Financial Fitness in a post-COVID economy

Using your digital bank to help customers take back control in a time of crisis

Executive summary - prioritise the financial health of your customers

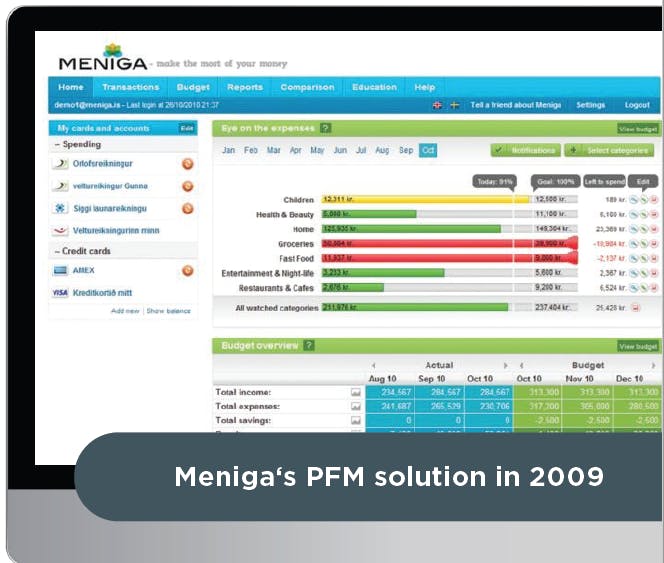

Meniga was founded in Iceland in the wake of the global financial crisis of 2007–2009. The elect of the recession in Iceland was palpable and Meniga quickly gained momentum by helping Icelanders find their way out of a precarious situation and get their personal finances back on track, gathering invaluable experience along the way. The recession that we face as a result of the Covid-19 pandemic will differ in many ways, but Meniga’s origins give us a unique perspective of the way forward for retail banks.

In this paper, we share our learning from a decade of working with leading banks worldwide in helping their customers manage their personal finances. We also surveyed 100 European senior bankers to gain scope and insight into the current retail banking climate.

Our aim is to equip you and your bank with the knowledge you need to navigate uncharted waters.

Key Takeaways:

Digital channels will be used with increasing frequency by a broader demography, making them the most crucial innovation focus for banks.

Banks must deliver the tools people need for financial self-help via user-friendly banking apps and personal financial coaches or risk losing them to challengers who offer more robust digital services.

Banks must be agile in their digital transformation & focus efforts on proven solutions that deliver tangible outcomes for their customers.

It is in times of crisis that banks create life-long customer loyalty. Now is the time to be assertive and step in with simple and highly effective methods to help customers take control of their financial health.

The coronavirus has driven a massive 72% rise in the use of fintech apps in Europe. ~Forbes

Contents

I. First things first...

II. Your digital bank has been under scrutiny

III. Be ready for competition

IV. Learning from crisis to better serve banking customers

V. How to evolve your digital bank

VI. Helping customers build financial fitness

VII. Speed and Agility Matter

VIII. How banks can ensure customers’ financial wellbeing in tough times

IX. Conclusion

At the time of writing, the Covid-19 pandemic is still raging. We are all experiencing unprecedented times with far-reaching ramifications for banks and their customers.

At the beginning of the pandemic, many banks went into crisis management mode to:

- Safeguard their operations

- Protect employees

- Ramp up digital infrastructure

- Enable a large part of their staff to work from home

- Keep essential projects going

- Respond to a huge volume of concerned customers

- Provide relief measures to customers in immediate distress

These are critical tasks that banks will likely have to maintain for some time. But it is also important for banks to forge ahead and re-initiate momentum as instrumental players in economic growth.

Before COVID-19, the banking industry did a great deal of talking about ‘becoming digital’, but less than 15% of organizations considered themselves digital transformation leaders. In fact, during the long-lasting recovery and prosperity experienced for more than a decade post-financial crisis, very few organizations ‘bit the bullet’ of building a digital-ready bank. ~ The Financial Brand

Your digital bank has undoubtedly been tested over the last few months.

