In the midst of a cost-of-living crisis, the significance of bolstering personal savings cannot be overstated. As households grapple with rising costs, there is an opportunity for banks to step in and help nurture healthy savings habits.

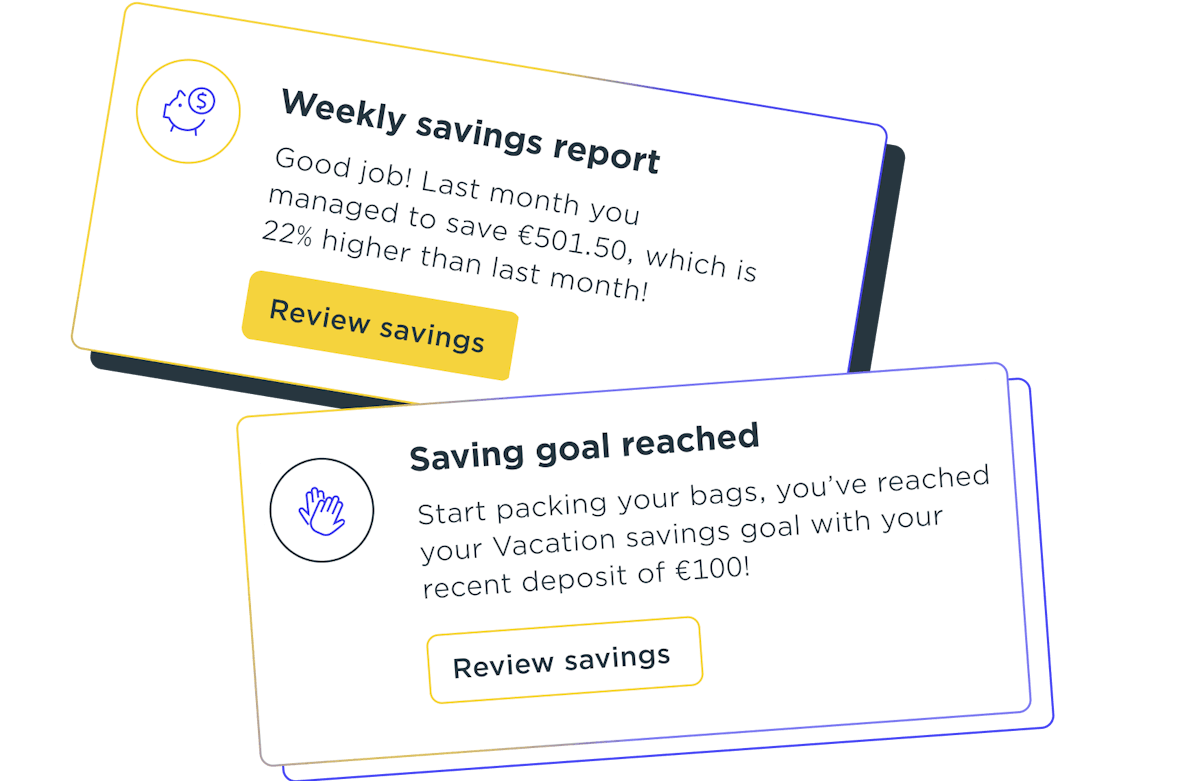

Banks increasingly recognise that the key to establishing savings habits with their customers lies in making the process simple, enlightening, and engaging. Combining that with personalised recommendations and real-time tracking, digital banks can empower customers to take control of their financial health.

One very simple but extremely effective way to do so is through automated savings.

Simply put, automated savings allow banking customers to create flexible rules which transfer a certain amount to a savings account automatically.

