Banks face mounting pressure on multiple fronts, rising customer expectations, intensifying competition from digital-first challengers, and tighter regulatory requirements.

Traditional analytics and legacy decision-making tools are no longer enough to keep pace with the speed and complexity of the modern financial system.

Without deeper insight into future trends and customer behaviours, banks risk falling behind.

That’s where predictive AI comes in. It enables banks to make proactive, real-time decisions with measurable impact.

Read on to learn more about AI-driven predictive banking to see how you can deliver measurable results across your organisation and boost margins.

How does machine learning impact predictive AI in banking?

The use of data in banking isn’t a new concept. Financial institutions have long relied on historical data for risk assessment, marketing, and compliance.

However, machine learning has shifted predictive capabilities from static, rules-based models to dynamic systems that learn and improve continuously.

Three major factors have enabled this shift:

-

Data abundance: Banks now have access to vast amounts of structured and unstructured data, from transaction histories to behavioural signals.

-

Advances in computing: Cloud platforms allow models to train and deploy at scale.

-

Algorithmic innovation: Techniques such as gradient boosting, deep learning, and ensemble modelling deliver far more accurate predictions than traditional statistical methods.

As a result, predictive AI enables better decision-making across customer engagement, risk management, operations, and more.

What data sources must banks prioritise for predictive models?

Banks that want to build high-performing predictive models must start with the right data foundation.

By prioritising and integrating diverse, high-quality data sources, they can significantly enhance the accuracy, relevance, and business value of their machine learning systems.

The key sources include:

| Data source | What it includes | Why is it important for Predictive AI |

| Transactional Data | Detailed records of customer transactions, spending behaviour, and income patterns. | Provides core signals for credit risk modelling, fraud detection, and personalised product recommendations. |

| Customer demographics | Age, employment status, education, lifestyle choices, and behavioural patterns. | Adds context for customer segmentation, improves risk assessment, and sharpens marketing strategies. |

| Credit history and account data | Credit bureau reports, loan performance, payment histories, and account balances. | Forms the backbone of credit scoring and default prediction models. |

| Open banking and external financial data | Data shared across institutions via open banking APIs, including assets, liabilities, and cash flows. | Offers a consolidated financial view, improving forecasting accuracy and lending decisions. |

| Alternative data sources | Mobile usage, telecom records, social network data, employment history, and geolocation. | Enhances credit assessment for thin-file customers and expands financial inclusion. |

| Macroeconomic and market data | GDP growth, inflation, unemployment, interest rates, and market trends. | Provides essential context for risk forecasting, portfolio optimisation, and scenario analysis. |

| Behavioural analytics and interaction data | Customer interactions via digital channels, call centres, and chatbots. | Reveals patterns for churn prediction, satisfaction tracking, and product adoption forecasting. |

1. Transactional data

Detailed records of customer transactions provide valuable insights into spending patterns, income stability, and overall financial health.

This data is essential for core applications such as credit risk modelling, fraud detection, and delivering personalised product recommendations.

