Digital engagement in banking: 8 strategies to enhance customer experience

1. Hyper-personalise through AI and data analytics

The foundation of any strong digital engagement strategy is a deep understanding of the customer.

Thus, you should harness the power of data analytics to gain customer intelligence and understand user behaviour, preferences, and pain points.

By analysing transaction history, digital interactions, behavioural signals, and demographic information, you can build detailed customer personas.

Armed with this intelligence, you can deliver AI-powered, hyper-personalised Insights to boost engagement, such as:

-

Tailored financial advice,

-

Product recommendations, and

-

Proactive service based on real-time customer data and behaviour to ensure that every touchpoint feels relevant and personal.

These 360-degree customer views integrate data from multiple sources, allowing you to anticipate life events and personalise interactions at scale.

The more you understand your user, the more effectively you can engage them.

2. Enhance mobile and online banking experiences

Banking is no longer confined to brick-and-mortar branches.

An increasing number of users use smartphones and computers to manage their finances, making it absolutely essential for financial institutions to provide a seamless and engaging digital experience.

Actually, non-cash transaction volumes are expected to amount to2.3 trillion by 2027, growing at a CAGR of 15%.

The quality of mobile and online banking platforms directly impacts customer satisfaction, loyalty, and ultimately, your competitive edge. Exploring great referral program examples can provide insights into how to encourage customers to share your services and attract new clients.

2.1.Mobile apps

The apps should be more than just scaled-down versions of traditional banking services.

They must be intuitive, fast, and feature-rich, designed with the user's needs and expectations in mind.

Customers should be able to perform all key transactions with ease, including:

-

Transferring funds between accounts,

-

Making seamless bill payments to a wide range of vendors, and

-

Monitoring their accounts comprehensively to stay on top of their financial health.

To achieve this, you need a clean and uncluttered interface, logical navigation, and robust security measures to protect sensitive data.

2.2. Online banking platforms

Online banking platforms should mirror the ease of use and functionality of mobile apps, providing a consistent experience across all digital channels.

What you can implement:

-

A responsive design that adapts to different screen sizes and devices is crucial to provide extra convenience and flexibility of use.

-

A search functionality to enable users to find the information they need quickly.

-

Live chat support for immediate assistance to users facing technical issues or having questions about their accounts.

-

AI-powered chatbots that can handle routine inquiries and provide personalised recommendations, freeing up human agents to focus on more complex issues.

-

Real-time alerts, delivered via push notifications or email, can keep users informed about account activity, potential fraud, and upcoming payment deadlines, empowering them to take control of their finances.

Data analytics come in handy here to help you understand user preferences and tailor the online and mobile banking experience accordingly.

For example, you can display frequently used features prominently, provide customised financial advice, and offer targeted promotions based on individual needs.

Get inspired:

