Helping banks build meaningful engagement

At Meniga, our mission is to help people understand and manage their finances. Or how I like to frame it; Spending on things that matter in life.

Our company has been on this path for 6 years now and I joined midway. That means I’ve been thinking about this challenge for over three years now. That makes almost 1300 showers (where I get my best ideas).

In 2016 we have also done close to 100 user tests and interviews on our revamped UX that we plan to launch next year.

Meniga is not like most fintechs. From the get go, we decided to work with banks to realise our vision. We have had the great fortune to work with some of the most innovative banks in the world. Our technology now helps millions of people understand and impact their financial situation.

Based on our project experience and the fact that we were modernising our API, we also started a new project for our reference apps.

Codename: Bank 42

The answer to the ultimate digital banking experience, the Universe and Everything.

The underlying theme for the project is meaningful engagement. We want more people to gain insight into their current financial situation and to motivate them for change.

For this to happen, we need to appeal to a wider audience and be top of mind even when you are not motivated to think about your finances.

I’ve split the goal of meaningful engagement into three themes that have guided us in our work this year. This blog is a short summary of these themes.

Building positive financial habits

I’m fascinated with the human mind and how we tick. Many apps have done well by integrating variable rewards at variable intervals in their UX. We even get asked for “Gamification” when engaging with potential bank customers. But my opinion is that banks need to provide more substantial rewards than gamified badges and levelling up in life. Most gaming apps have a short life span (Pokemon Go-ne?) and in order to bring long term meaningful engagement, banks need to bring real value and life changing behaviour. Like fitness apps, including Strava and Headspace. I’m biased here as both of these apps have changed my life for the better without going over the top in dishing out badges void of value.

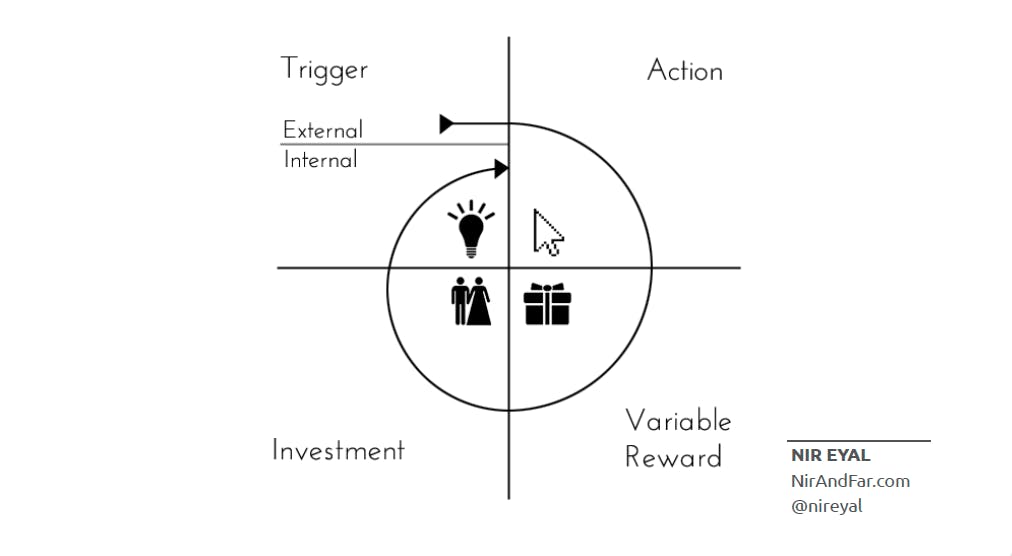

If you are keen to read more about how to create habit forming apps, I recommend Hooked: How to build habit-forming products

This brings me to designing for time well spent. I came across this idea browsing through Ted talks and it struck a chord. The apps I have on my first screen tend to be apps that I associate with this feeling.

Disclaimer: I have moved facebook to the third screen on my phone.

If a bank can leave this impression on it’s customers after every session. “This was good use of my time”. Then we are on to something. The rewards can be in the form of excellent usability. Removing hurdles for my most common tasks like understanding how much money I have and transferring funds. But then we can move on to informing and educating me about my finances. Tell me something I don’t know, like how my spending in bars or on bikes is trending compared to other people like me. Recommend products and financial advice that is relevant to me. Give me good deals and cash back with merchants that I associate with.

Pro tip: Giving cash is a good reward

To summarise. I feel that the path to promoting a healthy financial habit could be achieved by providing the most rewarding digital banking experience. I should leave my digital bank with a smile after every session thinking “this was good use of my time”.

Motivation and ability

People are strange. I have had more conversations about peoples’ financial habits and health than I can count. After each one I have become more convinced that there is no “one solution for all”. This year we have been recruiting people that are struggling financially to test our prototypes. It is a humbling experience and you learn a lot. Most days I’m surrounded with people that can have a lengthy conversation about their personal finance strategy. Stepping out of that bubble, I meet a single mom with children that no longer want to go the the grocery store with her. She’d rather get a decline on her credit card with bags full of products rather than checking her available balance. She is terrified of her financial situation.

