When banks and fintechs start looking at open banking providers, Tink and Plaid are usually the first names that come up. Both have built strong reputations for data aggregation, payment initiation and transaction enrichment. At the same time, each has clear strengths and some important limitations.

This article looks at how Tink and Plaid perform across key areas, and also considers Meniga for financial institutions exploring ways to connect data with customer engagement and gain long-term value.

Tink vs Plaid: How they compare on features, and where Meniga stands apart

Before we explore each option in greater detail, here’s a quick overview of the core features of these platforms.

| Feature | Tink | Plaid | Meniga |

| Financial data aggregation | 6,000+ banks across 18 EU markets | 12,000+ institutions in US, UK, EU, Canada | Multi-source aggregation, incl. open banking feeds, enriched into a unified schema |

| Transaction enrichment | Categorisation, logos, recurring detection, spend type | Basic categorisation and metadata | Localised categorisation, logos, recurring detection, continuous ML improvement |

| Payments | Bank-to-bank transfers, VRPs, payouts (EU focus) | Pay-ins, payouts, RTP, FedNow, ACH (US focus) | Focus on enrichment + engagement, integrates with banks’ existing payments |

| Risk & fraud tools | AI risk signals, income verification, fraud checks | Identity verification, Plaid Protect, fraud detection | Risk checks supported through enrichment, focus on behavioural insights |

| PFM tools | Not included | Not included | PFM APIs: budgeting, subscriptions, cashflow management |

| Insights & engagement | Not included | Not included | Insights Platform for hyper-personalised messages and micro-segmentation |

| Cashflow forecasting | Not included | Not included | Predictive cashflow with real-time alerts and financial guidance |

| Platform focus | Enrichment + payments in Europe | Connectivity + payments in US/global | End-to-end engagement platform: enrichment + PFM + Insights + ROI focus |

What is Tink: Overview and benefits

Tink, acquired by Visa in 2022, is a European open banking platform offering AI-powered tools for financial data aggregation, real-time insights, and payment initiation.

It connects with more than 6,000 banks across 18 European markets, supporting use cases such as personalised financial management, credit risk assessment, and instant bank payments.

With capabilities including behavioural analytics and sustainability tagging, Tink enables financial institutions to enhance decision-making and deliver more personalised customer experiences.

The solution is best suited for:

-

Financial institutions and fintechs building personalised budget and spending apps with rich transaction data.

-

Credit providers leveraging AI-driven risk scoring and alternative credit assessments.

-

Payment service providers and merchants using instant bank payments and recurring payment flows.

-

Businesses integrating account aggregation and embedded finance solutions to enhance customer financial management.

What are Tink’s key features?

Let’s check Tink’s core features and see how it helps banks and fintechs streamline financial data, payments, and insights.

1. Financial data aggregation

Tink provides AI-powered aggregation of real-time financial data, and it enables access to sweeping account types such as:

As a result, you get a 360-degree view of financial profiles.

2. Transaction data enrichment

Merchant Information is Tink’s new feature.

It uses machine learning and transaction enrichment to deliver detailed merchant information with logos, brand names, merchant category segmentation, and payments detection.

3. Risk assessment and fraud detection

Risk decisioning tools help you make smarter credit decisions by verifying income with real-time data to understand your customers’ true financial capacity.

You can identify spending habits and track recurring monthly expenses.

Also, you can assess creditworthiness with up-to-date, verified insights that reveal patterns in customer behaviour with Tink’s new feature, Risk Signals.

It is a suite of risk checks and rules built to monitor, manage and block riskier account-to-account payments.

This enables you to:

-

Verify account holder information, check the account status, identify suspicious activity, and more.

-

Evaluate risk based on recent transactions, chargeback history, and previous non-settled payments.

-

Verify a user’s ability to pay with real-time balance information, including their overdraft, credit lines, and pre-booked orders.

4. Payment Initiation Services (PIS)

Tink provides payments via open banking rails, including instant bank-to-bank transfers, variable recurring payments (VRPs), and instant payouts.

The service enables banks to check if sufficient funds are available in a customer's bank account before processing payments or setting up direct debits.

It refreshes balance data continuously to keep information up to date.

