How engagement analytics drive innovation at Meniga

One of the big challenges in digital banking is to understand customer behavior on the web and in apps. Knowing who does what, when and even why is key in driving user engagement. Meniga provides software and analytics solutions to banks and this is how we help.

I began my studies in Industrial engineering in 2007, only a year before the economic crisis hit Iceland. Following the crash, the founders of Meniga started thinking about creating a personal financial management system. When I was in my last year of studies in 2009, the first version of Meniga was launched. I immediately switched banks to be eligible and signed up.

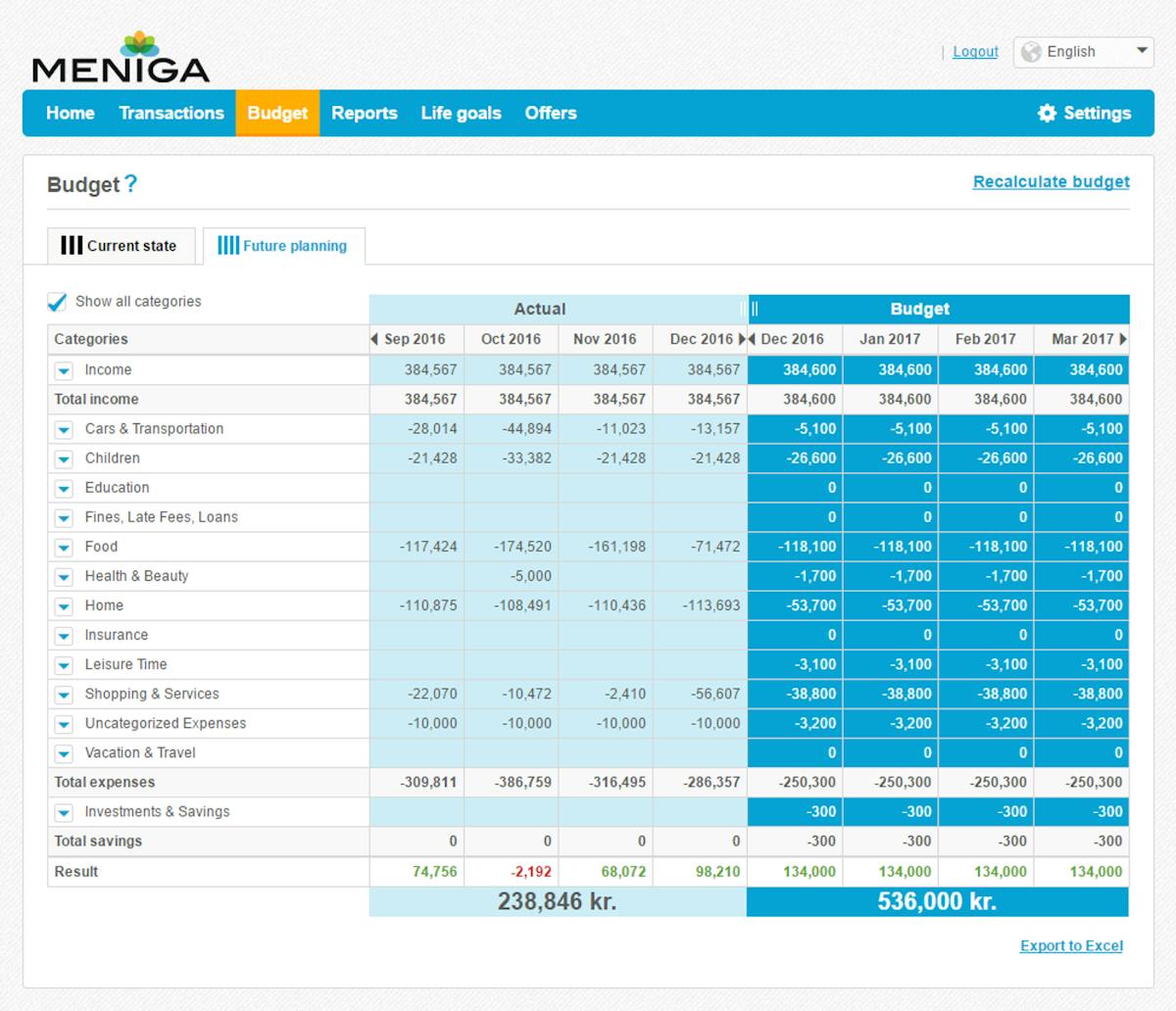

I loved the fact that there was a system measuring my finances and that I could access analytics and reports on my expenses at any time. I became a super user from first login. My favorite feature is, and always has been, the budget.

I realize that not all users are like me. As a data analyst and partly German (and thus extremely organized and disciplined), I´m an easy target. No, I cannot consider myself as the typical Meniga user.

For those who have no history with their users, the only option is to guess and imagine on different user profiles. That is imprecise at best, and often flat out wrong. That is why we have decided that it is time to measure, analyse and improve.

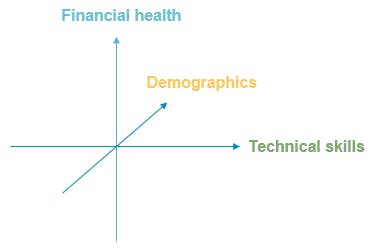

Meniga strives to ensure a feature portfolio that engages all types of banking customers. Getting the financially healthy and “on top of things” people engaged is relatively easy. Getting the financially challenged to engage and improve their finances, now that is the tricky part. This is why Meniga logs app and web actions centrally into its new data warehouse solution, making it possible to connect Meniga system engagement to user demographics and financial status.

This allows us to see how different groups use Meniga and identify the groups that need more attention. The results are used as basis for prioritizing the improvements of our current features and the backlog of new features. This analysis is conducted—like all other Meniga analysis—on aggregated and anonymous data.

The results on the feature analysis is already extremely interesting. Meniga has been running card linked targeted offers in Iceland for over two years with good results (average conversion rate at 11%, probably the industry’s highest). It turns out that our users love receiving cashback and the result is that 18% of the Meniga app login are to check out offers. Many sessions continue even further where users spend more time engaging with other features such as budget or life goals.

Meniga’s users are saving money on great offers and engaging with features that improve financial stability at the same time.

That is why it came as no surprise when the preliminary results of a study by Arna Olafsson, an assistant professor of household finance at Copenhagen Business School, showed that Meniga users are saving significantly by logging in more often. Users started logging into the Meniga system almost twice as often with the introduction of the new app and offers in November 2014. Instead of web logins being reduced by this new ‘app contender’ they also increased.

Analytics and results like these give us an idea of what drives banking app engagement, helps us understand the groups that use or do not use our system and thus aids us in internal decision making with regards to feature prioritization. Stay tuned… because there is much more to come!

If you want to know more, please contact us.

For more information visit www.meniga.com