Many banks face rising service costs and increasing churn as customers expect instant, personalised support. Traditional call centres can’t keep pace, while digital-first competitors win loyalty with fast, context-aware interactions.

Conversational banking offers banks a way to meet these expectations while unlocking new revenue opportunities.

Powered by AI and context-aware systems, it allows you to deliver seamless, accurate, and personalised interactions.

Read on to see how conversational banking improves customer satisfaction while reducing banks’ costs and driving upsells.

How conversational banking drives new revenue growth

When talking about conversational banking, the majority thinks primarily about improved customer service.

But conversational banking also helps banks create new revenue streams through personalisation, proactive engagement, and seamless digital experiences.

1. Personalised product recommendations

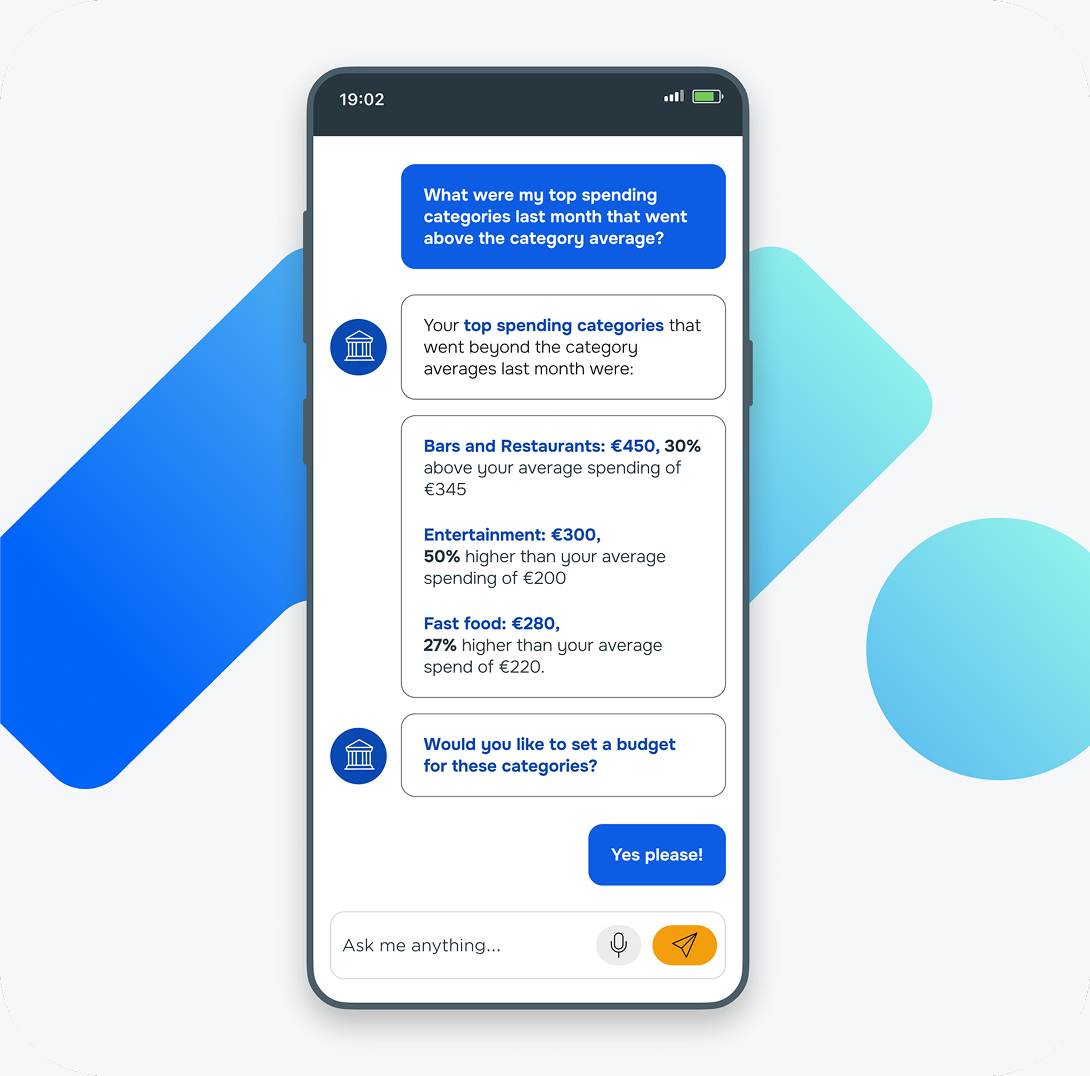

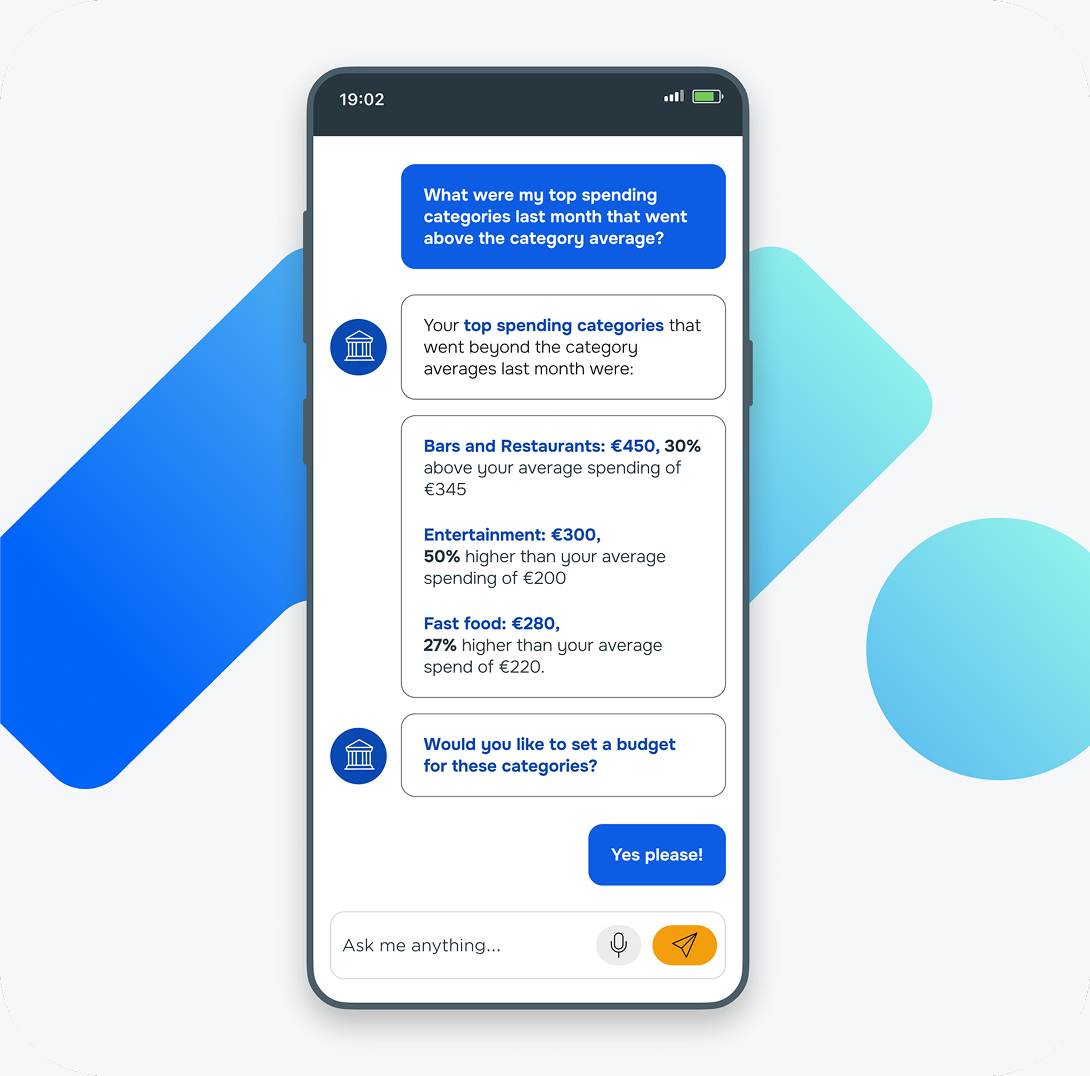

AI-powered chatbots analyse customer behaviour, goals, and transaction histories to deliver timely and relevant offers. This boosts Customer Lifetime Value (CLV) by helping customers make better financial decisions.

They do this in three ways:

-

Tailored financial advice: A chatbot might notice frequent travel spending and suggest a rewards card that fits the customer’s lifestyle.

-

Real-time recommendations: Instant analysis means offers arrive at the right moment, when customers are most receptive.

-

Behavioural insights: By monitoring patterns such as overspending or missed payments, AI can recommend budget plans or investment products.

As a result, this approach not only fosters upselling but also helps customers manage their finances better.

