Personetics is a well-known name for banks and FinTechs looking to deliver personalised financial experiences.

However, the market has grown considerably, and a number of innovative players are now offering compelling alternatives, each with unique capabilities.

Whether you’re evaluating new solutions, planning a digital transformation, or simply exploring what’s next in digital banking, our 10 Personetics alternatives should provide a great starting point to discover a solution that fits your needs better.

Let’s dive in!

10 Personetics alternatives you should know about

Here’s a quick breakdown of our top picks.

| Platform | Core Focus | AI & Insights | Data Enrichment |

| Meniga | Advanced Data Enrichment & categorisation, AI-powered insights, neobank-grade user experiences | ML-driven Categorisation, Hyper-Personalised Insights, Customer Intelligence, and Cashflow Forecasting | Impressive categorisation accuracy, fully localised and customisable for banks worldwide. |

| MX | Data enrichment & visualisation | Transaction AI + cash flow predictions | Deep transaction enrichment engine |

| Dimply | Financial wellbeing platform | Behavioural segmentation & insights | Spend categorisation, behavioural models |

| FinGoal | Lifestyle-based transaction AI | Lifestyle event detection & segmentation | Context-aware, lifestyle tagging |

| DeepTarget | AI-powered digital marketing | Predictive engagement AI (Andi™) | CRM-based, limited financial tagging |

| Array | Embedded fintech & credit tools | Credit & debt behaviour analytics | Credit file enrichment & ID insights |

| Tapix | Transaction data enrichment | 99.99% accurate merchant & category AI | Best-in-class enrichment, 4-layer AI |

| Bud Financial | Generative AI & finance data | Bud.ai LLMs, Insights Engine | Enrichment engine w/ merchant DB |

| Strands | PFM & BFM for banks | ML-based insight & segmentation | AI categorisation, merchant tagging |

| Moneythor | Digital personalisation & gamified UX | AI + behavioural science nudges | Transaction enrichment, tagging |

