People tend to stick with the same bank for a long time. But as tech giants, fintech and social media power houses enter this space, customers will likely have their heads turning before long.

Banks need to get themselves to a point where user experience, design thinking and focus on the customer is on par with the best in class apps and online services. Banks need to build strong long-lasting relationships so that the thought of switching providers isn’t even a consideration.

We believe that the key to building that trust is meaningful engagement.

In our first post in this series about meaningful engagement in digital banking, we discussed the power of building positive financial habits. This being the driving force that makes people change their ways, and the loyalty that it brings.

In this post, we look at the second step to meaningful engagement: catering for long-term relationships.

Being there when it matters the most

Acting as a trusted advisor, banks need to be there for major events in their customers’ lives. Being there for customers with the right advice, at the right time, goes a long way towards developing trust.

In our lives we have a few critical moments when dealing with money. Our first job, first line of credit, renting and perhaps buying our own place, first child and then maybe investments and considerations for a comfortable retirement. The number of such events varies between individuals, one’s motivation and path in life, but most of us have a few of such moments in our lives.

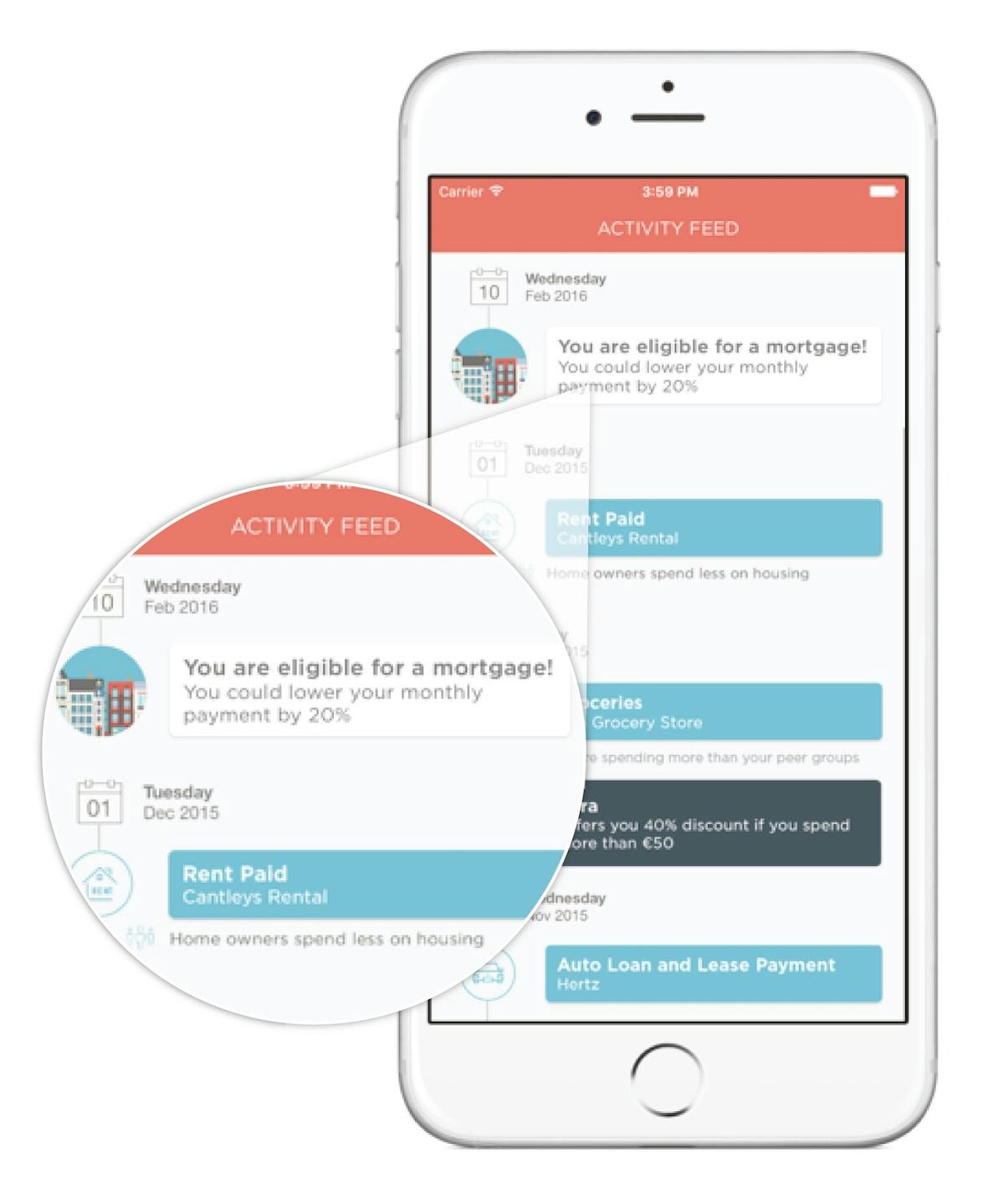

But what does being there mean? When the customer lands its first job, the bank might message and motivate him/her to put some money aside for savings. You might start considering your own place if the bank sends a personalised message on how renting can be expensive and perhaps a mortgage might make more sense at this point in your life.

Later in life, the person in question might receive a message with the insight that they are spending 25% more on groceries than other couples like them with a challenge to save on fast food. As the person approaches retirement, the bank might provide advice on how to put a retirement fund to good use, by using the bank’s pension or investment opportunities.

Each person’s journey through life is filled with expected and unexpected milestones. We all have our own spending habits and each of those habits is defined by the triggers we face every month, year or less frequently throughout our lives.

However, thanks to data that customers generate, banks are in a position to be there, at the right time, for everybody.

Valuable insight at the right time—that either helps me save time or manage my money better—is bound to build engagement. When it comes to finances, we can’t adopt the same gamification strategy that has helped many app developers get their users hooked on their apps. These tend to be short lived strategies. Banks need to consider a long term plan where rewards are in the form of contextual, high value advice and product offering.

Offering something for everyone