Tink’s Payments connection capabilities are currently available in France, Belgium and Denmark.

What are Tink’s advantages and drawbacks?

Before deciding if Tink is the right platform for your bank or business, it’s important to weigh its strengths and potential drawbacks.

Tink’s pros:

-

Deliver targeted recommendations using enriched transaction and behavioural data.

-

Accelerate underwriting and credit decisioning processes with AI-driven risk insights.

-

Has a unified API with extensive SDKs, sandbox environments, and authorisation tools.

Tink’s drawbacks:

-

Integration complexity: Despite Visa’s backing, Tink can be difficult to integrate with legacy core banking systems, requiring extra development effort.

-

Limited focus on customer engagement: Strong on enrichment, but no native tools for ongoing engagement or financial wellbeing.

-

Regional lock-in: Most value for EU-based banks; outside that scope, support is weaker.

-

Over-reliance on Visa ecosystem: Risk of vendor lock-in with slower product innovation compared to independent providers.

What is Plaid: Overview and benefits

Plaid is an open banking platform that focuses on financial data aggregation, payment initiation, identity verification, credit underwriting support, and AI-powered fraud prevention.

It enables financial institutions to securely access consumer-permissioned data, initiate payments, perform KYC verification, and build financial products.

Unlike Tink, Plaid has a bigger global coverage, and it’s especially strong in the U.S. market.

Regarding data security, Plaid utilises the Advanced Encryption Standard (AES-256) and Transport Layer Security (TLS) protocols to safeguard your personal information.

It also requires multi-factor authentication for added security to help protect your data in Plaid’s systems.

The solution is best suited for:

-

Personal and financial management

-

Banking and payment solutions

-

Lending and credit underwriting

-

Wealth management.

What are Plaid’s key features?

Let’s take a closer look at Plaid’s core features.

1. Financial data aggregation and account connectivity

Plaid connects securely to over 12,000 financial institutions across the U.S., Canada, the UK, and Europe.

It aggregates users' transaction histories, account balances, and spending patterns for third-party personal finance management solutions, budgeting apps, and lending platforms.

2. Identity and account verification

Plaid’s Auth product allows apps to instantly verify bank account ownership and routing numbers, eliminating the need for micro-deposits.

As a result, you can comply with KYC/AML regulations.

In addition, you can detect fraudulent behaviour early in onboarding and transactions.

The Identity product confirms user identities using bank data to enhance fraud prevention.

It enables you to auto-fill forms with identity data when users link their bank accounts. You can use identity data to prevent account takeover (ATO) or other types of transaction fraud.

3. AI and fraud prevention

Plaid integrates AI capabilities to enhance fraud detection and improve onboarding.

Some of the features include Silent Network Authentication for phishing-resistant phone and device verification, as well as a built-in fraud intelligence platform, Plaid Protect.

The platform helps you fight account takeovers, synthetic identities, and first-party fraud with insights from devices and identity connections across the Plaid Network.

4. Payment initiation

Plaid enables payment initiation directly from bank accounts. This includes both one-time and recurring payment capabilities, as well as pay-ins and payouts.

The platform supports instant pay-ins with Request for Payment (RfP) and intelligent routing across Real-Time Payments (RTP), FedNow, Same Day ACH, and other payment methods.

What are Plaid’s advantages and drawbacks?

Knowing Plaid’s pros and cons can help banks make an informed decision about integrating it into their financial ecosystem.

Plaid’s pros:

-

Has broad coverage,

-

Offers developer-friendly integrations, and

-

Provides high reliability due to robust fraud prevention tools and features.

Plaid’s drawbacks

-

US-centric coverage: Strong in the US, but patchier in Europe and Asia.

-

Enrichment gaps: Still lacks predictive categorisation and subcategories needed for deep personalisation.

-

Developer-first orientation: Great for fintechs and startups, but less tailored for large banks with complex compliance and reporting needs.

-

Limited engagement features: Like Tink, Plaid is connectivity-first, not designed for customer engagement or behaviour-driven insights.

Tink vs. Plaid: What are the main differences regarding data enrichment?

Tink and Plaid both enrich financial data, but their capabilities differ significantly in areas like branding and transaction insights.

