Recently, Business Insider published their Intelligence report “PERSONAL FINANCE MANAGEMENT DISRUPTORS: Here’s what banks can learn from innovative providers reaping ROI from personal finance management tools”.

The report first establishes why PFM offerings from banks have been under-performing both in ROI, as well as value for their end-users. They highlight the need for banks to turn these metrics around and call out Meniga, along with 7 other fintechs, who offer PFM solutions that go above and beyond when it comes to helping people with their financial lives.

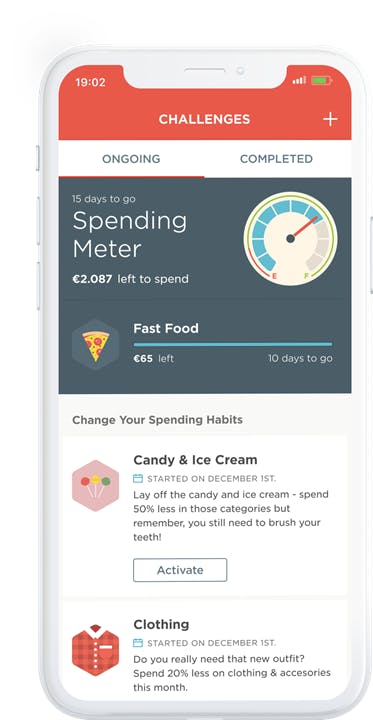

Specifically, Business Insider covers Meniga’s innovative Personal Finance functionality ‘Challenges’ which is designed to help people save in a fun way and drive customer engagement & loyalty for banks.

Meniga Challenges is designed to motivate users by gamifying savings in personal finances. From those who struggle, to the indifferent, to the highly motivated, Challenges work for the entire audience through a series of habit-forming activities. Serving as a prime example for one of the report’s main points of providing meaningful yet simple ways for end-users to interact with their finances.

The report had this to say about Meniga’s Challenges:

“Challenges utilizes gamification to attract people typically unengaged with PFM: Meniga takes inspiration from apps outside financial services that have successfully fostered digital engagement through habit forming loops. These include Facebook, Twitter, and Fitbit.

Contextualizing customers’ financial health goals by linking them directly to daily spending and habits can enable banks to make money management seem like a more relevant and engaging activity.

However, banks should also consider adopting similar KPIs used in the gaming and social media industries (e.g. retention, session time, and session depth) to assess how well their gamification is working.

In the case of Challenges, impact could be measured against metrics like what percentage of consumers who start a challenge complete it, and of those, what percentage start another one.”

The report states that Challenges is a prime example of PFM functionality that really works by helping people save money and drives engagement and loyalty for banks.

“Per Meniga, around 30% of all households in Iceland are signed up to Challenges online and via mobile. The 57% of users who accepted a Challenge in 2019 have shown a 24% uptick in app sessions, and 45% have shown a decrease in time between individual sessions.

People who accepted a Challenge in 2019 have saved, on average, €271 ($296) over the past year, with the largest amount saved by an individual through a Challenge being €3,230 ($3,527).”

These impressive results are especially important considering the Intelligence report makes the case that over the past decade, financial institutions have both promised and launched PFM offerings with little or nothing to show for.

“PFM user share plateaued at between 10% and 12% as of 2017, the most recently available data, per Celent.”

Why has PFM not worked until now?

The reason for the underwhelming results of these PFM offerings boils down to 3 factors: that they merely show financial data without offering any actionable items, the data available is narrow due to limited data sharing, and all-around poor user experience.

This bleak landscape is now being transformed with “a new breed of PFM providers”, whose primary focus is to provide end-users with simple actionable ways to take control of their finances. Using powerful technology, aggregated data, AI analysis, customers are presented with ways to interact with their money in proactive ways.

“Customers are responding to this upgraded version of PFM, and banks need to pay attention or they’ll risk eroding customer engagement and loyalty.

As customers engage with their finances more meaningfully, banks can translate this increased engagement into more revenue.”

The Personal Finance Management Disruptors report provides a thorough deep dive into the pitfalls of antiquated PFM solutions, the true value provided by the innovators, how investing in digital banking is essential for the growth and profitability of banks, and lastly, recommendations on how banks can move forward.