Clients who were once intimidated by their digital bank or just referred to visit a branch have been forced to adopt these new methods. Usage of banking apps will now truly cross over from early adopters to the mainstream, and even to laggard users. Although this usage resulted from critical need, it is essential that banks now offer clients both a user experience and a fully equipped toolbox they can engage with and eventually enjoy using.

12% of the adult population in the UK – some six million people – downloaded their bank’s app for the first time during lockdown. ~Nucoro

Put yourself in the shoes of customers using your app. What are their pain points? Has your bank fully digitised the processes they need? Is your app easy to use? Does your digital bank create value for customers under financial strain from reduced or outright loss of income?

Banking professionals are adamant that developing digital banking channels takes top priority, over streamlining operations and IT infrastructure investment. Interestingly, it also comes before rescue operations, but, as we will see, offering personal financial channels which enable customers to help themselves might be the most effective way banks can assist people now.

85% of bankers agree the COVID-19 pandemic will force customers to rely more heavily on online & mobile banks. ~ Independent survey of senior bankers across Europe

Interestingly, bankers anticipate that competition will continue despite radically changed market conditions. Some 70% think Open Banking innovation will accelerate, which could increase competition from challenger banks, big tech giants, and thousands of fintechs.

51% of bankers foresee that banks will lose customers to challenger banks or 3rd party providers in the post-Covid-19 climate. ~Independent survey of senior bankers across Europe

Big tech is moving into digital banking in a big way. Banks must recognise that digital banking is no longer simply transactional functionality which happens online; it is the capacity to deliver a full-service experience, activating the customer in ways that allow them to control their finances in a simple but effective way.

Beat the challengers by being there for your customers. Give people proactive advice on how to keep more of their earnings. Engage them with spending insights and savings challenges, or suggest they set themselves savings goals. People will appreciate the bank that helps them get through tough times and rebuild their financial lives.

Consumers are more dissatisfied with their banks' PFM services than with any other type of services they provide, and more than 40% of those surveyed stated that they find PFM services from non-bank providers more useful and helpful. ~ Business Insider

We at Meniga are no strangers to times like these. We were founded during the devastating financial crisis that hit our home country of Iceland in 2009, along with the rest of the world. We learned that in times of economic hardship and uncertainty, banks could and should provide customers with the right tools for personal financial management to take ownership of their financial health.

Originally, our Personal Finance Management (PFM) service was a standalone website, accessible through banks’ online channel. It enabled consumers to make sense of their spending by consolidating it into one place, categorising it and providing reporting.

Fast forward to 2011 when we launched our first smartphone app, centered around helping customers engage with their spending through easy-to-use, mobile-friendly insights and reporting. It is essentially a personal financial coach for our customers.

We had the advantage of having Iceland as a test market, enlisting much of the population to use our product. This provided us with direct feedback from a range of users, from the highly motivated who want to take control of their finances, to those who rarely check. This feedback influences the products and services which we provide to banks around the world.

Through the decade of experience, one of the main takeaways is that the banks who have helped people in times of crisis have created long-lasting loyalty from their customer base.

Islandsbanki, one of the largest banks in Iceland, partnered with Meniga in 2009 to provide their customers with the digital tools needed for financial self-help. 70% of Islandsbanki customers stated that having those personal finance solutions provided to them, actually increased their loyalty to the bank. Moreover, 88% of Islandsbanki customers said that they would continue to use their digital bank on a regular basis.

Currently, about one in five Icelanders have installed the Meniga app. Some 90 million people use Meniga APIs through banks we partner with globally.

Elisa, Meniga User

“I spend considerably less, for example on going to the movies, after I started following my spending with Meniga. I think it is user-friendly to see the overview in the app. For a time, I opened the app every day. Now I have a certain spending limit … I use the app now once or twice a week. I spend less than before, even if I am opening the app fewer times.”

Hafsteinn, Meniga user

"So far I've gotten 70,000 ISK cashback (from cashback offers)! I love Meniga! I also know exactly how much I spend on gas, food and partying. Although I could do with improving the ratio between those three."

Gudrun, Meniga User

"Meniga allows me to get an overview of where my money goes. Also, Meniga’s spending challenges make me want to improve my spending habits."