Here’s how they compare.

| Aspect | Tink | Plaid |

| Merchant logos and branding | Yes, includes logos and branded names | No, basic names and location only |

| Recurring transaction detection | Built-in with confidence scores | Limited, based on metadata |

| Spend type classification | Yes (fixed vs variable) | No |

| Enrichment detail level | High, with predictive tagging and subcategories | More basic categorisation and metadata |

| Data refresh | Real-time enrichment | Scheduled and on-demand |

Tink offers merchant logos and branded names, built-in recurring transaction detection with confidence scores, and clear classification of spend types, such as fixed versus variable.

Tink also provides high-level enrichment with detailed subcategories, all updated in real time.

Plaid, on the other hand, focuses on simplicity, offering basic merchant details, limited recurring transaction detection, and standard categorisation based on metadata.

Tink vs. Plaid: Which solution should you choose?

Both Tink and Plaid serve as strong data connectivity platforms, but their limitations are clear: Tink is constrained geographically and lacks customer engagement depth, while Plaid provides scale but falls short on enrichment and personalisation. For banks seeking to not just connect data, but convert it into engagement and revenue, Meniga offers the stronger alternative.

Meniga: A solid alternative to Tink and Plaid

Unlike Tink and Plaid, Meniga is not just a connectivity layer. It’s a complete engagement platform designed to help banks turn enriched transaction data into measurable business outcomes.

Our platform is designed for flexibility and scalability, integrating seamlessly with your existing core systems, allowing you to enhance digital channels without overhauling your infrastructure.

No matter how complex your technology environment, we support a fast, efficient, and future-ready digital transformation.

