What are the key technologies behind AI-driven transaction search in banking?

Banks should leverage the power of advanced AI and machine learning within modern, cloud-native platforms to improve their digital experience.

By combining natural language processing (NLP) for intuitive, conversational search, transaction data enrichment for richer contextual insights, and real-time AI-driven personalisation, financial institutions can deliver smarter, faster, and more human-like interactions that truly resonate with customers.

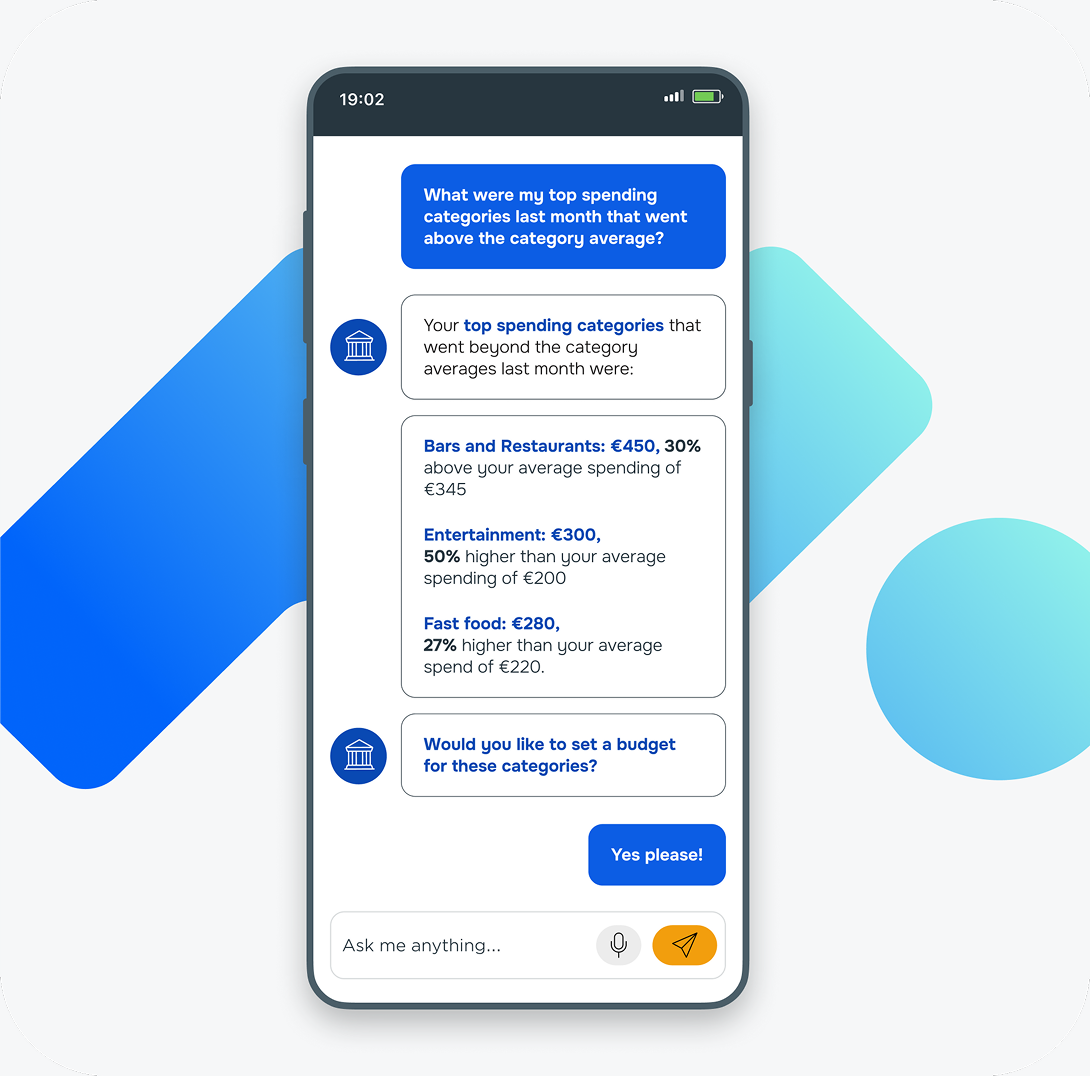

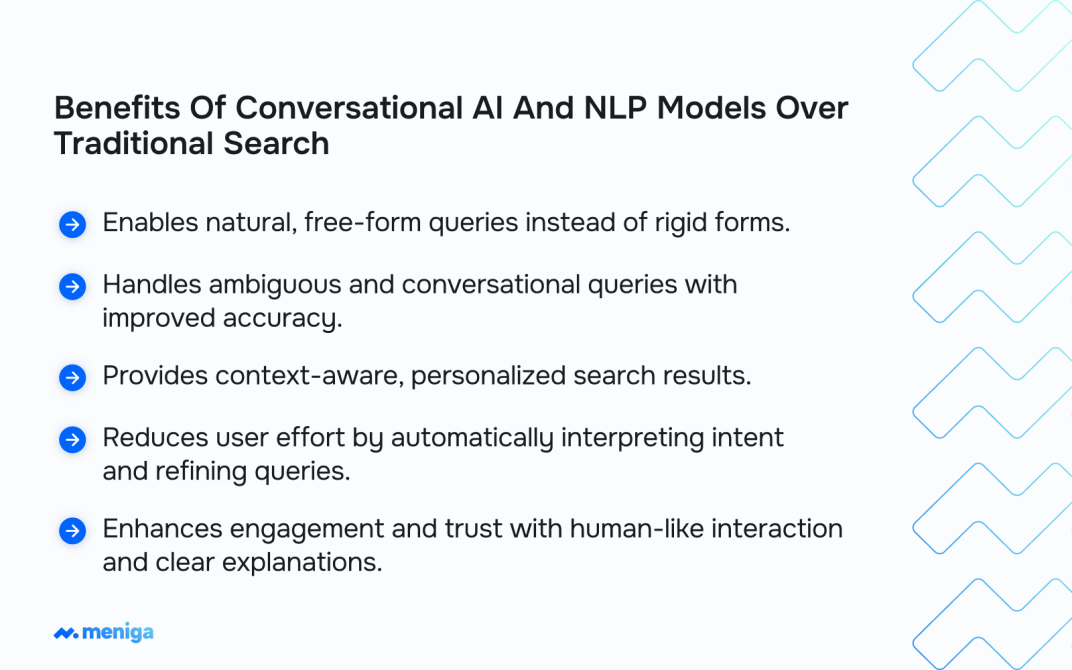

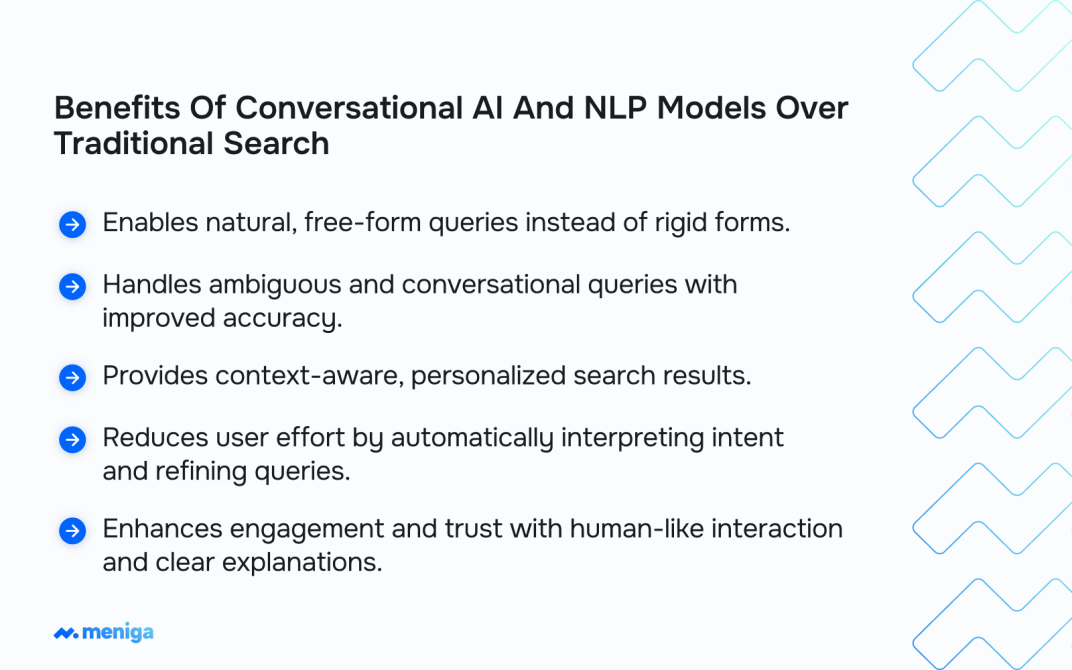

1. Use conversational AI and NLP in banking transaction search

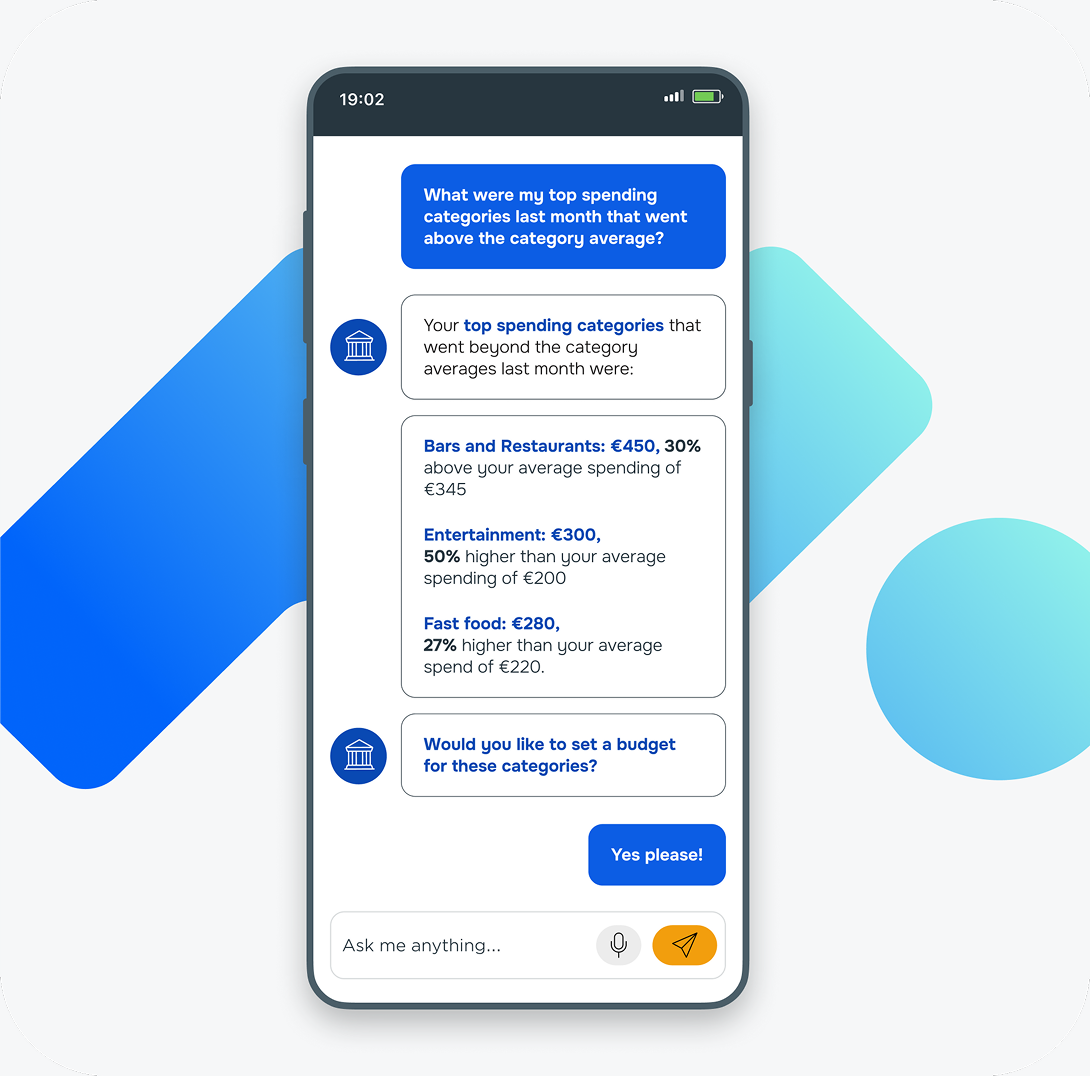

Conversational AI in banking no longer relies on rigid, rule-based chatbots.

It enables natural, context-aware search experiences where customers can use everyday language to ask complex questions about their transactions.

This improved transaction search combines several advanced capabilities.

Tip: For example, our advanced Conversational Financial Assistant, and LLM-powered solution built specifically for banks, lets customers interact with their finances naturally, asking questions like 'How much did I spend on groceries this month?' or 'Can I afford a weekend trip?', and receive instant, accurate insights.

Powered by enriched data and secured to banking standards, it delivers personalised financial guidance, reduces reliance on support channels, and strengthens digital engagement, positioning your bank as a proactive, trusted financial partner.

