This past year, fintechs and VCs alike have had to adjust how they do business as they navigate their way through the pandemic. Paying tribute to the enterprising Fintech founders and venture capitalists, UOB titled their recent report Get up, Reset, Go!

The ASEAN market, with its unique characteristics, has created an environment ideal for fintechs providing solutions for digital banks that can service the ever-growing population of the mobile-ready unbanked. And if there was any doubt in the trajectory of digital banks, the onset of the pandemic has all but certified that digital banks are the only way forward.

COVID-19 has accelerated the digital economy, creating numerous opportunities for FinTech firms across ASEAN. With an estimated 50 per cent of the ASEAN-6 population unbanked, and an additional 24 per cent underbanked, the market opportunity is huge.

Covering the broad scope of the fintechs space, from expounding on the current state of affairs, all the way to detailing the strategies for both VCs and fintechs, the report divides their findings into 3 parts:

- Get up — Investment strategies and plays that occurred this past year. While overall deals and funding numbers are down, green shoots of recovery are emerging.

- Reset — Impact of the pandemic on FinTech firms and their outlook on the future.

- Go — Developments in ASEAN’s FinTech industry and what the future is shaping up to be.

In order to conduct their research, UOB interviewed some of the most Powerful VCs operating in ASEAN including Herston Elton Powers, Do Ventures and UOBVM to name a few.

To cover the fintechs, UOB spoke with the companies making the biggest splash in ASEAN and Meniga is honored to be 1 of the 8 fintechs to take part.

The report provided 8 key findings for the fintech space:

- The pandemic aided FinTech firms’ business growth and customer acquisition, while their cash flow and profitability were hardest hit

- Pandemic benefactors — Payments, AI and Data Analytics, as well as Cybersecurity FinTech firms

- Early-stage fundraising perceived to be more negatively impacted by COVID-19 versus late-stage fundraising

- Two in three FinTech firms said COVID-19 would have a neutral or positive impact on their future fundraising plans

- 86 per cent of younger FinTech firms (< two years) prefer equity financing

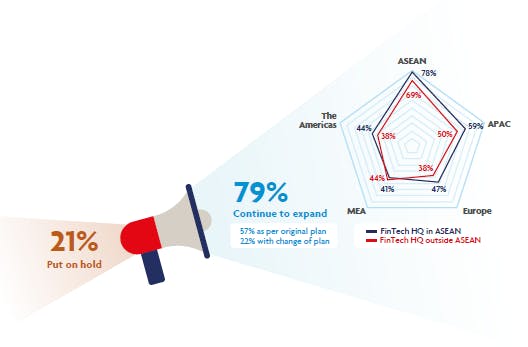

- Four in five FinTech firms will continue to expand despite COVID-19

- 87 per cent of FinTech firms say they are on track to make their businesses future-ready post-pandemic

These findings ring true for a company like Meniga, whose main purpose is to enable banks to help their customers through the hard times and into the good times through a fully equipped digital bank.

Another proven statement is that the quickest way to innovation is through partnerships…where banks can work with fintechs and leverage their ability to provide cutting edge technology that fits perfectly within their framework.

UOB and Meniga have worked together in just such a manner for their digital banking app TMRW, which has launched in Singapore, Indonesia and Thailand.

Get up, Reset Go! has provided an in-depth look into one of the most powerful and up and coming markets for the fintech space. It provides insider insight on fundraising, the most powerful market out of the ASEAN 6, the specific types of financial technology racing for first place and how fintechs have managed to survive one of the most challenging years in recent history.

Find the entire report, Get up, Reset, Go! here.