Meniga’s features that make a difference

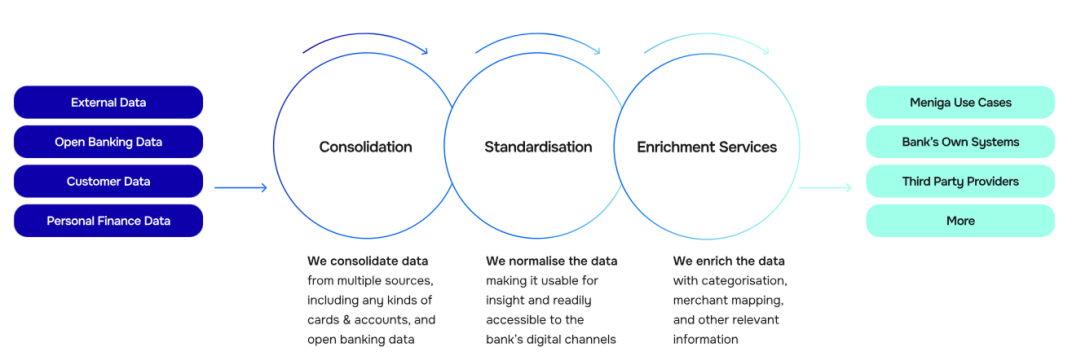

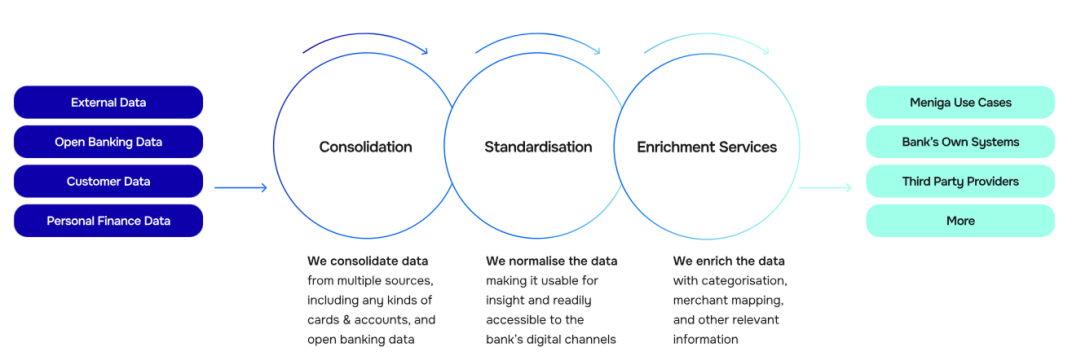

1. Data consolidation and enrichment

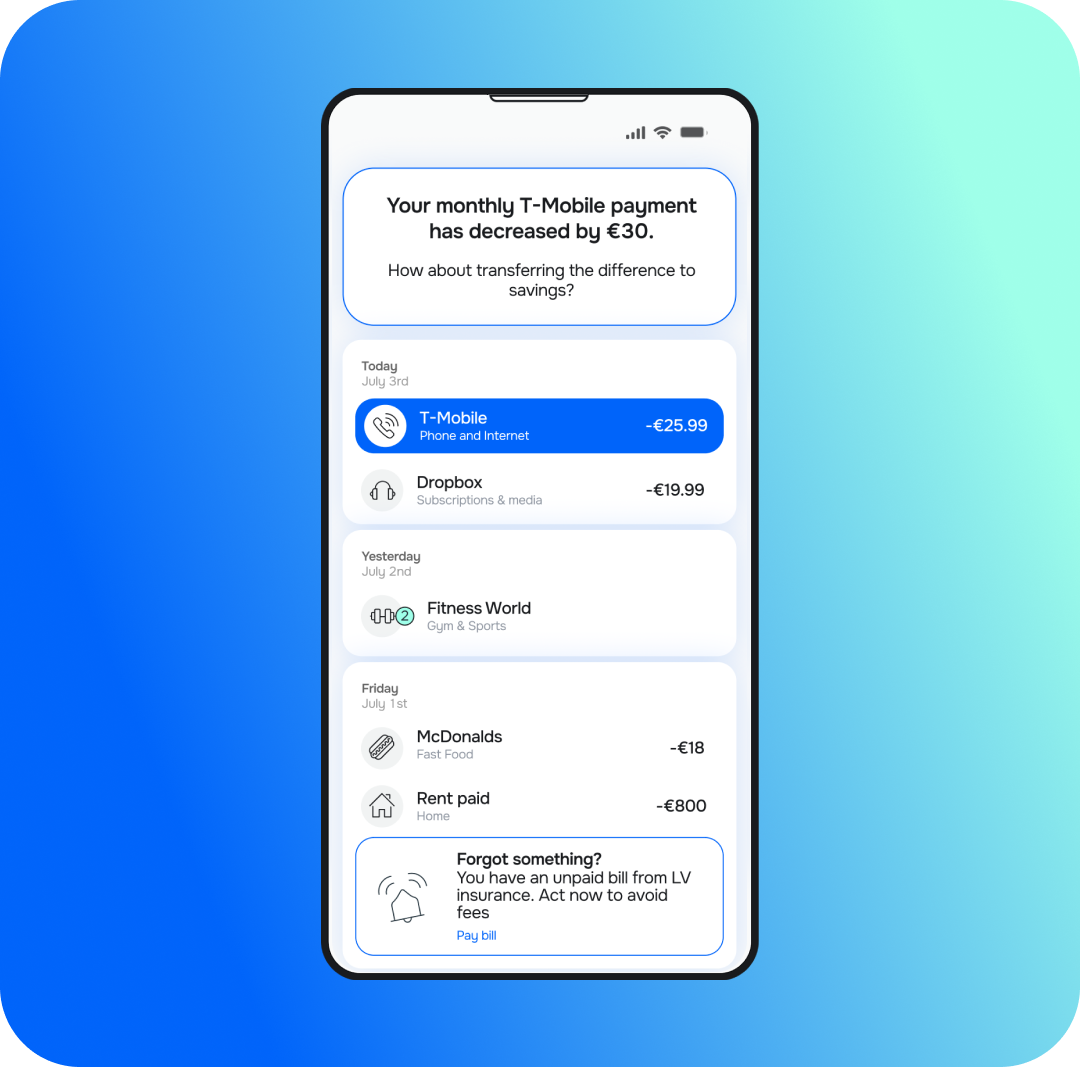

Meniga’s Enrichment Engine aggregates financial data from multiple sources, including open banking feeds, and transforms it into clean, categorised information. Merchant names, logos and recurring payments are added for clarity, giving banks a 360-degree view of customer behaviour.