2. Simplified product and service acquisition

Conversational banking streamlines the customer journey, making it easier and faster for customers to acquire financial products, such as credit cards, loans, and insurance.

It automates data collection and form completion in a conversational style, which is less intimidating and faster than traditional forms.

In addition, it integrates real-time eligibility checks, instant document submission, and application status tracking, accelerating approval and issuance.

Customers can switch between chat, voice, or app without losing the conversation thread, creating a seamless and satisfying experience.

As a result, it speeds up customer acquisition and reduces customer acquisition costs (CAC) by enabling more precise segmentation and targeting within the conversation itself.

3. Improved customer retention and loyalty

Conversational banking provides 24/7 personalised support and proactive communications, creating a seamless and pleasant customer experience that reduces churn.

Instant responses, multi-channel accessibility, and ongoing engagement improve customer satisfaction scores and foster loyalty.

Keeping customers engaged over time translates into sustained revenue streams through repeat business and referrals.

What impact does conversational banking have on operational costs and customer experience?

Conversational banking delivers measurable improvements in customer experience (CX) while helping banks optimise operational costs.

Its impact can be seen across several critical metrics:

Reduced call centre volume: Chatbots handle repetitive queries, such as password resets or balance checks, freeing human agents to focus on high-value tasks.

Lower operating expenses: Automation and AI reduce the need for large customer service teams, cutting labour costs without compromising service quality.

Improved agent productivity: AI tools assist agents with real-time suggestions and access to complete customer histories, enabling faster and more effective service.

Reduced fraud and compliance costs: Automated monitoring and verification streamline processes, helping prevent errors and fraud while minimising compliance expenses.

Faster response times: AI-powered chatbots provide instant, 24/7 responses across multiple channels, eliminating hold times and service delays. This immediacy significantly enhances customer satisfaction and convenience.

Reduced time to resolution: Virtual banking assistants handle routine inquiries quickly and escalate complex issues with full context, shortening resolution times and improving first-contact resolution rates.

Net Promoter Score (NPS): Personalised, proactive interactions and high-quality service through conversational banking boost NPS, reflecting stronger customer loyalty and a higher likelihood of recommending the bank.

Seamless omnichannel experience: Conversation continuity across channels ensures that agents can pick up interactions where they left off, minimising customer effort and frustration.

Customer retention and loyalty: Seamless and personalised engagements reduce churn, strengthen relationships, and foster long-term loyalty.

How would the chatbot detect the customer's current financial strain from transaction data?

