In a new interview in ComputerWeekly.com Georg Ludviksson CEO of Meniga emphasises that start up founders have to be passionate about their projects in order to be successful. He recounts his journey with Meniga and talks about his enthusiasm for personal finance management.

Read the full interview in ComputerWeekly.com

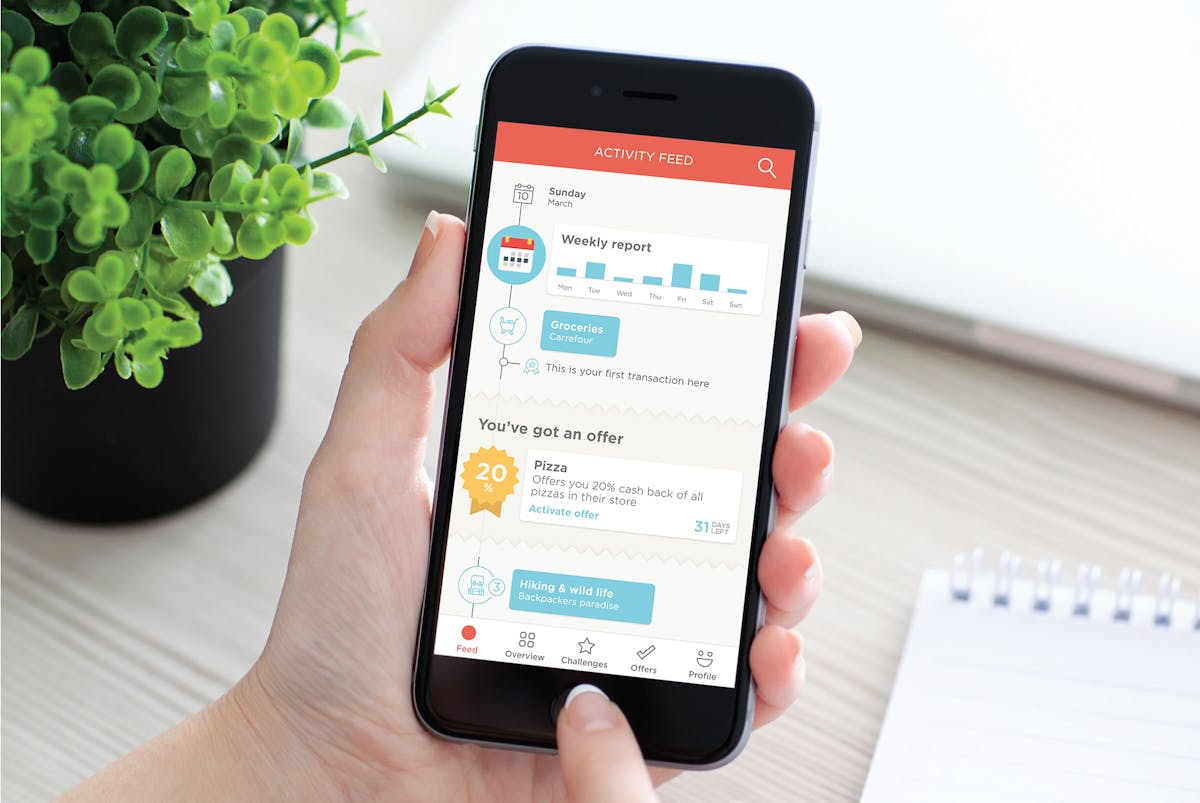

“The key theme is helping the banks evolve from a place you transact such as checking a balance, move money and pay bills into an application which is more like a financial coach.

You can still transact but it is telling you something insightful about your finances.”

Pivoting to business

Georg is a self described ´personal finance nerd´ with a passion for business, sales and marketing. Originally, he was a software developer and Meniga was not his first start up. In the interview with ComputerWeekly.com Georg recounts how his plans was to do a Phd in Machine learning and artificial intelligence but he switched to an MBA at Harvard Business School.

Inspired by helping family and friends

There he discovered a new generation of personal finance tools such as Mint.com. At this time he also began helping friends and family to manage their finances and that helped him exploring ideas in this space. Georg comments: “This was something that really spoke to me as an enthusiast and these tools were similar to some of the thoughts I’d had around helping people to better understand and manage their money.”

Financial crash of 2008 had a silver lining

When the financial crisis hit in 2008, Iceland was particularly affected. So instead of joining a hedge fund he founded Meniga. The crash had a silver lining for start up founders, many great talented software engineers were leaving their banking jobs and were available to join start ups such as Meniga.

Going live for the first time

The first business plan was ready in October 2008 when financial crash was hitting Iceland full force. Georg started working full time there in March 2009. Soon he recruited a CTO who became a technical co-founder. “In the Spring of 2009 we started building the original solution,” said Ludvikson. Success followed soon with the first bank, going live with a Meniga personal financial management solution linked to its online bank. The was the Icelandic bank Íslandsbanki.

“Once we had some initial success and been live with the bank for a few months we received €700,000 seed funding in April 2010 which we used to pay ourselves salaries,” recounts Georg. “We bootstrapped for the first year but we used revenue from this first contract to hire more staff and then got a third co-founder,” he added.

First Iceland, then the world

Icelandic expansion continued and Meniga signed up with two of the major banks before expanding internationally. “We decided everything would be international and used English as the corporate language. Iceland is a good place to start but it you want to grow you have to move overseas.”

Sales operation were set up in Sweden and Meniga´s product was sold to several medium sized banks in Scandinavia.

2013 was a pivotal year

In 2012 Meniga had 20 people working for them in Sweden and 15 in Icelanda and new customers were signed in Sweden, Germany, Poland, Spain and Finland. 2013 was a pivotal year for Meniga. The company got €6m in funding, grew to 85 employees and relocated its headquarters to London from Stockholm.

“In 2013 we decided London was a much better place for the sales team than Stockholm,” said Georg and cites such factors as access to sales talent, transport links and a large domestic market.

Building better banking experiences

As mentioned before, Meniga´s first customer was Íslandsbanki which partnered with Meniga to offer its customers a standalone personal financial management tool. Fast forward to 2019 and Meniga now offers a comprehensive platform which provides the building blocks for a digital bank. This enables bank to offer their customers the best in personal financial management.

The focus is clear. As Georg notes in the interview: “The key theme is helping the banks evolve from a place you transact such as checking a balance, move money and pay bills into an application which is more like a financial coach. You can still transact but it is telling you something insightful about your finances.”

Moving to the cloud

Banks integrate Meniga´s software which can be hosted in the cloud or on premise. Georg has noticed a clear trend for banks to host software in the cloud. “Many of the banks we worked with were reluctant to have the software in the cloud but this is now changing and many of our projects now are cloud based.

Computer Weekly provides the latest news and analysis through its website and 200,000-subscriber weekly digital magazine, as well as award-winning and exclusive premium content; a dedicated monthly magazine for European IT leaders; independent research studies; and the CW500 Club’s exclusive networking events for senior IT managers.

From being the world’s first weekly IT newspaper in 1966, to today’s multi-platform digital publication, Computer Weekly continues to reach millions of IT decision-makers in the UK, Europe and the rest of the world.