Happy new apps and a merry new Meniga web!

This year we went live with the 3rd generation of our user experience built on top of our shiny new rest API. Meniga has been in the business of helping people manage their financial life for over 8 years now and we have learn’t quite a lot. We predominantly work with banks all over the world, but in Iceland, where the company was founded, we have our own consumer facing approach. This is where we innovate and validate new concepts before we roll them into our official product line.

Iceland is a fantastic place to develop the future of online banking. We are a small nation that want’s to be big (334,252 people). Our banks have a shared digital platform and we have been doing multi-bank finance applications from the get go. 98% of transactions in Iceland are card based, we all have the latest phones and rank quite high for computer literacy. Last but not least, we have a pretty bad track record of managing our money ;)

During the last couple of years, our innovation focus at Meniga has shifted towards providing insight through personalisation, encourage people to improve their financial habits and provide tangible rewards in the form of cash back. You can read more about meaningful engagement here, here and here.

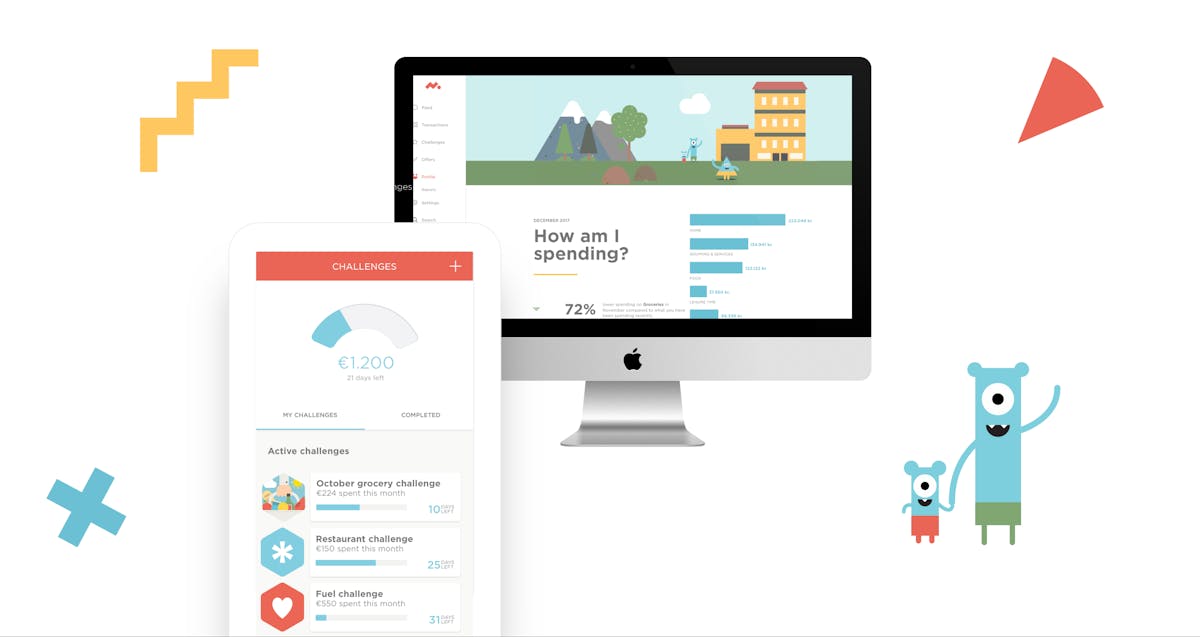

Armed with this vision we set out to build a new generation of mobile apps and a web application on top of our already proven technology platform.

Designed for engagement

We took a step back and revisited the information architecture from scratch with the aim to simplify it and make it applicable for banks of the future.

