Meniga’s Carbon Insight enables Íslandsbanki’s mobile banking app users to track their carbon footprint. As part of the agreement, Íslandsbanki will integrate the Carbon Insight solution into its digital banking offering, which will help drive customer engagement, boost loyalty and create a more robust environmental, social, and governance (ESG) strategy. As seen on Forbes!

Meniga’s Carbon Insight solution will provide Íslandsbanki customers with:

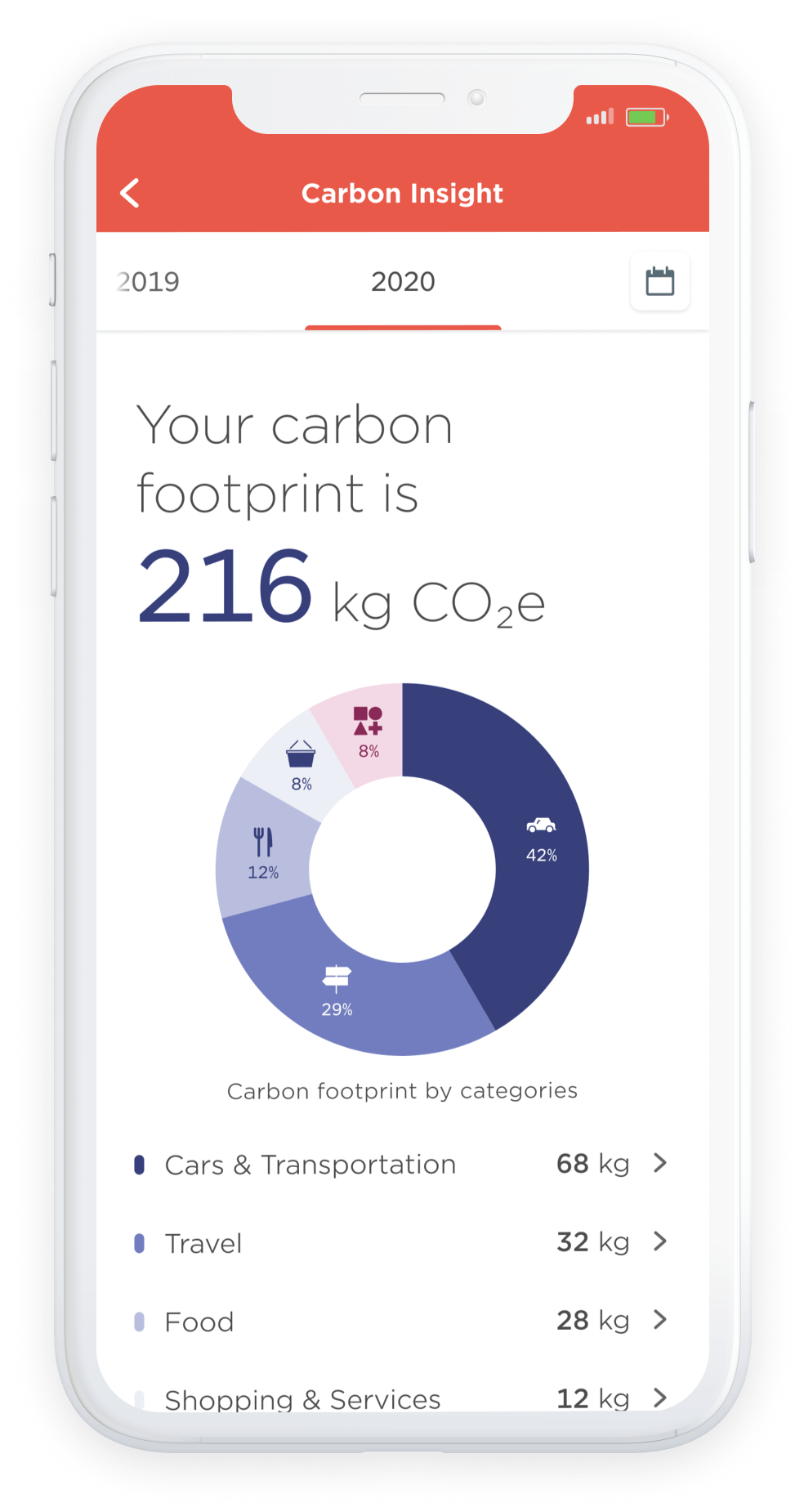

- An estimate of their overall carbon footprint based on their spending profile, broken down into spending categories and time periods