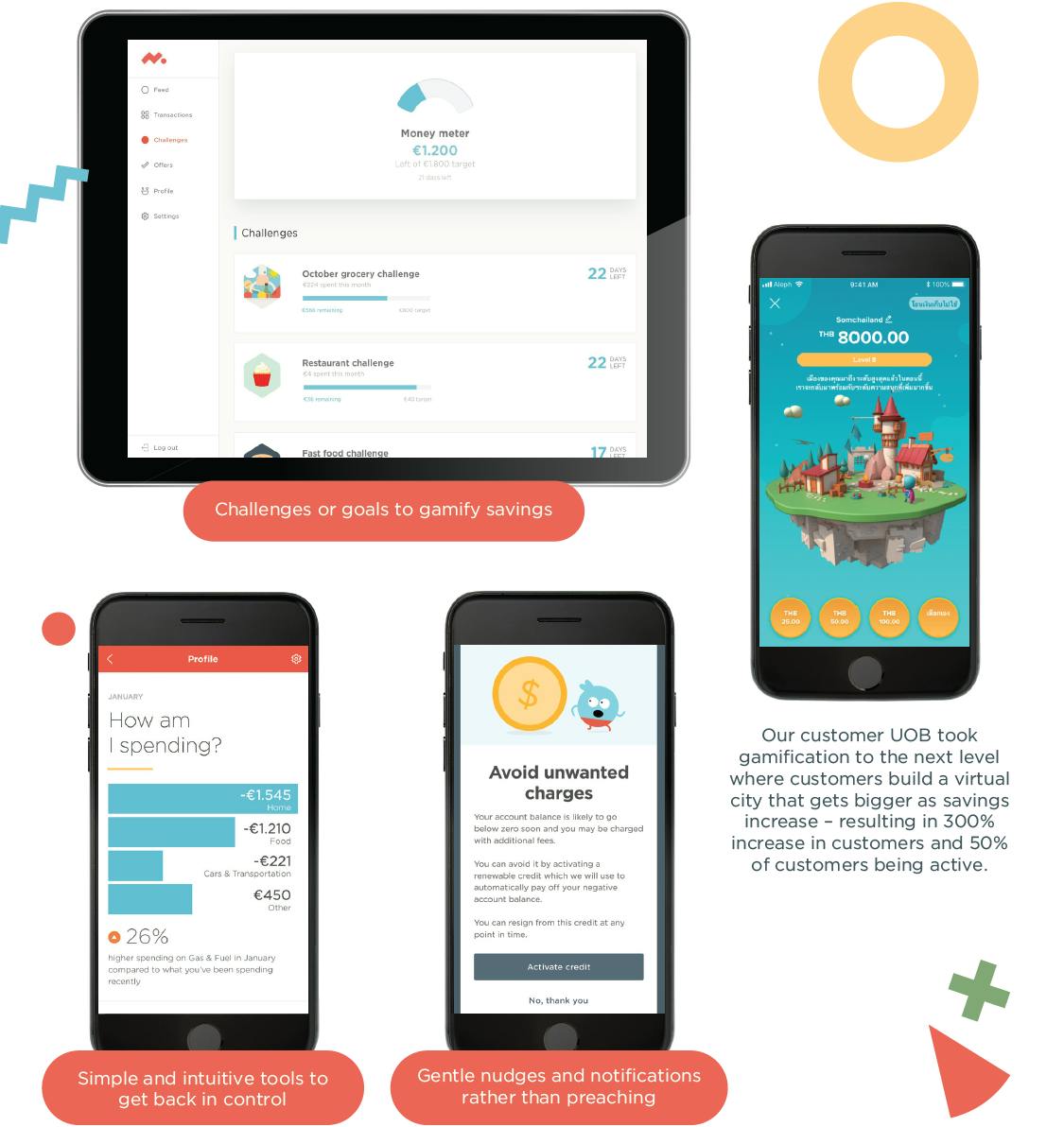

In 2019, the average savings per user who accepted a savings challenge was €218.

