Is transaction categorisation a feature or strategy?

Categorising transactions has been at the heart of what we at Meniga do since our founding in 2009. Fast forward to late 2018 and we are simplifying the financial lives of more than sixty five million customers of some of the largest banks in Europe. We do this by processing all their transactions in real time.

Learning the lessons of the PFM hype cycle

During this time the Personal Finance Management (PFM) has been through the whole hype cycle. We rode the initial wave of standalone finance management which you may have seen in the far-right tab in your online bank. We spearheaded the presentation of categories and insights as a part of day to day banking.

mBank was one of the first banks to fully integrate categorised transaction on the home screen as the default view for all their customers. Today most of the banks we work with understand the importance of a fully integrated user experience.

The implementation of categorisation is essential for great user experience

Transaction categorisation is now a standard feature for online banking. This is in some ways driven by the success of challenger banks like Revolut and Monzo. Banks are now racing to match their user experience.

This is great development and now banks come to us stating that categorisation is a must-have feature for their customers. However, in many projects we need explain that this seemingly basic requirement is not just a feature but an essential strategy for superior user experience in digital banking.

Learning directly from our customers and users

Meniga works with banks and financial institutions to categorise, consolidate and enrich transaction data from debit cards and credit cards. For the past nine years we have implemented 25 white label setups on premise with banks.

Eating our own dog food

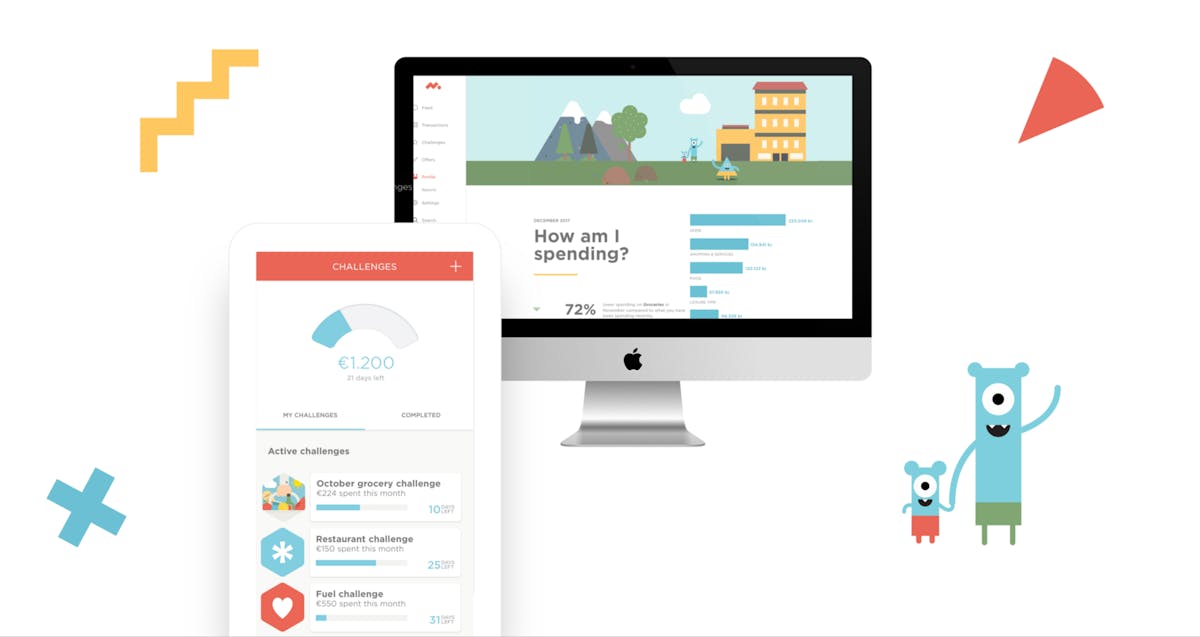

Our consumer app is connected to and integrated with the three major banks in Iceland. Developing and running the app has been our innovation vehicle and a way to learn directly what users want. We pass these lessons on to our bank customers around the world.

Since you made it all the way down here, I can assume you are deeply motivated to learn about what we have found out about transaction categorisation for bank accounts. And I can tell you that if you don’t have a strategy, you might as well save time and resources and keep your bank’s transactions as they are.

What are some good categorisation strategies?

I care about my customers and how they lead their financial lives

This is a good one. It aligns with our core vision. We believe that if you support people in spending money on things that matter and help them lead a healthy financial life, they will remain loyal customers.

I want to provide a better service based on data on actual user behavior

We also like this one. People are different. We have our personality traits, habits and needs. If you as a financial institution can provide me with financial advice or product recommendations when I am interested in such things, you are winning. Think Netflix for Banking.

I need more data in my data-lake

Not so sure about this one.

