8 benefits of data enrichment you can’t afford to overlook

On the other hand, leveraging data enrichment helps you tackle and resolve the above challenges while bringing multiple benefits.

1. Improved customer understanding

At the heart of data enrichment lies the ability to gain a 360-degree view of each customer.

By combining internal data such as account activity, transaction history, and product usage with external insights like:

-

Credit scores,

-

Lifestyle demographics, and even

-

Social media behaviour, you can build highly detailed customer profiles.

These enriched profiles help you better understand your customers' needs, preferences, and financial goals.

The result? Tailored marketing, sales, and service offers to distinct customer groups, which increases engagement and conversion rates.

Worth knowing:

Meniga’s Open Banking functionality combines external and internal data to provide a holistic overview and all your customers’ financial data in the app, helping you outperform competitors.

For example, you can spot when customers are losing interest in a competitor bank and offer them better rates or a more suited product.

Thus, you can create new revenue streams by hyper-personalising product offers

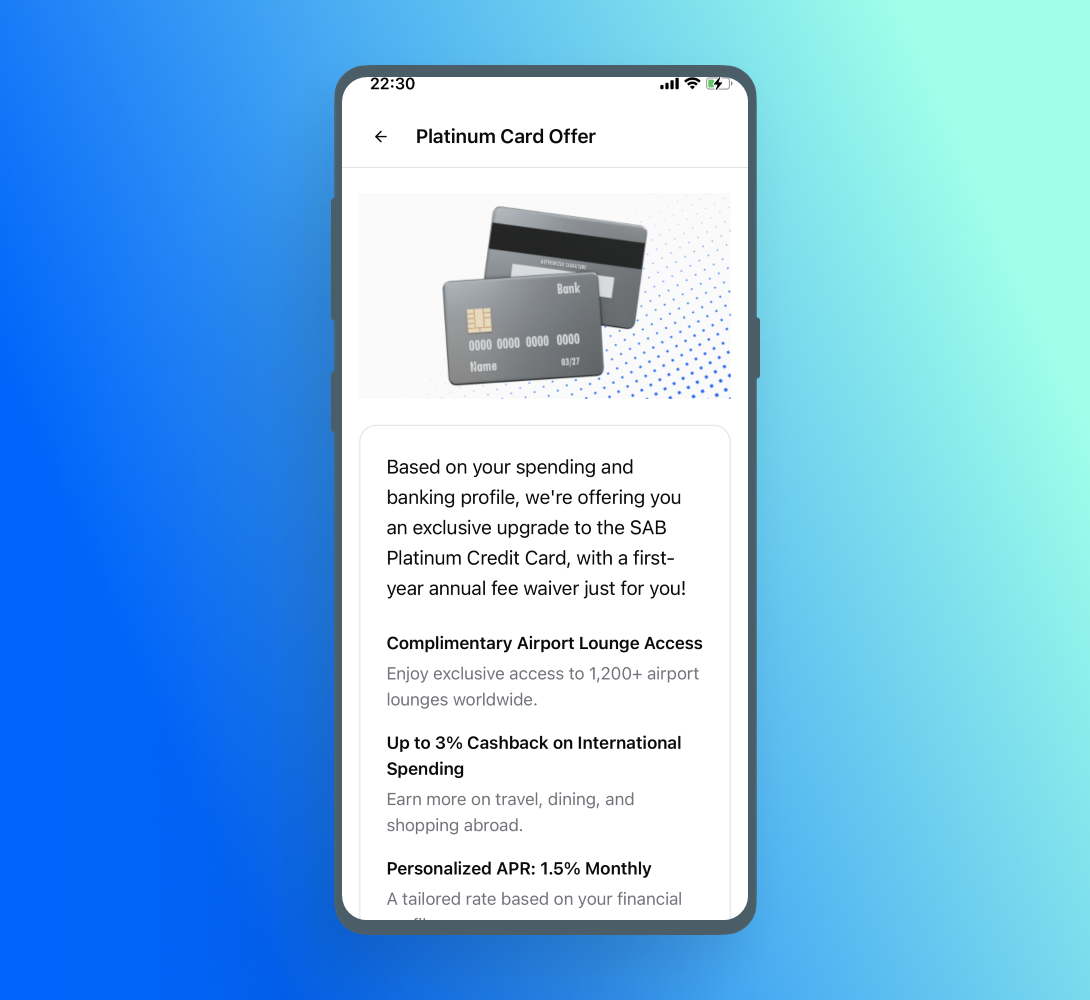