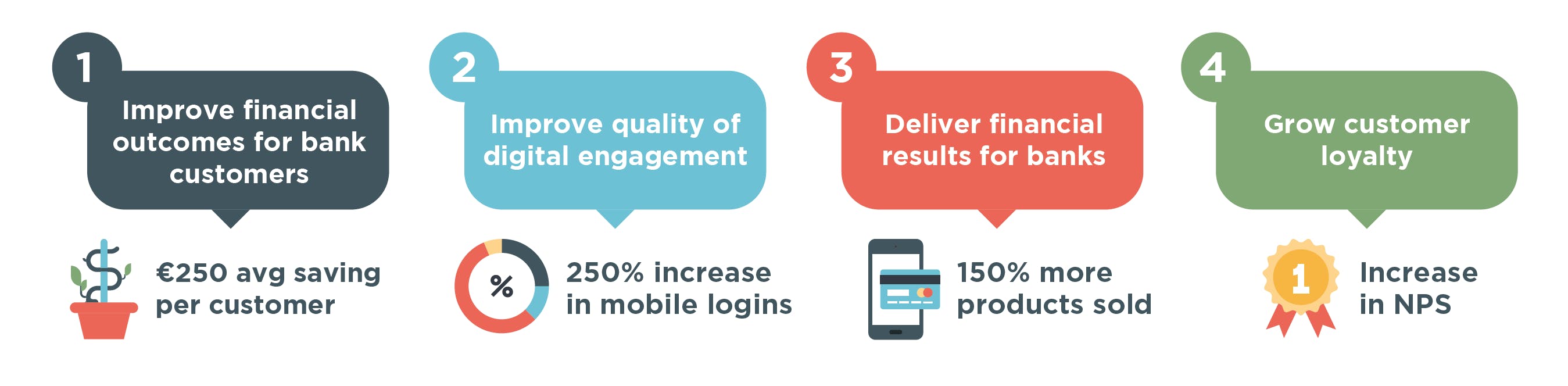

Enhancements to your digital channel should have clear objectives and desired outcomes. At Meniga we aim to achieve outcomes along four main dimensions:

Right now, the balance should be tilted towards improving customers’ financial outcomes. People will remember the financial institutions that helped them in 2020. Keep in mind your customers don’t just need insights or guidelines, they need tools to put advice into practice.

This is your opportunity to create long-term loyalty through a combination of tangible impact and treating customers with respect.

90% of bankers stated that having a good digital banking user experience for their customers will be more important post-Covid.

~Independent survey of senior bankers across Europe

As many as 53% of US millennials spend no time managing their finances. This means banks have to make their PFM offerings engaging enough to pull in "unengaged" groups, too. Building powerful incentives is core to this: Banks should consider studying what makes apps such as Facebook and Twitter so habit-building and "addictive", replicating elements of their design to hep gamify PFM. ~MyBank Tracker Study

Meniga has more than a decade of experience of working with banks with the sole aim of helping customers lead healthier financial lives and we have learned a few things along the way.