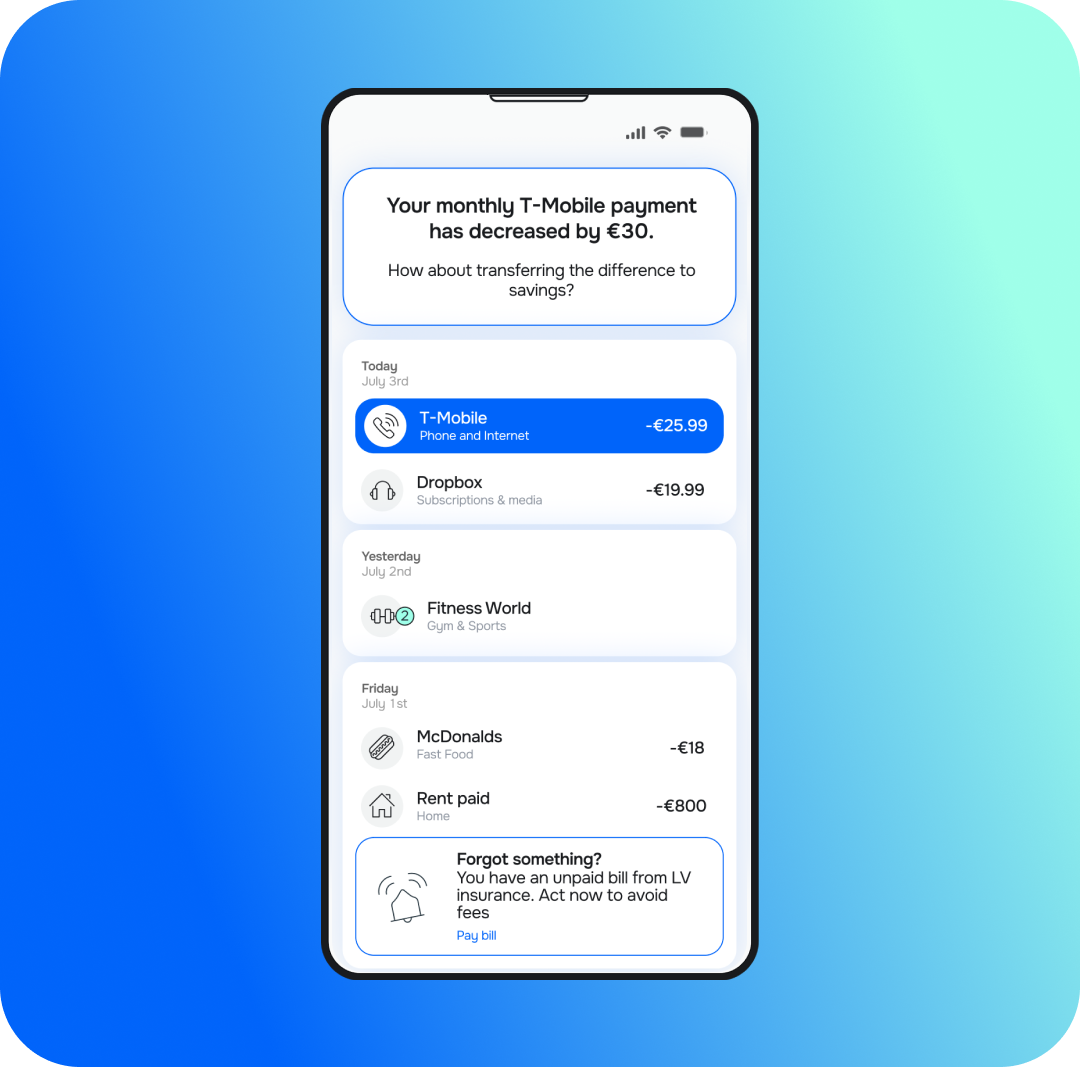

2. Insights Platform

The Hyper-Personalised Insights platform enables banks to deliver highly personalised, timely communication to customers. With integrated micro-segmentation tools, you can analyse customer behaviour in depth and create targeted insights that drive meaningful engagement, strengthen loyalty, and discover new revenue opportunities.

3. Cashflow Forecasting

Meniga’s Cashflow Forecasting provides customers with a clear outlook on their finances by identifying recurring income and expenses and alerting them to potential risks such as overdrafts or missed bills.