- A broad understanding of the specific aspects of their spending that are the most detrimental to the environment

- The necessary information and knowledge to alter their spending behaviour, boost their personal savings, and crucially, help save the planet

As worldwide anxiety around climate change continues to grow, many banks are recognising the unique opportunity they have to serve the needs of the rapidly growing segment of carbon-conscious consumers. A recent survey conducted by Meniga revealed that 80% of consumers experiencing its technology now want to use their banking apps to help them estimate their carbon footprint.

“With more and more people around the world growing anxious about the consequences of climate change, the need for solutions and initiatives that empower people to take action to help protect our planet has become a business imperative.

As custodians of our personal finance data, banks are in a unique position to play a key role in helping the rapidly growing movement of carbon conscious consumers make informed choices in their daily consumption.

We have seen great enthusiasm for our Carbon Insight product over the past few months, from banks and other key financial players, which is an encouraging sign from our industry that more green initiatives are still to come.

For our part, we’re extremely proud to be leading, alongside Íslandsbanki, in the green banking movement and the industry’s fight against climate change.”

“Consumers are increasingly interested in improving their carbon footprint and having a positive impact on the environment.

Meniga’s Carbon Insight solution will enable Islandsbanki’s customers to estimate the carbon footprint of their private consumption, identify carbon intensive purchases and ultimately reduce their carbon footprint while saving money at the same time.”

About Carbon Insight

Carbon Insight is Meniga’s inaugural green banking solution, which allows users to estimate and track the carbon footprint that stems from their spending, empowering them to take high-impact action, whilst enabling banks to unlock new dimensions of customer engagement and create a more robust ESG strategy.