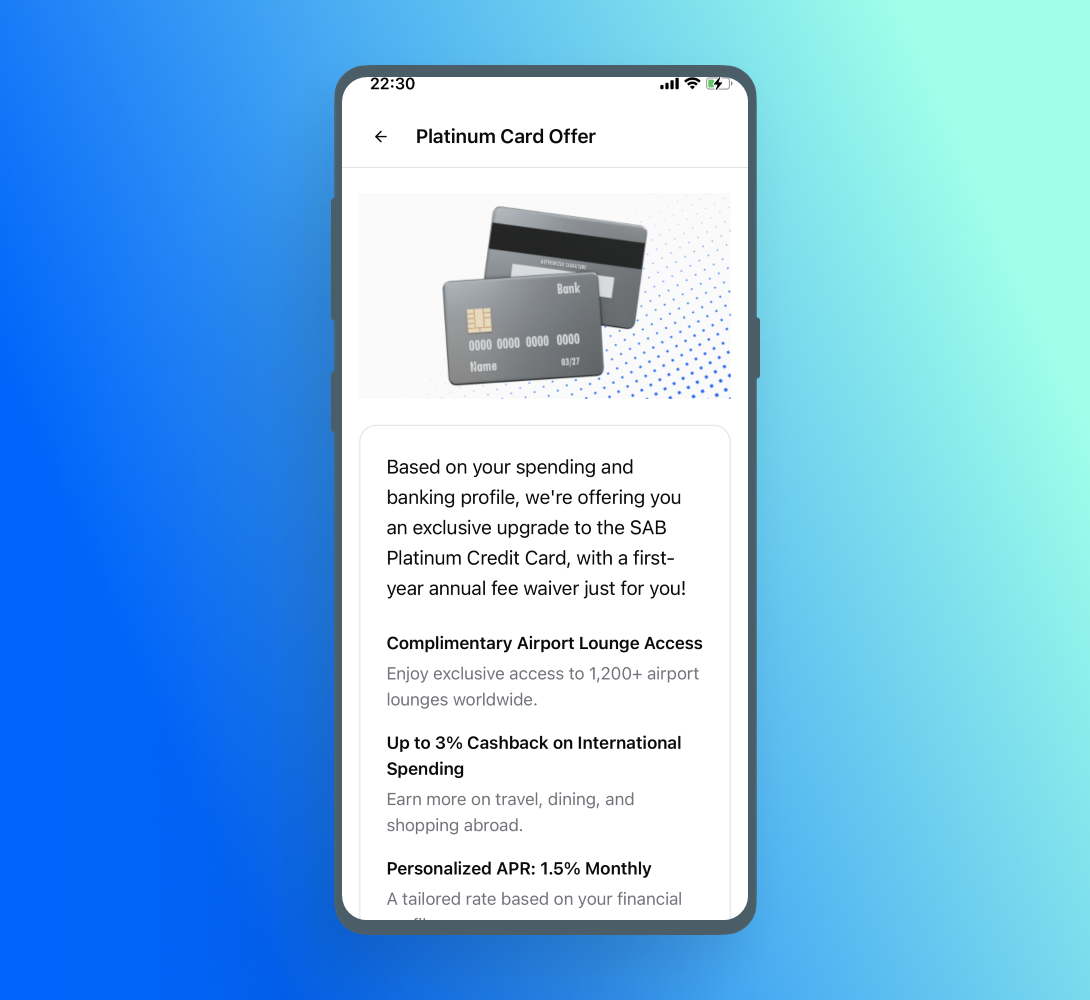

2. Enhanced personalisation of services

Customers expect banking experiences that are as seamless, intuitive, and personalised as those they receive from leading tech companies like Amazon and Netflix.

They expect your bank to understand their individual needs and offer solutions that are relevant and convenient.

Personalised banking demonstrates that you value your customers as individuals, leading to increased satisfaction and stronger loyalty.

When customers feel understood and appreciated, they're more likely to stay with your bank and recommend it to others.

Personalisation also opens up new revenue streams through targeted cross-selling and upselling.

Thus, data enrichment empowers you to move beyond generic services and deliver highly personalised financial solutions that truly resonate with your customers.

Whether it's suggesting

-

Tailored credit cards with rewards aligned to spending habits,

-

Customised loan packages with rates based on risk profiles, or

-

Investment portfolios aligned with income levels and financial goals make personalisation precise and impactful.

Worth knowing

Meniga’s Insights allows you to create personalised, rules-based user interfaces within banking app channels.

