For many people and businesses, it has been a difficult year both economically and emotionally but by sticking together, focusing on solutions and continuing to support one another, the world is on track to clear this hurdle and transition from this period of turmoil into one of growth, opportunity and prosperity.

Reflections from 2020

For us at Meniga, we feel fortunate to be in a digital business and have emerged unscathed from the pandemic. It has of course been a year of uncertainty and changes, and just like so many other companies, we had to adapt quickly and implemented several precautionary measures to make sure we would emerge strong from this period. Overall, however, our business has proven resilient as the pandemic has made digital banking more important than ever before and our personal finance solutions are in many ways even more relevant in uncertain times when people and businesses worry about their future prospects.

Digital Banking and Personal Finance has never been more important

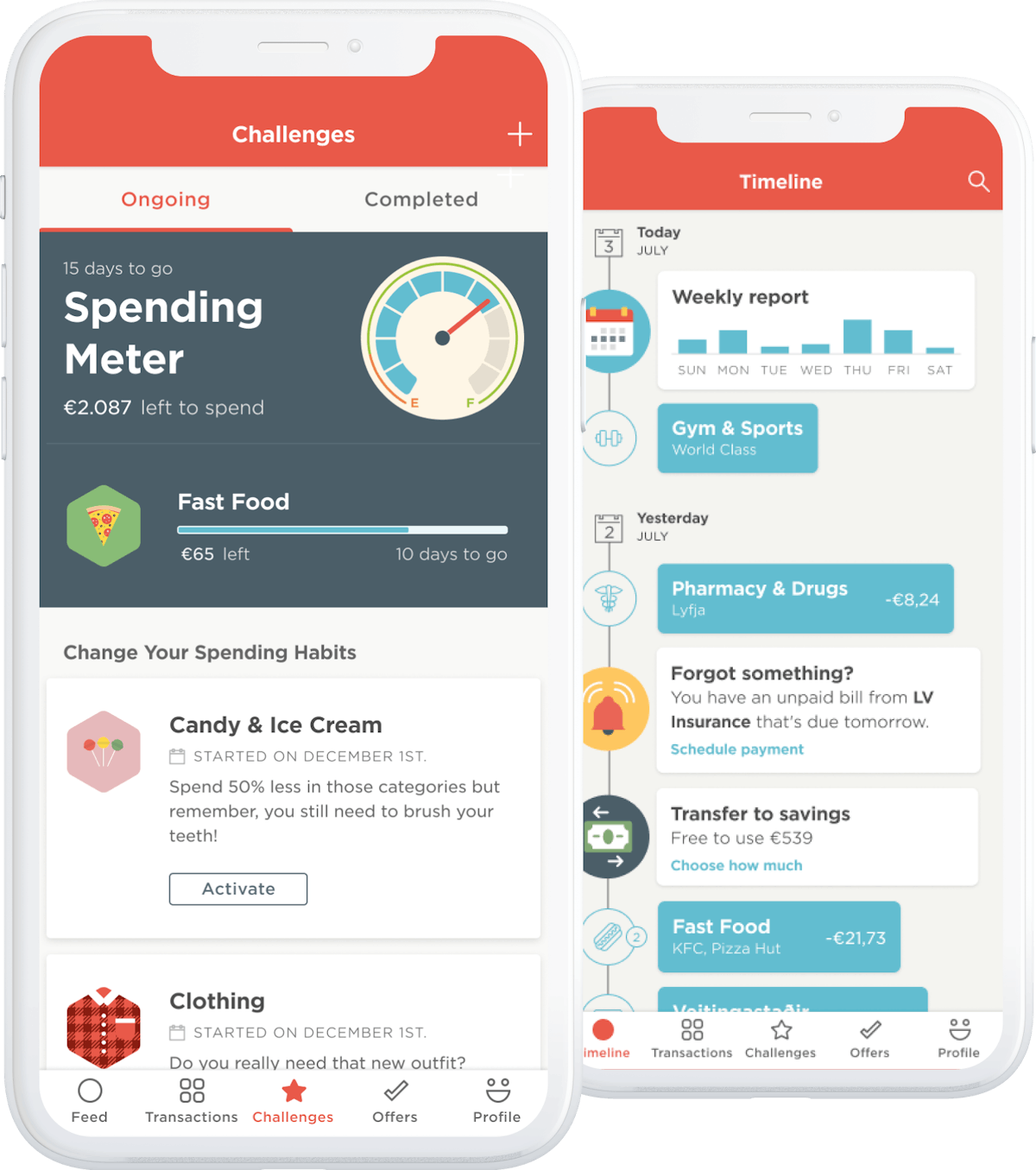

We have seen widespread acceleration of digital banking adoption this year, resulting in higher demand for our products and services. In April, for example, we witnessed an up to fivefold increase in the usage of some of the personal finance functionality we power, with many new users doing budgeting or other simple financial planning for the first time.

