What is the role of AI in personalised banking?

AI in digital banking relies on advanced algorithms, machine learning, and data analytics to deliver financial recommendations, services, and insights that are uniquely tailored to each customer’s profile, needs, and goals.

This way, your customers can receive timely, context-aware, and actionable financial advice.

As a result, it enables better decision-making, enhances financial health, and makes financial guidance accessible to all.

3 key impacts of AI in personal finance management

1. Improved accessibility

AI-driven financial tools are no longer reserved only for the privileged.

Thanks to integration with digital banking platforms, personalised advice is now accessible to younger, lower-income, and underserved users directly through their phones.

2. Higher customer engagement

Banks that use AI for personalised experiences see an increase in customer engagement since tailored recommendations and real-time insights make interactions more relevant and valuable.

3. Greater efficiency and speed

AI automation significantly reduces operational costs and speeds up loan processing times.

Therefore, it results in faster service, more scalability, and smarter, more individualised financial guidance.

How AI personalises financial advice across different customer demographics

AI personalises financial advice across different customer demographics by analysing a wide range of individual characteristics, such as:

-

age,

-

income level,

-

cultural background,

-

life stage,

-

gender, and even

-

accessibility needs.

The single goal is to deliver highly relevant and inclusive recommendations.

| Personalisation factors | How AI tailors financial advice |

| Life stage and age | Targets advice to age-specific goals: credit-building, family needs, and retirement planning. |

| Gender and career patterns | Accounts for career breaks and longevity risks for equitable planning. |

| Income and wealth levels | Offers affordable advice to low-income groups and advanced services to higher-income users. |

| Cultural and linguistic diversity | Supports multiple languages and culturally sensitive communication. |

| Accessibility needs | Ensures disability-friendly interfaces for barrier-free access. |

| Behavioural and transactional data | Uses spending and saving habits to send timely, relevant nudges. |

| Financial inclusion | Leverages alternative data to broaden access to credit and investments. |

1. Life stage and age

For younger users, AI recommends strategies focused on building credit, saving for or repaying student loans, and investing with lower-cost options.

For middle-aged customers and families, AI creates complex scenarios, such as saving for a child’s education, purchasing a home, or managing healthcare costs.

Older clients may receive advice tailored for retirement planning and decumulation strategies.

2. Gender and career patterns

AI in personal finance management takes into account factors such as career breaks for caregiving and longevity risks, which are more common among women.

This enables more equitable, long-term planning that acknowledges gaps in income or time out of the workforce, something often missed in traditional approaches.

3. Income and wealth levels

For underserved or lower-income groups, AI democratises financial planning by offering accessible, affordable advice, sometimes directly within banking apps.

For high-net-worth individuals, AI enhances wealth management through advanced tax optimisation and planning tools.

4. Cultural and linguistic diversity

AI-driven banking supports multiple languages, provides culturally relevant advice, and tailors communication styles to individual preferences.

As a result, non-native speakers, multicultural families, and diverse communities can feel included.

5. Accessibility needs

AI-powered financial platforms are incorporating features such as screen reader compatibility and adaptive interfaces to ensure that users with disabilities can access and act on personalised financial guidance without barriers.

6. Behavioural and transactional data

AI in personal finance management continuously learns from patterns in spending, saving, and borrowing to offer timely, context-aware nudges, such as reminders to avoid overspending, spotting unused subscriptions, and suggesting optimised saving contributions for each user.

7. Broader financial inclusion

AI-driven systems expand access to underserved populations by using alternative data such as transaction history, smartphone usage, social behaviours, and more to make fairer credit decisions.

As a result, it enables safe borrowing, savings, and investments that fit each user’s needs and background.

How AI personalises finance management in 6 effective ways

AI personalises financial advice through advanced, real-time analysis of each user's unique financial data, goals, behaviours, demographics, and external economic factors.

Thus, it delivers highly tailored and dynamic guidance that adapts as your customers’ circumstances evolve.

Let’s check how.

| AI Capability | What it does |

| Dynamic profiling | Builds evolving financial profiles from user data and behaviour. |

| Goal-based advice | Offers tailored recommendations for specific financial goals. |

| Real-time coaching | Sends timely alerts to improve spending, saving, and investing. |

| Inclusive personalisation | Adapts advice by age, gender, culture, income, and accessibility. |

| Automated investing | Creates and adjusts portfolios based on risk, timeline, and preferences. |

| Behavioural adaptation | Tailors tone and guidance to user emotions and habits. |

| Scenario modelling | Projects outcomes of financial decisions to guide planning. |

| Affordable access | Delivers personalised advice via apps: low cost, broad reach. |

| Conversational AI | Provides 24/7 help through chatbots and voice assistants. |

1. Holistic and dynamic profiling

AI begins by assessing your customer’s whole financial situation, including income, assets, debts, spending habits, and risk tolerance, as well as their specific financial objectives.