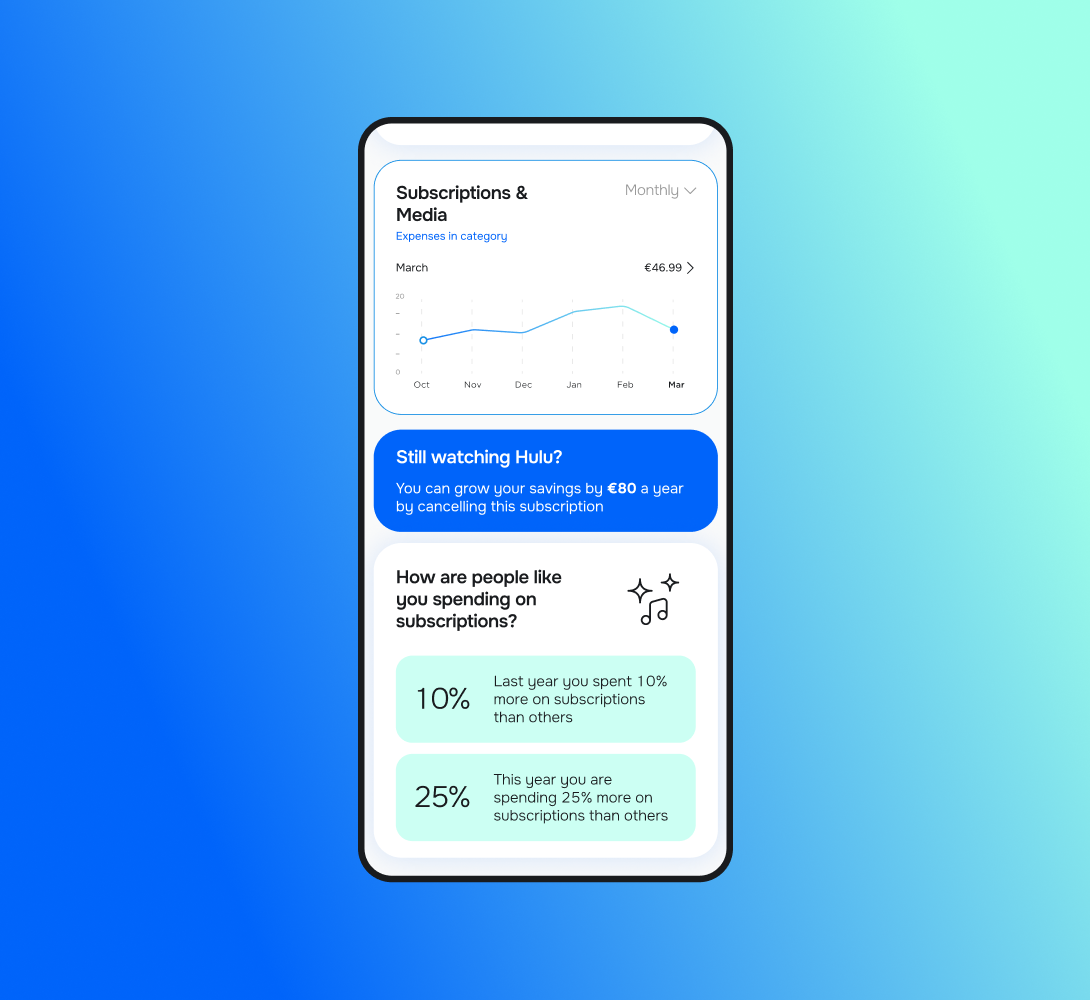

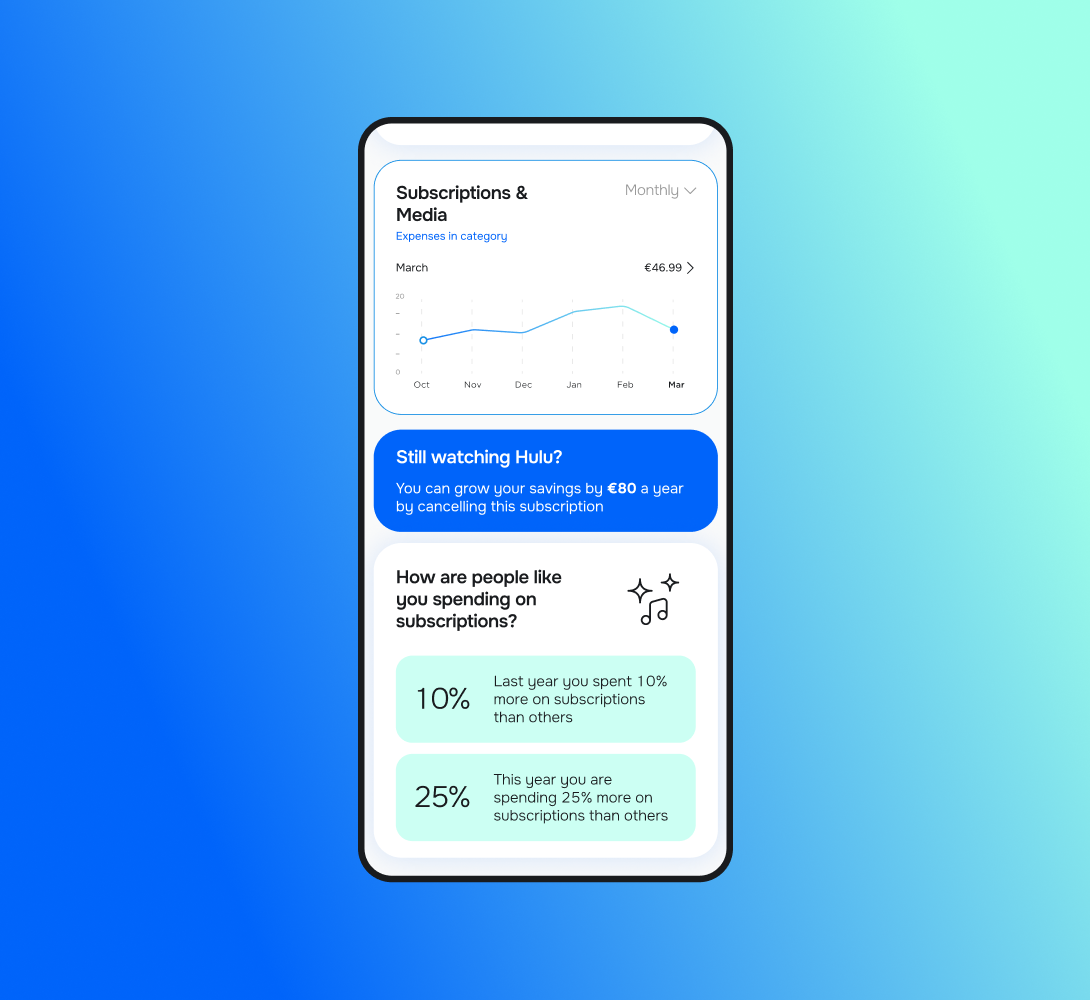

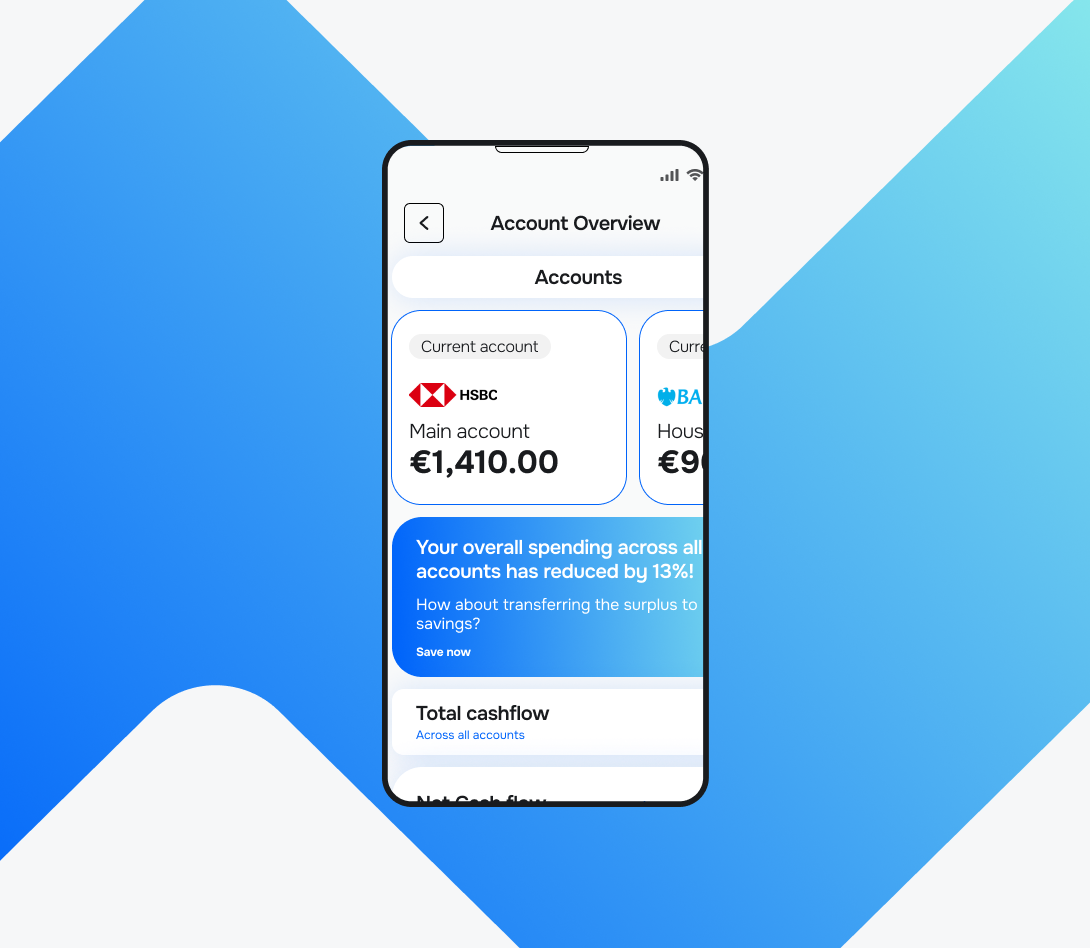

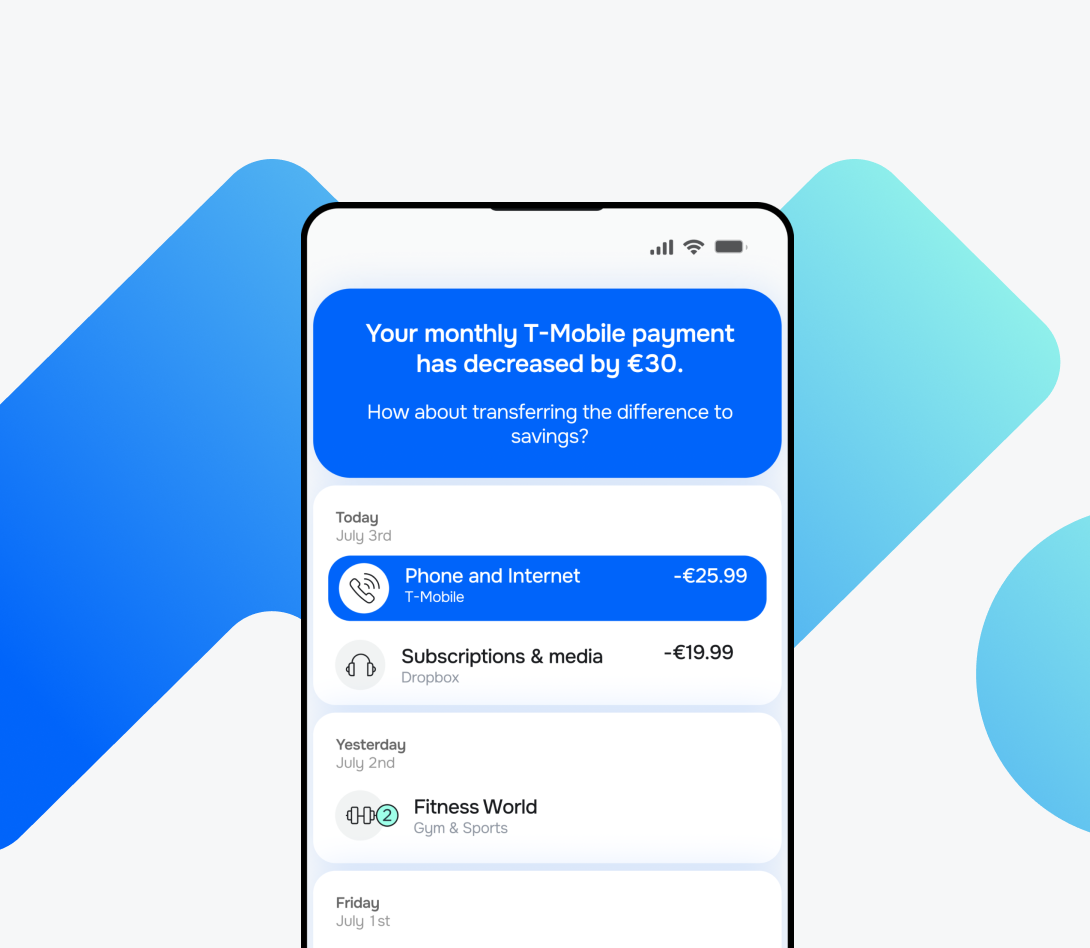

Meniga’s Enrichment Engine turns raw transaction data into a meaningful, visual story of your customers’ financial lives.

It categorises every expense and income transaction with exceptional accuracy, giving structure and context to what was once just a stream of numbers.

You can seamlessly integrate it with your existing category framework or take advantage of Meniga’s fully localised category tree.

Powered by machine learning, the system becomes even more precise over time, continuously improving through user feedback and community input.

2. Customer demographic and behavioural data