Furthermore, as people have become more reliant on their bank for financial support and guidance, we have noticed that banks have increasingly turned to third-party technology providers like Meniga to help them cater to the evolving needs of their customers. For that reason, 2020 has actually been the busiest year we have ever had. Since the onset of Covid-19, there have been 18 successful launches of our digital banking solutions across 17 countries. That’s by far the most we have ever had in one year.

Supporting our customers

Our priority is always to support our bank partners and their customers, and we’re extremely proud to have helped a number of banks innovate in their digital channels, drive customer engagement and earn the loyalty of their customers, thanks to our data-driven personal finance and digital banking solutions. In particular, we’re delighted to have helped UOB launch its digital bank TMRW in its second market, Indonesia; to have supported UniCredit in the launch of its Smart mobile banking app in several countries across Europe; to have assisted Swedbank in the launch of its brand new digital banking solution in its home markets of Sweden, Latvia, Lithuania and Estonia; and to go live with personalized Cashback Rewards in Nordea´s mobile banking app in Sweden. It is also a pleasure to welcome some new partners, including Nexi, Worldline and Five Degrees, and to have started working together on some exciting new digital banking innovations.

It’s definitely been a busy and challenging year, but I think it’s fair to say we’ve managed to demonstrate to our customers just how valuable a partner we can be, and especially now in the most turbulent of times.

We are expanding

In addition to acquiring new partners and customers, and developing and distributing digital banking and personal finance solutions to an even greater number of people across the globe, 2020 has also been a year of growth and expansion for Meniga.

Early in the year, we moved into a new office in Warsaw to accommodate for the doubling of the number of employees there. We also expanded to the US for the first time and welcomed new team members there. While the bulk of our business is in Europe we see demand for our solutions in all regions.

Innovation milestones

Innovation is a big part of our DNA and it’s always gratifying to see our products and services get recognized. In February, we successfully registered as an Account Information Service Provider by the Financial Conduct Authority (FCA) in the UK, which has helped expand our personal finance solutions to customers beyond the financial services sector and enabled us to provide additional, regulated products and services. This was an important milestone, and a significant step in our journey to be a global, one-stop-shop with seamless open banking support and connectivity in all of our solutions.

Our Cashback Rewards platform, which is today the largest transaction-driven marketing platform in the Nordics, was selected as one of the best technologies of its kind in 2020 by CardLinx, the globally leading non-profit card-linked offers & cashback association.

We’re also proud to have been awarded the IT company of the year by the esteemed Icelandic Computer Society (ICS). These awards are a testament to how hard our teams have been working behind the scenes to ensure we continually meet and exceed expectations by delivering outstanding innovations and products.