The system tracks user behaviour and financial status in real-time, dynamically matching relevant financial products.

What’s more, personalisation can go even further.

The system can compute complex mapping rules for price ranges or interest rates, displaying personalised values such as Cashback percentages or credit limits tailored to the user.

Thus, by dynamically adapting to user behaviour and financial status, the system delivers offers that maximise engagement and conversions.

3. Better fraud detection and risk management

Enriched data plays a pivotal role in fraud detection for banks and financial institutions. Traditional methods of fraud prevention often rely on basic transaction data, which can be insufficient for identifying increasingly sophisticated fraudulent activities.

Enriched data, on the other hand, provides a more comprehensive view of customer behaviour, since it involves supplementing standard transaction details with a broader array of information, such as:

-

Geolocation data,

-

Device information,

-

Social media activity (where permissible and compliant with privacy regulations), and even

-

Contextual details, such as the time of day or merchant category.

By analysing customer behaviour in real-time and comparing it with enriched historical data and industry-wide patterns, you can identify anomalies and suspicious activities with greater speed and accuracy.

For example, a sudden transaction originating from a foreign country, outside of the customer's typical travel patterns, backed by its geolocation data, would immediately raise a red flag.

Furthermore, enriched historical data allows banks to build robust behavioural profiles for each customer, painting a clearer picture of what constitutes "normal" activity.

As a result, the system can more easily spot deviations from the norm, which could indicate fraudulent activity.

Worth knowing

Besides notifying you about time-sensitive, personalised offers and payment and overdraft warnings, our push notifications also alert you to any suspicious activity or blocked transactions, enabling you to take immediate action.

Push channels are the fastest way to reach users, making them ideal for urgent and high-priority communication.

4. Streamlined regulatory compliance and Know Your Customer (KYC)

Financial institutions face increased scrutiny and higher expectations for verifying customer identities and preventing illicit financial activities.

Enriched data is crucial in supporting these compliance efforts by automating identity verification and risk profiling.

Thus, you can leverage data from a variety of verified sources, including

-

Government records (such as national ID databases and official registries),

-

Sanctions lists, maintained by organisations like the United Nations and OFAC in the USA,

-

Politically Exposed Persons (PEP) lists, and other trusted data repositories.

Automating and enhancing compliance processes with enriched data offers significant benefits:

-

It substantially reduces operational costs by minimising manual review and data entry ( more about it later).

-

It accelerates the customer onboarding process, improving the customer experience and enabling you to acquire new customers more quickly.

-

It helps you avoid costly regulatory penalties and reputational damage that can result from non-compliance.

5. Improve your credit decision-making and underwriting

Traditional credit scoring models often have significant limitations, particularly for customers new to credit or considered underbanked.

They frequently lack the extensive credit history that conventional scoring systems rely upon, leading to inaccurate assessments of their true creditworthiness.

Enter, data enrichment.

It involves incorporating alternative data sources beyond traditional credit reports to create a more comprehensive and nuanced understanding of an applicant's financial behaviour.

For example, it can include records of rent payments, consistent utility bill payments, and on-time phone bill payments.

These recurring payments demonstrate a responsible approach to financial obligations, offering valuable insights into an individual's ability to manage debt, even without a traditional credit history.

This way, you can make fairer and inclusive lending decisions.

By considering a broader range of financial behaviours, you can more accurately assess risk and extend credit to customers who might have been unfairly denied under traditional scoring models.

Furthermore, while expanding access, data enrichment also helps mitigate risks for you by providing a more comprehensive financial profile, allowing for more informed lending decisions based on a holistic view of an applicant's financial responsibility.