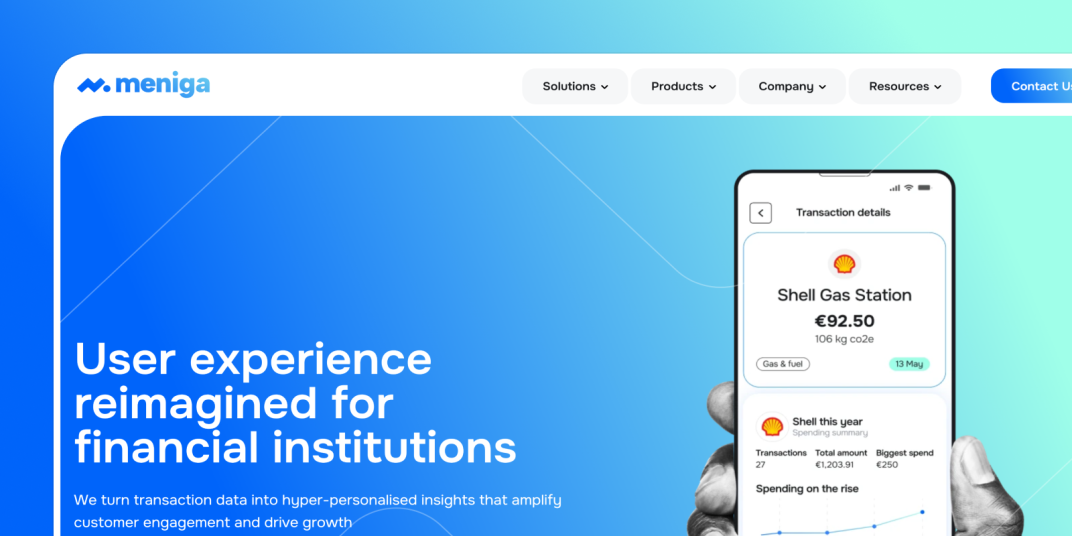

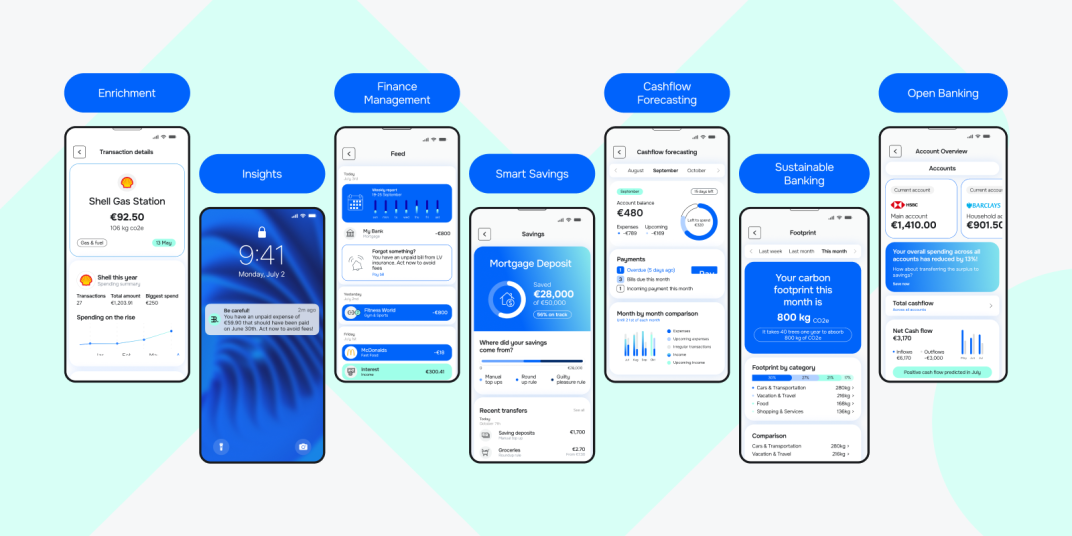

1. Meniga

Meniga provides digital banking solutions and enables large financial institutions to transform their online and mobile digital environments with minimal investment.

Our solutions are flexible and scalable and integrate seamlessly with existing systems. As a result, you can upgrade and modernise the digital environment regardless of the underlying architecture.

Key features:

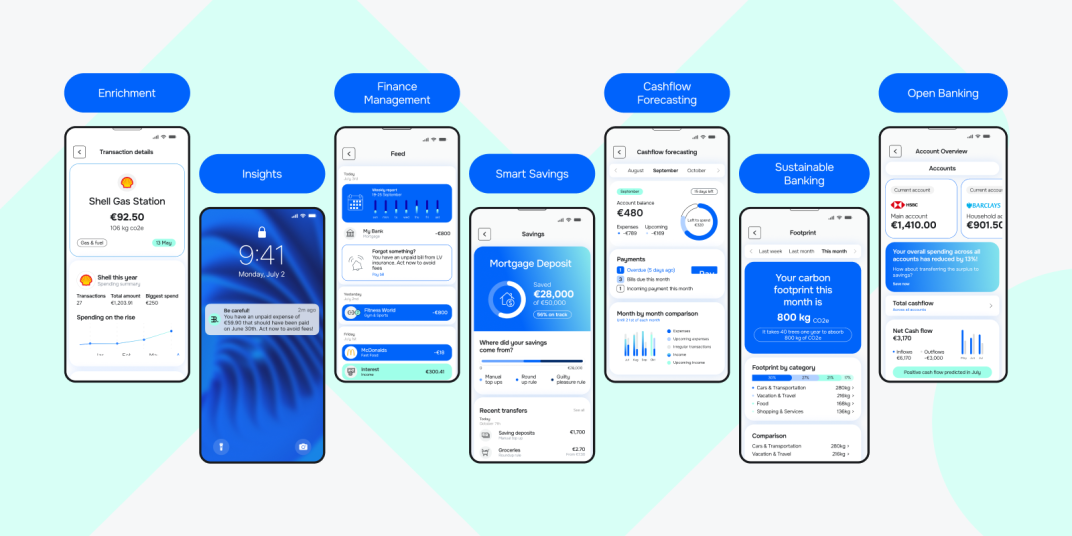

1. Data consolidation and enrichment

Our Enrichment engine solves a common problem of scattered, late, or inaccessible data, which leads to missed opportunities for innovation or a better customer experience.

We consolidate and enrich data from any source, including open banking, and then enhance and categorise that data with merchant logos, subscription information, etc.

As a result, you get a 360-degree view of your customers’ spending habits and finances, enabling you to provide custom and tailored solutions and products.

Our enrichment features help you:

-

Categorise all expense and income transactions with great accuracy.

-

Integrate with any existing category tree or use Meniga’s fully localised one.

-

Best of all, the intelligent categorisation learns from users and community contributions, so it becomes more powerful with time.

2. Insights Platform

Unfortunately, established banks lag behind market standards in delivering personalised services, losing out on opportunities for meaningful engagement and revenue.

Our AI-powered platformempowers you to build:

Therefore, it allows you to create, manage, and deliver hyper-personalised insights to customers in real time, and go beyond generic notifications.

Instead, you can reach the right customer at the right time and in the right context.

3. Cashflow Forecasting module

AI-powered Cashflow Assistanthelps your customers understand their balance history and projects future cash flow, improving financial literacy and management.

In addition to building awareness on recurring income and expenses, it can help customers avoid unnecessary fees associated with overdrafts and unpaid expenses with helpful and timely warnings.

Based on the current liquidity status and upcoming transactions, the Assistant alerts customers when finances are likely to run dangerously low and advises on whether they should save or spend.

Meniga: key takeaways

Overall, Meniga provides solutions that:

-

Modernise outdated legacy systems.

-

Close the gap between you and neobanks with out-of-the-box financial wellness modules to introduce engaging digital banking experiences.

-

Provide tailored and hyper-personalised solutions and products for your customer base.

-

Create and maintain sustainable revenue growth through targeted digital sales, deposit growth, etc.