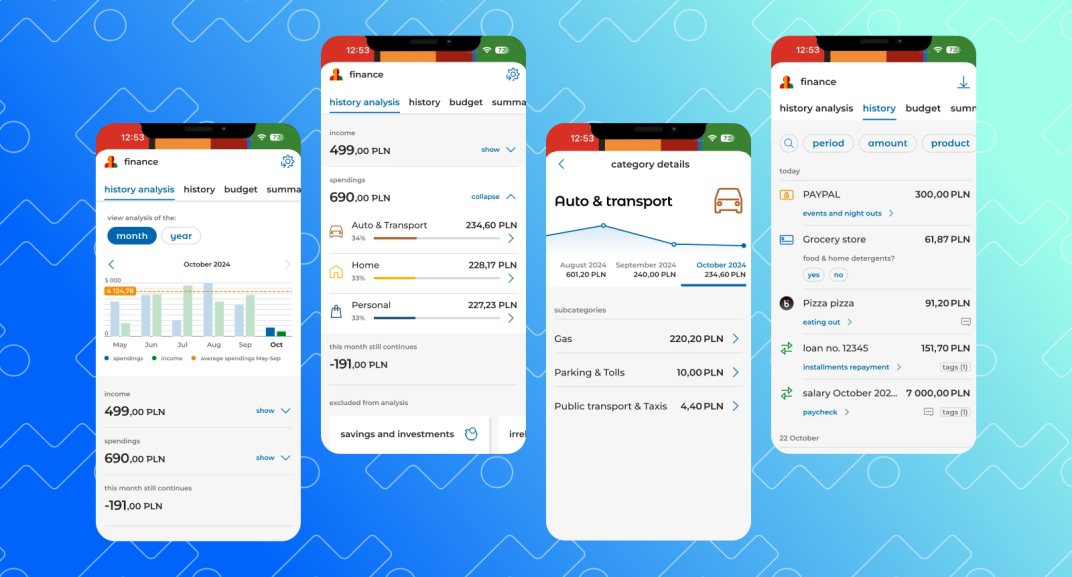

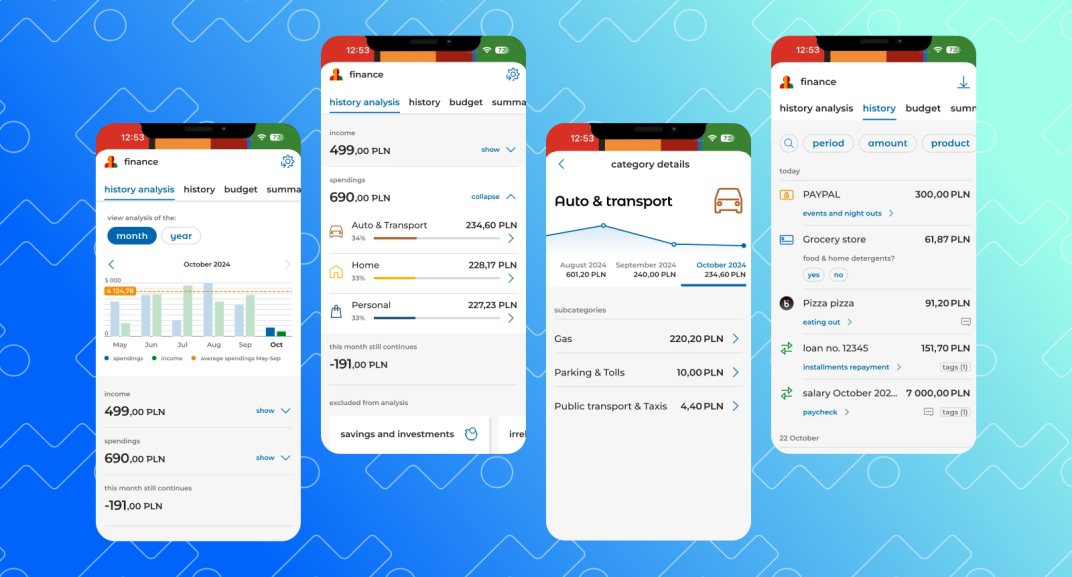

mBank, the first fully online bank in Poland, opened the door to mobile and online banking in the region, and has since expanded to Slovakia and the Czech Republic.

They collaborated with us to help transform the user experience using our APIs.

Their challenge was to help customers wisely manage their current and future finances by providing well-structured information on their inflows, outflows, and assets.

Thus, Meniga helped us redesign the system to create a simple and user-friendly interface, allowing customers to better understand their incomes and expenses.

In addition, the customers can:

-

Leverage a Google-like search engine that can define different budgets along with constant monitoring.

-

Track their budget with automatically segmented expenses by category, subcategory, down to transaction detail.

3. Provide seamless omnichannel experiences

Customers interact with banks across multiple channels, including mobile apps, websites, social media, email, and in-branch.

An effective digital strategy must unify these touchpoints into a seamless omnichannel experience.

Therefore, whether a customer starts a loan application on a mobile app and finishes it in a branch, or asks a question online and gets a follow-up via email, the experience should feel consistent and connected.

Omnichannel onboarding and unified service journeys:

-

Reduce friction,

-

Lower drop-off rates, and

-

Improve satisfaction, as customers can start and finish processes on any device or channel.