Information such as age, employment status, education level, and lifestyle choices provides valuable context that helps segment customers more effectively.

When combined with behavioural data, it enables more precise risk assessment and sharper marketing strategies.

3. Credit history and account data

Traditional data sources, including credit bureau reports, loan performance records, payment histories, and account balances, remain the basis for evaluating creditworthiness and predicting defaults, and provide the backbone of most predictive risk models.

4. Open banking and external financial data

Data shared via open banking APIs extends visibility beyond a single institution, offering a consolidated view of a customer’s assets, liabilities, and cash flows.

As a result, this richer perspective enhances forecasting accuracy and improves decision-making in areas such as lending and financial planning.

5. Alternative data sources

Nontraditional data, such as mobile phone usage, telecom records, social network links, employment history, and geolocation data, can strengthen predictive models, particularly for customers with thin or no credit history.

Banks can leverage this data to create new opportunities for financial inclusion and more nuanced credit assessments.

6. Macroeconomic and market data

Broader economic indicators, including GDP growth, inflation, unemployment, interest rates, and market trends, provide essential context for predictive modelling.

Incorporating these variables improves risk forecasting, supports portfolio optimisation, and enables more robust scenario analysis.

7. Behavioural analytics and interaction data

Data from customer interactions across digital channels, call centres, and chatbots reveals patterns that help predict churn, measure satisfaction, and anticipate product adoption.

Therefore, banks can take proactive steps that strengthen customer relationships and improve retention.

6 areas where predictive AI adds measurable value

Predictive AI doesn’t have a single use, but has a versatile capability that you can embed throughout a bank’s value chain.

Here are some of the most important use cases.

1. Hyper-personalised marketing and cross-selling

Customers are increasingly demanding financial services that anticipate their needs and address their individual circumstances directly.

Predictive AI makes this possible, enabling banks to transform generic outreach into hyper-personalised engagement that builds trust and drives growth.