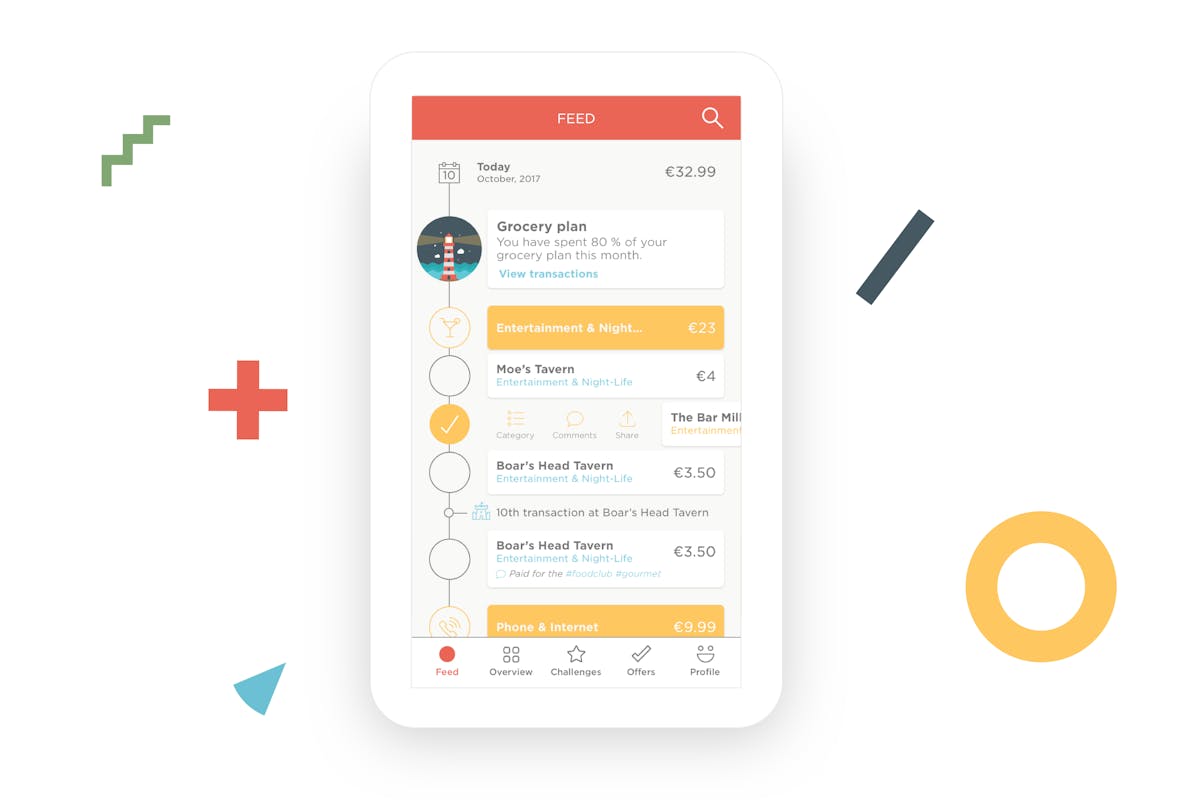

Our activity feed is still at the heart of what we do. A personalised view of your transactions (that make up your life) and enriched user events relevant to your spending and activity. We changed the way we group things and improved on the design we have had live for the last couple of years.