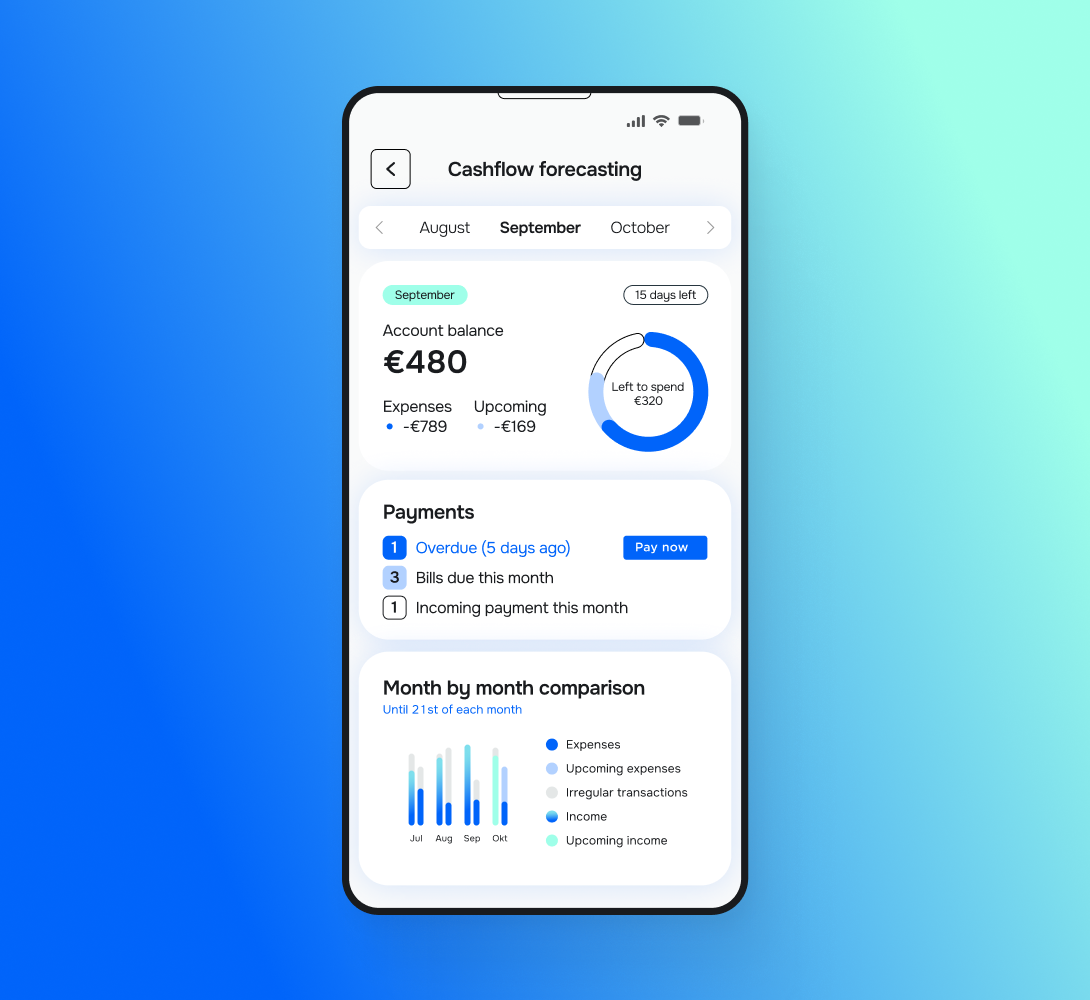

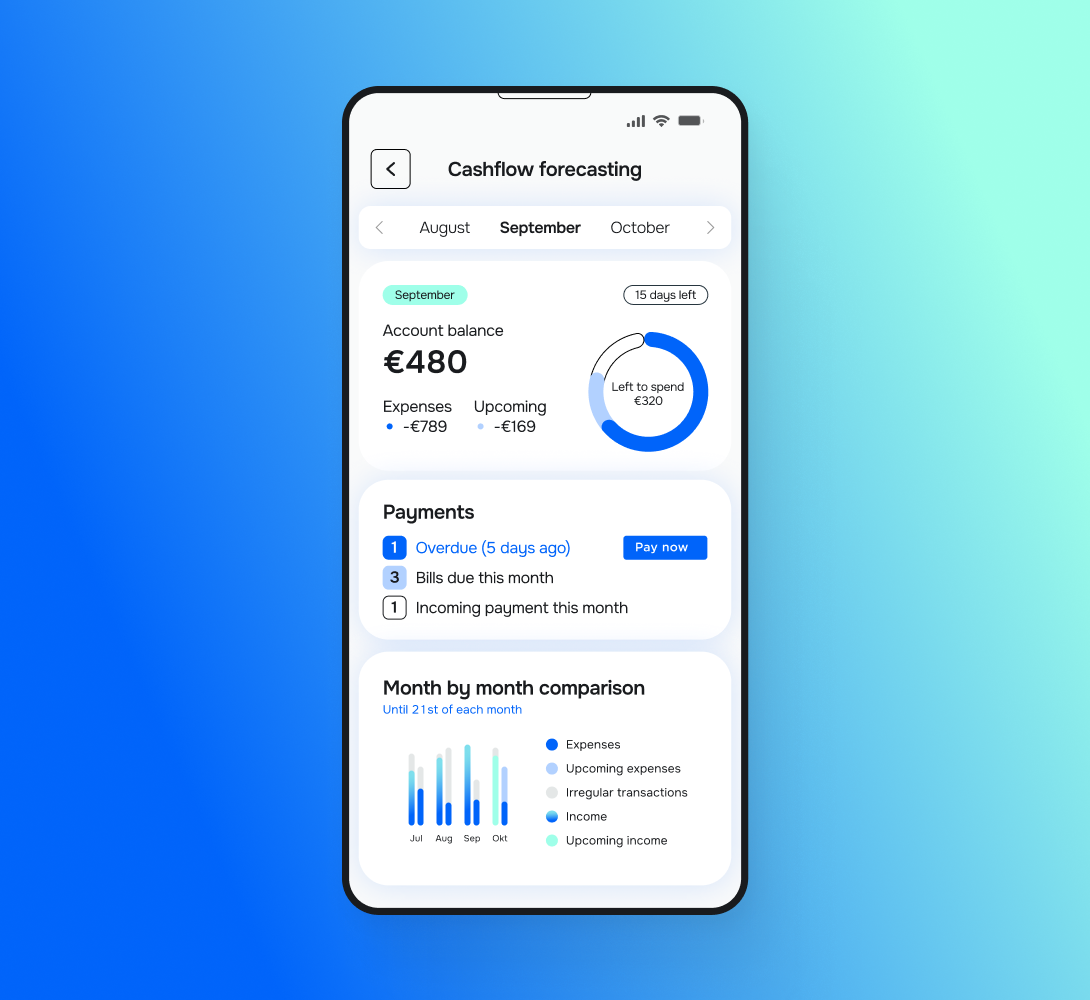

A chatbot can detect a customer's current financial strain from transaction data by analysing spending patterns, cash flow, and unusual transaction activities in real time.