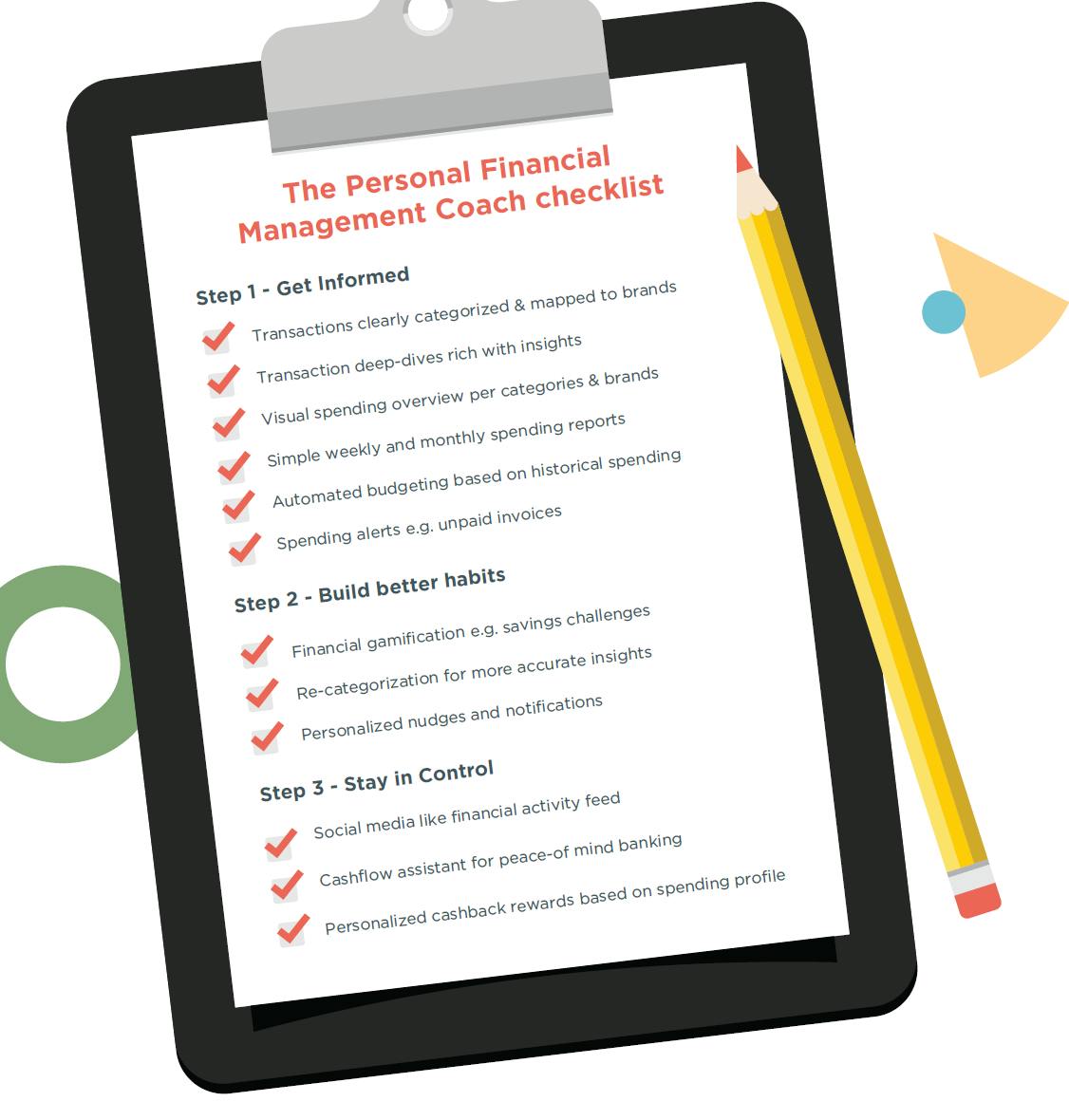

Financial fitness has many similarities to physical fitness - it’s all about building the right habits and once in a while you need to make a real effort to turn things around and get into shape.

Banks that are serious about being trusted financial advisors to their customers should integrate personal finance management into the everyday digital banking experience.

Transactions should be categorized, interactive entities rich with insights. Nudges, tips, and personalized recommendations should be at the forefront of the digital banking app.

Today, most of our clients integrate Meniga functionality tightly into their main digital channels leveraging our out-of-the-box APIs - putting personal finance insights and personalised nudges at their customers' fingertips.

On average, bank customers who make use of PFM tools are 18% wealthier than those who don't and they tend to own every major financial product, such as mortgages and car loans, all of which are key bank revenue. ~Javelin Research Data

