With mobile banking apps being used by more people than ever before, now is the perfect time to super-charge engagement by learning the lessons provided by social media.

Read our insight paper to discover how to maintain increasing engagement rates

Mobile banking apps are now all the rage, with some reports even suggesting that they proved more popular than social media apps during the pandemic.

There was a time when banking and social media were poles apart when it came to digital engagement, but the two are starting to converge.

Some of the best mobile banking apps now even resemble social media, offering a constant stream of information and alerts about customers’ personal finances, loans and investments.

It doesn’t have to end there – a future where banks integrate data from social media apps and enrich their transaction feed with customer reviews for stores or restaurants is well within reach.

All this is made possible by obtaining the users’ consent and interfacing with the social media platform’s APIs.

Like it or loathe it, social media apps provide a masterclass in how to engage customers. Until now, banks have been resistant to take too much inspiration from social media, and for good reason.

The heavily-regulated environment that is banking means that engagement with customers demands some structure in order to minimise risk. As a result, social media itself has proved to be just another customer service channel, as opposed to somewhere for banks to look to truly engage with customers about their financial habits.

However, with the evolution of mobile banking apps, banks can look at more emotionally engaging ways to connect with customers, to not only retain them but to drive more revenue from them.

While more people than ever are using mobile banking apps, banks need to turn usage into engagement if they want to keep the kinds of numbers we saw during the pandemic.

Otherwise, mobile banking apps will remain transactional, limiting their potential for banks and leaving customers frustrated. Social media has shifted the expectations of customers and caused them to rethink their relationships with brands, with banks being no exception.

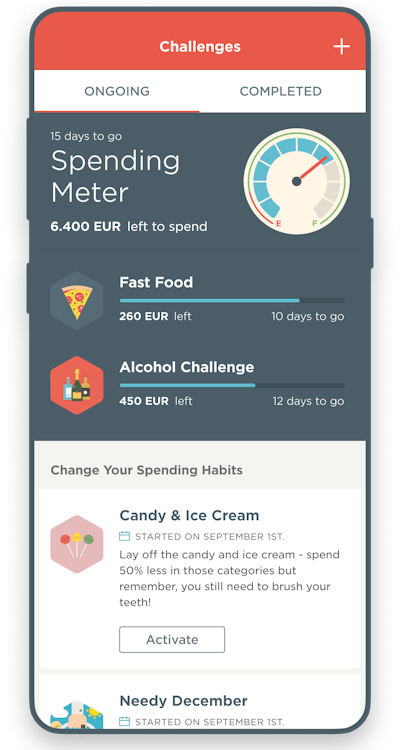

A focus on the user experience will help banks differentiate and super-charge their engagement through superior functionality. This might include automated, notification-driven personal finance insights, such as alerts for unusual spending and low balances, as well as insightful nuggets on spending behavior. Playful savings challenges and personalized offers will help ensure users are engaged, spread the word and keep coming back for more.

However, banks have to be mindful not to over-complicate things and instead focus on getting the ‘simple’ things right: delivering the most relevant content to users, fostering a sense of community and enabling customers to take control of their personal finances.

Meniga takes inspiration from market-leading platforms that excel in habit-forming loops like social media and fitness apps to develop digital banking solutions which keep users engaged on a level never before seen in banking.

Take our Personal Finance Management (PFM) tool, which includes a communication channel containing personalized user events. It also gives users the opportunity to see how their financial situation compares with their peers, creating an element of ‘social banking’.

To understand more about what’s possible with PFM, click here.