With Meniga, you can:

-

Modernise legacy systems and fast-track your digital transformation.

-

Bridge the gap with neobanks by integrating ready-to-use financial wellness tools that enhance customer engagement.

-

Deliver hyper-personalised products and experiences that genuinely meet your customers’ needs, while driving sustainable revenue through smarter digital sales strategies.

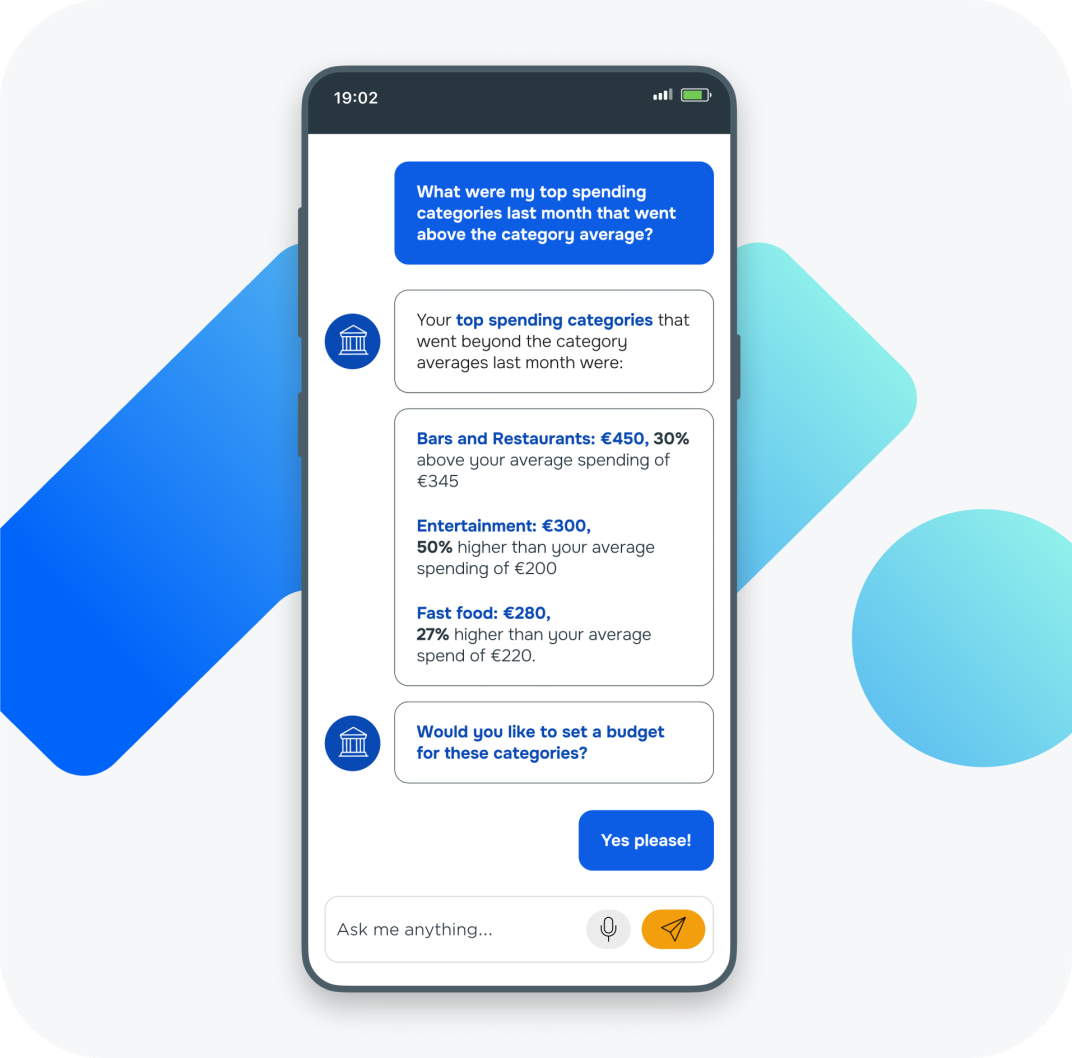

What’s coming next?