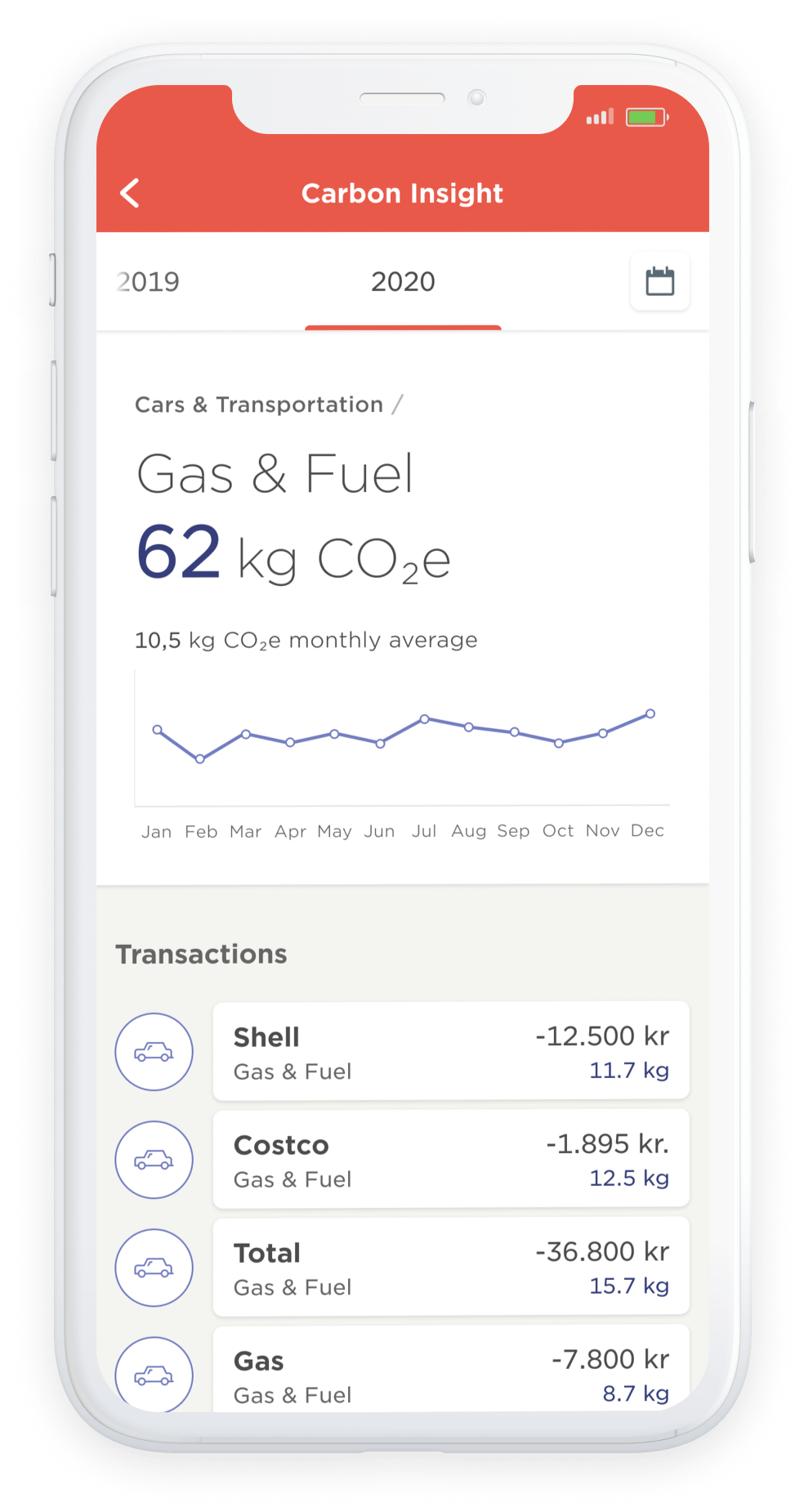

The carbon footprint of transactions and purchases is calculated through the Meniga Carbon Index, which has been created by a team of data scientists using the latest environmental research and databases on the carbon emissions of goods and services. The Meniga Carbon Index contains the carbon intensity value of approximately 80 spending categories, as weighed against a currency unit. When a purchase is made in a specific spending category, the carbon intensity value of that particular category is multiplied by the purchase amount, which provides a reliable carbon footprint estimate.

The Carbon Insight solution informs, empowers and motivates customers to take action against their carbon emissions, by allowing them to:

- Track their estimated carbon footprint for a given time period (which can be broken down into specific spending categories)

- Track the estimated carbon footprint of individual transactions

- Compare their overall carbon footprint and the carbon footprint of spending categories with that of other users

The development of Meniga’s Carbon Index is overseen by the Meniga Environmental Advisory Board, represented by climate change experts from organisations such as UNFCCC, Accountancy Europe, World Resource Institute and the University of Iceland.

Want to know more?

If you want to learn more about Carbon Insight visit our website or sign up for our webinar on Carbon Conscious Banking on 10th of March.

About Íslandsbanki

A leader in financial services in Iceland, Íslandsbanki is a universal bank with total assets of ISK 1,345bn and a 25% — 40% market share across all domestic business segments. Building on over 140 years of servicing key industries in Iceland, Íslandsbanki has developed specific expertise in tourism and the seafood, energy industries.

With a dedicated team of 750 employees and a vision of being #1 for service. Sustainability has been part of Íslandsbanki DNA for years and the bank´s defined purpose is "Moving Iceland forward by empowering our customers to succeed”.