Annually Finovate Europe brings together over a thousand financial services professionals, investors and fintech enthusiasts to celebrate the cream of the crop in the fintech world. With over 70 companies demoing and over 120 expert speakers the event showcases cutting-edge technology over the course of four days.

Finovate Europe 2018 is the eight consecutive year Meniga participates in the event and needless to say we had something interesting planned.

This year, Chief Product Owner Finnur Magnússon and Senior iOS Developer Haukur Ísfeld unveiled Meniga’s latest innovation: personal finance Richest Transactions — a new way for banks to think of customer transactions. Richest Transactions inspire banks to branch out from the familiar digital banking customer experience to introduce services such as restaurant recommendations in the context of everyday banking.

The new innovation is designed to enrich the digital banking user experience and drive meaningful engagement between banks and their customers.

During the presentation, Meniga demonstrated how banks can use 3rd party data such as merchant directories and Open API connectors to deliver insightful advice and actionable content in the previously under-utilised transaction detail screen.

Banks have access to a lot more relevant data than many leading fintech and social media platforms, but this it is often found on a range of systems, making it challenging to pull together an overall picture.

Open Banking is now making banks organise customer data, which in turn allows them to complement their own data with 3rd party sources and provide customers with interesting insights by simply clicking on a transaction.

Banks have been ignoring one of their most valuable assets — transaction data.

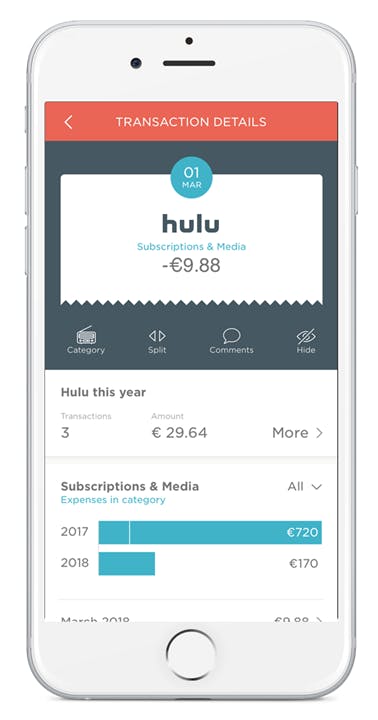

Meniga is helping banks worldwide enrich transaction data. Contextualising transactions is at the heart of what we do. Three years ago we introduced the transaction detail screen, which provides a clear overview of expenses by category and by merchant when clicking a transaction.

We created a new destination and habit for people to learn about their spending. It quickly became one of our most popular personal finance features — increasing the number of users clicking on a transaction from 3% to 45%. Now we have taken the concept to a completely new level.

Enriching transactions with 3rd party data enables banks to provide their customers with a delightful user experience.

Many banks are having problems these days with the user experience in their online & mobile banks. Our experience shows that providing insights in context creates a more seamless user experience. One way to achieve this is to compliment transactions with 3rd party data.

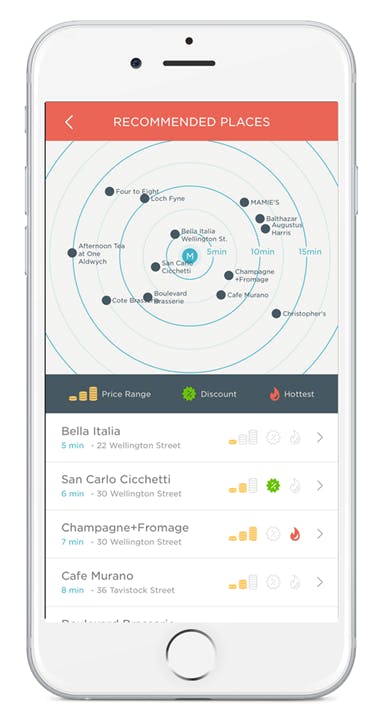

For instance, when customers click a transaction a bank could provide them with restaurant recommendations based on where people similar to them like to eat or detailed progress on their loan mortgages — everything in context with their personal finances.

The key drivers for successful customer engagement are to reduce friction, solve everyday problems and create new habits.

That’s why we created a new way for banks to think of customer transactions. Not as boring lines of text and code but as a story of people’s daily lives full of interesting insights. Providing banking customers with insights and actionable content in context with their financial life through enriched transactions drives meaningful customer engagement.

Finnur Magnússon, chief product owner at Meniga commented: “We believe that banks have been ignoring their most valuable data — the transaction. Spotify has music, Netflix has films, Instagram has photos and Banks have transactions. They shouldn’t think of transactions as boring lines of text and code but as a story of people’s lives full of interesting insights. Helping banking customers understand their financial lives by enriching transactions has the potential to really strengthen the relationship.

Recently we launched our new app in our native market where we redesigned and simplified the user experience by contextualising functions and content. Our data shows that we have increased daily engagement by up to 400% since the launch.”

The Meniga platform is multi-bank PSD2 ready and provides a complete overview of peoples’ finances and enriched transactions from all cards & accounts. It has the most accurate categorisation engine and merchant mapping algorithms on the market and helps banks provide a superior user experience using modern APIs.

For more information, visit www.meniga.com/finovate

Want to explore Open Banking opportunities and build meaningful customer engagement in your digital banking environment?

Contact us at info@meniga.com