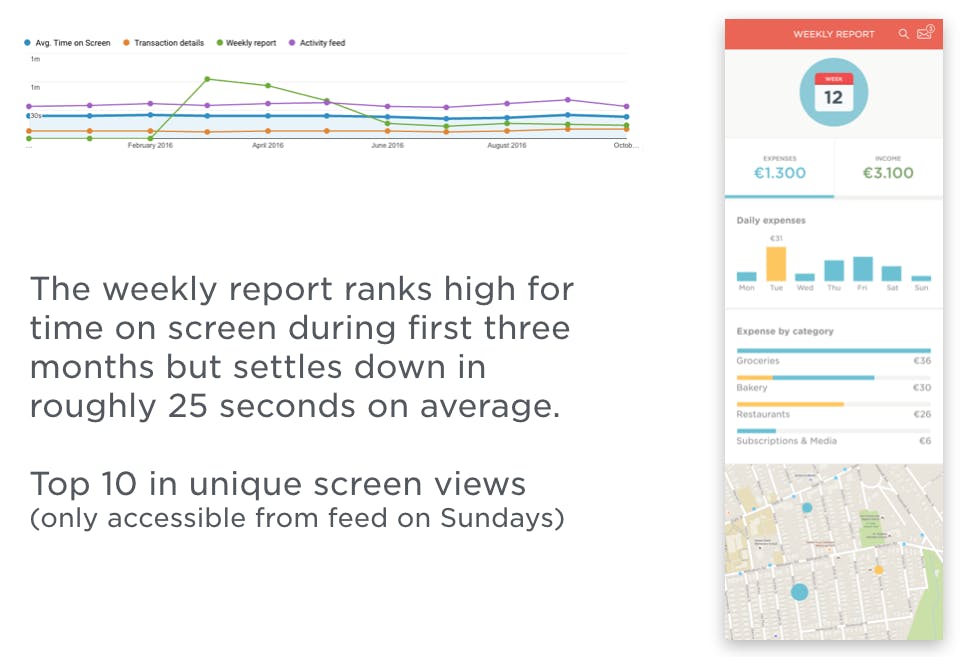

Some people are motivated while others are not. We also go through different levels of motivation in our life. Based on the analytics we have from our Meniga.is setup in Iceland, we see that in the first week of January, people are more motivated to take a good hard look at their finances. You wake up with a bad hangover but still motivated to make this year the best one yet. You are going to buy a gym membership (not always a sound investment), tidy up the storage and sort out your finances! Then February rolls in and you are back in the daily rut and struggling to pay of the credit card bill from holiday shopping. In my travels I have learnt that in Spain and Italy this motivational high is often linked with August after the summer holidays. In Brazil, for many people it is after the carnival.

Reflecting on your spending is a healthy activity and our most engaged users do that a couple of times per week. But there are a few moments in life when you are more motivated to look hard at your finances. This might be when you graduate, buy your first flat, have your first baby, retire or get divorced. Some banks complain that engagement numbers for budgeting are low (15–25% of monthly active). But I would like to challenge that. If you omit it, you might be missing an opportunity to make a difference in people’s life when they most need it. We have also seen that once people have taken a couple of hours to revise their budget, they consider themselves budgeteers. Even though they only track expenses through email without updating any plans.