Here is how it typically works:

1. Spending pattern analysis

The chatbot reviews the user's recent transactions to identify if spending exceeds typical amounts in essential categories such as groceries, utilities, or loan payments. Consistent overspending or frequent small payments that deplete the account may signal financial strain.

2. Cash flow monitoring

By examining the timing and frequency of income deposits and expenditures, the chatbot can detect if cash inflows are insufficient to cover outflows, highlighting potential liquidity issues.

3. Missed or late payments

The chatbot looks for patterns of late bill payments or declined transactions due to insufficient funds, which are strong indicators of strain.

4. Proactive engagement

When financial strain indicators arise, the chatbot can engage the user proactively, asking questions such as ‘I noticed your spending on groceries has increased recently. Would you like some tips to manage your budget?’

Worth knowing

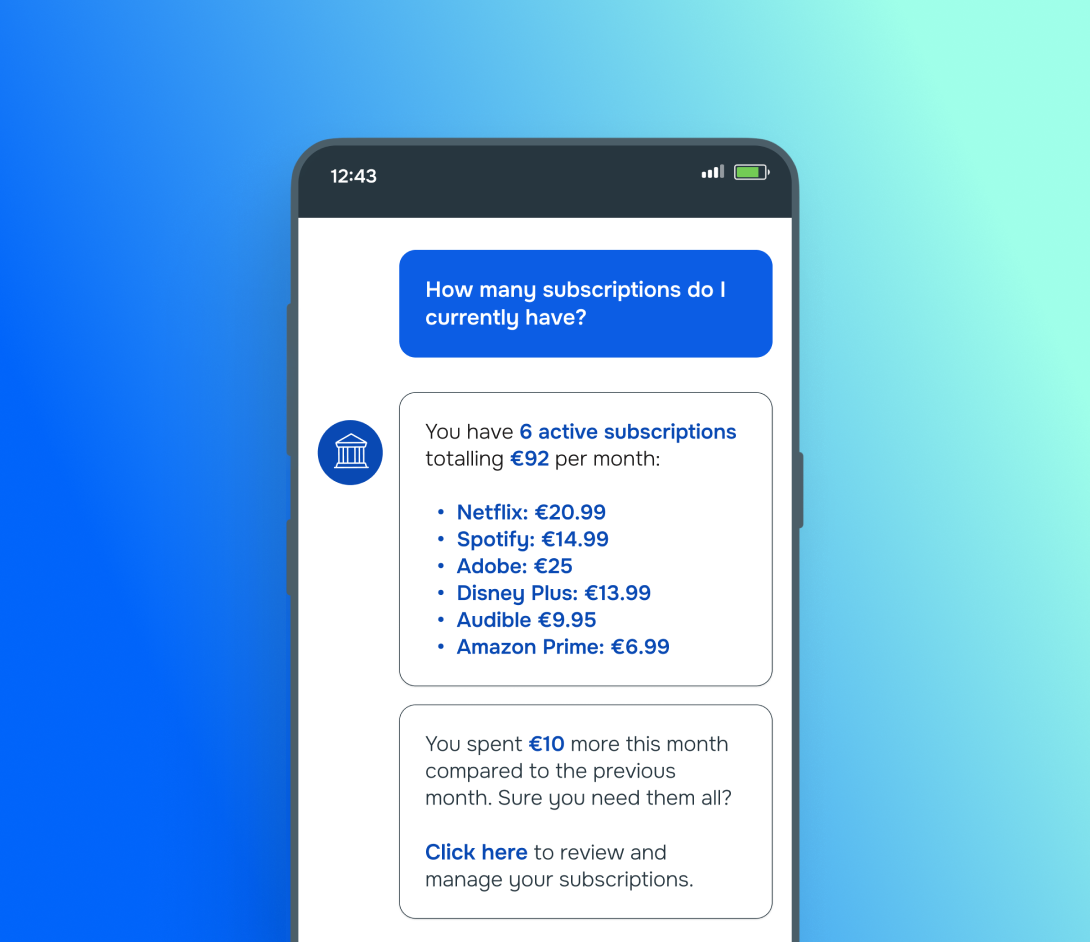

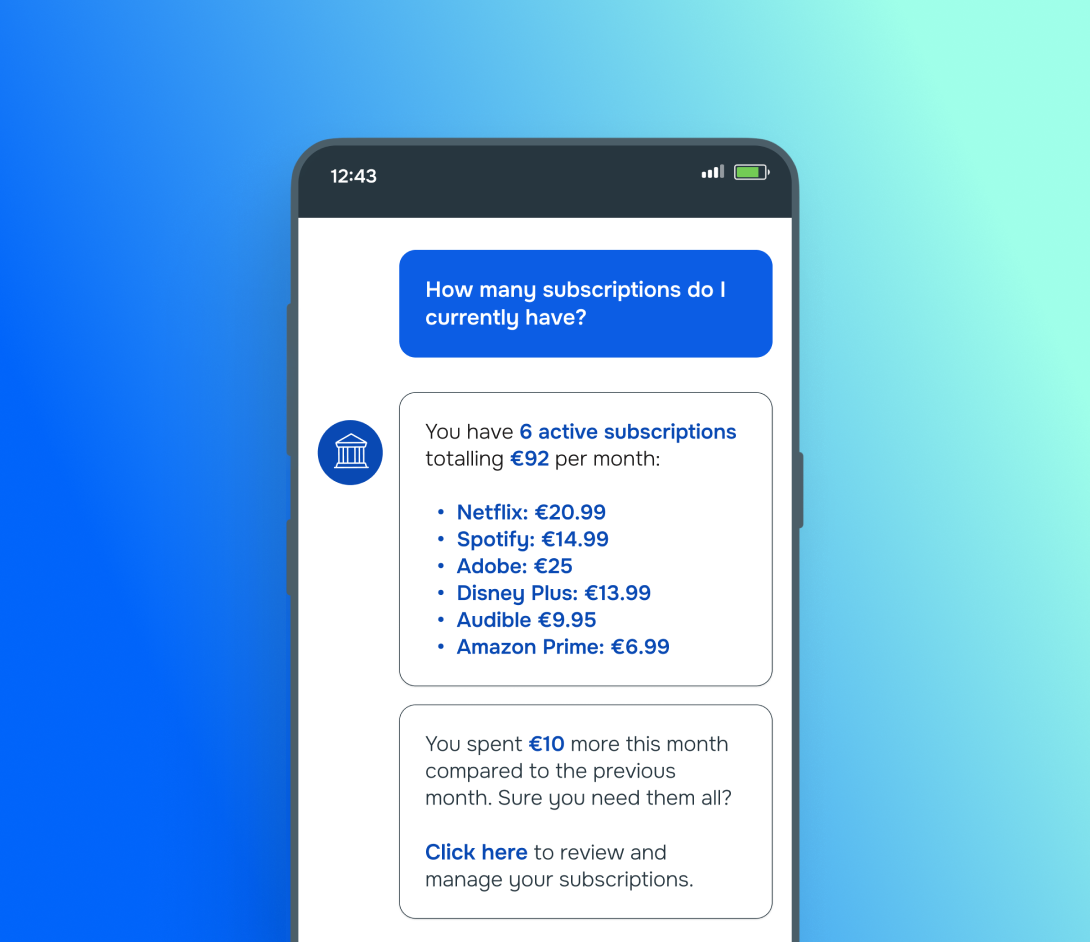

Meniga is set to transform the way banks engage with customers through the Meniga Conversational Financial Assistant, an advanced LLM-powered solution built for the digital age.

Customers can ask everyday questions, such as ‘How much did I spend on groceries this month?’ or ‘Can I afford a weekend getaway?’ and get instant, accurate answers in a natural, conversational flow.

Leveraging enriched data and secured with banking-grade protection, this intelligent assistant delivers hyper-personalised financial guidance, reduces the burden on customer support teams, and drives stronger digital engagement, helping your bank stand out as a forward-thinking, trusted financial partner.