Whether the customer is saving for a home, planning for retirement, paying off debt, growing investments, or preparing for their children’s education, AI uses this information to create custom strategies aligned with those goals.

In addition, recommendations dynamically adjust as financial situations or external factors, such as market changes or life milestones, shift.

It helps banks understand not only the financial situations of their customers but also their personal goals and challenges.

As a result, they can then create fully tailored campaigns and products that meet their specific needs.

Worth knowing

With Meniga, banks can transform meaningless transaction data strings into actionable insights and visual spending stories for customers.

We gather, consolidate, and enrich data from internal bank sources and open banking APIs.

As a result, this enables a 360-degree view of customers’ financial behaviour, providing valuable context for every transaction.

2. Real-time proactive advice

By monitoring account activity in real time, AI in personal finance management

enables banks to deliver highly personalised, context-aware financial nudges.

For example, if a customer consistently maintains surplus cash in their checking account, the system can suggest transferring funds into a high-yield savings product.

And the benefits are mutual: for the customer, it means better financial outcomes, and for banks, it means increased product engagement.

Additionally, AI can detect patterns of overspending, missed payments, or financial stress, and trigger timely alerts with actionable guidance.

This proactive support positions you as a trusted advisor and a strategic financial partner, not just a service provider.

What additional benefits does it bring you?

These micro-interventions translate into measurable business value:

-

Increased cross-sell opportunities through personalised product recommendations.

-

Improved customer retention by preventing churn linked to poor financial outcomes.

-

Enhanced data utilisation, turning raw transactions into relationship-building touchpoints.

-

Real-time financial nudges are a scalable way to deliver meaningful advice, strengthen trust, and grow wallet share.

For example, with Meniga’s Insights platform, you can move beyond generic banking notifications by providing hyper-personalised, AI-powered insights and communications directly to your customers.

It uses advanced AI to build and deliver personalised, contextual insights to each customer.

3. Automated savings and investments

Automated investment management is one of the key features of next-generation digital banking.

Robo-advisors, fully integrated within banking apps, use AI to build and maintain personalised portfolios tailored to each user’s unique financial profile.

These systems take into account critical variables such as risk tolerance, investment horizon, liquidity needs, and other criteria.

Unlike traditional advisory models, these platforms continuously monitor and rebalance portfolios as market conditions shift or a customer’s life circumstances change.

Moreover, the system adapts in real time, making it relevant.

In addition to portfolio building, AI helps your customers define and prioritise objectives, and builds tailored strategies for each.

Based on income and spending patterns, the platform:

-

recommends how much to save,

-

where to allocate funds and

-

when to adjust contributions.

For customers juggling investments and liabilities, AI can create dynamic repayment plans that minimise interest, accelerate payoff, and preserve financial flexibility.

Again, benefits go both ways.

For banks, automated wealth solutions enable them to democratise investing and bring financial planning tools to customers who legacy advisory models traditionally overlooked.

Worth knowing

Meniga’s Smart Savings solution enables your customers to create separate savings pots, each tied to a specific financial goal such as buying a home, purchasing a car, or funding a vacation.

The solution allows both manual contributions and automated savings rules, such as rounding up transactions or transferring a fixed amount on payday.

As a result, this gives users flexibility while encouraging regular saving.

4. Predictive analytics and scenario modelling

Through advanced predictive analytics and dynamic scenario modelling, AI empowers your customers to explore financial “what-if” scenarios in real time.

For example, a customer is thinking about increasing their monthly savings.

The system can simulate a range of possible outcomes based on real data and current market conditions.

It factors in variables such as:

These multiple simulations help them understand the long-term impact of that change. Moreover, the system can show how this decision aligns with their personal goals and suggest a suitable product.

The system proactively notifies customers when they’re drifting off track or when new opportunities emerge.

For example, if a customer’s savings rate drops below target, AI can issue a friendly nudge with updated suggestions.

Or, if a better investment product becomes available, the system may recommend a switch that aligns with the customer’s risk profile and timeline.

From the bank’s perspective, this personalised insight capability provides an opportunity for targeted upselling, such as:

-

offering an investment account,

-

personalised savings product, or

-

financial coaching session.

Additionally, banks can drive deeper engagement by positioning themselves as a proactive partner, not just a passive service provider.

5. Behavioural adaptation and emotionally intelligent support

By analysing both transactional behaviour and behavioural cues, AI systems can adapt the tone, timing, and style of financial guidance based on a customer’s emotional state, habits, and personal context.

It marks a shift from generic automation to deeply personalised financial coaching that feels both responsive and human.

Language, delivery style, and even timing of notifications are adjusted based on individual user preferences, cultural background, gender, and life stage.

Additionally, AI in personal finance management can help banks and financial institutions offer features such as:

By meeting your customers where they are mentally and emotionally, you can:

-

Increase app engagement and daily usage

-

Improve financial behaviour outcomes, such as higher savings rates or reduced credit use.

