Legacy core banking systems are holding banks back. They’re expensive to maintain, painfully slow to adapt, and simply not built for today’s fast-moving digital economy.

As fintechs and neobanks race ahead with real-time services, hyper-personalisation, and agile product rollouts, many traditional banks are still struggling to push updates through systems built decades ago.

However, if your bank is willing to take a leap, core banking modernisation will be one of the biggest differentiators in the market.

Read on to learn how core banking modernisation can future-proof your bank and open new revenue streams.

How do traditional banks still work?

Traditional banks have long relied on monolithic, legacy core banking systems, centralised platforms that process transactions, manage accounts, and support day-to-day banking operations.

These systems, often decades old, have:

-

Hard-coded business rules and limited flexibility.

-

Batch processing leading to delays in real-time services.

-

High maintenance costs of up to 70–78% of IT budgets are required to keep legacy systems running.

-

Siloed architectures that make integration with new digital channels and fintech partners difficult.

-

Manual interventions for compliance, reporting, and customer onboarding.

While these systems have provided stability, they now struggle to keep pace with the demands of real-time digital banking, open banking, and personalised customer experiences.

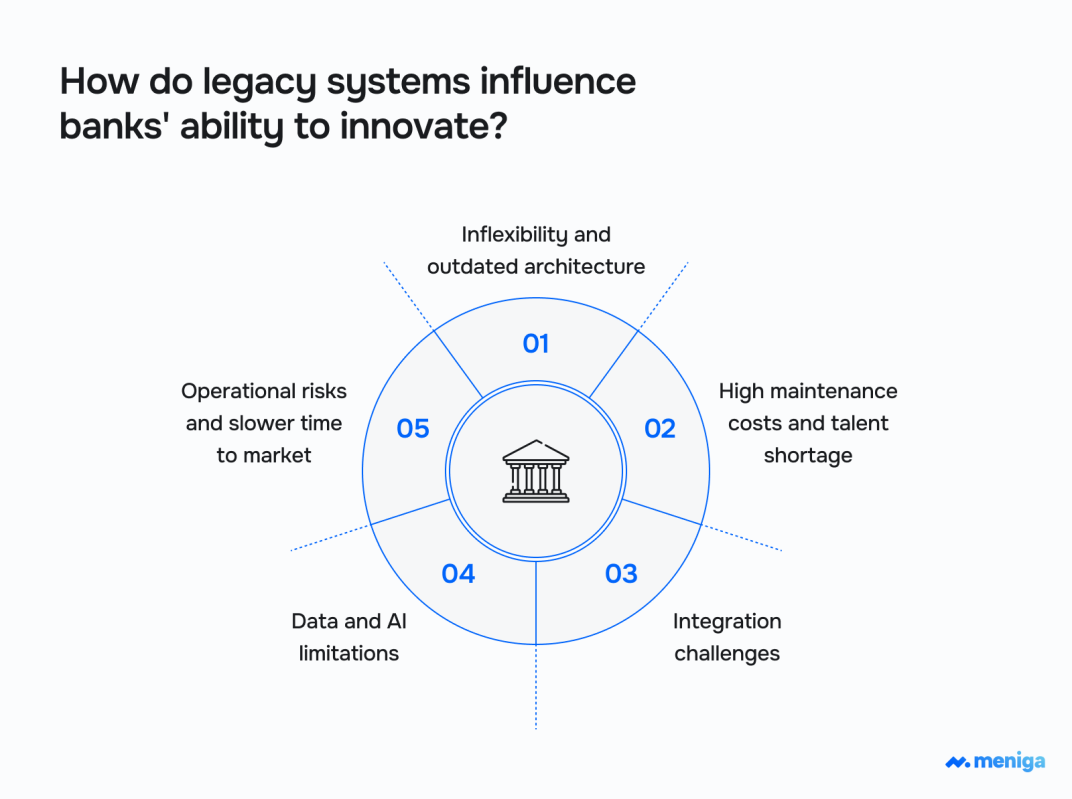

How do legacy systems influence banks' ability to innovate?

Let’s see in more detail how the above factors affect your bank’s ability to innovate by creating technical, operational, and strategic constraints.

-

Inflexibility and outdated architecture: The system makes even minor updates complex, time-consuming, and costly, slowing down the deployment of new features and services. As a consequence, banks can’t quickly adapt to evolving customer demands or regulatory changes, which directly affects innovation speed and agility.