Banks are going green

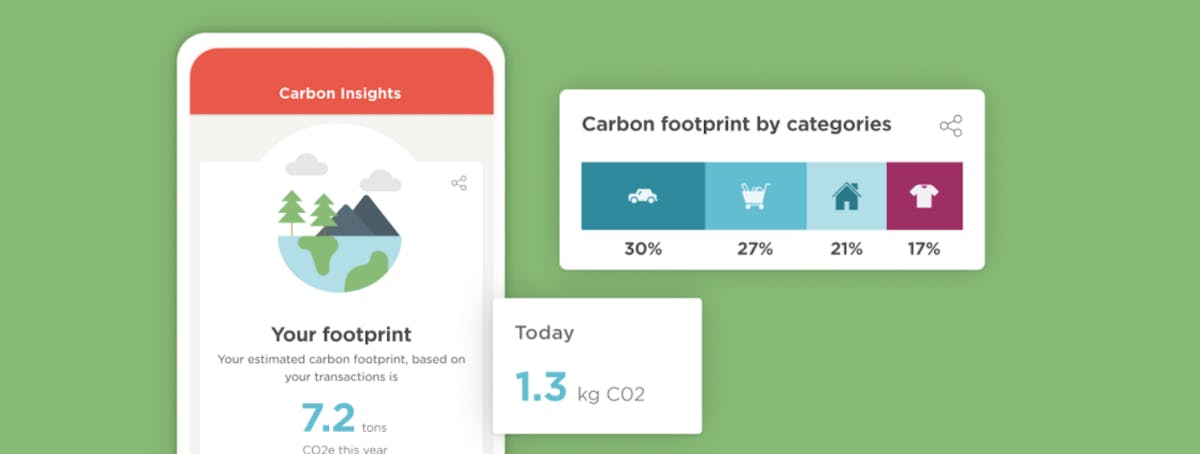

In 2021, we will of course be working around the clock to perfect and improve our existing products and services, and roll out additional solutions, including our new and innovative solution: Carbon Insights.

As people around the world are becoming increasingly concerned about climate change, more and more banks are looking at incorporating sustainability into their services, and be more appealing to this new generation of carbon-conscious consumers. Our Carbon Insights product allows digital banking users to reliable estimate and understand their carbon footprint in a holistic way from their transaction data. In turn, banks can supercharge their CSR strategy whilst unlocking new dimensions of customer engagement, by providing users with an understanding of their total carbon footprint, and empowering them to take high-impact action to offset it or build more sustainable habits. I’m pleased to share that we see massive interest in this new product from many banks around the world and will be going live with it with many banks in 2021. ‘Green banking’ is already making waves in the fintech and banking sector and it will really take off in 2021 with many projects in the works.

We’re backed by strong partners and investors

As strategic innovation partners to many of the world’s leading banks, we have invited a number of them to invest in Meniga to further strengthen the relationship. In 2020, we announced an €8.5m million funding round and welcomed new strategic investors in Groupe BPCE in France and Grupo Crédito Agrícola in Portugal with participation from existing investors. The funding allows us to grow faster and ensures a strong balance sheet, which is essential in turbulent times.

Outlook for 2021

As we approach the new year, I want to highlight two trends I expect to become more pronounced in 2021 and beyond.

Digital Banking will become smarter and more focused on financial wellness

Meniga was founded on a vision that, to stay relevant and close to their customers, banks would have to transform their digital banks from a place to transact and conduct banking into more of a virtual financial advisor or financial coach for its users. The need to help people understand and manage their money becomes much clearer during recessions and times of uncertainty like we have seen after the pandemic hit the world. Accordingly, supporting their customers is much higher on banks’ agendas than before and we have many exciting projects in the works to this effect that we look forward to unveiling in 2021, including our ‘Smart Money Rules’ product, which helps people automate savings in an easy and seamless manner.

What the pandemic has taught us is the importance of having the necessary tools in place to guide your customers through the difficult times, and the players that have managed to do so are the front-runners in the post-Covid landscape. Banks, fintechs, and even Big Tech generally understand the necessity of including financial wellness into their core offering, and we will see an increase of personal finance empowerment in the years ahead.

Digital banking will become much greener

I also believe 2021 will be the year with purpose and environmental awareness in banking will be high on the agenda. The pandemic has made it clearer than ever that we are all in the same boat when it comes to fighting the global challenges shared by all humanity. The pandemic will subside in 2021 but environmental challenges will not and people are increasingly aware of the social and environmental impact of their consumption. More and more people are looking for ways to make their lifestyle and consumption sustainable. It’s obvious to me that banks should play an important role in fighting climate change and enabling sustainable consumptions, by helping their customers better understand the impact of their consumptions and by making it easy to take action, such as offsetting their carbon footprint (which is much cheaper than most people realize). Meniga’s solutions have taken on a whole new environmental dimension and we can’t wait to launch this new and exciting part of our offering in several countries in 2021, and to continue to help banks make their digital banking solutions more impactful and meaningful for their customers in the process.

As we exit 2020, we leave behind all the obstacles and set-backs associated with the pandemic, and instead look forward to a year of growth and prosperity.

From everyone here at Meniga, we would like to wish you good fortune in 2021, and hope you will have a happy and relaxing holiday season.