Challenging spending behaviour

Three years ago we started a journey to revisit our thinking around how to help people lead better financial lives.

At Meniga we have been running our own application in Iceland for almost 10 years while working with many of the largest banks in Europe as a technology innovation partner. But we have not been happy with the level of engagement we were getting for our financial planning features. We have great engagement from people with high motivation levels but struggle to engage with the wider population that are less inclined to actively manage their money.

We built our product on traditional budgeting and have tried and tested many types of goal setting functionalities through the years. The engagement tends to be between 15 and 25 percent for those type of features depending on how the UX is implemented. But we wanted more and the people who struggle and need help were not in our active user group.

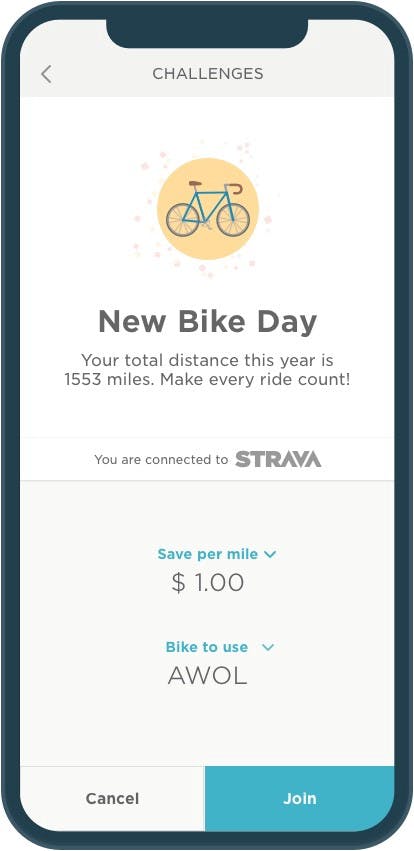

So this led us to revisiting the whole user experience and last November we launched the 3rd generation of our App in Iceland. One of the main shifts was around how we packaged goal settings. We combined all those features in a single section called Challenges.

It is not revolutionary in the sense that it is inspired by successful health and fitness apps like FitBit and Strava. It is however not something many banks or financial institutions have as a part of their digital offering. There is a global trend for people to stop paying gym memberships and rather rely on fitness coaches on their phones. Why can´t we have the same for financial health and banking apps?

Having studied people´s behavior and personality traits. We wanted to try a new approach. Rather than focusing on transfers to savings and total amounts of income contributed to goals. We wanted to challenge people to change their lifestyle and habits in order to have more money sitting on their accounts at the end of the month. During our user testing, it became evident that many people don´t consider themselves to be the “savings types” and we specifically reached out to people that don´t have any regular savings. We invited people who struggled to make ends meet every month to test our concepts while we worked on them.

But to make a long story short, since last November, our engagement numbers have multiplied and we have run all sorts of challenges. The themes have been related to grocery spend, reviewing subscriptions, reducing fast food and clothing spend. Sometimes supported with content and advice, sometimes not. We have actually found that we get much higher engagement for challenges that are backed with content, communications and financial advice. It is something for banks to think about when it comes to designing their user journeys. Not many banks have the ability to communicate with their customers through digital channels like that. Many struggle when it comes to defining a tone of voice and offering financial advice.

Forty percent of our monthly active users have completed one or more challenge.

The results we are seeing for Challenges with our community in Iceland are very promising. Forty percent of our monthly active users have completed one or more challenge and people save on average 12,000 ISK (close to 100 EUR). For some cases we have double and tripled that amount. But the most important part of this for me is to receive feedback from people that tell us we are having a significant impact on their bottom line. For someone to save 20% on Groceries for one month is a tough challenge. Specially if we challenge you to stay healthy and get through the challenge without other family members noticing. It means better planning, new recipes, shopping at different places, getting invited for dinner parties and lot´s of clever tricks like that. Just to speak for myself. I have done this twice and found out that making such changes to my normal routine, I actually contribute to roughly ten percent continued savings on groceries after completing the challenge.

We recently found that thirty percent of people who took the “Park your car for a week” challenge, indeed saved a quarter of their fuel spend for that month. This month we have a fascinating theme going where we are challenging people to buy 10,000 liters of clean water from Unicef for every 1,000 ISK they save. This is backed by a study that claims younger people would like to contribute more to charities. We think it´s a fantastic idea.

Today we are demonstrating the future of challenges at Finovate NY. We want to make savings fun, random and help people build new positive habits. We want to connect your savings to things like sport, music, weather, philanthropy and global good. We don´t expect people to be immersed in their financials every day. But we want to provide the nudges and tools to improve your lives when you feel motivated to make some changes. This is just one of the ways we are trying to make a good impact on people´s lives.

Do you have any bad spending habits that are ripe for a challenge?