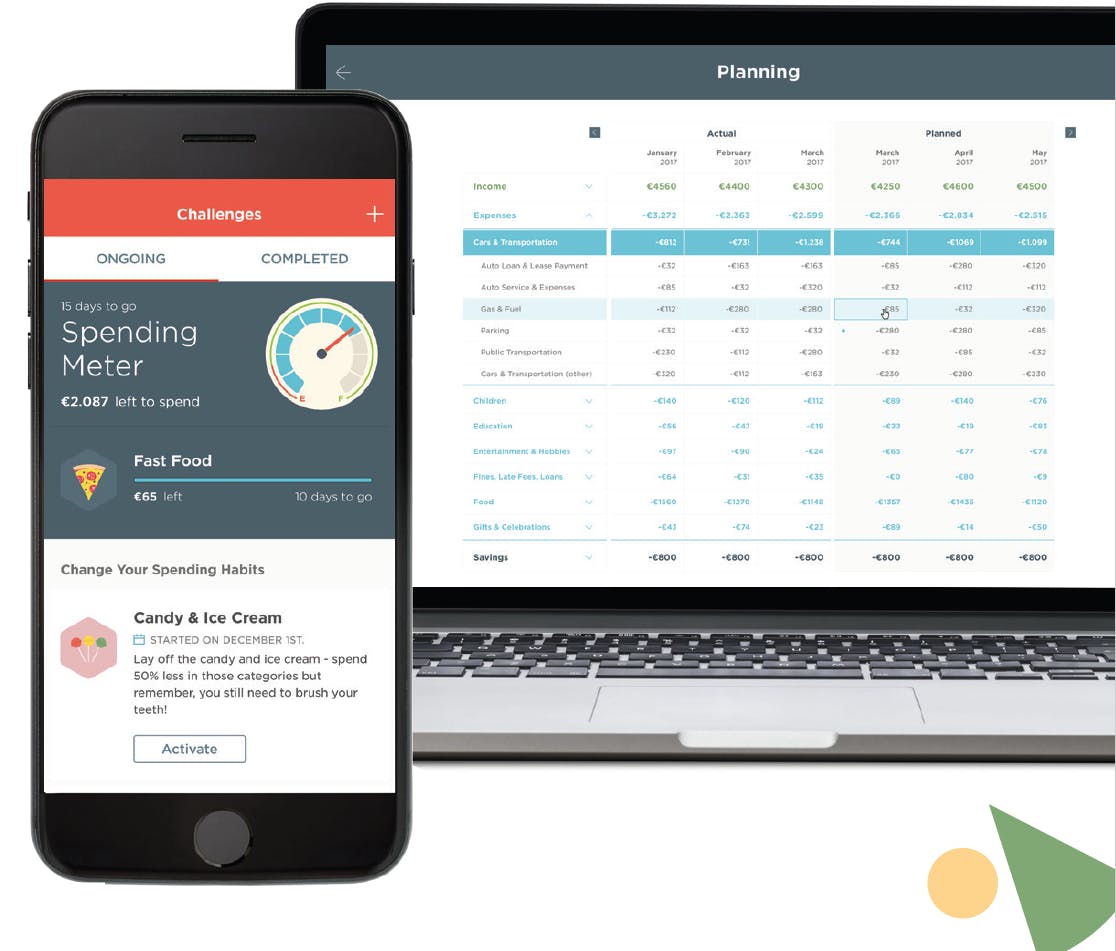

It is equally important to provide tools for deeper engagement. Budgeting and expense analysis is not anyone's favourite activity, but most of us need it from time to time - when we start a family, when we buy our first house - and of course in times of financial crisis.

Banks are aiming to deepen customer loyalty and retention with new and improved PFM tools; they should measure these tools' impact using metrics that centre on customer satisfaction, such as engagement with (rather than just adoption of) each new feature, as well as Net Promoter Scores for each new rollout. ~ Business Insider Report

Banks cannot predict post-pandemic market conditions, but they can certainly increase the speed of digital banking innovation by using proven methods and leveraging existing technologies in the market.

As an example, Meniga’s offering includes:

- A broad set of tried and tested personal finance management features accessible via API

- Out-of-the box front end that can be used as inspiration or starting point

- A solution that can be hosted on-premises or in the Cloud (Software as a Service)

- A solution that can be configured with your data connectors, branding, choice of categories, and front-page digital banking content

Design Sprints are a proven methodology for finding and validating solutions before starting costly development work. The outcome is a tested rototype of a banking app your customers need and want.

The structure of a Design Sprint:

- Get a team of key stakeholders together – don't forget the front line and customers!