Key technologies that power Conversational Banking include:

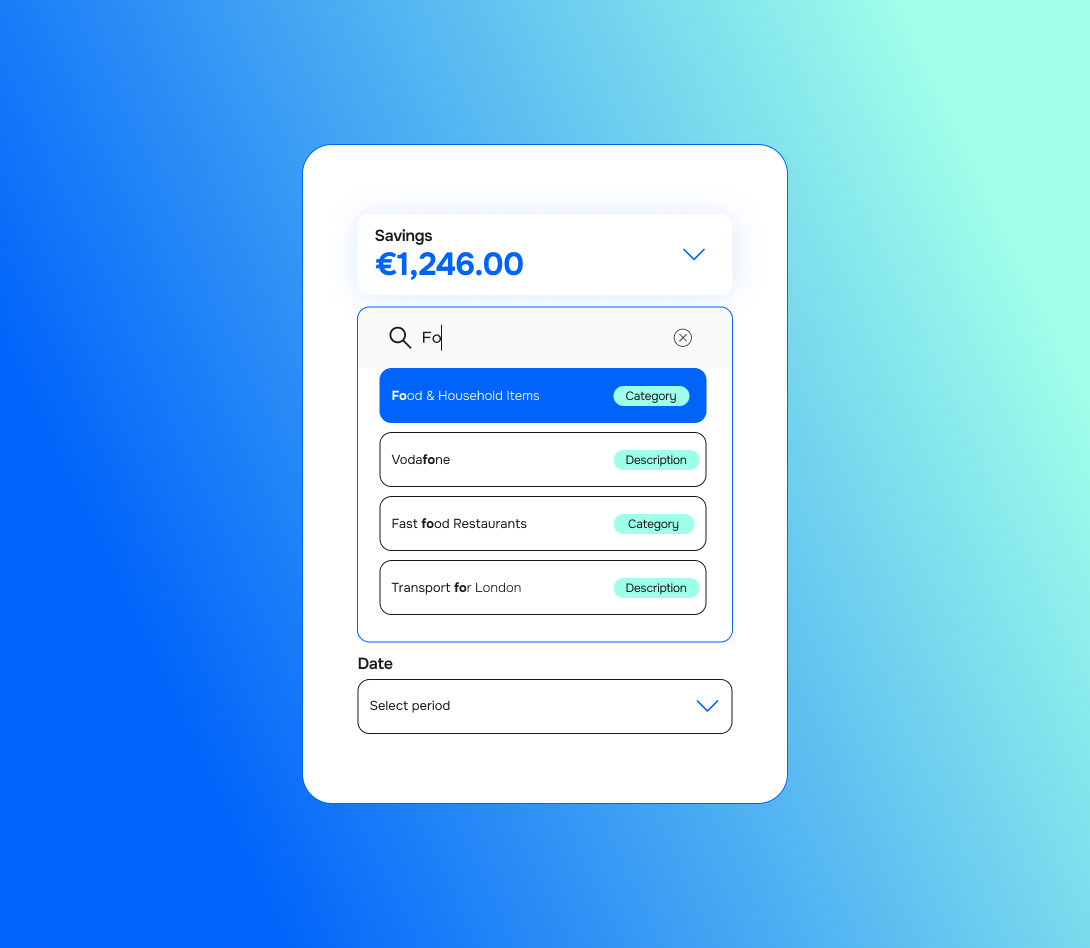

1.1. Natural Language Understanding (NLU)

Modern NLU models go beyond surface-level text parsing. They understand intent and extract key details such as dates, amounts, merchants, and transaction types.

By leveraging contextual understanding, they handle ambiguous or incomplete queries, drawing on user history or session context to fill in the blanks.

As a result, customers can search naturally without worrying about exact keywords.

1.2. Natural Language Generation (NLG)

Once the system understands a query, NLG models step in to craft clear, conversational responses.

They don’t just return data but summarise insights and explain patterns in plain language, making transaction information easier to digest and far more engaging for users.

1.3. Dialogue management

Great conversations flow naturally, and so does a well-designed AI search system.

Dialogue management enables multi-turn interactions, asking follow-up questions when needed.

For example: ‘Do you mean last Friday’s dinner, or all dinners from last week?’

This way, the system ensures accuracy while keeping the experience smooth and human-like.

1.4. Context awareness

By leveraging transaction history, location, time zone, and behavioural data, conversational AI tailors every search to the individual.

Thus, it can highlight frequently accessed transactions, surface personalised insights, or even make contextual recommendations in real time.

1.5. Machine Learning enhancements

These systems aren’t static, and they continuously learn. Through ongoing user interactions, they:

-

Refine intent recognition,

-

Improve entity extraction, and

-

Adapt to new merchants, payment types, and products.

Over time, the experience becomes smarter, faster, and more personalised.

1.6. Multi-channel support

Customers move between channels, and conversational AI follows them.

Whether through mobile apps, web dashboards, voice assistants, or messaging platforms, customers can search, ask, and operate naturally.