-

High maintenance costs and talent shortage: As we’ve already mentioned, maintaining legacy systems consumes a large portion of IT budgets due to expensive hardware, licensing, and the decreasing number of specialists skilled in legacy technologies.

-

Therefore, this financial and human resource drain limits investment in new technologies and innovation initiatives.

-

Integration challenges: Legacy platforms weren’t designed for open banking or API-driven ecosystems, making it difficult to integrate with fintech partners, mobile apps, or cloud services. Your bank then becomes restricted from offering seamless omnichannel experiences or embedding innovative financial products, which customers now expect.

-

Data and AI limitations: Legacy systems often produce fragmented, inconsistent, or delayed data, directly affecting the use of generative AI and advanced analytics that could drive personalised, real-time banking services. Without clean, integrated data, you miss out on AI’s potential to streamline operations and enhance customer experience.

If you want to learn more about how AI can transform your banking, you don’t want to miss our blog, AI in Digital Banking - How it is Transforming the Industry.

Overcoming these constraints through core modernisation is essential if you want to remain competitive, reduce operational costs, and meet rising customer expectations.

Why is core banking modernisation a competitive differentiator?

Core banking modernisation fundamentally transforms how you operate, innovate, and engage with customers.

Below are the main reasons why modernisation sets leading banks apart.

| Competitive differentiator | Explanation and benefits |

| Increased operational efficiency | Boost processing speed and uptime Reduce costs tied to legacy maintenance. |

| Faster time-to-market and innovation | API-driven, microservices-based cores allow rapid product launches and adaptation to market changes |

| Enhanced customer experience | Real-time processing, 24/7 digital access, and AI-powered personalisation improve satisfaction, retention, and digital engagement. |

| Cost reduction and resource reallocation | Lower maintenance expenses free up capital for innovation, digital initiatives, and customer-centric strategies. |

| Regulatory compliance and risk management | Integrated compliance tools, audit trails, and security features reduce regulatory risks and strengthen institutional resilience. |

| Scalability and future-proofing | Cloud-based platforms scale easily with demand and support ongoing integration of emerging tech like AI, open banking APIs, and digital currencies. |

1. Major efficiency gains and lower costs

Modern core banking platforms, especially cloud-native and modular ones, streamline processes, automate routine tasks, and replace outdated systems that require constant manual maintenance.

As a result, you get significant cost savings, particularly in reduced spending on legacy maintenance, which eats a large portion of IT budgets.

Poor system quality can result in €2.25 million in additional maintenance costs per year per system.

You can redirect these freed-up resources toward innovation, product development, and better customer experiences, giving you a sharper competitive edge.

2. Faster innovation and time to market

Traditional core systems are inflexible, making it difficult and time-consuming to roll out new products or respond to shifting market demands.

Modern platforms, built on microservices and powered by APIs, change that.

They enable faster development cycles, easier integration with 3rd parties, and quicker product launches.

This kind of agility is crucial for staying competitive with neobanks and fintechs. In addition, it is also important for meeting rising customer expectations.

3. Enhanced customer experience and real-time services

Customers expect more than just basic banking. They want instant access, seamless digital experiences, and real-time transactions around the clock.

Modern core systems make this possible with:

Thus, modernisation results in higher satisfaction, stronger digital adoption, and deeper customer loyalty.

4. Improved regulatory compliance and risk management

According to the 2025 State of IT in Financial Services Report, 44% of financial organisations' systems have an average or below-average security rating.

However, modern core systems come with built-in compliance tools, automated audit trails, and advanced security features, making it easier to keep up with shifting regulatory demands.

By reducing the risk of non-compliance, penalties, and costly disruptions, modernisation strengthens both operational resilience and institutional trust in the eyes of regulators and customers.

5. Scalability and future-proofing

As customer expectations grow and transaction volumes increase, you need infrastructure that can scale effortlessly without requiring constant reinvestment or disruptive system overhauls.

Modern core banking platforms built on cloud-native and modular architectures offer exactly that.

They grow with your business by default, handling increased demand while maintaining performance and reliability.

Beyond scalability, modernisation also provides the base for long-term innovation.

Continuous integration of emerging technologies, such as AI, machine learning, and open banking APIs, enables modern cores to adapt quickly to industry shifts and changing customer behaviour.

6. Strategic alignment and ecosystem integration

Modern core banking systems aren’t closed and siloed. On the contrary, they are open, collaborative, and ecosystem-driven.

They leverage open banking standards and API-first architectures to enable smooth integration with fintechs, payment platforms, and other 3rd-party service providers.

