The rise of ride-hailing and how it impacts the finances of the riders

Banks are increasingly using intelligent apps to engage with their customers based on behavioural patterns and financial habits. In this article, we look at the implications of some aspects of the sharing economy from the money management perspective.

Financial habits and behaviours are continuously evolving

Any attempt to help people to manage their finances should start with an understanding of their financial and spending habits. This is increasingly complicated, with the everyday spending and income patterns constantly evolving. We are changing our behaviours to adapt to the changes in the world around us and this is immediately reflected in our finances. What has been obvious a few years ago might no longer make sense, and what was a niche or non-existent might have profound effects now or near future. A great example is the rise of the ride-hailing.

Take the picture at the top — a familiar sign — to some extent. But also, an outdated one, for two major factors. First, the venerable Crown Victoria from Ford is no longer on the market. Ford ceased the manufacturing of this V8-powered gas guzzler in 2012 and nowadays you are more likely to get a ride in a yellow Prius than the oversized sedan once synonymous with taxi (or police cruiser). But more interestingly, you are increasingly less likely to use a taxi. That is the second factor here.

The rise of the ride-hailing apps

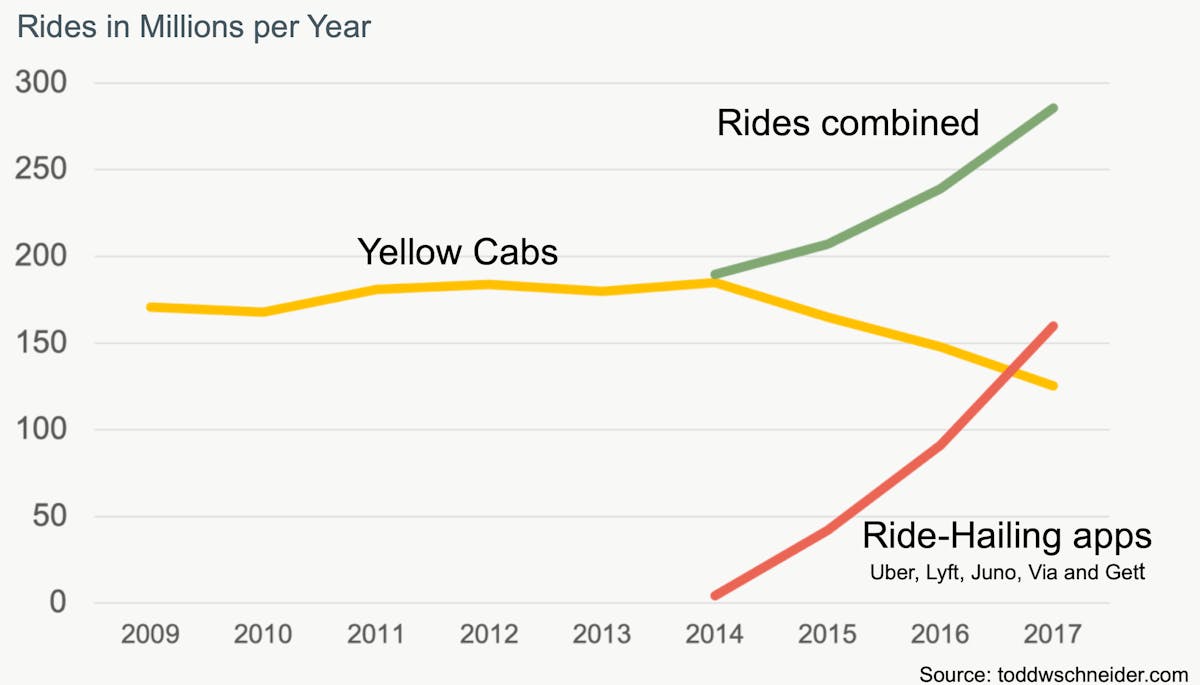

With the advent of ride-hailing apps, the options for consumers are virtually limitless. Interestingly, it is not a simple competition with traditional taxis — data shows that the overall number of rides has increased steeply since Uber, Lyft and others started competing with the yellow cabs.

Take the example of New York City. At the advent of ride-hailing in 2014, there were almost 180 million taxi rides and only 4.5 million rides with Uber and other ride-hailing apps. In 2017, ride-hailing apps got to whopping 160 million rides — but it didn’t happen exclusively at the expense of yellow cabs. Rides with traditional yellow cabs did decline, but with yellow cabs getting around 125 million rides in 2017, it is clear that the overall market increased — at least in terms of the number of transactions.

Upending transit around the world

This change is not limited to New York City or to the US. In 2017, the ride-hailing segment worldwide had more than 380 million active users — and this number is expected to double within the next 6 years. It is safe to assume that in many countries, a significant number of customers is using those apps — which means that many banking customers are doing it, too.

Why should banks care about ride-hailing apps?

So how is this relevant from the financial management point of view and how can financial institutions be more active in this area? What used to have been a single type of spending ‘Taxis’, now has become many. In order to understand it better, it is becoming more and more vital to be able to quickly understand every movement on the current account or the card. Having merchant information — whether it is Uber, Lyft, Juno, Via or Gett — or the old-fashioned Radio Taxi Group — helps.

Also, having a category that groups all of these services make it easier to understand the big picture Once it’s done (and it should happen automatically), it becomes much easier to provide an instant overview, the ability to search and filter with a specific type of financial activity, track overall spending and more.

Putting understanding of financial habits and behaviour at the centre of our development

At Meniga, we put understanding everyday life spending and income at the centre of our development. Being able to instantly categorise transaction and detect every merchant is a key component of our Digital Banking platform. Regardless whether you are in love with London’s black cabs, Uber or Lyft, we enable banks to make it easy for the customer to know what is happening and how it fits the bigger picture, so people are never lost when it comes to controlling their financial life.

Finding new customer segments and developing new product offerings

There are other dimensions to this as well. Not only can banks use enriched transaction data to help their customers track their spending. They can also use it to find new customer segments. People who use ride-hailing apps instead of the traditional cab could be a relevant customer segment. For example, they might be likely to be tech-savvy and open to using new banking apps or services.

A bank could discover a sizeable segment of city dwellers that have replaced car ownership for ride-hailing apps. That may have obvious implications for insurance sales or car financing products. On the other hand, if people are saving money this way, it can open up new possibilities for saving products. That is why it is vital that banks keep a close eye on changing customer behaviours and habits.

More information on www.meniga.com