Banks are quickly finding themselves in a “functionality-race” with each other i.e. who can go to market with the newest set of features and who can do it fastest. What is often under-looked is the architecture that sits behind it and the associated tech debt that is being created. As a result, infrastructure costs can rapidly start to spiral as you create too many interdependent systems or processes while striving to remain competitive.

To mitigate these challenges, banks find themselves compelled to explore cost-cutting measures. According to The State of Digital Transformation 2023 report by Capgemini, on average, organisations have to cut costs by 10-20% to ensure the sustainability of their digital transformation initiatives.

In this article, we explore four technology trends for Personal Finance Management and digital banking which will become a must for any new technology, along with the benefits they can achieve.

1. Portability: Portability refers to the ability to move software applications and data seamlessly between different environments, such as on-premises and cloud. With open-source tools, financial institutions can shift their data without worrying about compatibility issues. This is important because it allows companies to build upon a foundation that is flexible and adaptable to any external changes in technology. Without portability, financial institutions risk getting left behind with outdated frameworks that do not integrate well with new technologies.

2. Accessibility: Having a fully accessible agile infrastructure is crucial for financial institutions to power their digital ecosystems. This means setting up real-time data delivery properly to enable quick and accurate decision-making. It allows banks to be proactive when serving their customers with data but also for identifying trends, patterns, risks or even opportunities