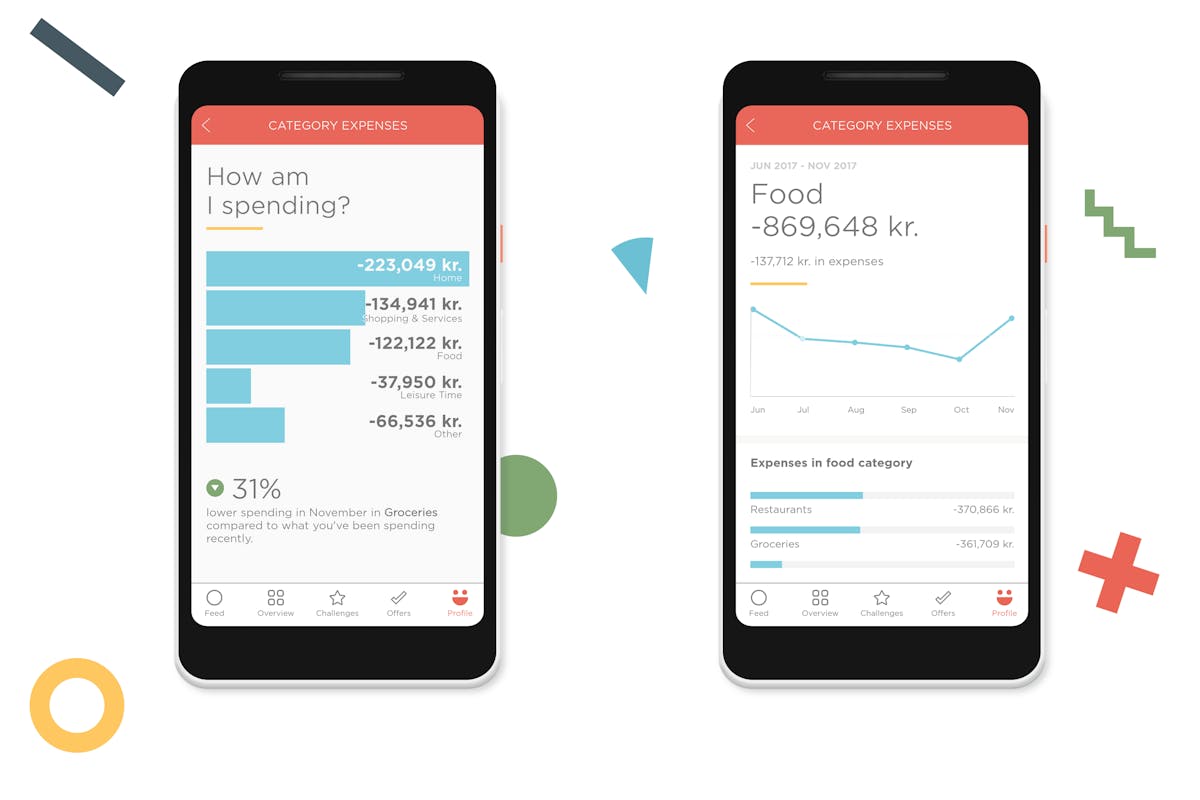

The transaction detail screen got some extra attention as we have learnt that more than a third of our monthly active user base now get’s insight about their spending by clicking on transactions. This is one of our unique offering and we have not seen any bank deliver the richness of transactions the way we do. Now you can see how much you spend at a merchant or in a category moments after you swipe your card. From that screen you can also drill down and inspect your expenses at similar merchants and spending in the category over time.

For the first step in our vision, the insights part, we also designed a new profile screen; your financial profile. It is designed more like an infographic with many of the most popular overview reports in our old apps. It is a simple on the surface interface but rich when you start navigating through.

We know that insight is the key for many people to better manage their finances. We have for example worked with scientists to develop insight from anonymised user data and found that people who track their spending actively save on average €2 per login (mostly on delayed fees) compared to the group that signs up and does not use the apps.

The next step was to find a way to motivate people to improve their habits. We implemented Challenges as a way to focus on one area of spending for a short amount of time. In some aspects inspired by the health and fitness apps out there like Fitbit 10.000 steps and Strava goals and challenges. There are so many similarities between getting financially and physically fit but not many fintech apps have gone there.

Last but not least we have our card linked offers up front and centre. Offering 20%–30% deep personalised discounts and cashback repayment every month.

So far so good

Early signs are in and we have more than doubled our daily active numbers, increased screen views by 80% and roughly 30% of our weekly active users have accepted one or more challenges.

We are now at a place where the technology stack is clean and fresh from top to bottom and our innovation teams are at a place where we can deliver and validate our concepts at a much faster pace. I am very excited about what 2018 will bring and look forward to working with the good people in Iceland to help the world get a better grip on their financial lives.

Have a good one!