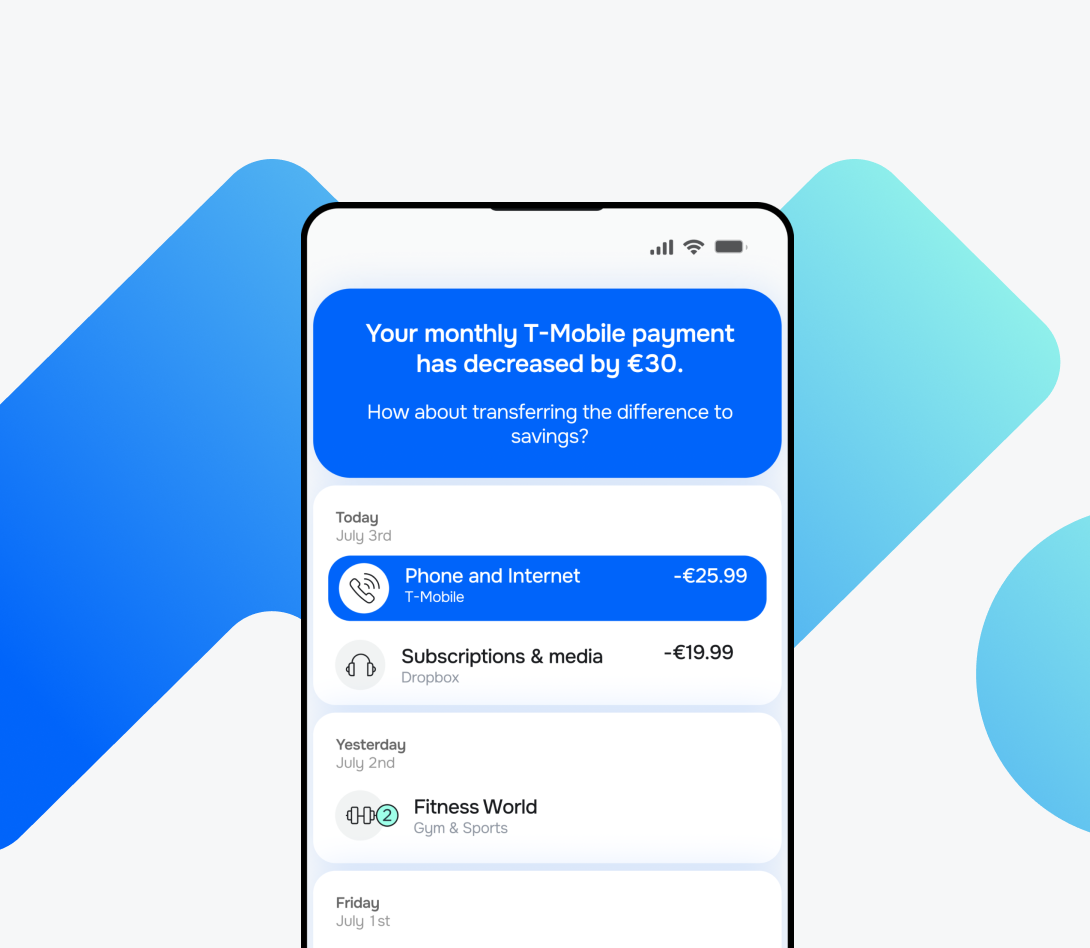

By analysing vast volumes of transactional data, behavioural signals, and lifestyle patterns, predictive models can pinpoint the exact moments when customers are most likely to be receptive to new products or services.

For example, detecting significant life events, such as a new job, a change in spending habits, or a major purchase, enables banks to proactively offer relevant products, including investment accounts, insurance, or tailored credit solutions, precisely when they are needed.

Beyond short-term gains, smarter cross-selling strategies deepen customer relationships, foster loyalty, and position the bank as a trusted financial partner rather than just a service provider.

2. Credit risk analysis and loan underwriting

By moving beyond traditional credit scoring methods, machine learning models incorporate a much broader range of signals: from income patterns and payment histories to alternative data such as:

-

Employment records,

-

Digital behaviours, and

-

Spending trends.

Thus, the richer, more holistic view enables banks to assess risk with far greater precision and confidence.

The result is a more inclusive and dynamic lending process.

| Key internal data sources driving predictive accuracy in lending |

| Data type | Description / Examples | Predictive value for lending |

| Transactional data | Detailed account transactions, including cash flow and spending behaviour | Signals cash flow stability, spending patterns, and early warning signs of financial stress |

| Credit and payment history | Payment timeliness, delinquency history, credit utilisation, and length of credit history | Core predictor of loan default risk and repayment behaviour |

| Account balance and cash flow patterns | Dynamic balances, inflows/outflows, liquidity trends | Anticipates repayment capacity and potential financial strain beyond static snapshots |

| Application and onboarding data | Employment details, income, debt levels, and other loan application information | Foundational predictors for creditworthiness and eligibility |

| Derived behavioural features | Engineered features like debt-to-income ratio, late payment frequency, and spending volatility | Enhances model performance by summarising complex behavioural patterns |

| Text and unstructured data | Transaction notes, customer communications, and other textual data analysed with NLP | Provides additional signals of financial health and potential risks |

Predictive AI allows banks to extend credit responsibly to customers who might have been overlooked by conventional scoring systems, while still maintaining rigorous risk controls.