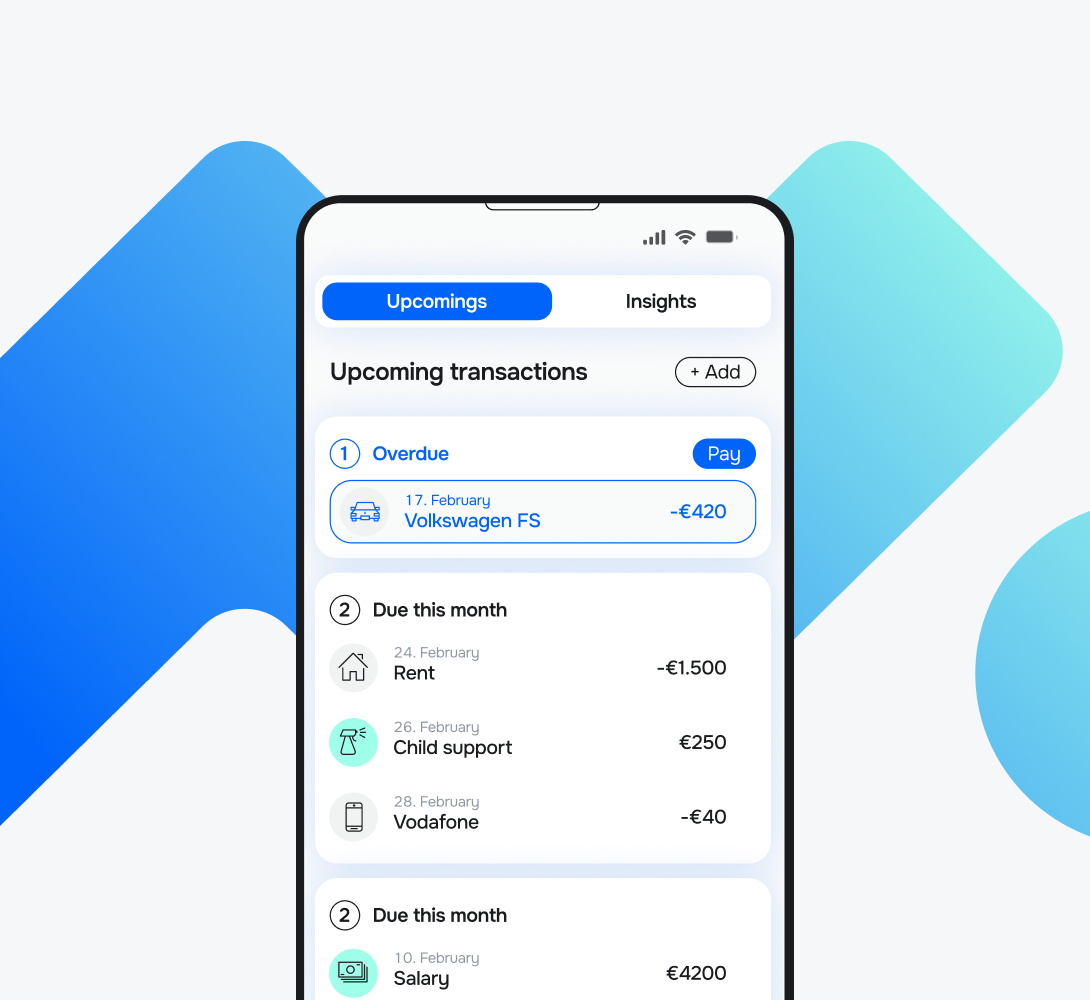

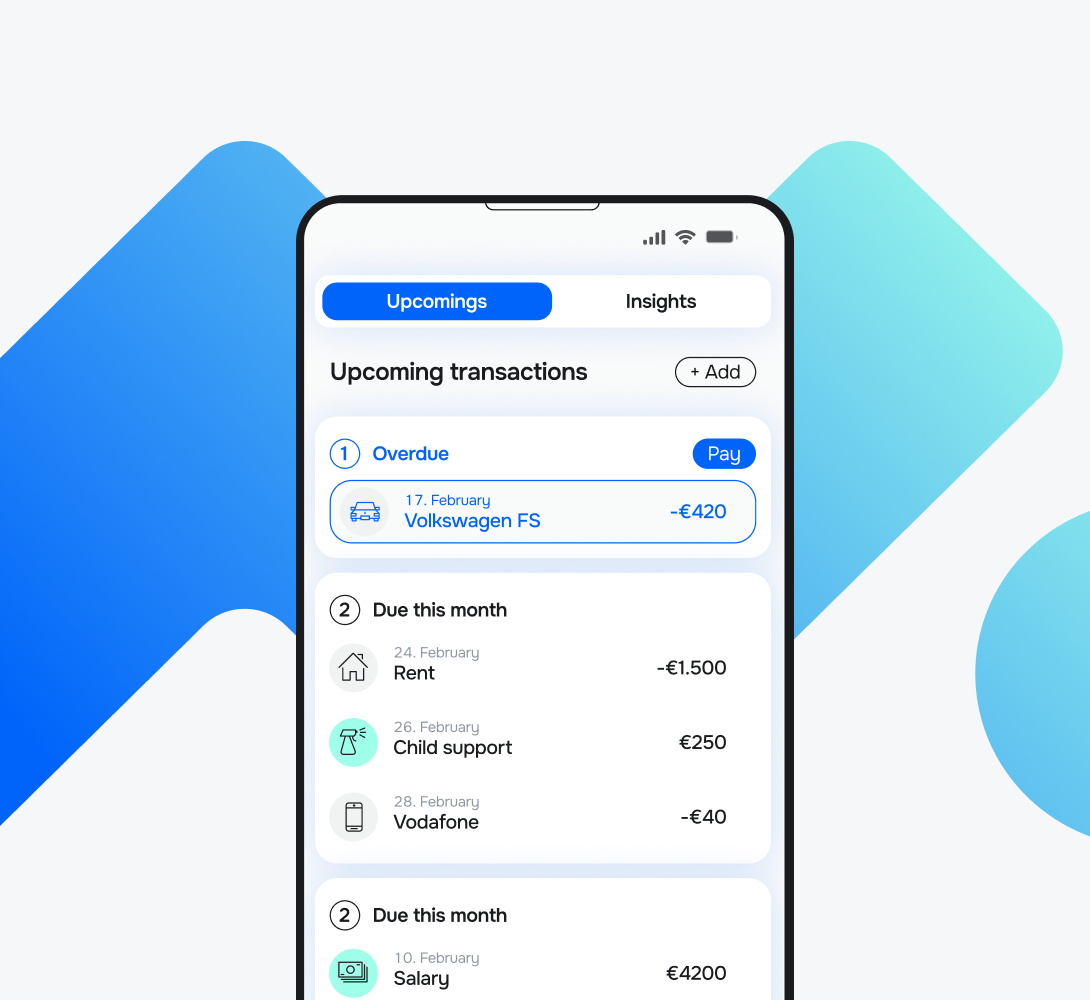

4. Enable proactive alerts, notifications, and real-time engagement

When users receive timely and relevant notifications about their transactions, payments, and security events, they feel informed and in control, which leads to increased confidence in the platform and the service it provides.

This proactive approach goes beyond simply reacting to customer inquiries.

It anticipates their needs and provides valuable information before they even have to ask.

The key to successful implementation lies in personalisation and user control.

Allowing users to customise their notification preferences empowers them to filter out irrelevant information and focus on what truly matters to them.

Not only does this enhance the user experience, but it also significantly reduces the risk of "app fatigue," where users become overwhelmed by excessive or irrelevant notifications and disengage from the application altogether.

Furthermore, enabling quick actions from alerts can boost convenience.

For example, a user might receive a notification regarding a pending payment and be able to approve or deny it with a single tap, without having to navigate through the entire application.

By investing in targeted, personalised, and actionable notifications, you can witness significantly higher engagement rates, improved customer satisfaction, and ultimately, increased customer loyalty.

Worth knowing

With Meniga’s context-aware tools, you can reach customers via push channels — The fastest way to reach out, ideal for urgent and high-priority communication.

5. Embedded finance and open banking

By embedding banking services into non-financial platforms, such as eCommerce application development, lifestyle apps, and more, you can meet customers where they are and offer contextual financial solutions.