The full report can be purchased here, here are the key takeaways:

There’s ample demand for bank-provided PFM tools, however, suggesting that banks should revisit PFM tools as an essential value proposition. Over 75% of respondents to an RFi survey cited by The Financial Brand said they would prefer to use PFM tools from their primary financial services provider (typically a bank). This compares with just 6% who said they’d prefer PFM tools from fintechs or neobanks.

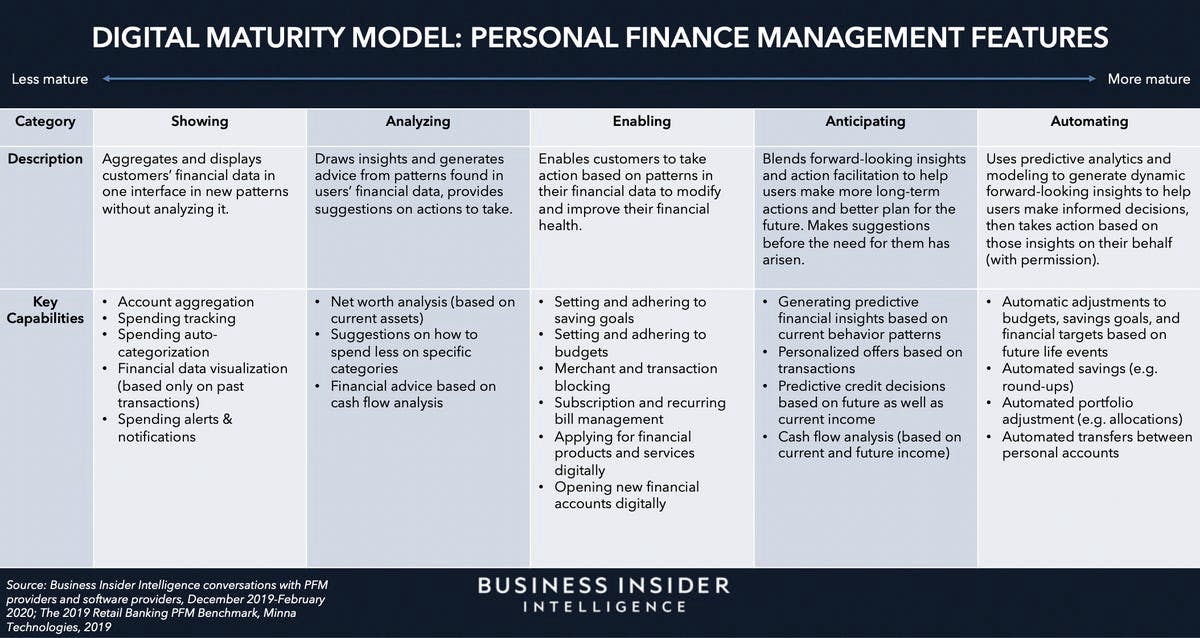

Business Insider Intelligence’s PFM Digital Maturity Model allows PFM providers to identify their offerings’ strengths and areas for improvement. Our model — which was informed by exclusive interviews with leading PFM providers — identifies five distinct stages of PFM feature development and measures the magnitude of value that can be added at each. Banks can use the model to measure their own development as they build out their PFM strategies.

The more that banks can employ highly mature PFM tools, the better they will be able to capture the significant opportunity presented. They can specifically gain ROI on their PFM investments in two key areas:

- Customer retention: 71% of Gen Zers believe brands should “help them achieve personal goals and aspirations,” per PSFK data, so incorporating personalized insights and advice into banks’ PFM products would create substantial customer value.

- Increased customer lifetime value: On average, bank customers who make use of PFM tools are 18% wealthier than those who don’t, per Javelin Research data cited by MX, and they tend to own every major financial product, such as mortgages and car loans, all of which are key bank revenue sources.

About Business Insider

Business Insider is an online platform that offers the latest business, celebrity, and technology news across America. The platform also covers technology, finance, politics, strategy, life, sports, and more. The site also provides and analyzes business news and acts as an aggregator of top news stories from around the web.

Business Insider was founded by Kevin Ryan and Henry Blodget in May 2007 and is based in New York, United States.