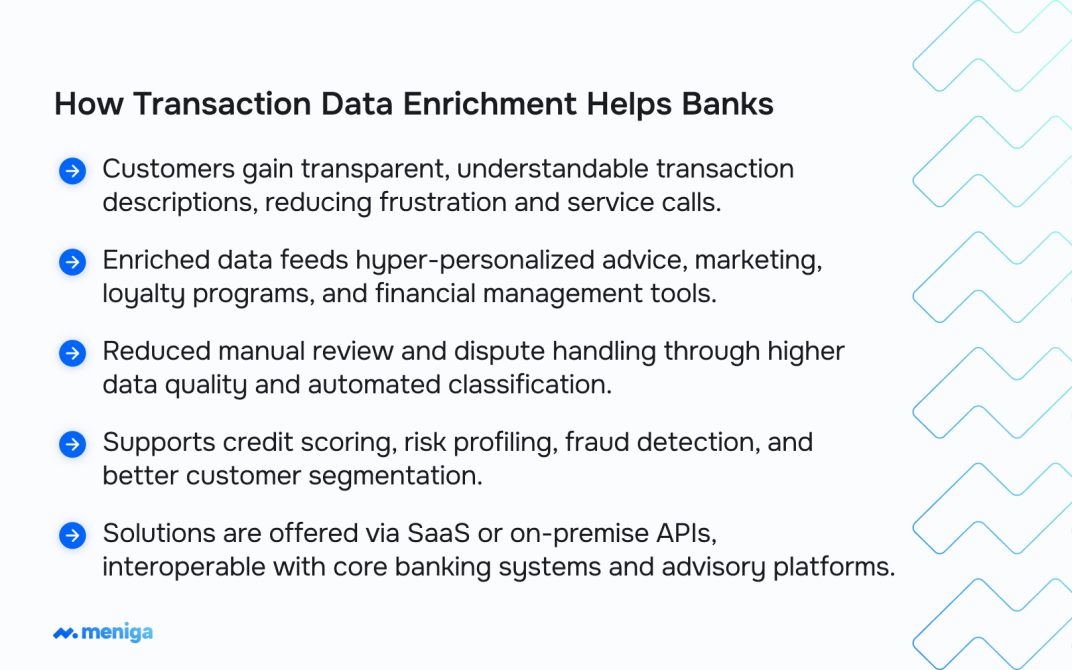

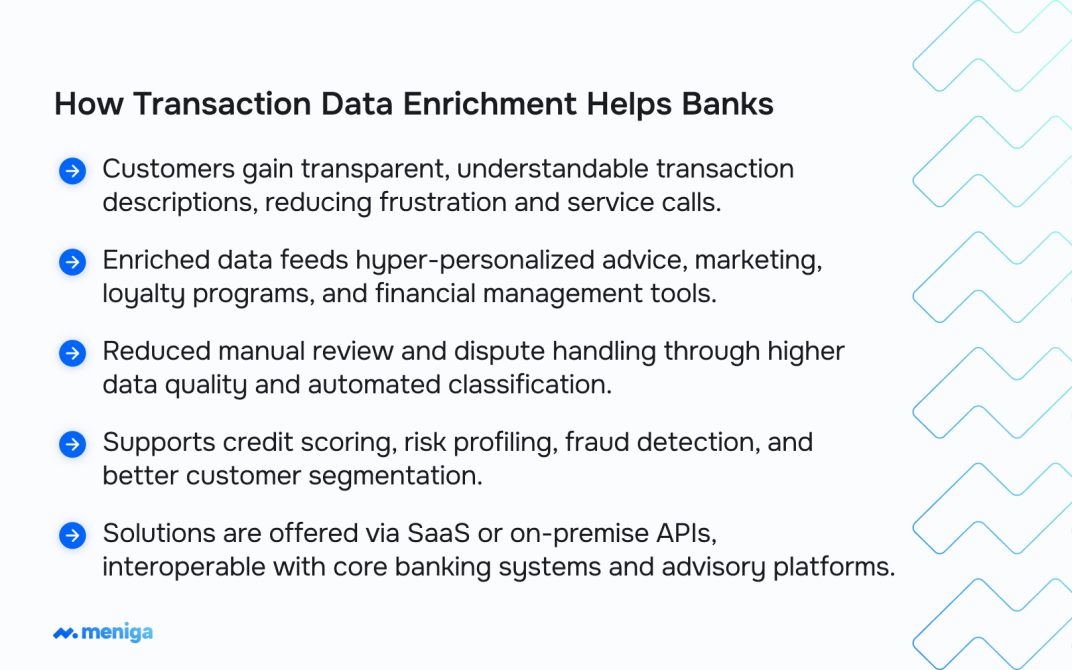

2. Leverage Transaction Data Enrichment

AI-powered transaction data enrichment goes above raw data cleaning to create rich, multi-dimensional insights that enable banks to innovate, personalise, and differentiate.

Transaction data enrichment transforms raw financial transaction records, which often contain limited and cryptic details, into structured, contextual, and actionable information.

Let’s see how AI-powered Enrichment works:

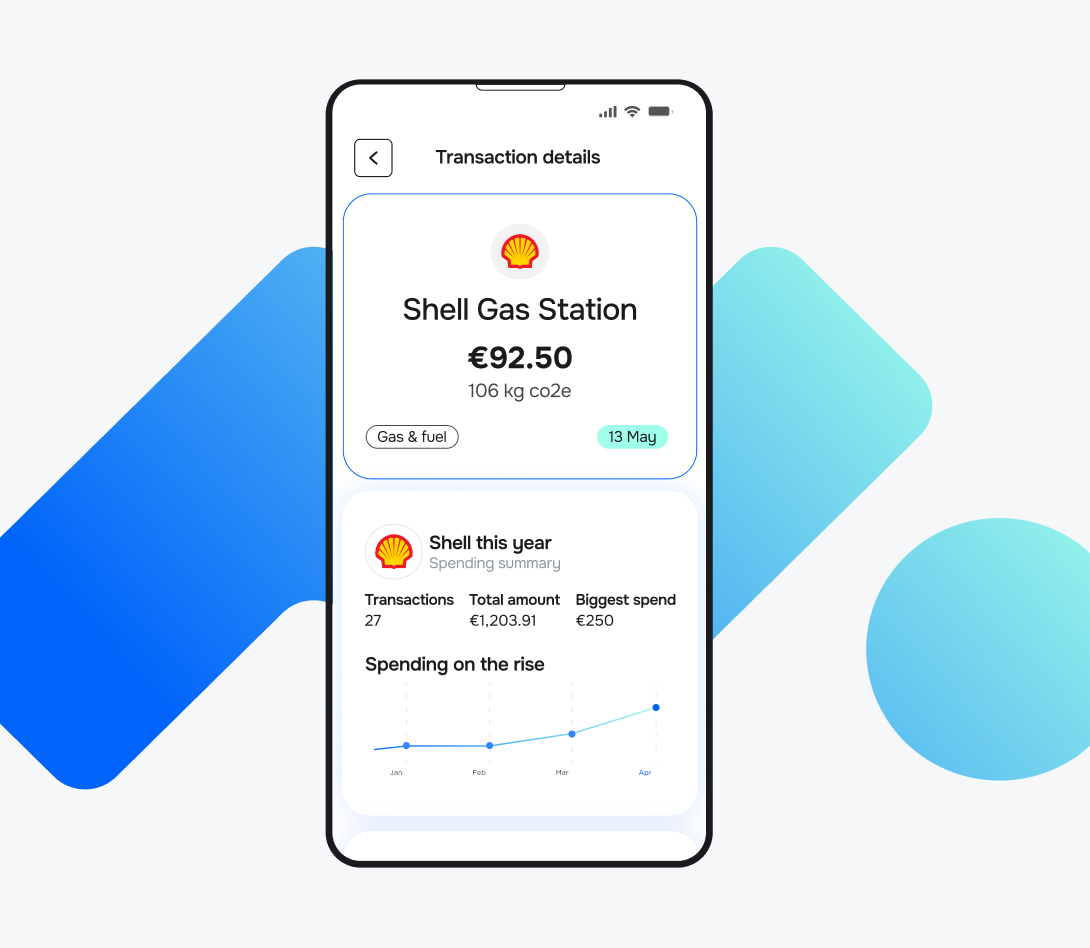

2.1. Merchant identification and normalisation

Raw transaction strings often read like digital hieroglyphics, packed with codes, abbreviations, and inconsistencies.

AI models, backed by comprehensive merchant databases, cross-reference these fragments to identify and normalise merchant names accurately.