At the same time, it enhances portfolio quality by identifying early warning signs of potential defaults and enabling proactive interventions before issues escalate.

Automation also plays a crucial role.

Intelligent underwriting systems powered by AI can rapidly analyse complex datasets, streamline documentation checks, and make real-time credit decisions.

Not only does this improve operational efficiency, but it also transforms the customer experience, reducing friction, shortening approval times, and delivering faster access to financial products.

3. Compliance monitoring

Machine learning systems continuously analyse transactions, customer behaviour, and operational data to detect anomalies and patterns that may indicate regulatory breaches or suspicious activity.

By automating these processes, you can identify potential issues in real time, rather than waiting for periodic audits or manual reviews.

Explainable AI (XAI) plays a key role in ensuring that high-risk decisions are transparent and defensible.

By providing clear and interpretable insights into why a transaction or account was suspicious, AI helps satisfy regulatory requirements while maintaining trust with both internal and external stakeholders.

In addition to detecting anomalies, AI streamlines compliance workflows, reducing the manual effort involved in audits, reporting, and investigations.

Real-time audit trails and predictive monitoring enable compliance teams to:

4. Fraud detection and prevention

Predictive AI enables banks to stay ahead by continuously analysing transactional patterns, account behaviour, and emerging threat signals.

Machine learning models can identify subtle anomalies that may indicate fraudulent activity, identifying them in real time for further investigation.

By integrating multiple data sources, including transactional histories, behavioural insights, and device or location information, AI systems reduce false positives while increasing the speed and accuracy of detection.

Therefore, you can prevent losses before they occur, protect customers, and strengthen trust.

Moreover, automating routine monitoring and alerts frees compliance and risk teams to focus on complex cases, enhancing overall operational efficiency and resilience.

5. Operational efficiency and process optimisation

Operational efficiency is one of the most important drivers of profitability in banking, and predictive AI enables you to optimise resources, streamline workflows, and reduce costs.

By analysing historical operational data alongside real-time metrics, AI models can forecast demand across branches, call centres, and digital channels, enabling smarter staffing, scheduling, and resource allocation.

Moreover, predictive systems support process automation by identifying repetitive or bottleneck-prone tasks that can be automated, from document verification to routine approvals.

It results in faster, more accurate operations, improved customer service, and reduced operational risk.

Over time, AI-driven predictive insights also highlight opportunities for continuous improvement, helping banks adapt processes in response to evolving customer behaviours, market conditions, and regulatory requirements.

6. Customer churn prediction and retention

Retaining customers is far more cost-effective than acquiring new ones. Yet, many banks struggle to identify early signals of dissatisfaction or disengagement.

Predictive AI improves customer retention strategies by analysing interaction data, transaction patterns, and behavioural trends to forecast which clients are at risk of leaving.

Once high-risk customers are identified, you can take targeted actions, such as personalised offers, proactive service interventions, or tailored financial advice to improve engagement.

This approach ensures that retention strategies are precise, timely, and aligned with each customer’s preferences and life stage.