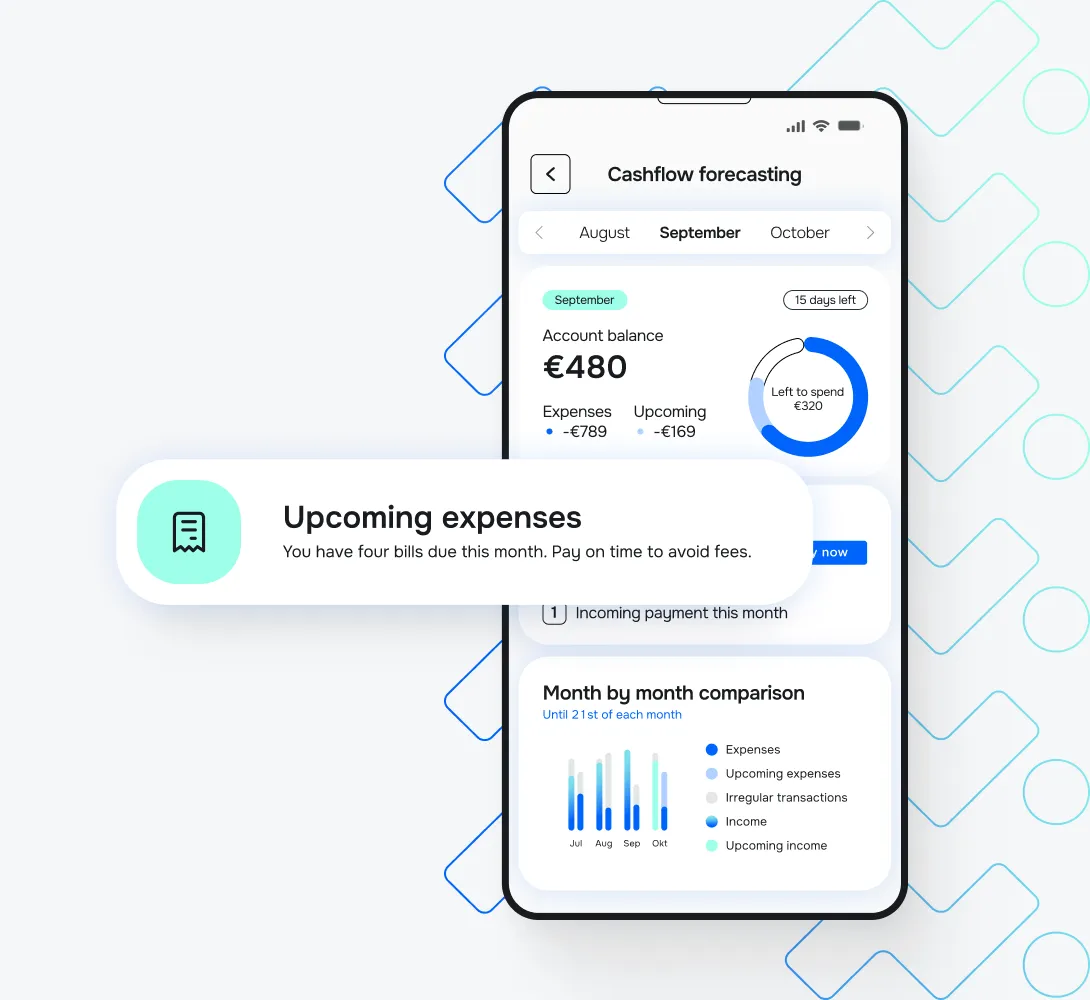

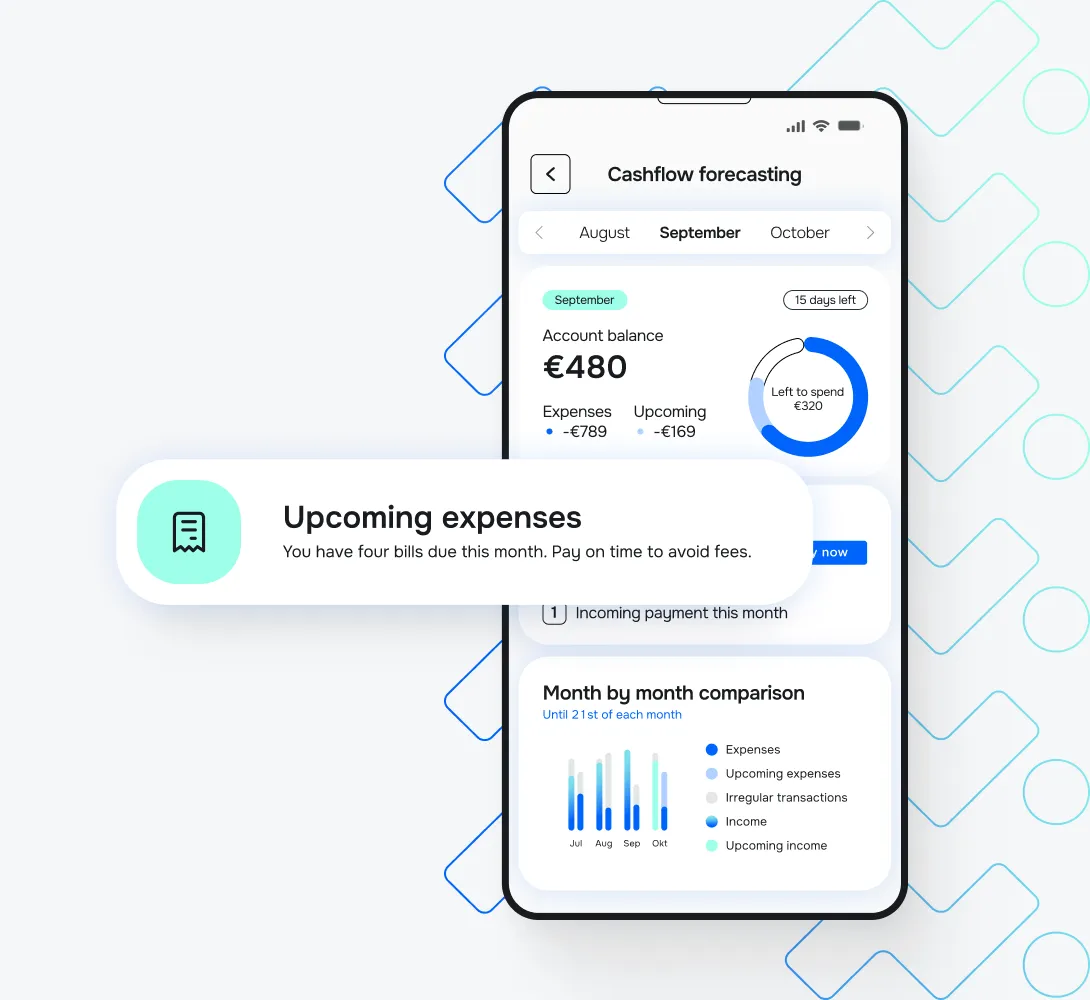

Worth knowing

Meniga’s solutions enrich your credit assessment with alternative metrics, such as:

-

Cash flow analysis and forecasting,

-

Behavioural intelligence and spending habits, and

-

Income stability, to expand credit access to underbanked customers.

Thus, specific data that Meniga provides can support the overall process of assessing creditworthiness and making credit decisions, not only improving a ‘score’.

In addition, our Upcoming expenses feature enables you to evaluate users and their financial behaviour better, helping you make an informed decision about their loan capabilities.

