Newly launched German bank Consors Bank (CB), born from France-based BNP Paribas’ German personal investment and online trading broker Cortal Consors SA, has entered the growing German retail-banking sector. To secure the type of engagement any new digital proposition requires, CB has rolled out its own financial planner that puts control of consumers’ incoming and outgoing finances at their fingertips.

Across the border in France, sister bank Hello bank! has exceeded all expectations. Their German counterparts posed a key question: ‘How can I manage and grow my money quickly and easily?’ The answer was a new financial platform for Consors Bank customers, powered by Meniga.

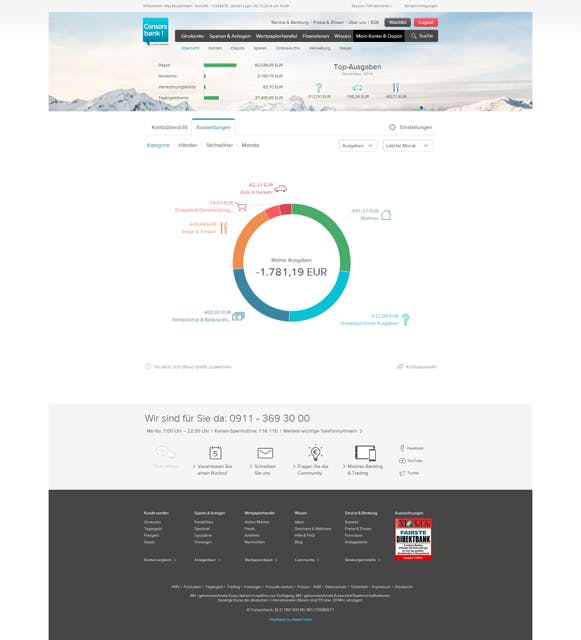

Meniga and Crealogix worked jointly with Consors Bank to create a world-class digital bank where Meniga’s market-leading Personal Finance Management (PFM) Solution was combined with Crealogix’ digital banking portal. The result provides Consors Bank’s customers with a user experience that pushes the boundaries of digital banking engagement.

“If you know how much you spend each month on your car, food or lifestyle, and how much you will have left by the end of the month, it gives you better control over your daily money. But categorizing all transactions manually can be quite tiresome. Thanks to the categorization engine of Meniga, we were able to take away that inconvenient effort from our customers and thus provide the launching pad towards financial independence,” said Clemens Eckstein, senior expert for eBusiness with Consors.

Effortless, accurate automatic categorization at launch is essential to bringing PFM to consumers, and PFM in itself is the engine that enables the engagement this new digital proposition relies on.

The ethos behind Consors Bank is to provide a product that fits the lifestyles of people on the move, and their slogan ‘Mobile, just like you’ perfectly embodies all aspects of the new platform.

This is something that Meniga has been bringing to 25 banks around the world since 2009. The partnership with Consors Bank fits seamlessly within Meniga’s vision of building the future of banking by empowering a smarter consumer.

“Consors Bank is a shining example of a bank that understands that to thrive in a fast-changing world, they must embrace technology, user-centered design and new ways to become a trusted advisor in a much broader sense than most banks are today. It has been extremely rewarding to help realize this vision with Consors Bank,” said Georg Ludviksson, co-founder and CEO of Meniga.

About Meniga:

Meniga is the European market leader of white-label Personal Finance Management (PFM) and next-generation online banking solutions. Meniga’s award winning solution helps multiple retail banks across the world create mutually beneficial digital relationships with their customers by dramatically improving their online and mobile banking user experience through innovative solutions designed to get people to think about and engage with their finances. Meniga believes in a consumer driven data ecosystem where digital engagement is translated into market intelligence and helps optimise spending by offering consumer’s highly targeted contextualised offers (PFM driven marketing).

About Consors Bank:

Cortal Consors is a European broker in personal investing and online trading.

Formed by a merger of French company Cortal and German company Consors, they launched a 2003 rebranding campaign. Cortal Consors is a subsidiary of BNP Paribas’. By 2010, Cortal Consors had more than 1 million customers in three countries (France, Germany and Spain).

Consors Bank is one of the leading direct banks in Europe. Their goal is to be a trusted partner for investments. Offering a diverse product offering, helpful services, useful tools and a strong commitment to innovation.

BNP Paribas — Parent company

High-quality services, building long-term, trusting relationship with the customer, are goals that are firmly anchored in Consors Bank parent group, BNP Paribas’.

Originally published at meniga.com on December 18, 2014.