This process resolves duplicates, aliases, and spelling variations, turning ‘AMZ123-PMT’ into a clean, user-friendly ‘Amazon.’

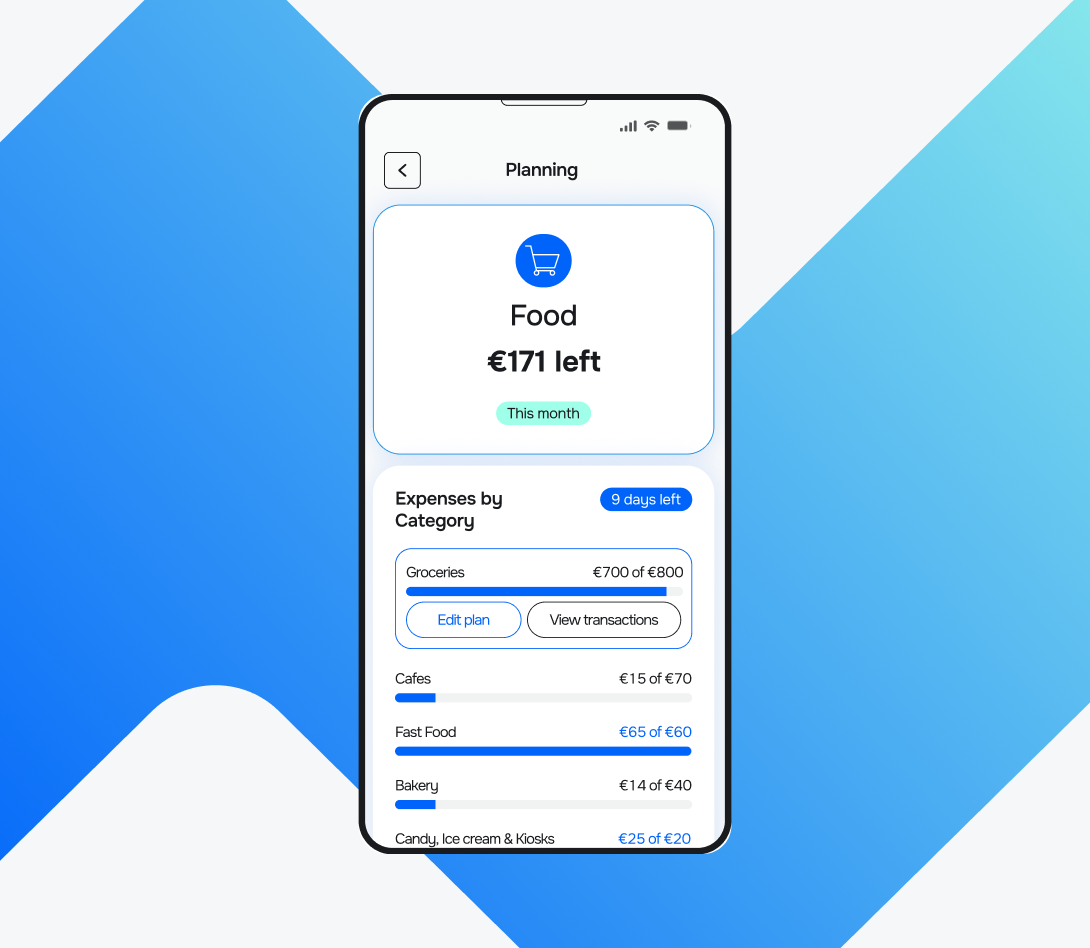

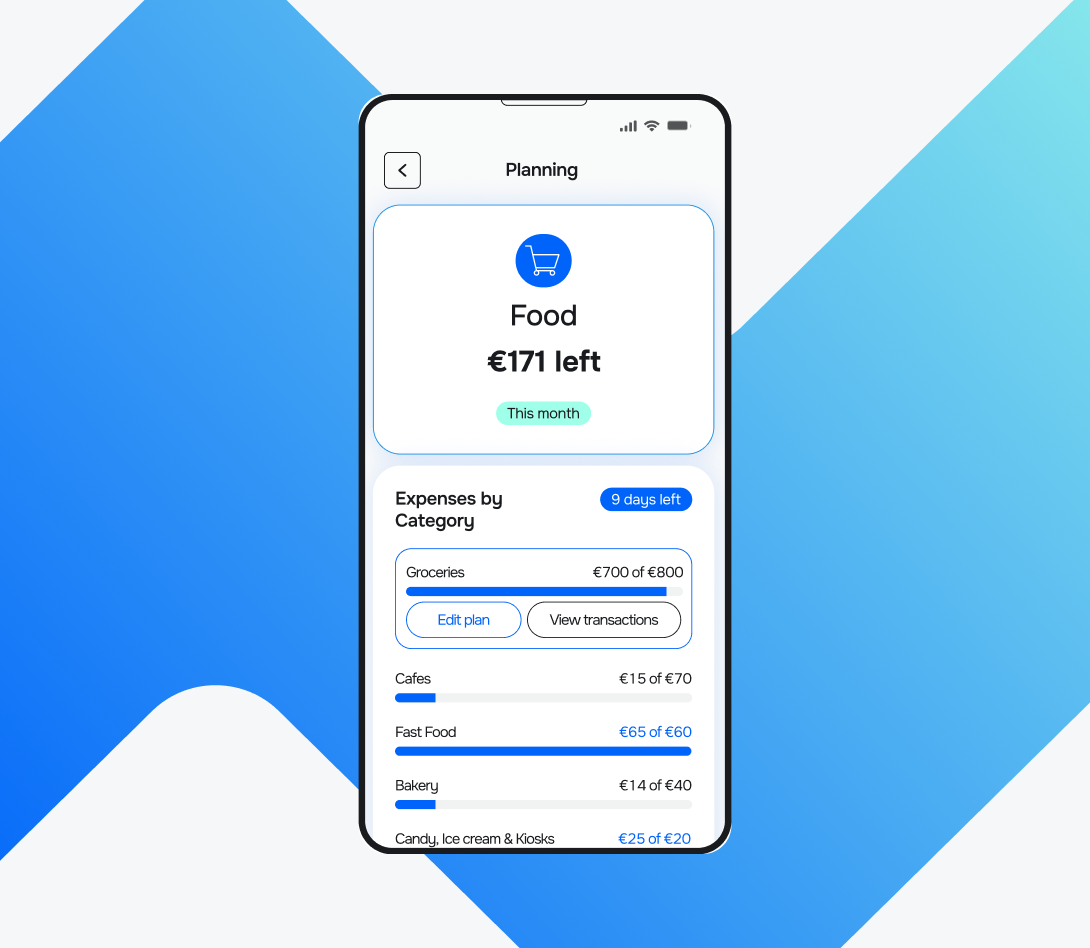

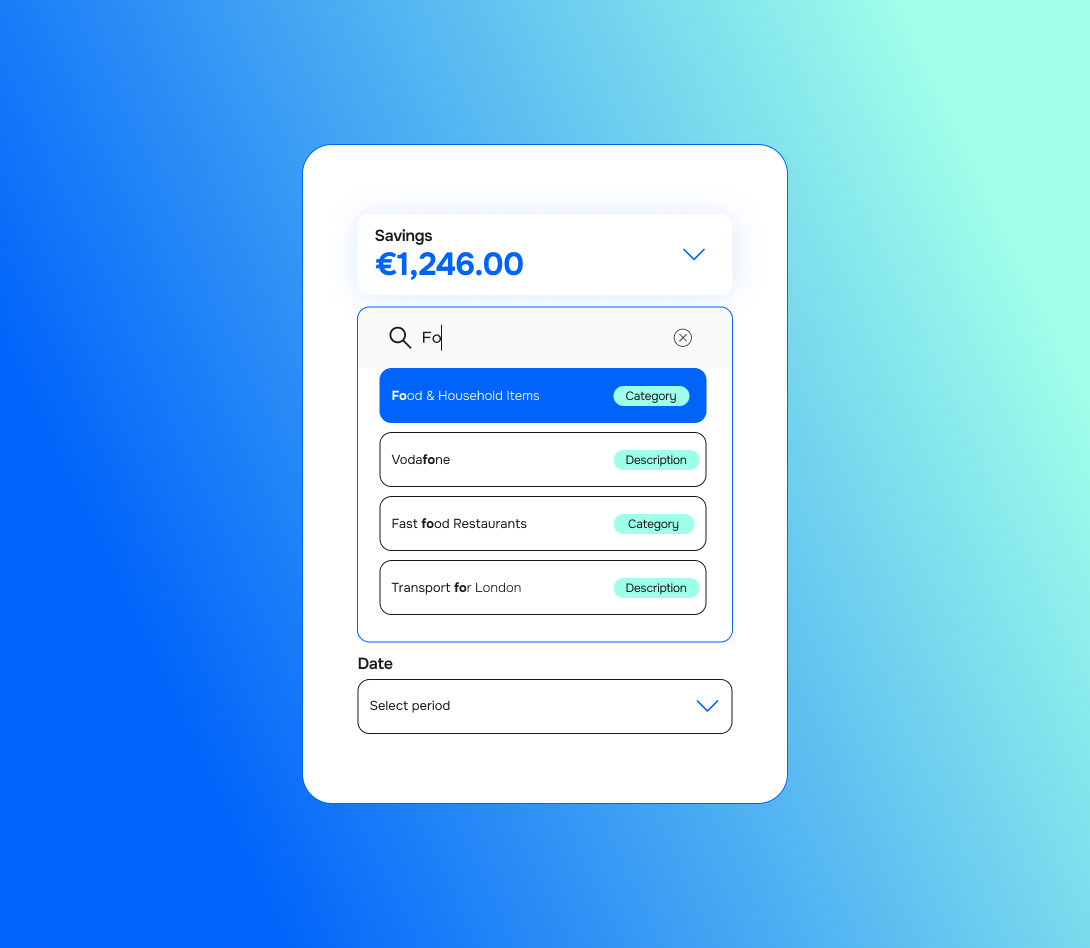

2.2. Intelligent categorisation

Through machine learning classification, transactions are grouped into detailed, multi-level categories such as ‘Food > Restaurants, or Transportation > Taxi.

These models are trained on vast sets of financial data to achieve great accuracy.

It enables customers to instantly understand where their money goes, while banks gain deeper behavioural insights for analytics and budgeting tools.

2.3. Geolocation Enrichment

AI knows what the transaction was, and it also knows where.

By analysing merchant and terminal data, transactions can be tagged with geographic metadata like coordinates, city names, or even specific locations.

This enables map-based visualisations and location-driven insights, adding another layer of personalisation and transparency.

2.4. Spending patterns and behavioural insights

Using historical transaction streams, AI identifies recurring behaviours, anomalies, and user-specific patterns, such as:

-

Recurring subscriptions,

-

Lifestyle segments, or

-

Spending irregularities.

It can detect sudden shifts in financial behaviour, supporting both personalisation and risk monitoring.