By partnering with agile fintechs and embedding new services such as budgeting tools, investment options, or embedded lending into your platforms, you can:

Challenges in core banking modernisation

Despite its multiple benefits, core banking modernisation can come with a set of challenges that span technology, operations, data, compliance, and organisational culture.

1. Data privacy, quality, and integration complexity

Data privacy and risk concerns are paramount, with 93% of banking leaders citing them as major challenges.

Data quality is another significant issue, as legacy data is often fragmented, inconsistent, or incomplete.

According to the same source, 81% of respondents say that legacy systems and integration complexity represent another big hurdle.

This fact highlights the difficulty of connecting old and new platforms, especially when migrating large volumes of sensitive data.

2. Program governance and risk management

Modernisation is a complex, high-stakes initiative requiring robust governance frameworks and cross-functional teams.

Effective risk management and alignment across business, operations, and technology stakeholders are a must if you want to avoid operational disruptions and ensure timely execution.

3. Customer experience and transition risks

Ensuring a seamless customer experience during migration is challenging. Even minor disruptions can affect trust and increase churn.

Transparent communication and real-time updates are necessary to maintain customer confidence through the transition.

4. Performance bottlenecks and security vulnerabilities

Legacy systems suffer from performance bottlenecks. Even small updates can take weeks or months.

Outdated security features expose banks to heightened risks of cyberattacks and data breaches, which are more costly for banks using legacy technology.

5. Cloud migration and technology gaps

Many legacy systems aren’t compatible with cloud-native architectures, making it difficult to leverage modern scalability, resilience, and cost benefits.

6. Organisational and cultural resistance

Cultural resistance and a lack of change management are major barriers. Many banks underestimate the organisational transformation required, focusing too narrowly on technology rather than business process and people change.

Key mitigation strategies for successful core banking modernisation

Mitigation strategies imply a well-governed, phased, and customer-centric modernisation.

This holistic approach will enable you to minimise operational risks, protect customer experience, and bring more value faster.

1. Incremental and phased modernisation approach

Avoid “big bang” overhauls. Instead, adopt modular, component-based strategies that allow gradual migration and reduce operational disruption.

This approach enables early value delivery, risk containment, and continuous business operations during transformation.

2. Comprehensive data migration and quality assurance

-

Implement best practices for data migration, including thorough documentation of legacy architecture, mapping data silos, and validating data integrity through parallel runs or dual processing.

-

Focus on cleaning and consolidating data to improve integration and analytics capabilities in the new system.

3. Cloud migration and technology modernisation

-

Leverage cloud-native architectures to enhance scalability, reduce hardware maintenance, and improve API integration.

-

Use hybrid models that allow legacy and new systems to run concurrently, minimising risk and enabling smoother transitions.

4. Security and compliance

-

Embed multi-layered security frameworks and automated compliance tools early in the modernisation process to mitigate cyber risks and regulatory breaches.

-

Ensure new systems support evolving regulatory requirements with built-in audit trails and data protection mechanisms.

For more strategies and inspiration, check our blog, 6 Best Practices For Modernising Legacy Banking Systems

How can you seamlessly modernise core banking with Meniga?

Meniga offers a seamless approach to modernising core banking by providing flexible, scalable, and modular digital banking solutions that integrate smoothly with existing legacy or modern infrastructures.

Our microservices architecture gives you the flexibility to build and launch new features fast and right when customers want them.

Thus, we can help you accelerate time-to-market and support continuous innovation without requiring a full core overhaul.

How else can we help?

1. We provide portability across on-premise and cloud environments, enabling you to adopt cloud infrastructure at your own pace while ensuring real-time data accessibility and system observability. This way, you can optimise performance, detect issues proactively, and scale efficiently.

2. You can leverage AI-driven data enrichment and hyper-personalised insights to enhance customer engagement. By consolidating and analysing transaction data, you can deliver tailored financial advice, budgeting tools, cash flow forecasting, and boost customer engagement and retention rates.

3. Through our open-source databases and modular release management, you can reduce IT costs related to maintenance, upgrades, and integrations.

Case Study: Launching a market-leading Neobank - moey!

Like most established banks, Crédito Agrícola were facing intense competition from challenger banks who were offering more innovative and customer-centric experiences. Their strategy? To build their own neobank, moey!, powered by Meniga technology. Read more here.

Enticed to discover more?

Contact us today to learn how to set a future-ready foundation that helps you stay ahead of the curve and not just keep up.