Banks can make a big impact on digital engagement with small changes

The needs of digital banking customers vary from person to person. However, there are a few things that are universal in what they want from their digital bank:

- It must feel cutting edge

- It must be helpful in ways that are meaningful to them

- It must be uncomplicated to use

2 primary indicators that your digital bank is not satisfying those needs are:

- Stagnant or dropping digital engagement rates

- Decreasing customer retention rates

A few of Meniga's use cases

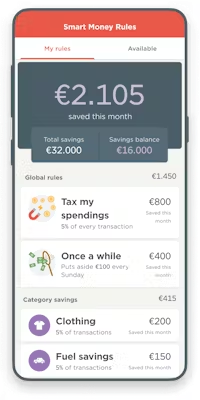

Meniga Smart Money Rules

Benefits for banks

- Increase digital engagement

- Increase customer loyalty

- Improve customer retention rates

- Cross and upsell banking products

How it achieves this:

Through Smart Money Rules, banking customers save money and build healthy financial habits through fun and easy to implement automated rules.

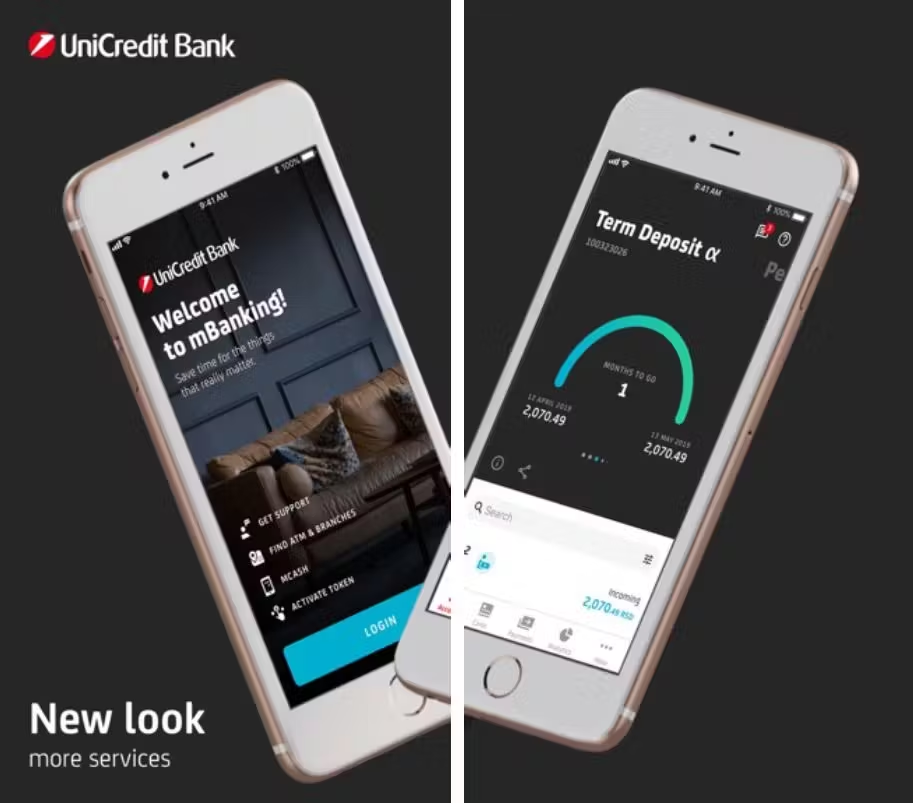

See how Unicredit Bank increased their monthly active users by 49%

See Success Story

See Success Story

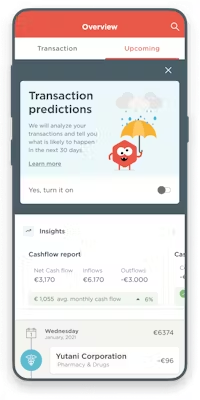

Cashflow Assistant

Benefits for banks:

- Increase digital engagement

- Increase customer loyalty

- Improve customer retention rates

- Cross and upsell banking products

How it achieves this:

Cashflow Assistance helps retail banking customers stay on top of their finances by building awareness around spending habits, reoccurring expenses and upcoming bills

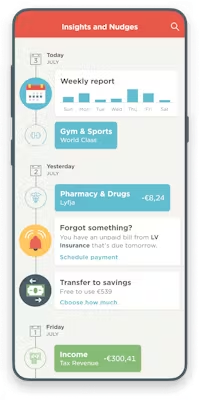

Insights and Nudges

Benefits for banks:

- Increase digital engagement

- Increase customer loyalty

- Improve customer retention rates

How it achieves this:

Meniga understands the power of insights, nudges and notifications. Taking inspiration from social media platforms as well as health and fitness apps, we have mastered the art of customer engagement as it relates to digital banks.

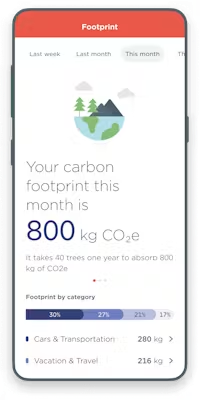

Carbon Insight

Benefits for banks:

- Increase digital engagement

- Increase customer loyalty

- Improve customer retention rates

- Meet ESG/CSR goals

How it achieves this:

Meniga Carbon Insight gives customers the opportunity to understand, calculate, reduce and offset their personal carbon footprint through their digital bank.

There's no need for a complete overhaul to make a great digital bank

Take inventory of your digital bank and identify the gaps. Meniga has a white-label solution that enables your digital bank to reach its full potential. Depending on your specific needs, our range of a la carte products can be implemented with ease and efficiency as stand-alone solutions or grouped together in a way that fits your bank.