As customers worldwide head to their online and mobile banking apps more than into physical branches, there is a critical need to provide an engaging and meaningful digital banking experience, or banks risk losing their customers.

By maximising the value of their data, Islamic banks are in a unique position to go above and beyond for their customers by offering specific financial products that align with their values.

Shariah-compliant features to boost digital engagement

- Budgets & Planning – Simple but effective ways to help your customers ensure financial wellbeing, establish budgets or send warnings when expenses exceed their balance

- Insights & Reports – Interactive account overviews across all accounts with endless filtering options

- Spending Challenges – Encourage your customers to build healthier financial habits and save money in small attainable increments

- Activity Feed – A perfect avenue for religious financial education that fits perfectly in the activity feed of their transactions and personalised insights

- Islamic/Lunar Calendar - Ensure that your real-time is in the right time for your customers

51% of bankers believe financial digital advisors that help customers save will increase engagement.

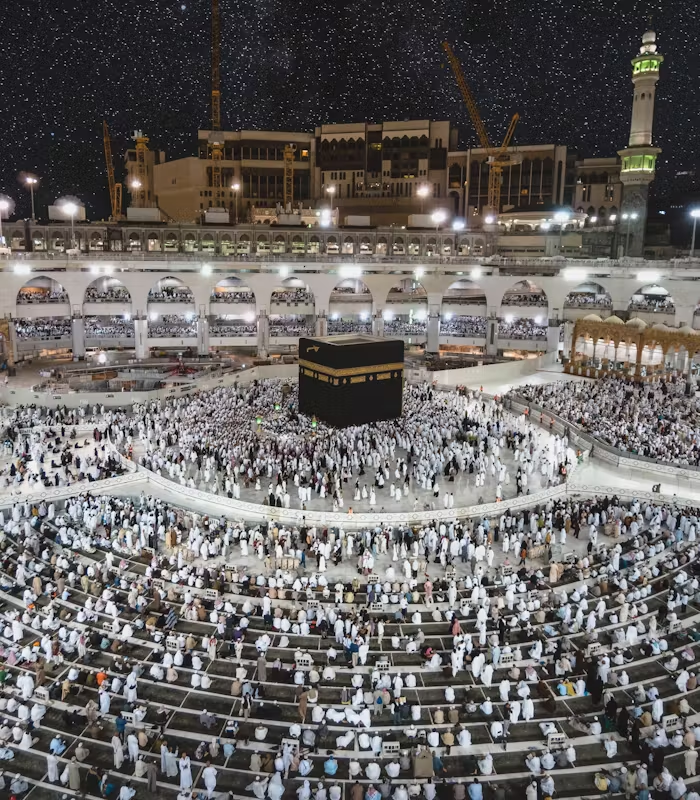

Islamic specific savings coach for Hajj or Zakat

- Spending Challenges – set a challenge where customers work to limit their spending in a specific category you suggest based on their historical expenses

- Savings Goals – create a separate savings pot where customers can easily monitor and feel immediately rewarded for contributions

- Automated Savings Rules – create flexible rules that can “round up” amounts to accumulate funds in a savings account.

- Nudges & Insights for Savings – hyper-personalised nudges and notifications to help customers stay motivated towards their savings goals

Become the trusted Islamic financial advisors your customers need

- Cross and upsell Halal banking products

- Help customers find the right product for their needs like Ijara vs Musharaka mortgages

- Educate everyday customers on Islamic finances and raise Islamic financial literacy

- Create a loyal and more engaged customer