Imagine receiving a personalised loan offer while browsing for a new appliance online, or effortlessly splitting a restaurant bill with friends directly within a social messaging app.

By seamlessly integrating financial services into the user's existing workflows, you can provide a more intuitive and frictionless experience, increasing engagement and reducing the likelihood of customers switching to competing financial providers.

A great assistant in this domain is open banking, which uses APIs to enable secure data sharing and connectivity between different financial institutions and 3rd-party developers.

Open banking empowers customers to manage multiple financial products and accounts from different banks and providers through a single, unified interface.

Thus, it provides a holistic view of a customer's financial situation, making it easier to track spending, manage budgets, and make informed financial decisions.

Furthermore, open banking fosters innovation by allowing fintech companies and other third-party developers to build new and innovative financial products and services on top of existing banking infrastructure.

Worth knowing

With Meniga, you can combine Open Banking, external data, and internal data to offer customers a holistic overview of their finances.

Meniga processes internal and external financial data from various sources in real-time, standardising it for banks' digital channels via our RESTful API.

We leverage flexible technology that can be configured to meet your specific business needs, while providing connections to many world-leading open banking aggregators.

Meniga provides you with:

-

Standard connectivity through pre-built connectors

-

PSD2 compliant Payment Initiation Services

-

Full support for consent management

-

Seamless integration and flexible deployment.

6. Encourage customer feedback and participation

Engaged customers want their voices heard. You should make it easy for users to provide feedback.

Ways to implement customer feedback:

-

Conduct seamless in-app surveys triggered after specific transactions or interactions.

-

Introduce star rating systems with optional comment fields to measure satisfaction with specific features.

-

Encourage reviews on app stores and actively monitor social media channels for mentions, comments, and discussions related to your services.

-

Incorporate a dedicated feedback portal within the app or website to provide a centralised location for users to share their thoughts and suggestions.

However, simply collecting feedback isn't enough.

You should actively listen to what your customers are saying and, crucially, respond in a timely and meaningful manner.

Acknowledging feedback, even if it's negative, shows that you're paying attention. Addressing concerns, offering solutions, and explaining the reasoning behind decisions all help build trust and strengthen the customer relationship.

Furthermore, and perhaps most importantly, you should strive to incorporate customer suggestions into product updates and new app features.

Suppose a user suggests a streamlined bill payment process or a more intuitive budgeting tool.

Implementing these ideas and then explicitly highlighting that the change was inspired by customer feedback sends a powerful message: "We value your input, and we're committed to building a digital banking experience that meets your needs."

7. Provide security and trust

Customers must feel that their data and money are safe.

Investing in robust security features, such as biometric authentication and two-factor verification, enhances this trust.

Furthermore, the use of real-time fraud detection systems, powered by algorithms and machine learning, can proactively identify and flag suspicious transactions, preventing potential financial losses before they occur.

Equally important is to communicate your security protocols clearly and transparently to your customer base.

Many users aren’t technically savvy and may not understand the complexities of cybersecurity.

By explaining security measures in simple, accessible language, you can educate customers and alleviate anxieties.

Don’t forget to provide regular updates on security enhancements and actively educate users on how to protect themselves from phishing scams and other common online threats.

When users genuinely feel protected and understand the efforts your bank makes to safeguard their assets, they are far more likely to engage with digital platforms.

As a result, it will lead to increased adoption of digital banking services and greater overall customer satisfaction.

8. Measure performance to continue optimisation

To improve digital engagement, you should track performance and optimise based on data.

Key metrics to monitor include:

-

Session duration — Are customers spending enough time interacting with the platform to complete their tasks?

-

Login frequency — Indicates how often customers find value in using the digital services.

-

Net Promoter Score (NPS) — Provides critical feedback on customer loyalty and their willingness to recommend the bank's digital offerings to others.

-

Feature adoption rates — Are new features being embraced by users? If not, why? Is there a usability issue, a lack of awareness, or simply a lack of need?

-

Customer retention — The ultimate measure of success. Are customers staying with the bank, or are they moving to competitors with superior digital experiences?

Therefore, developing metrics and strategies at each stage becomes paramount for any digital bank.