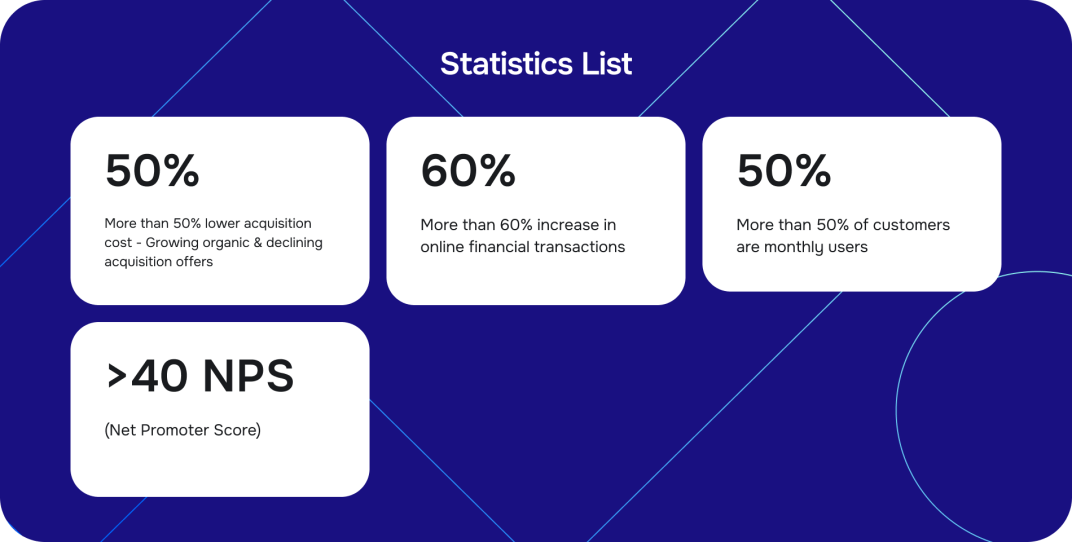

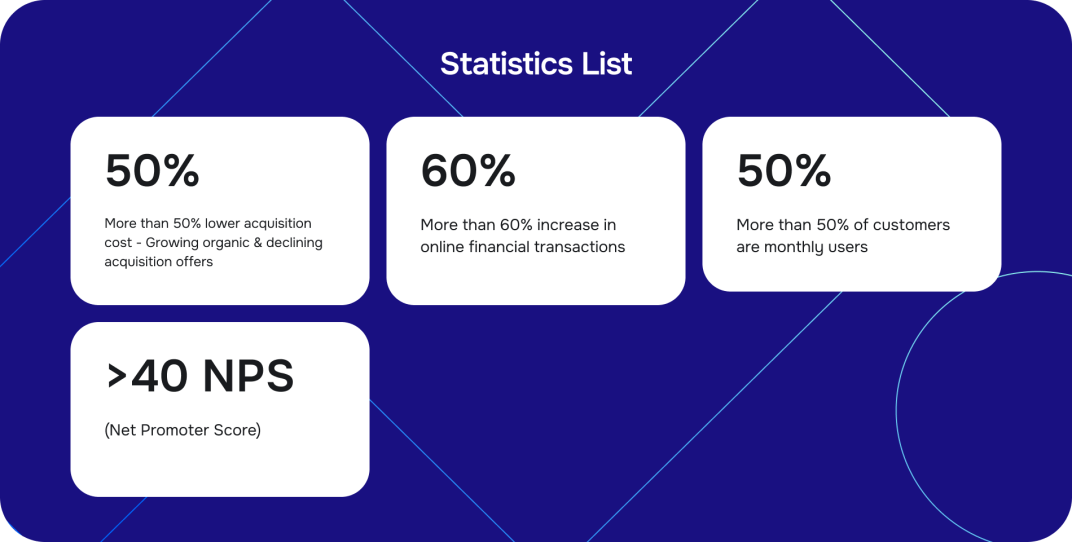

Real-world impact

One of our clients, UOB, one of the leading banks in the ASEAN region, wanted to create a solution that caters to millennials.

With our help, the bank developed a gamified solution to help millennials establish healthy financial habits and enhance their savings.

Here are the results.

For more information on this story, check our UBO case study.

6. Real-time fraud detection and enhanced security

Modern AI systems are trained on vast, dynamic datasets, including

As a result, they can detect anomalies and suspicious account activity extremely quickly.

For example, repeated failed login attempts, irregular fund transfers, or deviations from known behavioural patterns all trigger real-time analysis and response.

One of the greatest advantages is that these models continuously learn and evolve, adapting to emerging fraud tactics, seasonal patterns, and even user-specific risk profiles.

Besides obvious benefits for your customers, you also benefit from this impact.

You gain stronger asset protection and reduced financial liability due to faster detection and response.