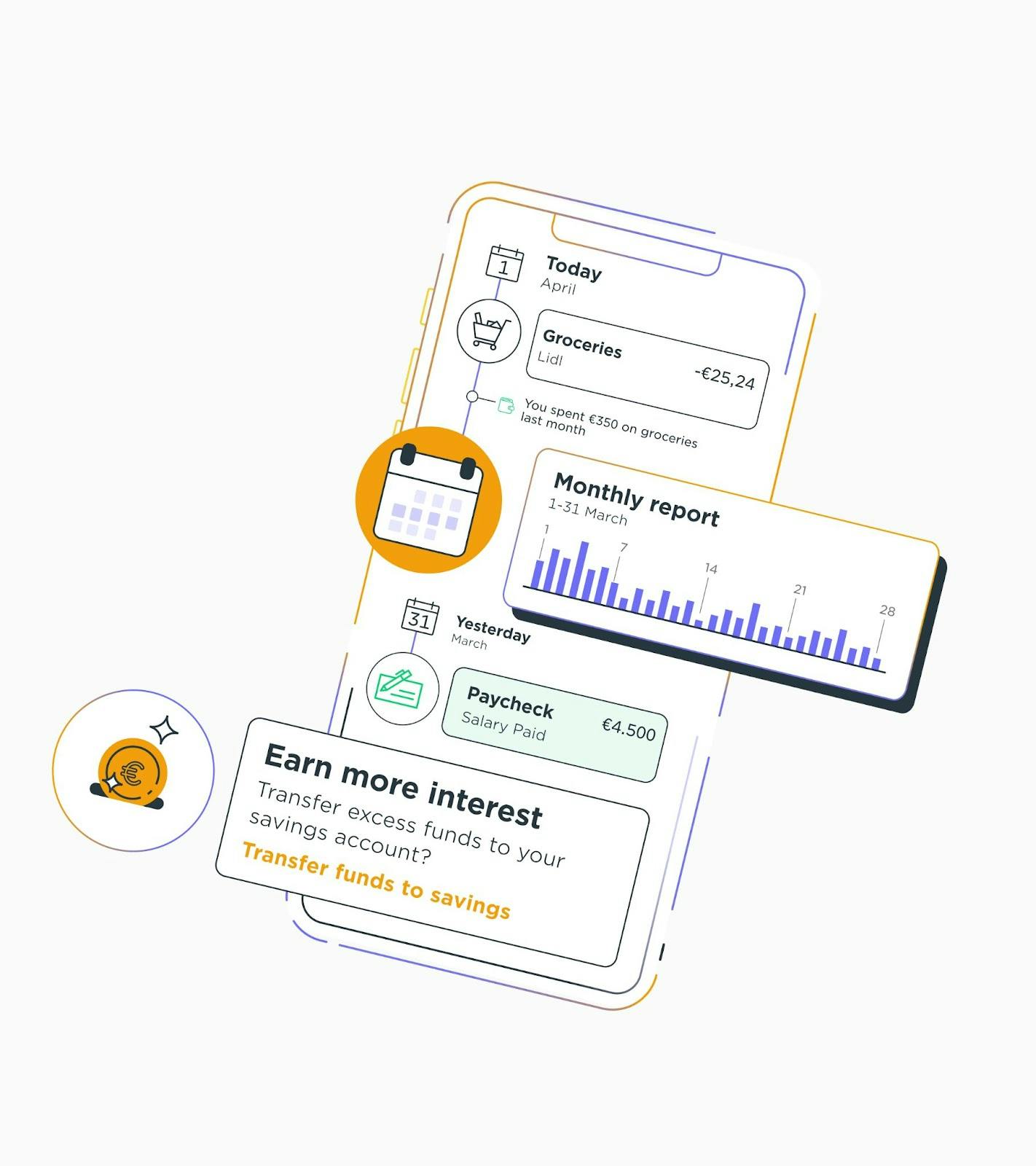

When it comes to PFM, customers want to get their transactions and insights in real-time so that they can quickly adapt their behaviour to improve their financial wellness. E.g. If a customer initiates a new transaction which would take them into overdraft, the bank can notify them in real-time so that they can avoid unnecessary fees.

3. Observability: Observability is the ability to see everything that is happening in a system and being able to control it. Identifying problems in a timely manner and managing available resources before customers become aware of them is crucial for financial institutions. This helps to optimise their infrastructure and ensure that it is running at peak performance. By being able to see how much of your hardware is being used at a particular place, you can allocate them correctly.

4. Micro-Service Fluency: Micro-Service Fluency means solving problems with an efficient, scalable, and flexible infrastructure. The importance of delivering services quickly and efficiently is essential for financial institutions to adapt to changing customer needs and market conditions. With a modular architecture, companies can easily separate their services into smaller, more manageable components, making it easier to implement solutions that can adapt to changing customer needs and market conditions.

When it comes to PFM, we make sure to separate the monolith approach taken by others so that our partners can consume only the relevant services, directly linked to the outcomes they want to achieve for themselves and their customers. For example, delivering Carbon Insight as a standalone solution means banks do not need to consume other PFM features, but instead can focus on this sustainability use case to improve climate consciousness for customers, promote eco-friendly banking products and create a measurable impact in climate change.

At Meniga, we understand the importance of modernising IT infrastructure, which is why we have upgraded our technology to help optimise the operation of existing or future technology stack with our latest software version. These major changes to our technical architecture come with a new cloud-native approach and our set of micro-services will solve your unique business challenges.

1. Cost Reduction: Modern modular architecture allows for better resource allocation, enabling financial institutions to reduce run costs. With a modular architecture, companies can easily separate their services into smaller, more manageable components, which reduces the complexity of the infrastructure and reduces costs by 20%.

2. Cost Avoidance: Adopting compartmentalised services and allocating resources properly can help reduce the future compliance costs by up to 10%, and security costs by up to 20%. A modular architecture enables financial institutions to upgrade specific components of the system without affecting the entire infrastructure, reducing the overall cost of one-off upgrades.

3. Non-Financial Benefits: Speed to Market and Real-Time Monitoring are essential for financial institutions to develop and deploy new features faster. By having a modular architecture, companies can take advantage of new technologies and enhancements easily by deploying new features and providing a more agile and flexible platform, which can help increase their speed to market by up to 30%.

By embracing the latest technology advancements such as .NET 6 and Kafka, organisations can unlock a world of possibilities for modernising their digital banking architecture. These enhancements enable seamless integration of new features into a modular architecture while adopting a cloud-first and cloud-agnostic approach, ensuring standardised data integration.

With the ability to support multiple operating systems and leverage tools like Prometheus and Jaeger for event and metric monitoring, organisations can achieve heightened scalability, efficiency, and agility.

At Meniga, we are dedicated to empowering our clients with solutions that not only transform digital banking systems but also outperform competitors, enabling clients to stay ahead in the dynamic FinTech industry.

Ready to revolutionise your digital banking architecture and surpass your competition? Contact Meniga to explore how our scalable, efficient, and agile solutions can propel your organisation towards success in the rapidly evolving world of FinTech.