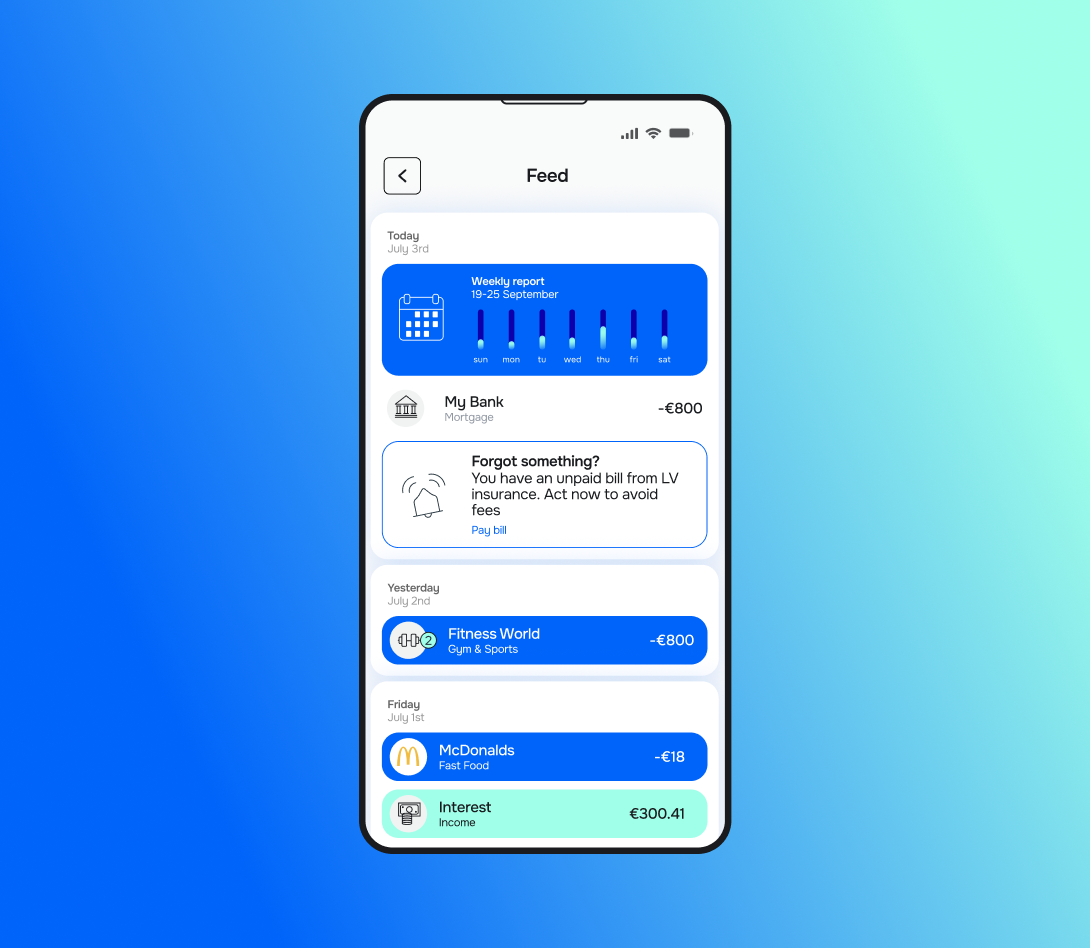

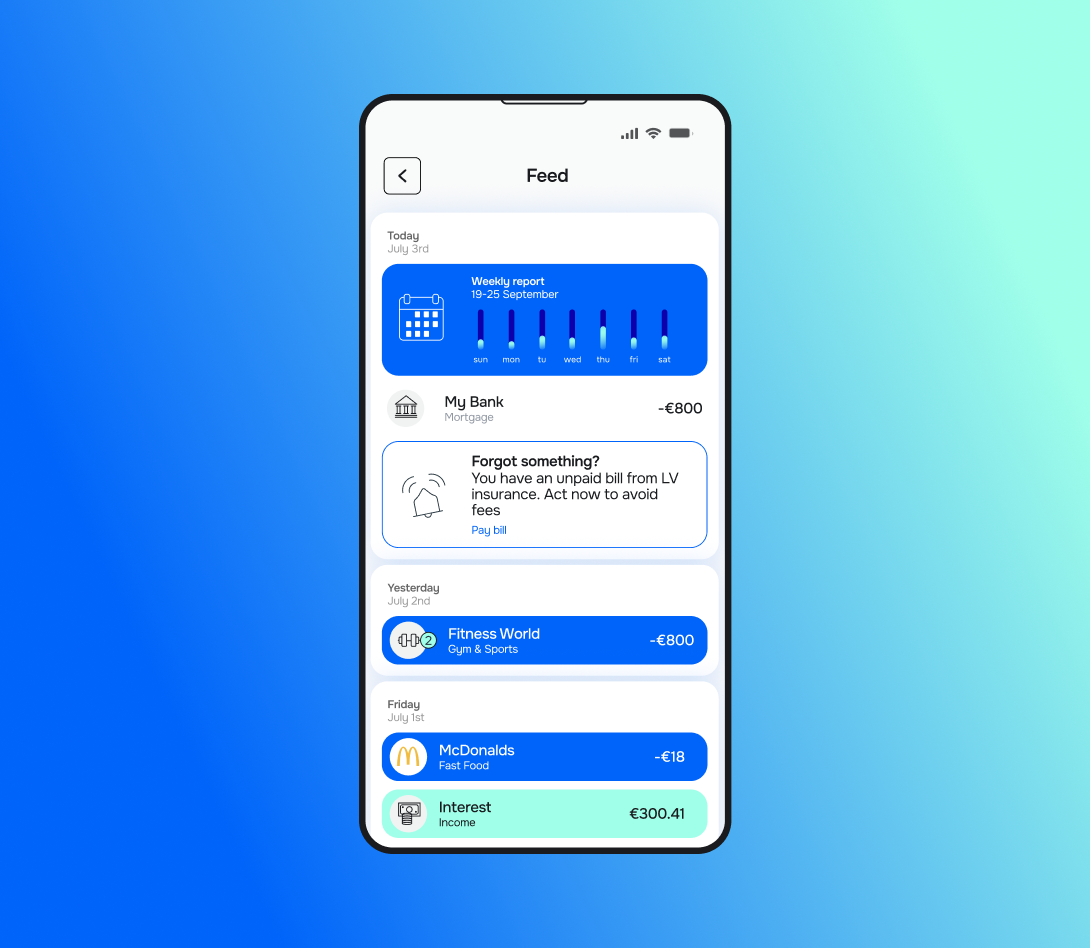

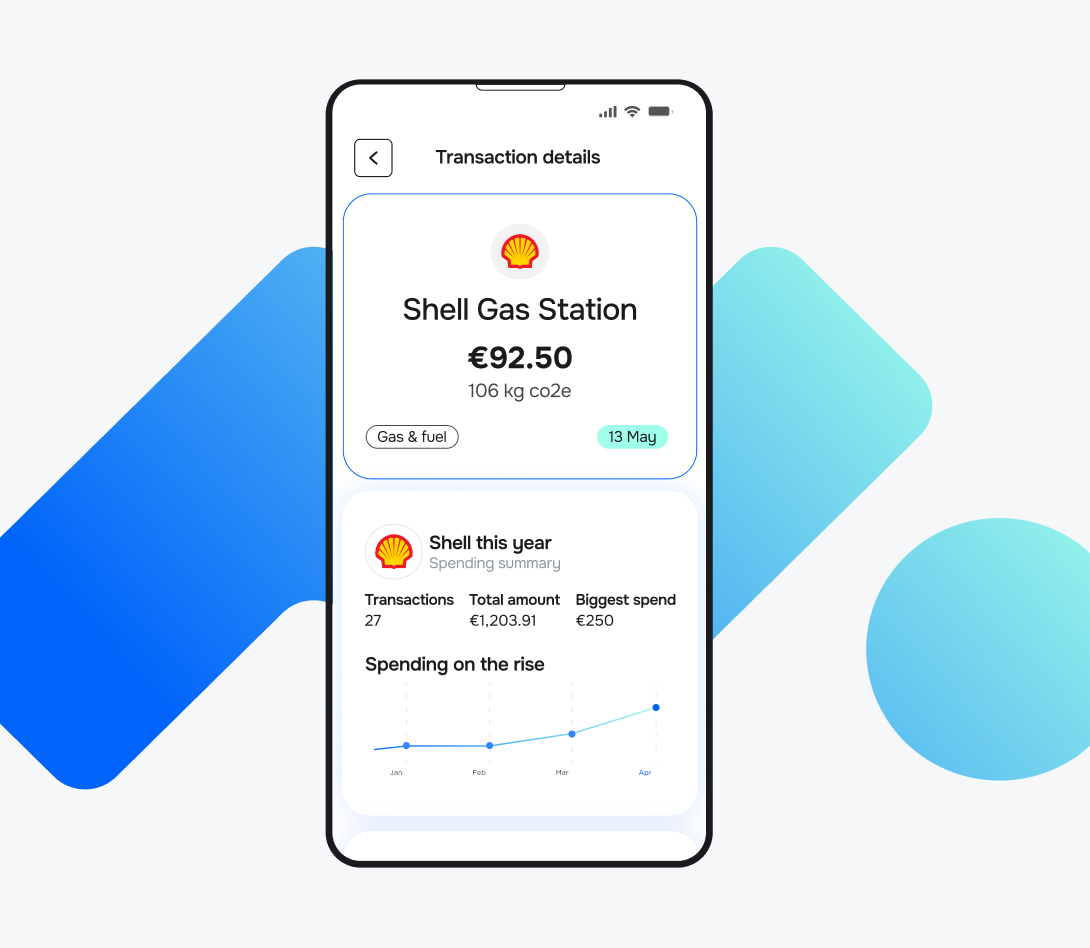

2.5. Visual and branding improvements

Data enrichment also improves presentation and trust.