In the early days of personal finance management, banks offered budgeting features and were disappointed with the amount of people using such functionality on a monthly basis. People who are highly motivated to sort out their finances and willing to spend time getting to know the features of the budgeting tool will be highly engaged. Others may be more inclined to try to ignore their financial situation and hope it goes away.

Banks need to cater to people with different levels of motivation and the ability to engage with their personal finances. We all go through different levels of motivation in our life. In our 8 years of data, we see a common pattern where people sign up and monitor their finances for a while and then they spend 1–2 hours budgeting and then become highly engaged and active users. But they might not have to revise their budget more than once or twice per year at most.

Based on the analytics we have from our B2C setup in Iceland, we also see that in the first week of January, people are more motivated to take a good hard look at their finances. You wake up with a bad hangover but still motivated to make this year the best one yet. You are going to sign up for a gym membership (not always a sound investment), organise the storage and sort out your finances! Then February rolls in and you are back in the daily rut and struggling to pay off the credit card bill from holiday shopping. In Spain and Italy, this motivational high is often linked with August after the summer holidays. In Brazil, for many people, it is after the carnival. While budgeting tools might not drive frequent engagement, they need to be there for when the customer needs them.

If people feel their bank really understands them and their financial situation, they are less likely to look elsewhere and start afresh with a new financial provider. If they are learning something that will help them improve their lives, they will keep on coming back for more. Make it easy for them – there should be no unnecessary hoops to jump through or hurdles to navigate; ease of use will make your app an essential part of their life.

Like when Strava introduced the yearly goal (in January), runners and cyclists who had been competing with each other on their weekly goals leapt at the chance to try this new yearly goal (me included) – some significantly increasing their mileage as a result. It is also important to design financial challenges for motivational peaks and troughs like this. If you miss that moment, you might be missing an opportunity to make a difference in a person’s life when they most need it. At the same time, designing touch points that will get people interested and connecting to the app when they are not in the middle of a big life change is equally important.

Help people make a positive impact on their lives and they will forever be grateful.

These are just a few examples of how banks can cater to long-term relationships in the context of digital banking. For further inspiration, check out our Insight Paper: Meaningful Engagement in Digital Banking.