We at Meniga are obsessed with how banks can use data to gain competitive advantage in a world where they are increasingly challenged by tech giants. The interesting thing about banking data is that seemingly mundane aspects make a huge difference whether it can be used in a meaningful way to create value for customers.

Hit the sweet spot of transaction categorisation

A prime example is how your bank categorises and enriches transactional data. If this is done well, the bank will have a crucial engagement feature locked down in its banking app. The bank is able to understand the spending habits of its customers and use that data to offer customers the right products or nudge them to improve their financial habits.

Don’t skimp on categories

But how many categories should your banking app have? Won’t just ten or twenty do for the sake of simplicity? That may sound good on the face of it but our experience tells us otherwise. Banks should offer their customers a large selection of transaction categories. They should optimise their merchant mapping to make the transaction categorisation as accurate as possible. Equally important is to allow users to change the category assigned to a transaction, which feeds back to the optimisation and allows for a highly personalised user experience.

Some real life data

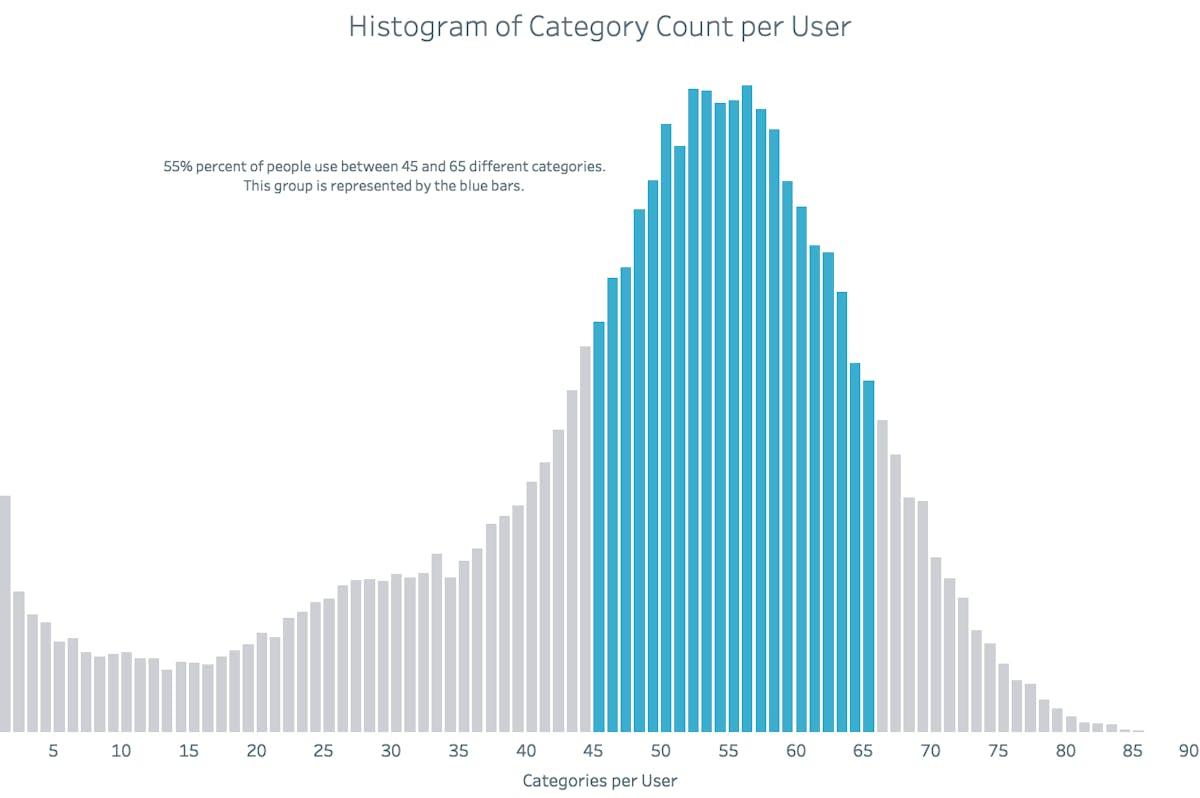

In our own B2C PFM app which Meniga runs here in Iceland, we aggregate, map and enrich transaction data from the main three Icelandic banks. In our app, transactions can be mapped to 140 categories. In 2018, more than 50% of our active users have had their transactions mapped between 45 and 65 categories. A large portion of our users have even more granular categorisation.