By adding merchant logos and clean labels, enriched data turns bland transaction lists into visually engaging experiences.

Some advanced systems even apply sentiment or context annotations, helping customers quickly recognise familiar brands and feel more connected to their spending data.

How can you maximise the power of Transaction Data with Meniga?

Meniga’s Enrichment Engine transforms raw transaction data into a clear, visual narrative of your customers’ financial lives.

Every income and expense is intelligently categorised, turning what was once an incoherent string of numbers into structured, meaningful insights.

You can integrate it effortlessly with your existing category system or leverage Meniga’s fully localised category tree for a ready-made solution.

Powered by machine learning, the engine grows smarter over time, refining its accuracy through user interactions and community-driven feedback.

3. Use cloud-native architecture with XaaS

Banks are increasingly adopting cloud-native, modular architectures that leverage Everything-as-a-Service (XaaS) platforms, such as AWS, Google Cloud, Azure, and niche fintech-specific cloud providers.

As a result, you can more easily integrate third-party APIs for continuous data enrichment, easy updates, and enhanced security in real time without system downtime.

Modular architecture supports easy addition or replacement of enrichment, indexing, or search components.

4. Benefit from real-time data and personalisation

AI-driven real-time transaction insights and autopersonalised search results are the basis for delivering highly relevant and timely financial services to customers.

Here’s how they can help:

Instant processing

AI-driven systems continuously analyse transactions in real time, enabling banks to instantly recognise spending patterns, detect anomalies, and identify suspicious activity as it occurs.

This proactive monitoring strengthens fraud prevention and AML compliance, enabling banks to deliver timely alerts and personalised customer notifications, which enhances both security and trust.

Dynamic risk scoring

AI continuously evaluates each transaction against individual behavioural baselines and dynamic risk profiles, identifying potential fraud in real time while reducing false alarms. This ensures faster detection and smoother customer experiences without unnecessary friction.

Regulatory compliance

With automated, AI-powered compliance checks, tasks like sanction screening and KYC updates happen instantly and accurately.

Banks can stay aligned with evolving regulatory standards, reduce manual overhead, and maintain full compliance without slowing down operations.

In addition, autopersonalized search helps with:

-

Behavioural profiling: AI models learn individual user financial behaviour, preferred merchants, spending categories, and seasonal patterns to rank and filter search results that best match user intent.

-

Contextualised search: Search results adapt based on context, such as recent queries, location, device, time of day, and user goals (budgeting, expense tracking, and others).

-

Adaptive learning: Machine learning continuously refines personalisation models from interaction data, improving result precision and reducing irrelevant noise.

-

Segmentation and cohort analysis: Users are grouped into cohorts with similar spending habits or needs to drive targeted personalisation and suggest relevant transactions or alerts.

5. Implement security and privacy measures

Ensuring robust security and privacy measures is a must for protecting customer data, maintaining trust, and safeguarding banking operations.

Protecting customer data requires a multi-layered approach that combines advanced technology and ethical practices.

-

Data encryption: Banks secure transaction data both in transit and at rest using advanced cryptography, including early adoption of post-quantum standards, to guard against emerging threats.

-

Zero-trust security: Every user and device is verified continuously, with behavioural analytics detecting unusual activity to prevent unauthorised access and lateral movement.

-

AI-powered threat detection: Machine learning monitors transactions, network traffic, and user behaviour in real time to detect sophisticated attacks, such as adaptive phishing, deepfake fraud, and ransomware, and respond automatically.

-

Ethical AI practices: AI models in transaction search are governed for transparency, fairness, and auditability, with strong privacy measures and compliance with GDPR and PCI DSS.

-

Cloud security: Cloud-native banking platforms leverage micro-segmentation, secure APIs, and continuous compliance monitoring to protect workloads.

-

Access management: Multi-factor and biometric authentication, combined with role-based access controls, ensure sensitive data is only accessible to authorised users.

-

Security awareness: Ongoing employee training fosters vigilance against social engineering, spear-phishing, and insider threats.

-

Third-party risk management: Banks assess and continuously monitor the cybersecurity posture of vendors and APIs to mitigate supply chain risks.

Together, these measures create a robust security framework that safeguards transactions, builds customer trust, and supports safe innovation in digital banking.

Meniga helps banks and financial institutions turn transaction data into meaningful, personalised insights that make it easier to deliver products tailored to each customer’s needs.

We supply banks with a modern, intelligent Transaction Search experience, which transforms search from a simple utility to an engagement engine that reveals intent, surfaces insights, and drives conversion. It allows for deep search across structured and semi-structured data, across custom tags, categories, brands, or subscriptions, and enables real-time filtering.

At Meniga, we’ve long recognised that transaction data is one of the most underused resources in financial services, often falling short of its potential to drive innovation or enhance customer experiences.

Too often, this data is scattered across multiple sources, poorly categorised, and lacking the enrichment needed to make it truly meaningful.

Furthermore, delays or limited access frequently prevent it from being used for real-time analytics, insights, or customer engagement.

That’s why we focus on bringing clarity and value to transaction data.

Our solutions are flexible and scalable, working seamlessly with any existing system.

By combining internal and open banking data, we give banks a full, 360-degree view of customers’ spending habits and financial lives, helping you engage smarter and build stronger relationships.

Relying on AI and machine learning means that accuracy improves over time through user and community contributions.

With our solutions, you can:

-

Give customers real-time insight into their disposable income, empowering smarter decisions about spending and saving.

-

Deliver dynamic, context-driven content tailored to individual segments based on unique spending habits, cash flow, and financial goals.

-

Leverage real-time signals from external systems such as CRMs to provide timely guidance.

-

Encourage saving with gamified rules that automatically set money aside, helping customers grow their savings effortlessly while understanding whether they are safe-to-save or free-to-spend at any moment.

Curious to learn more?

Contact us today to see how you can turn transaction data into smarter insights and personalised banking experiences.