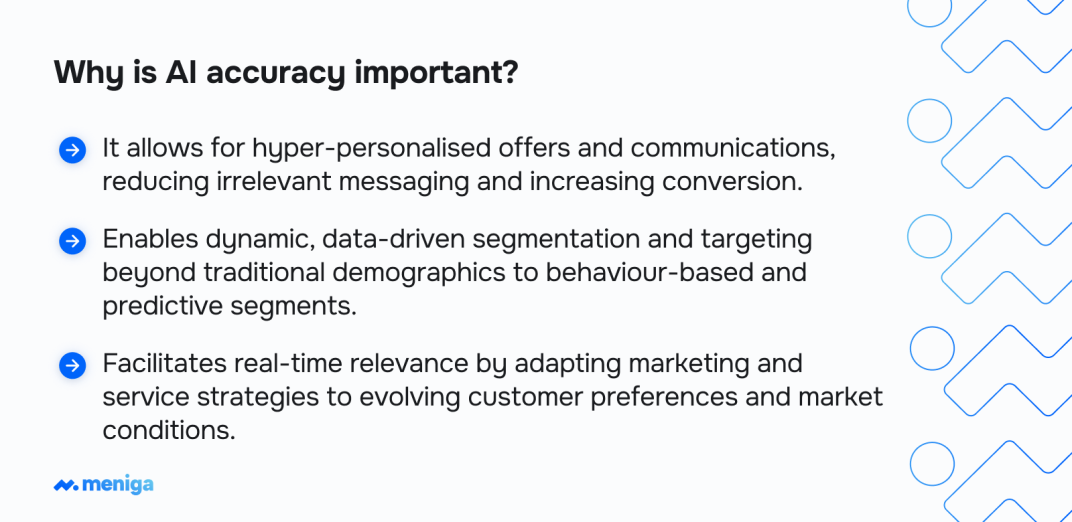

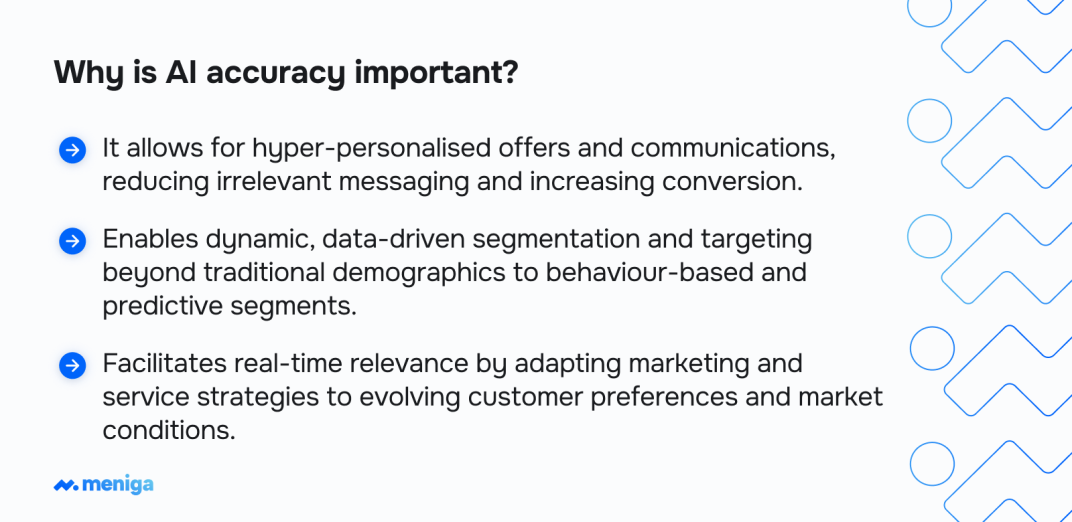

Why are AI accuracy and context retention important for customer outcomes?

AI accuracy and context retention have a significant impact on customer outcomes by enabling consistent, personalised, and relevant interactions that foster customer trust, satisfaction, and loyalty.

Accurate AI is key to delivering reliable, consistent information, which builds customer trust and minimises frustration due to errors or conflicting responses.

This reliability also speeds up problem resolution, allowing inquiries to be handled more efficiently and improving overall satisfaction.

Equally important is the AI’s ability to retain context across interactions.

By remembering past conversations, preferences, and transaction history, AI can provide continuity in service, avoiding repeated explanations and creating a seamless experience.

When AI combines precision with context awareness, it can offer personalised recommendations and support tailored to individual customer needs.

Not only does this strengthen relationships, but it also drives retention and increases lifetime value.

Worth knowing: Did you know that companies leveraging AI to personalise their communications have experienced a 30% boost in customer retention rates?

Which customer segments benefit most from better AI accuracy?

Customer segments that benefit most from better AI accuracy are those with diverse and complex behaviours, high-value needs, and personalised service expectations.