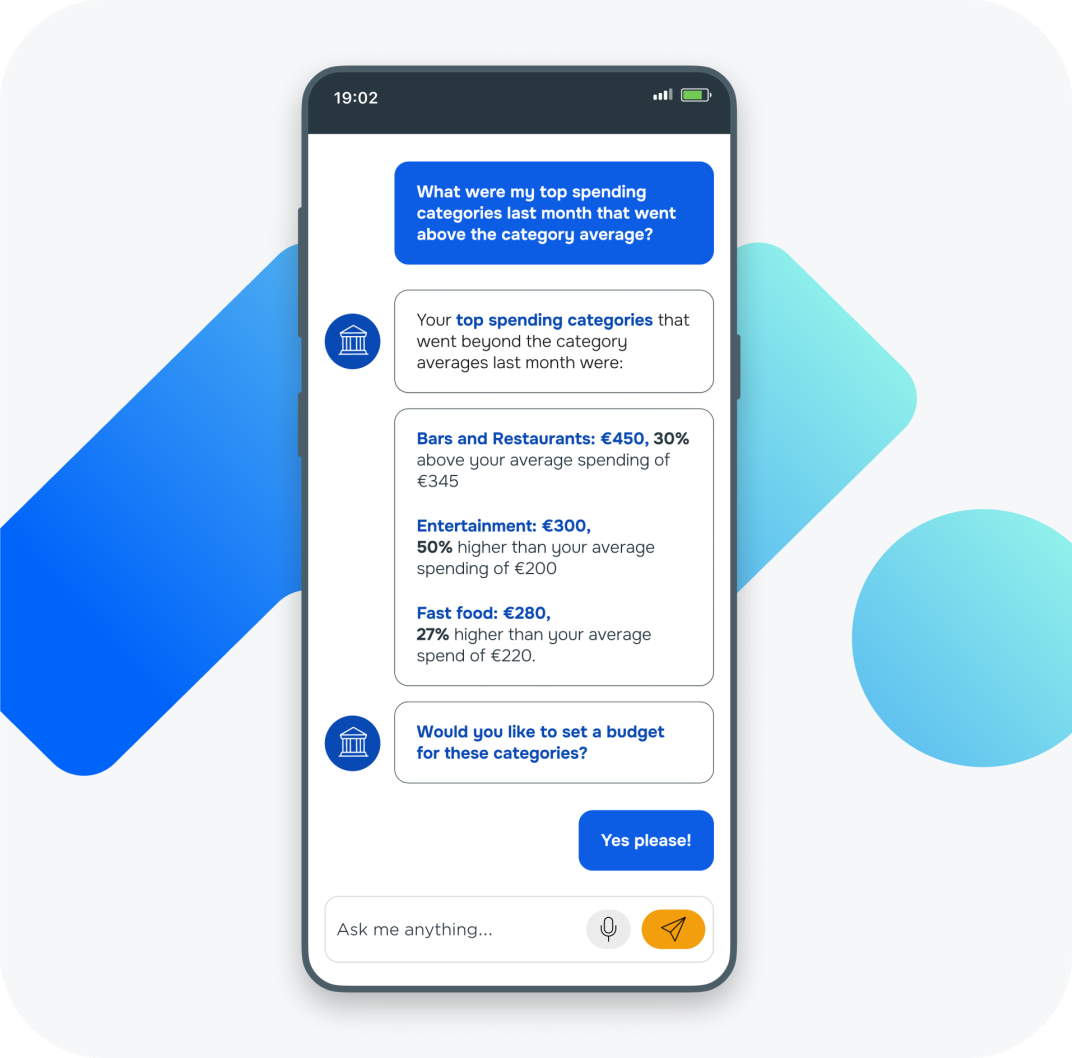

We are developing the Conversational Financial Assistant, an LLM-powered tool that allows customers to ask natural-language questions about savings, spending, and other financial matters, receiving accurate, real-time answers.

Leveraging enriched data and banking-grade security, it provides personalised guidance, reduces support demands, increases engagement, and positions your bank as a trusted, innovative advisor.

Here’s a glimpse of what’s coming.

Enticed to know more?

Contact us today to learn more about how you can transform your digital banking experience with our solutions.