Isabel Moratiel and Michal Bezak from Meniga presented at the DIA Munich 2018 conference and demonstrated how insurance companies can take advantage of the many opportunities open banking present to them.

The conference took place on the 17th and 18th of October and, it was attended by some 1,200 decision makers in the insurance industry.

More customer choice for financical management

European PSD2 regulations require financial institutions to make bank accounts data and payment initiation accessible for third parties. The purpose of the regulation is to give customers more choice for financial management and payments.

Contextual engagement with online customers

This enables insurance companies to engage better with customers online. For example, it is now easier for insurance companies to present their services just when their current or potential customers need them the most. Isabel and Michal demonstrated how this can be done with Meniga´s Financial Coach app.

Smart insights and notifications guide the user. Depending on user consent, the Meniga Financial Life Coach collects, aggregates and categorises all transactions from bank and credit card accounts owned by the customer. The app uses this data to help the user manage her finances and gain healthy financial habits. This is especially useful in major life events, for example when buying the first house or welcoming a child into the world. Smart insights and notifications are used to guide the user along the way.

Insurers can tap into these moments and place personalised and relevant offers to customers.

Comparing yourself with peers

Isabel and Michal demoed an example where a user would be informed that he is spending more on house insurance on average than her peer group. She can click further to explore all related payments in one place. This user scenario gives insurers an opportunity to engage with the the customer in a meaningful way. Another example is how the app can help users avoid late payment of insurance fees.

In conclusion, Isabel and Michal talked about how Meniga has worked with individuals who are financially challenged. It is after all our vision to help people lead better financial lives.

Learning from the users

While Meniga primarily provides white label Fintech solutions to banks around the world we have been running and developing the public Meniga web site and app in our home country of Iceland for the past decade. This has taught us a great deal about what works and does not work when dealing with users of financial apps. For example, to maximise engagement, the activity feed brings a similar experience to the one people are used to see in social media.

Inspired by health apps

We have developed our user experience around the concept of financial fitness. Among other things we have been inspired by health apps such as Fitbit and Strava.

Challenges met

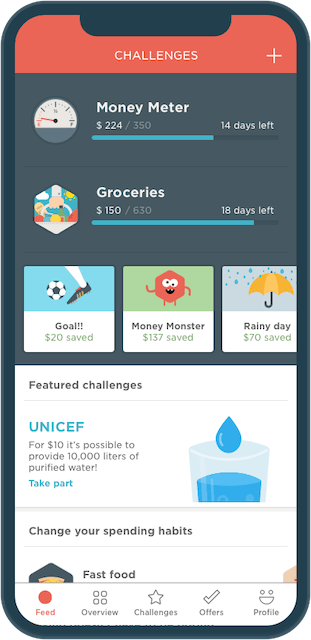

An example of how we engage and inspire our users in our home market of Iceland are the Meniga Challenges. This functionality enables us to motivate people with different personality traits and financial habits. Big spenders can be challenged to save more for example. The app keeps track of progress. We have found out that about 50% of monthly active users has accepted one or more financial challenge. Financial behavior can be changed, and positive habits formed over time without much effort from the users. This is a valuable lesson for the financial and insurance companies which want to gain competitive advantage through the adoption of Fintech.

More information on www.meniga.com