-

High-value and wealth management clients: Accurate AI helps analyse spending patterns, risk profiles, and investment preferences to tailor personalised financial advice and products, enhancing satisfaction and retention.

-

Young professionals and digital natives: These customers frequently use mobile and online banking, expecting fast, intuitive, and personalised digital services. AI accuracy ensures relevant product offers and seamless experiences.

-

Complex product users: Customers using multiple or sophisticated financial products require precise and contextual support to navigate offerings, make informed decisions, and optimise their portfolios.

-

Churn-risk customers: Accurate AI can identify subtle behaviour changes or dissatisfaction signals, enabling timely intervention with personalised retention offers.

-

Frequent transactors and retail customers: For these customers, AI accuracy ensures efficient handling of routine inquiries and customised marketing offers based on real-time transactional data.

- Niche and lifestyle segments: AI’s ability to analyse granular behaviour data allows precise targeting of segments defined by lifestyle, values, or preferences, such as eco-conscious buyers or small business owners.

Which product types see the largest upsell lift from personalised AI suggestions?

Products that experience the greatest upsell growth from personalised AI suggestions are usually those where customer preferences, behaviours, and financial goals can be closely analysed.

As a result, it enables timely and relevant recommendations for upgrades or complementary offerings.

| Product Type | How AI chatbots drive upsell and cross-sell |

| Credit cards and credit lines | Identify customers likely to benefit from upgrades or higher credit limits based on spending and repayment behaviour, boosting upsell success. |

| Savings and investment accounts | Promote premium savings accounts, investment products, and wealth management services aligned with customers' financial goals, increasing cross-sell rates. |

| Insurance products | Suggest additional coverage, bundling options, or policy upgrades based on customer profiles and life changes for personalised offers. |

| Loans and mortgages | Detect optimal refinancing opportunities or recommend additional loan products, improving conversion and customer lifetime value. |

| Payment and digital banking services | Recommend fee-based premium services, instant payment features, or subscription models targeted to specific customer usage patterns. |

| Complementary financial services | Upsell services such as tax advisory, retirement planning, and financial planning tailored to specific customer segments and needs. |

Why these products benefit most

-

They often have clear customer usage and behaviour signals that AI can analyse to detect upsell readiness.

-

Customers are more receptive to personalised financial advice for products impacting their money management and financial security.

-

These product categories commonly have multiple tiers or add-on options suited to individualised recommendations.

-

The financial impact of these upsells is often significant, directly contributing to increased revenue and deeper customer relationships.

What are the risks that could undermine conversational banking value?

Conversational banking creates clear benefits, but banks must also address risks that could compromise its value if not managed carefully:

-

Customer expectations and brand trust: Banking customers aren't very forgiving of mistakes. A poorly designed chatbot built on fragmented or unreliable data that provides incorrect balance information or fails to understand context can damage brand credibility faster than slow service.

-

Legacy system integration: Most banks still depend on complex, decades-old core systems. If conversational AI cannot integrate seamlessly, it may deliver incomplete or outdated information, which leads to frustration and regulatory exposure.

-

Compliance and data privacy: Conversational interfaces handle sensitive financial data in real time. Every interaction must meet strict auditability, GDPR, and local banking requirements. Failing to do so risks fines and reputational damage.

-

Accuracy and financial risk: In banking, accuracy is critical. Misquoting a loan rate or giving the wrong repayment date can result in financial losses for both the bank and the customer.

-

Scalability under load: As adoption increases, banks need to ensure conversational platforms can handle peak demand during salary days or periods of market volatility without slowing down.

-

Fraud and cyber threats: Conversational channels may become targets for fraudsters using social engineering or phishing techniques. Without strong authentication and monitoring, banks risk exposing new vulnerabilities.

-

Ethics and transparency: Customers expect fairness and clarity in financial advice. If AI systems display bias or provide opaque recommendations, trust can erode, and regulators may intervene.

To preserve trust and unlock value, banks should combine robust technology with compliance frameworks, human oversight, and ongoing monitoring. When managed properly, conversational banking strengthens the bank’s position as a trusted financial partner.

What is the value of conversational banking?

By delivering fast, accurate, and personalised interactions, banks can enhance customer satisfaction, build loyalty, and reduce operational costs.

At the same time, AI-powered insights and context-aware systems create opportunities for targeted upselling, proactive support, and smarter decision-making.

The result is a win-win: customers enjoy seamless, meaningful experiences, while banks strengthen their bottom line and position themselves as innovative, trusted financial partners.