In our latest Webinar episode, we had a very compelling talk between Ricardo and Georg discussing the role and responsibility of digital banks to help customers in challenging times for Meniga’s virtual sitdown.

Digital Banking during the pandemic and what to expect in 2021

Moderator Bragi Fjalldal (CMO and VP of Business Development) set the stage by highlighting the fact that the pandemic had, without a question, shifted digital banking innovation priorities. However, the real question is in which direction are they shifting towards.

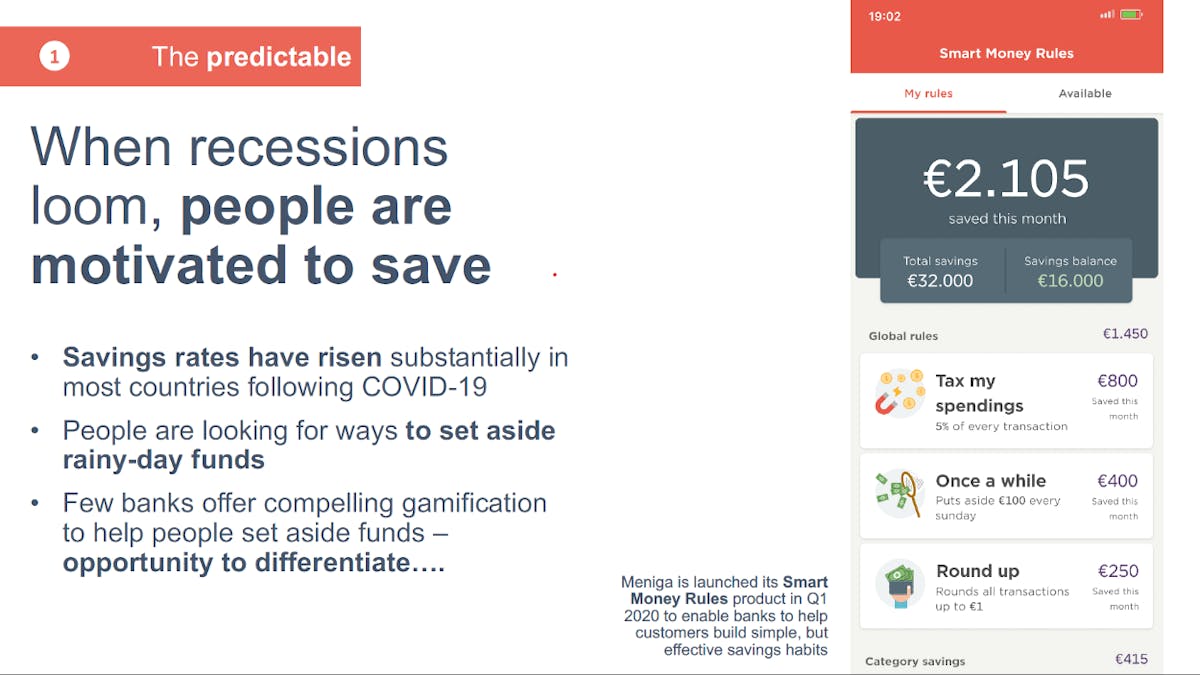

According to Fjalldal, the predictable response would be that digital innovation will be focused on helping people to save. The reminder of hard times actually motivates people to save as soon which means digital banks need to provide simple, easy, and gamified ways to help people set aside funds.

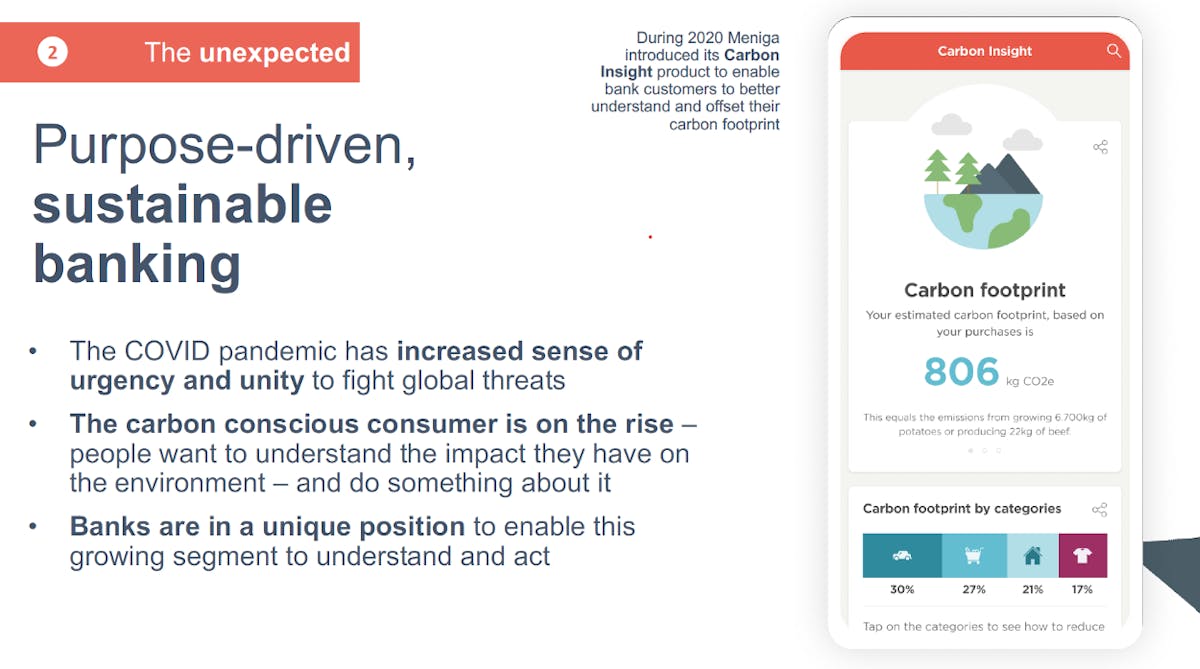

The unexpected shift is that banks are striving to meet the needs of their carbon-conscious consumer….a segment that has increased in the onset of COVID-19. The pandemic has increased the sense of urgency and unity to fight global threats and people want to understand the impact they have on the environment.

Opening up to the panel, Fjalldal leads the discussion on the future of digital banking, motivations behind priority shifts, and how it will actualize for the end consumer.

Key Takeaways

Here are some of the highlights and key takeaways from Ricardo and Georg:

- The fundamental message to banks is that in order to stay relevant to their customers, they need to evolve their digital banks beyond just transactional basics to be a personalised financial coach.

- Not all PFM are created equal, it is a broad term that can mean a lot of things. Ensure your PFM has the potential to make a meaningful impact on the end-user.

- The quality of enriched data is very important as you can’t have functionality without having accurate data.

- Prioritize digital investments that have a relevant impact on customer experience or the capacity to serve customers remotely.

- The first step should always be to look into the needs of your customers and evaluate use cases before investing in infrastructure.

You can watch the full episode below:

Stay tuned for upcoming Webinars where will continue to discuss and explore the latest & greatest in digital banking.