Offer the richest transactions

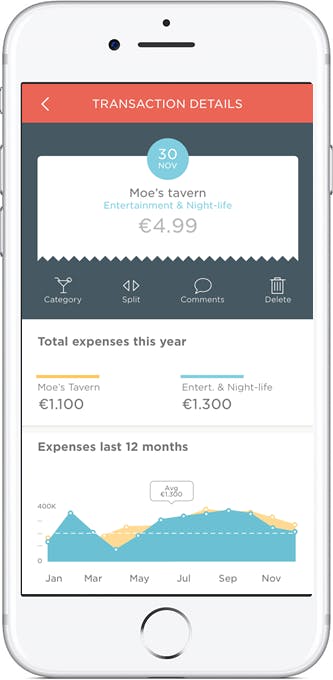

We have also seen the effectiveness of offering enriched transactions. Our transaction detail screen provides a clear overview of expenses by category and by merchant. The introduction of the transaction detail screen created a new destination and habit for people to learn about their spending. It quickly became one of our most popular personal finance features — increasing the number of users clicking on a transaction from 3% to 45%.

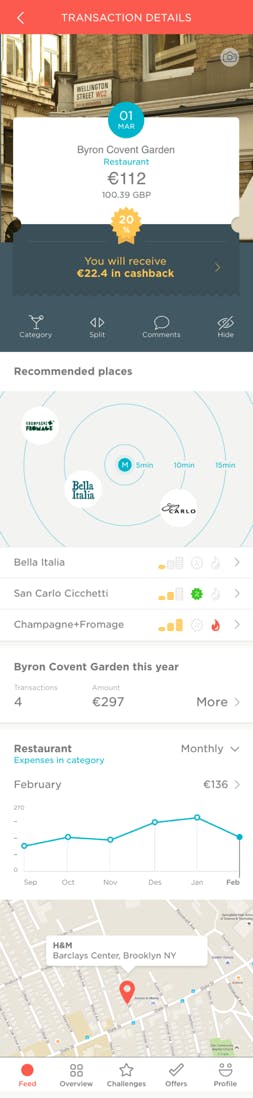

Since then we have expanded the transaction detail screen and introduced what we call the Richest Transactions at Finovate Europe last year where it won best of show. Richest Transactions inspire banks to branch out from the familiar digital banking customer experience to introduce services such as restaurant recommendations in the context of everyday banking.

Vacation spending binge categorised to the max

Let me give you an example of this works. In February alone the Meniga app mapped my spending to no less than 22 different categories. I went on a trip to Boston with my wife and of course we shopped and dined out at many different places. Nevertheless, the Iceland based Meniga app mapped out my spending in the United States 100% accurately. My excitement about this was indicative of my recently discovered enthusiasm for accurate banking transaction mapping, which comes from working at a company such as Meniga.

Crowdsource for best results

I can change or even split the spending categories for each transaction. So if I am shopping at Amazon and buying many different things in one order, I can adjust the transaction categorisation to better reflect my spending. Meniga’s system learns from these adjustments, the app gets better data, transaction mapping is improved and the potential for meaningful engagement is improved. With this approach and a highly engaging user experience Meniga has managed to successfully crowdsource transaction mapping. The end result is a very granular analysis of my spending which I can use to better understand my finances. My bank gets a fuller picture of me as a customer and should be able to offer me better service. My beloved Meniga offers from my favourite brands are even more personalised. So it is a win win situation all around.

Users are more enthusiastic about categorisation than you think

But do people really bother to engage with their transactions? Our data tell us that they do. A big variable is whether the user is deep diving into her finances and using our web interface or just very quickly looking at the smart phone to get quick insights. Around half of active users edit categories. The user interface is a crucial factor. If category editing is easy and intuitive, users will be more likely to engage with this feature.

Make your banking app central to daily life

So offer a wide range of categories for your customer’s banking transactions. Automate your transaction mapping as much as you can, offer customers enriched transactions and delight them with great user interface. Actively use the data generated to build personalised and meaningful engagement. This will elevate your banking app from being a place where people check their balance once in a while to a crucial part of people’s daily lives.

For more information visit www.meniga.com