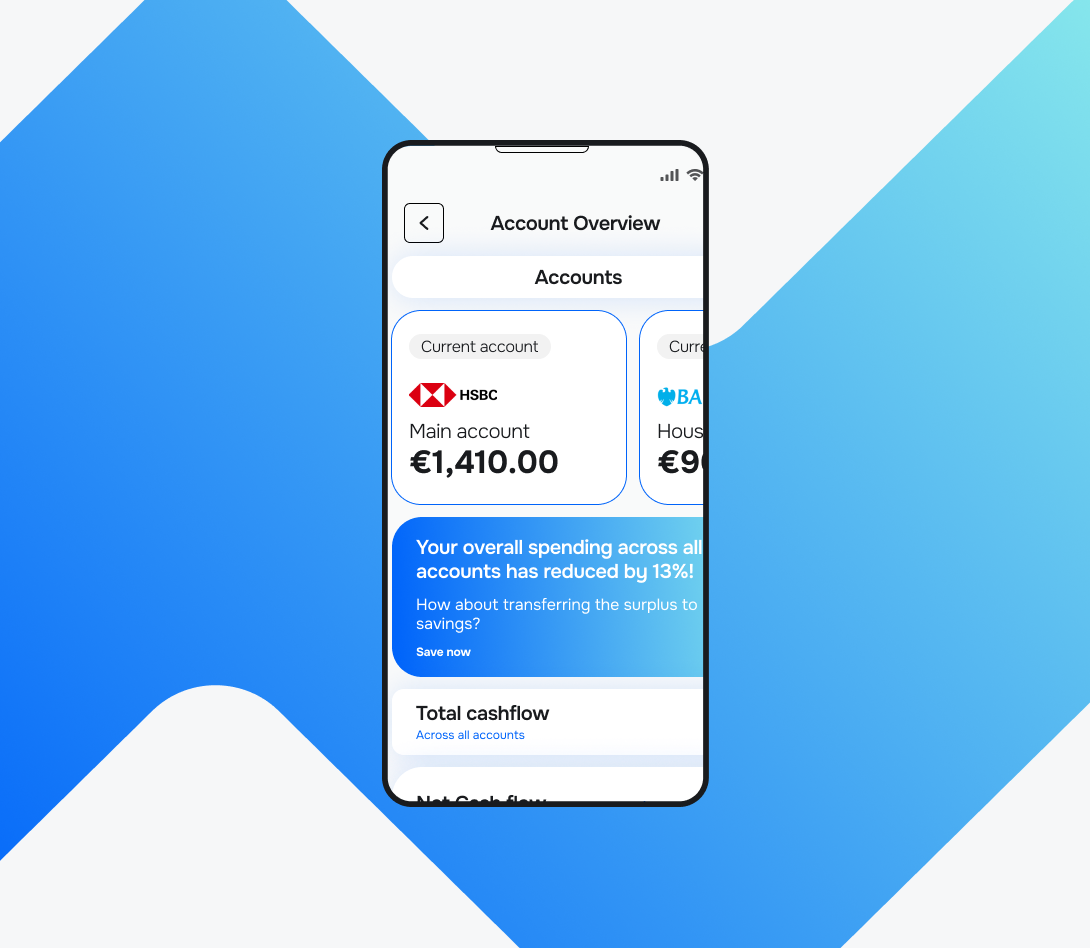

How can you turn AI-driven predictions into actionable insights with Meniga?

True value from predictive analytics goes beyond algorithms.

It starts with a strong foundation: accurate, well-organised data, ethical use of insights, and technology that keeps customers in control of their finances.

This is where Meniga makes a difference. As a trusted partner for digital banking, we help banks and financial institutions to:

1. Unify fragmented data into a comprehensive, actionable view.

2. Deliver personalisation responsibly, ensuring transparency and trust.

3. Integrate seamlessly with existing banking systems.

4. Provide customers with real-time visibility into their disposable income, empowering informed decisions about saving and spending.

By bringing these elements together, Meniga enables banks to turn predictive analytics from abstract models into tangible, customer-focused outcomes that drive engagement, loyalty, and smarter financial decisions.

Did you know that we are developing the Conversational Financial Assistant, a next-generation, LLM-powered solution built specifically for banks.

This tool allows customers to interact with their finances in natural language, asking questions such as, ‘What have I spent on groceries this month?’ or ‘Can I fit a weekend trip into my budget?’ and receiving accurate, real-time answers instantly.

Leveraging enriched data and secured with enterprise-grade protection, the assistant:

-

Delivers highly personalised financial guidance,

-

Eases the workload on customer support teams and

-

Boosts digital engagement.

In doing so, it positions your institution as a trusted, forward-thinking partner in your customers’ financial lives.

Enticed to learn more?

Contact us today to discover how you can leverage predictive AI to create measurable value for you and your bank.