- Use proven tools such as the Customer Journey Map

- Sketch out potential solutions to customer pain points

- Create app prototypes

- Test prototypes with users

Another proven way to speed up innovation and time to market is leveraging out-of-the-box digital banking APIs. Examine best-of-breed banking APIs to determine whether they can save time and money on banking app development.

Lastly, prevention is better than cure. Banks have extensive data about their customers and their financial behaviour. Before the pandemic, banks used our AI tools to anticipate which customers would be predisposed to adopt banking products. Now they can use this technology to determine which customers are likely to experience financial difficulty, and engage with them to prevent their situation from spiralling out of control.

Adapt to a new customer norm with new business models. Until now, most banks have marketed products using broad demographic segmentation. But customers are increasingly expecting individualised offerings, and leaders will need to use data to fine-tune their customer, product and pricing strategy to deliver on those expectations. ~ PriceWaterhouseCoopers

Recessions are times when long-standing loyalties are built in the financial services sector. As a bank you need to ensure you are there for your customers. And that means not only helping people treat the symptoms of their financial distress with payment holidays and credit extensions - it means helping them help themselves. Banks need to ensure they are providing customers with the tools and advice they need to both 1) get in control and 2) stay in control of their finances.

For some banks this means augmenting what you already have, for others it means a substantial investment in digital assets. But time is of the essence - banks need to be deploying these solutions in the coming 3-6 months.

To meet the need in the market and recognising the sense of urgency in deploying solutions, Meniga has developed the Personal Finance First Aid toolkit which allows banks to quickly deploy web and app digital experiences combining COVID related messaging, financial distress solutions, personal finance advice and best-in-class personal finance management features. The package includes out-of-the-box web front-end and apps and can be deployed on premise or as SaaS in the cloud.

The most challenging part of turning around a difficult personal finance situation is establishing new habits. Here we can draw upon learning from the health and fitness world, which inundates us with messages to take control of our own health. They have set up systems, designed programmes and created apps to make “getting into shape” accessible for all, simple to get started, and with achievable goals so we can build healthier habits.

This is exactly what banks need to be doing with their customers’ financial health. At Meniga, we take inspiration from these pocket personal trainers who encourage us to do better and give us badges and kudos when we progress. They cover every degree of fitness, from Couch to 5K to Strava – and financial apps must do the same.

In the post-pandemic world, it is crucial to deliver the right messaging at the right pace to support customers in creating new habits and rebuilding their finances. For many consumers and small businesses, this means the complete restructuring of financial behaviour. This is undeniably difficult. But banks are in a unique position to make it possible by providing customers with:

We find ourselves entering a period where the majority of any banks’ customers will be in some degree of financial distress. This is a period where long- term loyalties are built in the financial sector - people will remember how their bank treated them in 2020.

2020 will also be the year that catapulted the digital laggards into the digital banking age - investing in developing a modern digital banking experience has gone from being important to being a qualifier for staying in business.

Over 75% of respondents to an RFi survey cited by TheFinancial Brand said they would prefer to use PFM tools from their primary financial services provider (typically a bank). This compares with just 6% who said they'd prefer PFM tools from fintechs or neobanks. ~The Financial Brand

As banks find themselves prioritising their digital channel budgets, we recommend keeping:

Prioritize products and features that improve financial outcomes for your customers

Make sure you have the basics covered - do you have the tools that your customers need to get back in control of their finances? If not, find a way to deploy them ASAP

Partner with fintechs with proven solutions to accelerate your time to market. Look for evidence in e.g. savings delivered and improvement in loyalty

Plan for the long-term: build agile teams and efficient models for collaborating with third parties. Embrace Open Banking by being open yourself

These strategies will go a long way to establish trust and loyalty, ensuring that your bank will be the one people turn to.

Related articles

Meniga Smart Money Rules

Help your banking customers set money aside and leverage their savings in ways that are important to them.

Meaningful Engagement In Digital Banking

Banks can learn a lot from the user experience of Facebook, Fitbit & other digital leaders. See how banks can develop meaningful engagement in their digital channels.

Business Finance Management

BFM helps your bank discover new revenue streams from a commonly underserved segment.