I want to build a loyalty program based on what people spend on

Can be done, but you should rather look into merchants and brands. More on that dimension later.

Common pitfalls of transaction categorisation

Now I want to share some of the common pitfalls and misconceptions about what constitutes a good categorisation experience.

I want 100% categorisation accuracy

This is a common request but can’t be done. Because … gifts … and supermarkets and life. Until we implement mind reading, I won’t know if that toaster is for you or a gift for your mother. It might be accurately categorised as ´Appliances´ and most people might be happy with that. But for someone that is motivated to track their spending. Gifts might be more appropriate. Most people are happy with ´Groceries´ or ´Supermarkets´ for transactions at Tesco or Costco. But I might have been buying clothes. I might even be in the 5% of highly motivated people that split their spending into multiple categories based on what I purchase.

Based on the projects we have done, we see that for an initial pass we can get around 75% accuracy and going beyond 85% by learning from community interaction.

I want 100% categorisation coverage

This is simple. We have a category titled ´Uncategorised´.

It is great for ATM withdrawals and transfers to people. As we have seen in our own app, this can be used as a prompt for people to aim for an inbox zero type of experience.

People should not be able to change categories

So wrong. People are different, and life is complicated. But if you give me a report of my spending, I should be able to make it right for myself. Again with the gift example. Clothing could be for me, my children or someone else. These can be different buckets for reporting on clothing spend. I might also spend on fine dining at a fancy restaurant. Next week I’m back but I will be reimbursed by my employer because I’m entertaining clients. I certainly don’t want that contributing to my own spending reports.

We should only detect one category for each transaction

Nope. Amazon!

Also, is a takeaway sushi place with AL-fresco dining classified as ´Restaurants´ or ´Fast food´?

Meniga returns up to 5 recommended categores for each transaction. The top runner is selected, but we also surface the other relevant categories to simplify the re-categorisation process for people.

I only want 12 categories (because that is what the challenger banks have)

We beg to differ. We have 11 parent categories but around 140 categories in total. It is harder to implement a good engine with high accuracy for this granularity and a challenge to simplify the UX for end users. This is something we have focused on and for instance a user only sees the recommended 3–5 categories as a first impression when changing a category. Then they might choose to pick a different category from the full tree. This is only required on rare occasions.

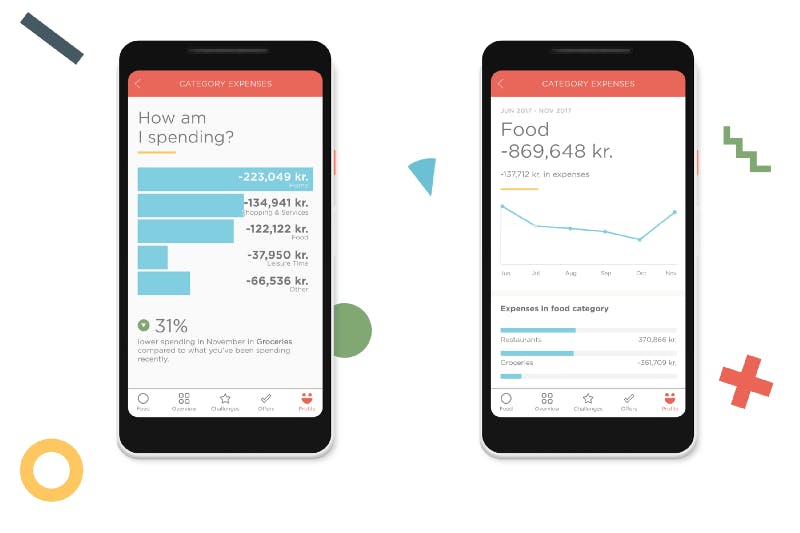

But when it comes to insight, setting spending challenges and building engagement. Only having one category for food just doesn’t cut it. We break it up into groceries, fast food, restaurants, cafés, kiosks and ice cream shops (it’s a thing in Iceland). These are all vastly different when it comes to having an impact on your spending habits.

Once I implement the engine, I’m good

Wrong again. You are constantly seeing new merchants and even merchants that go from selling kebab to cutting hair.

This transaction should have the same category for everyone.

Not true. Again, with personalisation. It is such an important theme when designing for engagement. I might only buy ´Books´ from Amazon but you might mostly buy ´Clothes´. I might only buy ´Fast food´ at a petrol station but you buy ´Fuel´. This is where the recommendation engine and the personal preference comes in. If I as a user have to change the category of my purchases every time, I will give up. But if the system learns my preference and remembers, it has a much better chance of winning me over and keeping me engaged in the long run.

Categorisation lives in a vacuum

To drive engagement, you have to provide value for my actions. Insight and reports into spending should be the minimum return for me engaging in the process. For every update I do, I’m improving the quality of the reports and personalising the app for me.