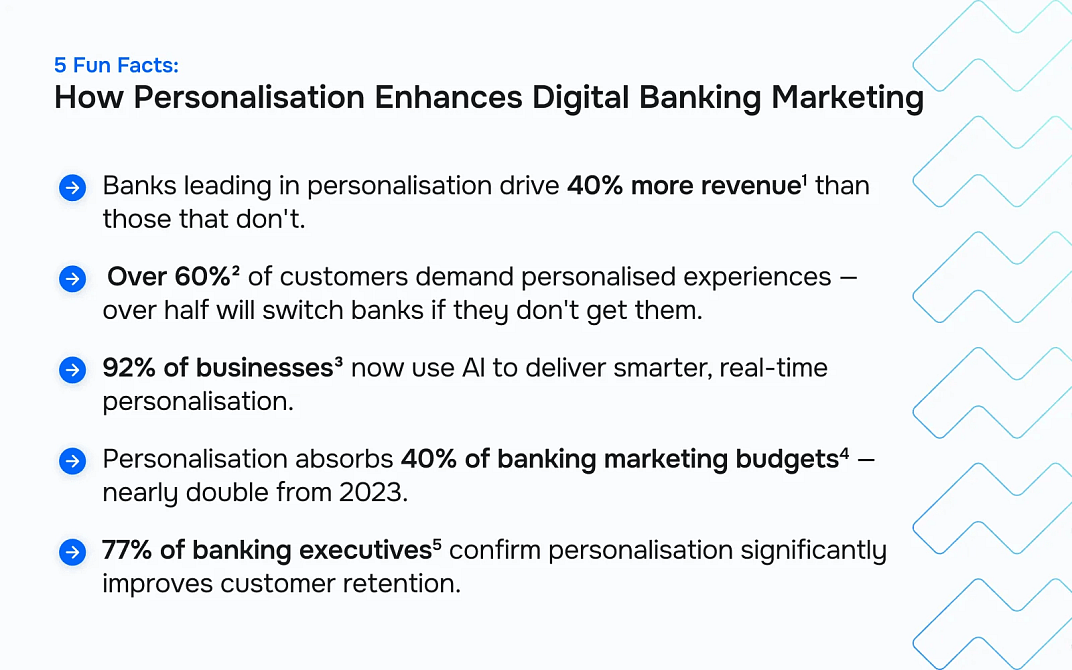

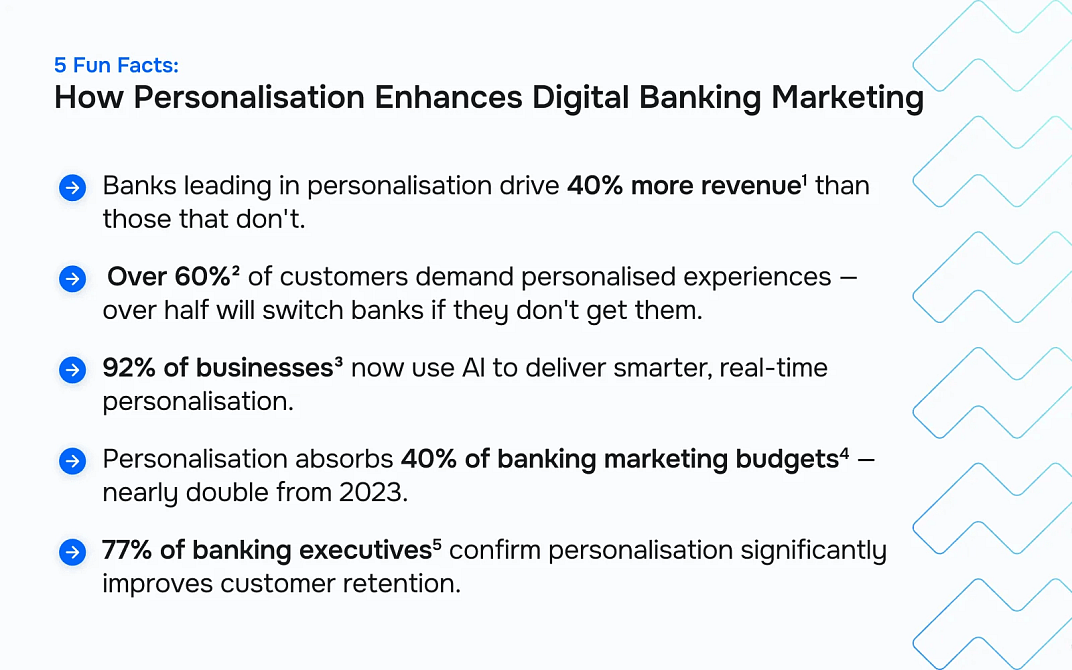

6. Smarter marketing campaigns

Marketing in the modern era thrives on data.

With richer, more comprehensive insights into customer preferences, behaviours, and motivations, your marketing teams can develop highly targeted and personalised campaigns.

Sources:¹ McKinsey, ² The Financial Brand, ³ Demand Sage, ⁴ Sepire ⁵ The Financial Brand

Enriched data enables a deeper level of segmentation, moving beyond basic demographics to focus on real-life factors such as:

-

Individual spending habits,

-

Current life stage, such as new parent, recent graduate, retiree, geographic location, and even

-

Preferred communication channels.

Furthermore, you can combine enriched data with machine learning algorithms to predict future customer behaviour, allowing marketers to proactively engage with potential customers at the precise moment they are most receptive.

This level of granularity dramatically improves campaign effectiveness.

By delivering the right message to the right person at the right time, your marketing team can drive significantly higher ROI.

Moreover, targeted marketing minimises marketing waste by focusing efforts on the most promising segments, reducing spend on audiences who are unlikely to respond. As a result, it leads to a better customer experience, as potential customers are less likely to be bombarded with irrelevant or unwanted marketing messages.

As Bernard Marr wisely put it: "In a world of infinite choice, relevance wins."

Worth knowing

Meniga’s AI-powered Engagement platform analyses behavioural data, so you can create ultra-specific customer segments, such as "Likely to Invest" or "Starting a Family."

Micro-segmentation allows you to understand your customers on a granular level and maximise ROI by promoting relevant products to the right customers.

For example, suppose your customer’s salary is typically credited on the 10th, but recurring payments, such as rent or subscriptions, are due earlier.

In that case, with Meniga, you can suggest overdraft protection or savings transfers to avoid shortfalls.

Or, if a customer frequently books flights, you may recommend a travel credit card with relevant perks.

