“We’re increasing the richness of our users’ lives through their transactions,” says Finnur Magnússon, Meniga´s VP of Product in a new´Spotlight´ interview with Financial Intelligence.

In a recent interview with Financial Intelligence, Meniga´s VP of Product Finnur Magnússon, shared insights on Meniga’s Richest Transactions innovation. The innovation is designed take something simple as clicking on a transaction to inspire banks to branch out from the familiar digital banking customer experience and introduce services such as restaurant recommendations.

Read the full interview here.

“Categorising a user’s previous spending has almost become a hygiene factor for modern PFM apps. Our goal was to have banks interact with users at an earlier stage of their transactions.

The answer was transactional data that was so rich, it would become another element of the user’s lifestyle choices.”

A decade in the making

The interview covers how Meniga is leveraging open banking to transform Personal Finance Management (PFM) apps so they match services and user interfaces offered by e-commerce leaders. Meniga has been working on developing the Richest Transactions in banking apps since our founding in 2009. This is done by aggregating and consolidating 3rd party transactional data which is made available by Open Banking and crunch it by the latest AI.

Creating an explosive of engagement in banking apps

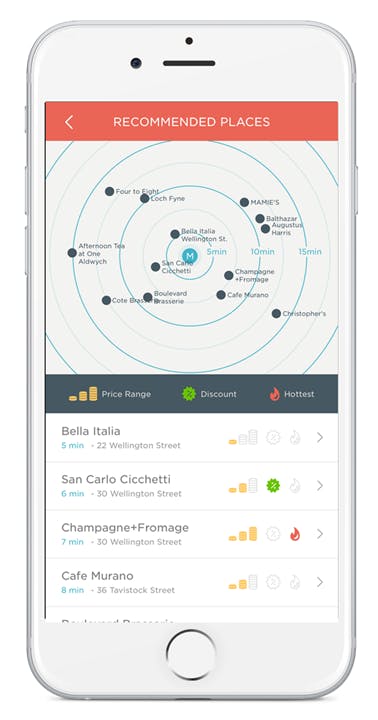

One user story this enables, for example, would be a person exploring a previous transaction from a restaurant in her banking app. She can explore recommended restaurants by price range, available discounts and even user ratings. As is stated in the interview, adding insights to transactions created an explosion of engagement. Clicks on transactions increased from 3% to 45% in Nordics after insights were added. This provides an important insight for banks which are looking for ways to optimise engagement rates in their apps.

Constantly evolving platform built for customers

Finance Intelligence identifies the strength of the Meniga platform being that it uses machine learning to constantly evolve to be more accurate in its recommendations.

Unique offer for banks

Finnur explains in conclusion: “What makes our offer unique is the infrastructure of our platform. It has been built for the customer and as such, banks are formatting their data to fit our platform and not the other way round. This creates better harmony between the different data sources we’re pulling from and therefore, identifying much more relevant trends.”

This it precisely what make transactions shine!

More information is on www.meniga.com

About Financial Intelligence

Financial Intelligence provides fund and wealth managers, traders, insurers, analysts, and investment and retail bankers with the intelligent advantage to make informed decisions, understand past trends, forecast future performance, drive profitability, and increase returns.