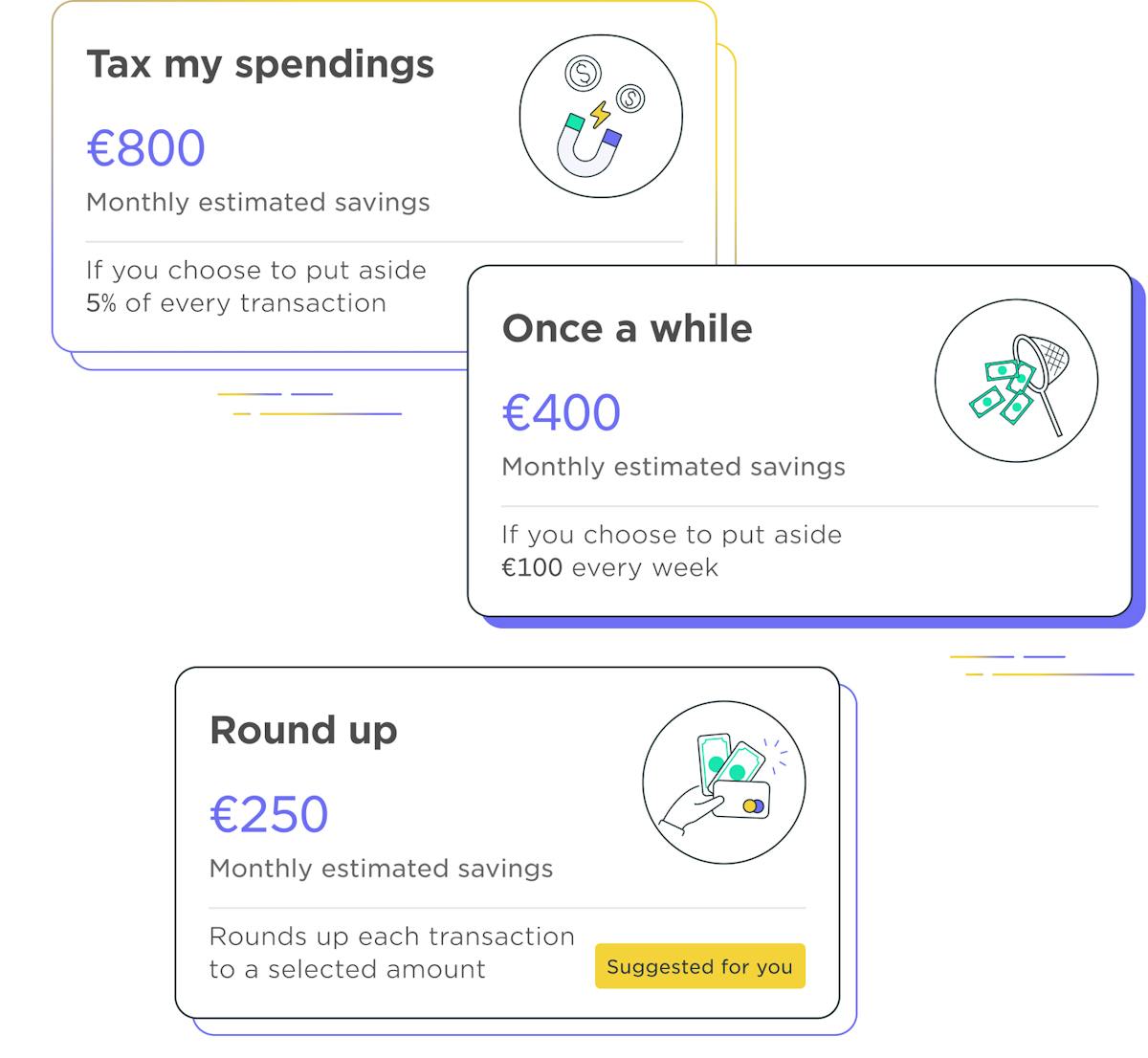

The most basic ones usually revolve around transferring a specific amount at a certain time interval, e.g. putting €500 into a savings account every month when you receive your salary. Other simple rules include reserving a percentage of every transaction or percentage of income for savings.

Then you can dive a bit deeper and customise the rules, such as:

- Rounding up transactions to the nearest € (or even €10 or €100) and transferring the difference to savings. Typically, each transfer is relatively small, minimising the financial impact while allowing savings to accumulate rapidly.

- Taxing guilty pleasures, for example fast food, bar & nightlife purchases, clothes, shoes, or even gas. The benefits for this approach are twofold; you grow savings while spending money on things you enjoy – or skip that purchase to avoid the tax.

- 52-weeks rule where you incrementally set aside small amounts each week; €1 in the first week, €2 in the second, all the way to €52 in the last week of the year. By the end of the year, you’d have seamlessly saved €1378 without noticing the cost of saving.

Finally, you can completely personalise the rules to fit with your own savings goal with If-This-Then-That (IFTTT) logic tied to events outside of the digital bank. For example, you can “bet” on your favourite sports team where if they win a match, €100 go into your savings account. You could also set up a literal rainy-day fund where for every day it rains, €10 go to savings.

Banks can help the customer get started by finding rules that would save the most based on historical spending. In addition, they can nudge customers into starting by showing how much they would have saved if they started using automated savings one year ago. Inviting them to create personalised goals for their savings can motivate customers even further and strengthen these habits.

In conclusion, automated savings are simple, fun, and effective way for banks to grow deposits and help customers maintain healthy savings habits even when funds are low.

Would you like to talk to one of our experts? Click here