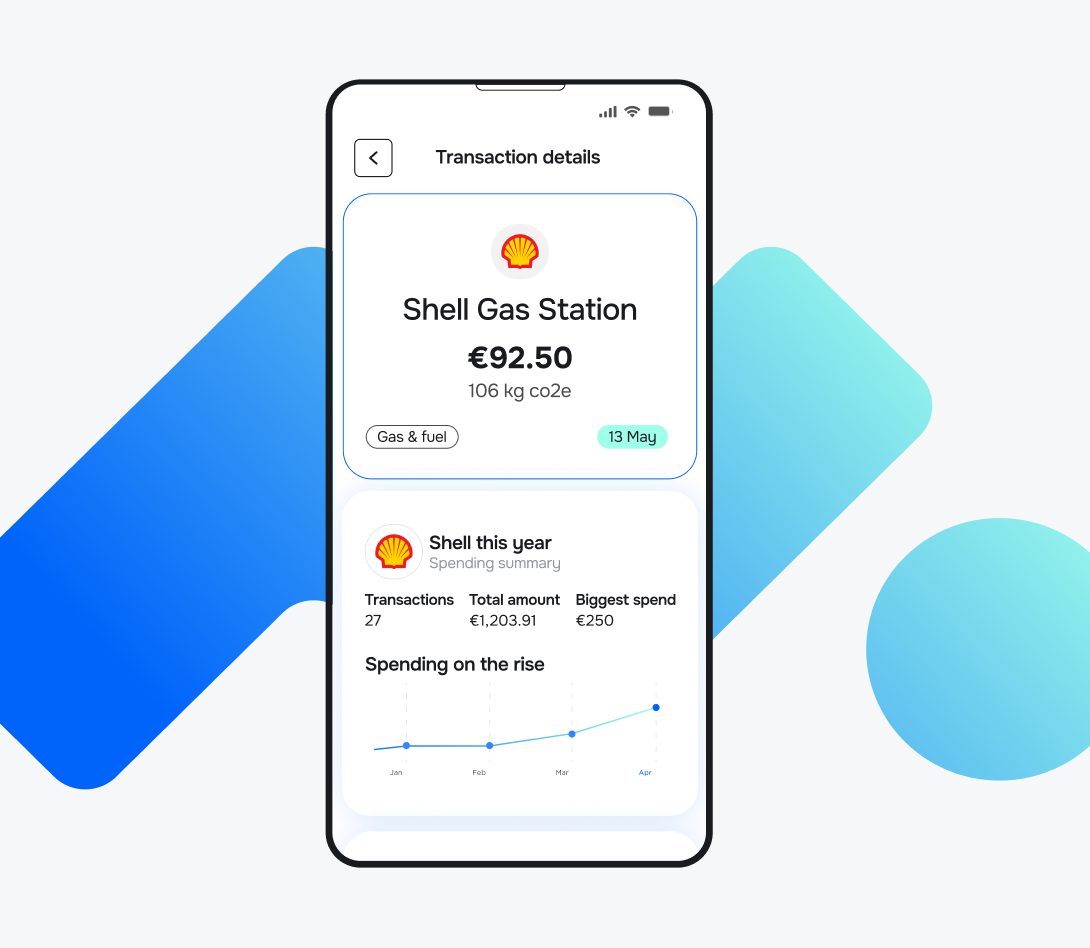

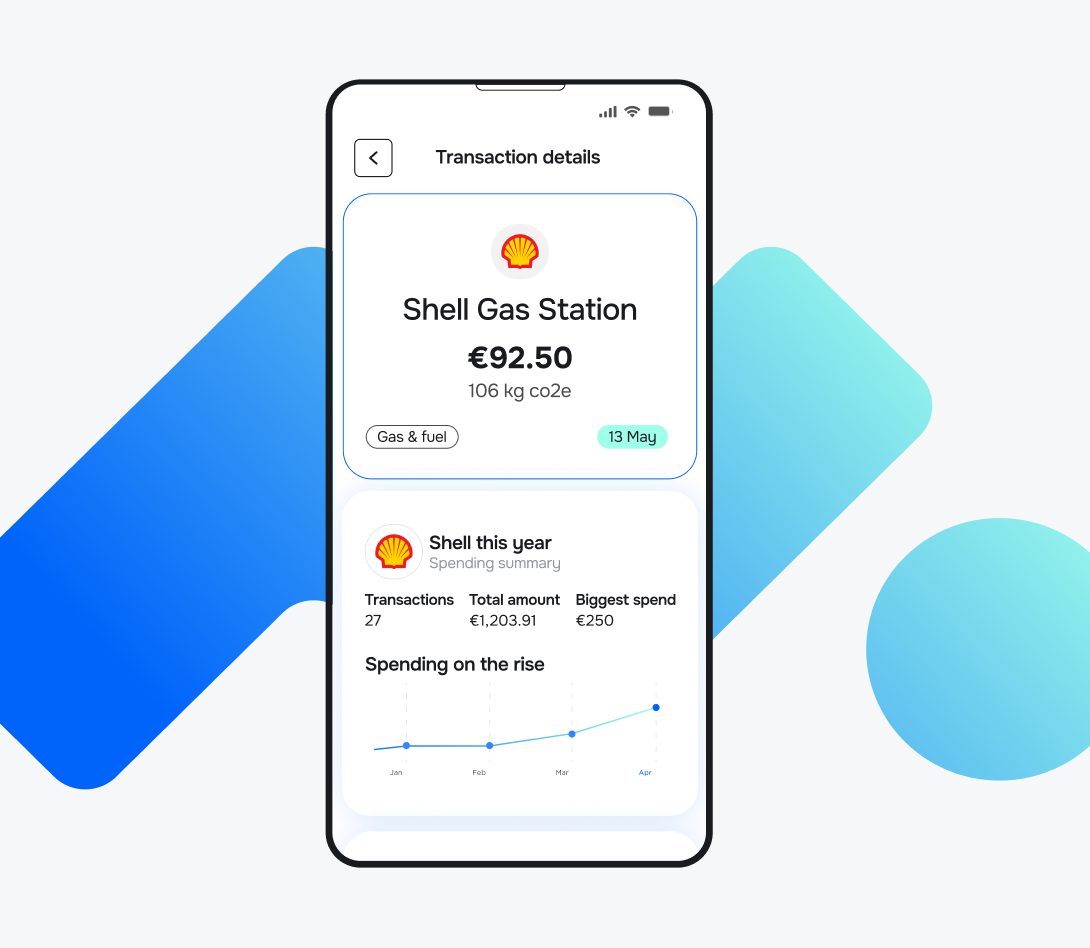

7. Operational efficiency and cost reduction

When you think about the traditional banking landscape, you can’t help but notice that manual processes consume a lot of time and resources.

Data enrichment streamlines these, offering a powerful antidote to inefficiencies.

For example, without enriched transaction data, customer service frequently handles inquiries from customers to clarify vague or incomplete transaction descriptions.

Data enrichment resolves this by including:

-

Merchant names,

-

Logos,

-

Contact information, and even

-

Location data to transactions, preemptively answering customer queries, and drastically reducing call volumes.

Furthermore, the benefits extend beyond customer service. Risk and compliance checks, traditionally labour-intensive, can be automated with enriched data.

This automation frees up compliance teams to focus on more complex investigations and strategic risk management.

By minimising manual intervention and automating key processes, data enrichment enables your staff to reallocate their time and expertise to higher-value activities, such as:

-

Developing new financial products,

-

Improving customer relationships, and

-

Driving strategic initiatives, ultimately improving the bank's profitability and competitive edge.

Worth knowing

Meniga enrichment brings the data to life with merchant mapping, including logos, clean descriptions, analytics, subscription identification, and more.

We have experience across different markets, and our category tree is fully localised and customisable for global clients.

8. Gain a competitive advantage

By augmenting your existing data with supplementary information from internal and external sources, you can achieve a deeper, more holistic understanding of your customers, your operations, and the broader market environment.

Thus, your bank can better anticipate emerging market trends and

-

Identify shifts in customer preferences,

-

Predict changes in demand for specific financial products, and

-

Proactively adapt its strategies to capitalise on new opportunities.

This agility and customer-centric approach, fueled by data enrichment, is crucial for standing out in a crowded market.

You can attract new customers by offering superior products and services, and you can retain existing customers by providing a more personalised and engaging experience. These factors, in turn, contribute to sustained profit growth and long-term success.

8.1. Leverage AI to gain a competitive advantage

Regarding advanced technologies like AI and ML, they are only as effective as the data on which they are trained.

High-quality, comprehensive, and enriched data is crucial for enabling the algorithms to:

-

Deliver accurate predictive insights,

-

Automate complex processes, and

-

Create innovative customer experiences.

For example, enriched data can power AI-driven chatbots that provide instant and personalised customer support, or it can enable machine learning models to detect fraudulent transactions in real-time.

These robust capabilities are key differentiators in a market, allowing you to offer unique value propositions and stay ahead of the competition.