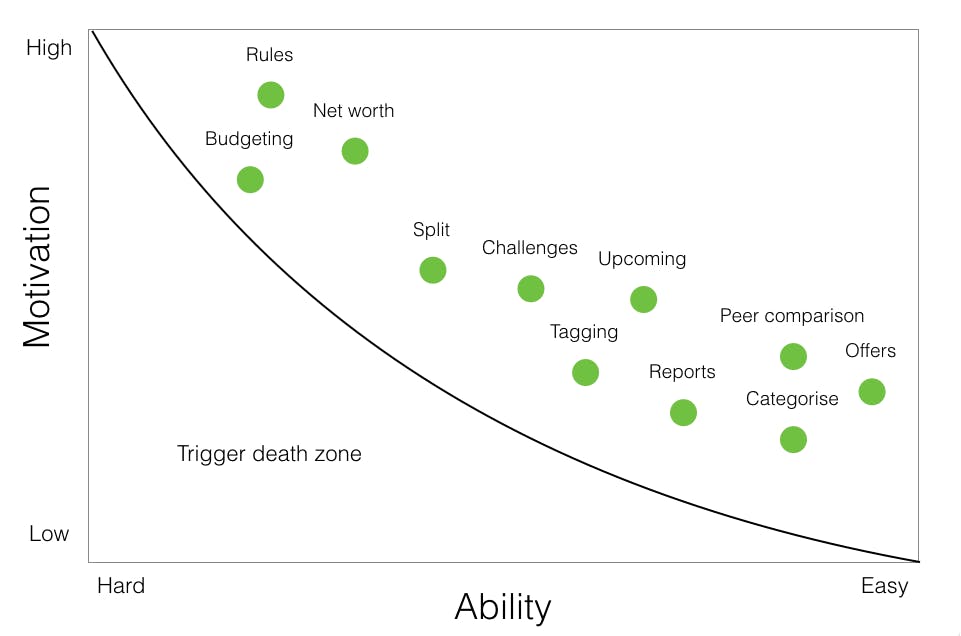

Before we started working on the Bank 42 project, I came across studies from BJ Fogg on Motivation waves. He has also been investigating how we form habits and has this nice way of visualising the odds of people using a feature based on how hard it is and how motivated they are. So I made a stab at classifying the engagement hooks Meniga provides and then tried to identify ways to increase the actions in the lower right corner.

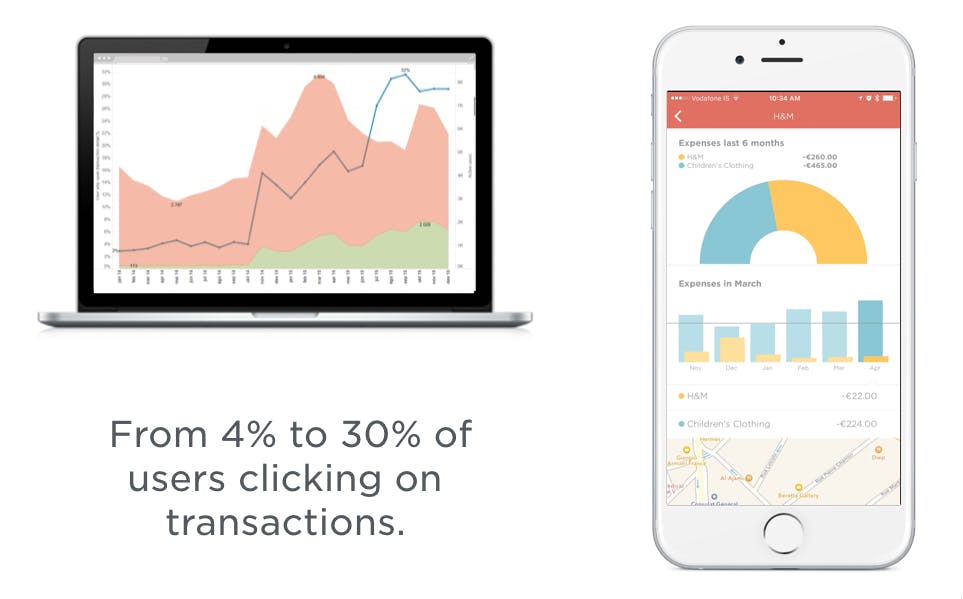

We also looked at ways to move goal settings further down on the diagonal line with the aim of increasing engagement. For instance we see that 60% of our monthly active mobile users like to confirm or update categorisation. This is an investment in the system to make the reports more accurate and personalised. We have even received comments from highly motivated users complaining about too few categorisation confirmations. The system learns and we stop asking for similar transactions after a while. Offering the ability to categorise is one of our most frequent, low effort engagement hook. But more on that later.

Personalisation is key

The last theme for our ambitious project was sparked from running GV Design Sprints. We recruited people that some might classify as financially challenged. We set up surveys when recruiting testers and varied our tests for different levels of financial fitness. It became obvious early on that if we were to reach one of our objectives to “Help more people reach their financial goals”, we would have to cater to different personalities.

I have been using personas for the best part of this millennium and am a big fan. But I wanted to dig deeper and understand why people react so differently to their financial situation. I reached out to my psychologist friends and family connections and did not have to go far. At Meniga we have a diverse crowd of employees and one of our App developers is doing advanced studies in psychology. He pointed me in the direction of the Big five personality traits.

I did some reading and studied articles that used the Big five as a basis for looking at how people manage their finances. It came as no big surprise that people rank high for Conscientiousness tend to do well financially and like to do a good job, while people who rank high for Neuroticism do not. Our super-users belong to the first group but people who have a tendency to experience negative emotions such as anger, anxiety, or depression are not as actively engaged in their personal finance.

Based on this insight and the fact that most online banking apps look the same, we have taken a different approach. Content, insights, goal settings and copy is catered for different profiles based on their financial status and engagement metrics. We are still defining the details of a personalised digital banking experience, but the thinking behind it seems solid and we are getting good results from our tests.

This post is a summary of a more extensive talk I gave at our recent customer conference in the Blue lagoon. I will be sharing more insight as we progress and enter the Beta phase. We look forward to going live with our new designs and UX and will keep you posted on our journey towards a more financially fit global population.

Interested in hearing more? Contact us and we can chat about engagement.