London, March 2018

We are proud to announce that Meniga has been selected as ‘Best of Show’ winner at this year’s Finovate in London — Europe’s leading Fintech event. Each year Finovate Europe brings together over a thousand financial services professionals, investors and fintech enthusiasts to celebrate the cream of the crop in the fintech world. This year’s event took place during 6–9 March at the ExCel in London.

This is Meniga’s fourth win at Finovate in eight years, taking home the famous glass trophy in 2011, 2013, 2015 and now in 2018 — making Meniga one of the most successful companies at Finovate since it’s founding.

In front of a full house the ExCel in London chief Product Owner Finnur Magnússon and Senior iOS Developer Haukur Ísfeld introduced our latest personal finance innovation, ‘Richest Transactions’ — a new way for banks to drive customer engagement by providing insights in the context of everyday banking.

The innovation encourages banks to branch out from the familiar digital banking customer experience by enriching transactions and utilising previous banking ‘dead-ends’ such the transaction screen to put insights at customers’ fingertips.

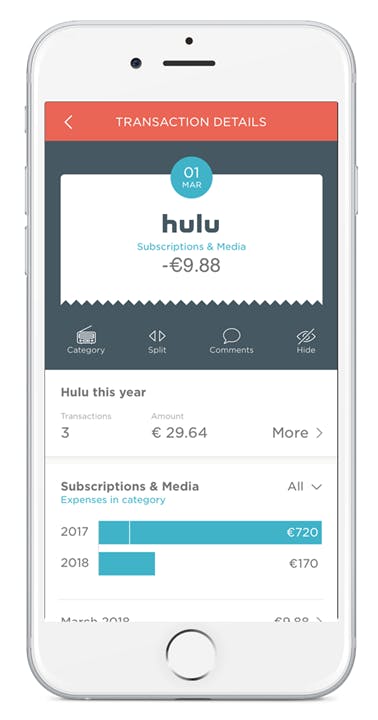

Three years ago we introduced the transaction detail screen, which provides a clear overview of expenses by category and by merchant when clicking a transaction. We created a new destination and habit for people to learn about their spending.

It quickly became one of our most popular personal finance features — increasing the number of users clicking on a transaction from 3% to 45%. This year we decided to take the concept to a new level.

With Open Banking upon us, it has never been more important for banks to defend their position as the go-to provider of financial services and engage more meaningfully with customers. That’s why Meniga is encouraging banks to go back to basics and re-think one of their most valuable and potentially most neglected asset — ‘the transaction’.

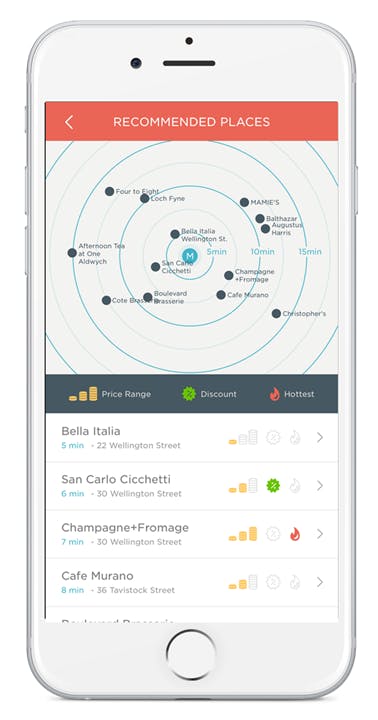

During the Finovate presentation, Meniga demonstrated how banks can use third party data, such as merchant directories and open API connectors, to deliver insightful advice and actionable content — for instance restaurant recommendations based on where people similar to them like to eat— by simply clicking on a transaction.

Finnur Magnússon, Chief Product Owner at Meniga said: “We believe that banks have been ignoring their most valuable data — the transaction. Spotify has music, Netflix has films, Instagram has photos and Banks have transactions. They shouldn’t think of transactions as boring lines of text and code but as a story of people’s lives full of interesting insights. Helping banking customers understand their financial lives by enriching transactions has the potential to really strengthen the relationship.

While many banks are continuously adding new features clustering their online & mobile banking services, Meniga’s approach to customer engagement is creating a seamless user experience by providing content in context - driving meaningful customer engagement.

Thank you everyone for voting for us!

Want to know more about our products and services? Request a Demo!