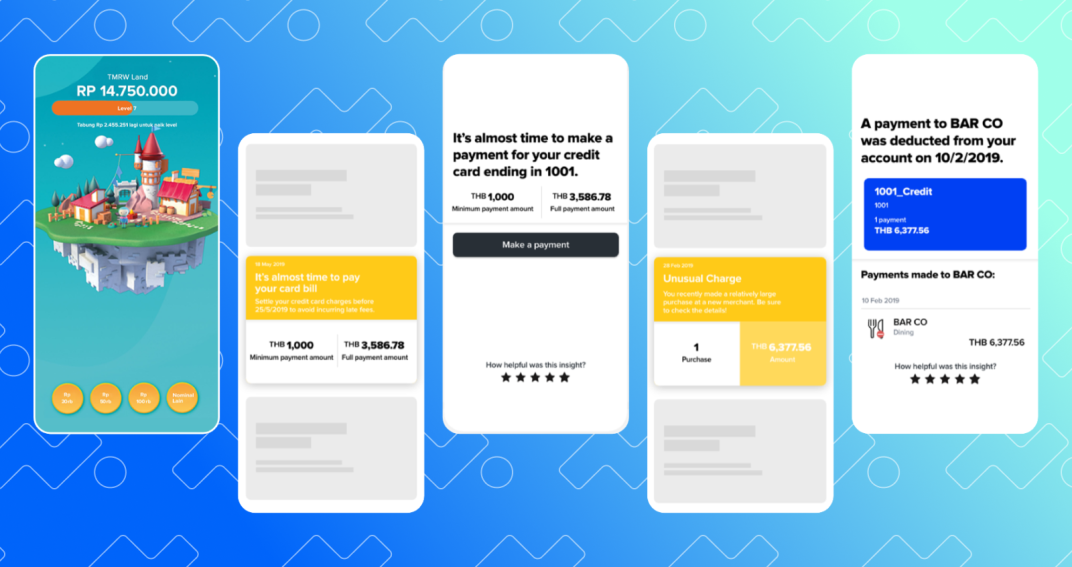

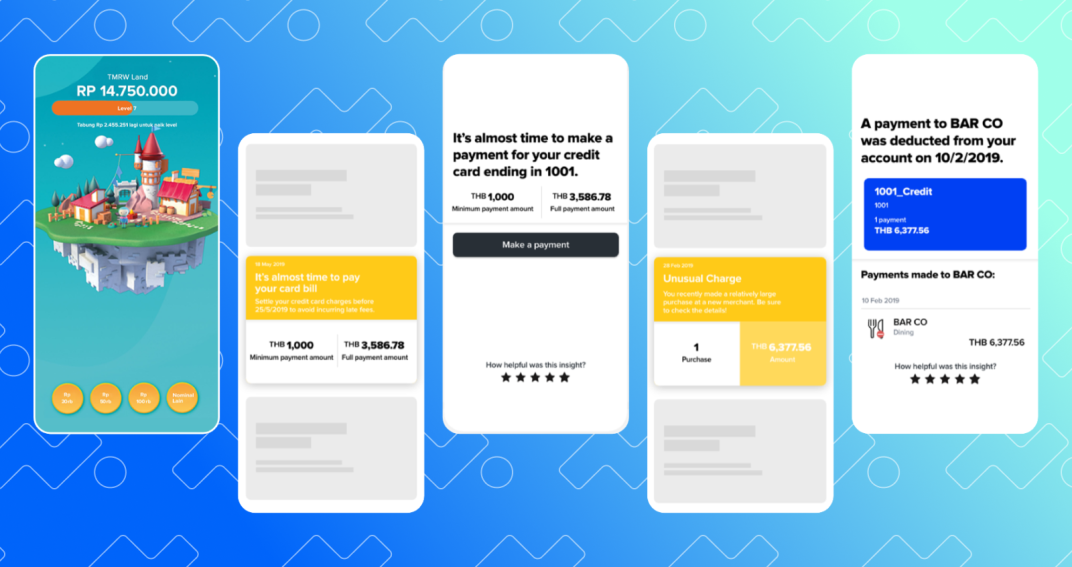

UOB is a prominent Asian bank with over 500 offices across 19 countries, including major markets in the Asia Pacific, Europe, and North America.

They wanted to launch the TMRW app with gamifying features, developed specifically for the millennial market in ASEAN countries.

Meniga’s technology to process, clean, and categorise complex transaction data enabled the generation of highly personalised financial insights for effective digital finance management.

The result was a banking app that functions like a mobile game: It allows customers to level up and build a virtual city that gets bigger as their savings increase.

In addition, customers get payment reminders for outstanding bills and instant alerts for unusual or duplicate charges.

5. Provide proactive financial coaching

You may have noticed that there is one notion that is an underlying denominator in all of the above categories: hyper-personalisation.

It is exactly hyper-personalisation that enables you to move from broad advice or one-size-fits-all suggestions to insights and products based on customers’ actual behaviours.

Therefore, you can send a reminder when spending trends rise above normal, or a prompt to move idle cash into a high-yield savings option.

These micro-interventions encourage better habits, such as saving regularly, paying down debt, and staying within budget without overwhelming the customer.

Over time, customers should create meaningful behaviour change and reduce the financial stress that many customers experience daily.

6. Make your solutions goal-based and automated

Managing money effectively often comes down to setting clear goals and sticking to consistent habits.

To make that easier for your customers, you can offer goal-based and automated tools that help them take action without constant oversight.

Customers can define specific financial goals and align their banking activity around those objectives. Once they set a goal, automation does the heavy lifting, and it can:

-

Transfer money into savings or investment accounts on a recurring schedule.

-

Round up purchases and deposit the spare change into a designated goal fund.

-

Pay bills on time to avoid late fees and protect credit health.

-

Send alerts when spending exceeds budgeted limits or when there’s an opportunity to save more based on available cash flow.

These automated features reduce the friction of manual money management, helping customers stay on track with minimal effort.

Moreover, they help your customers develop sustainable habits.

Did you know?

With Meniga’s Smart Savings tool, you can provide gamified and automated savings to help customers grow deposits.

This handy feature enables them to:

-

Round-up transactions to the nearest €.

-

Tax certain categories, such as guilty pleasures.

-

Save a percentage of their income.

-

Set the time interval.

Customers can also choose whether to transfer directly to savings, donate to charity, or set up automatic investments.

What’s more, your customers can create pots of savings where they can work towards a specific target.

They can add their pots manually or through automatic savings rules and monitor and track the progress to gamify goal management.