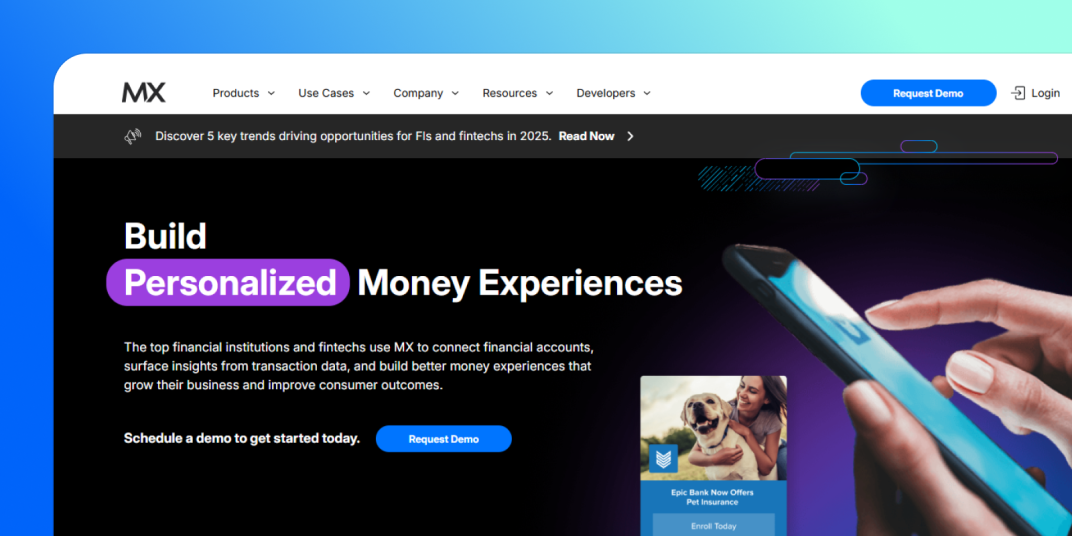

2. MX

MX is a fintech company specialising in financial data connectivity, enhancement, and personalised money experience solutions for financial institutions and fintechs.

It focuses on improving customer financial health through clear, visual insights.

Key features:

-

Financial data connectivity — Provides account aggregation and instant account verification services, enabling seamless linking and verification of financial accounts across banks, credit unions, payment providers, and fintech apps.

-

Data enhancement and insights — Enriches raw financial data by cleansing, categorising, and adding context. AI-powered analytics provides personalised financial insights such as spending patterns, savings opportunities, duplicate payment tracking, etc.

-

Customer analytics — Combines enhanced transaction data with AI and machine learning to identify cross-sell opportunities, predict churn, and optimise marketing ROI for financial institutions.

-

Loan origination and processing— MX provides lenders with real-time insights and additional sources of information on borrowers’ financial behaviour, helping them create more relevant offers while minimising risk.

3. Dimply

Dimply is a customer experience platform tailored specifically for financial services.

It provides solutions to enhance customer engagement through personalised experiences and effective data utilisation.

Key features:

-

Customisation capabilities — Choose from over 100+ existing features, such as Insights, reports, mission, challenges, content, tools, or quizzes and personalise it to resonate with your audience.

-

Intelligence API — Utilises AI and machine learning to deliver personalised financial insights. It allows for audience segmentation based on factors like financial health and literacy levels.

-

Engagement tools — Engage and connect with customers through notifications, engaging content and gamification.

-

Drag-and-drop interface — Facilitates the creation of custom user experiences without coding expertise. It enables you to build digital and automated journeys in Dimply’s flow builder for mobile and web.

4. FinGoal

FinGoal provides personalised financial insights and data analytics solutions for financial institutions.

It helps financial institutions transform raw transaction data into actionable intelligence.

Key features:

-

Insight platform — Overlays digital banking and financial data to generate detailed user personas. By analysing transaction behaviours, it identifies life events and financial patterns so that you can create calls-to-action tailored to individual users.

-

Transaction enrichment — Transforms raw transaction data into actionable insights through categorisation and tagging. It offers over 750 categories.

-

Account aggregation and verification — FinGoal verifies and connects your users' off-bank data to the digital banking core for a 360 view of all accounts.

-

Personalised next best actions —FinGoal analyses user spending patterns to suggest the next best action that perfectly aligns with each user's needs and current situation.

5. DeepTarget

DeepTarget is a specialised digital marketing software for financial institutions, including banks and credit unions.

It helps financial organisations:

-

Increase loan demand,

-

Promote product adoption, and

-

Deepen customer engagement through personalised, targeted communications across multiple digital channels such as online banking, mobile banking, web, and email marketing.

Key features:

-

Digital Experience Platform (DXP) — Integrates data sources and uses AI and machine learning to deliver highly personalised, real-time marketing messages and product offers.

-

3D StoryTeller™ — Creates discoverable, AI-powered financial stories that match targeted offers and financial wellness information to customers based on their specific financial life stages.

-

Data mining and business intelligence — Leverage extensive customer data, such as demographics, credit ratings, financial products held, and transaction behaviour, to generate personalised offers and communications for increased CTR.

-

Online banking — Provides an intelligent marketing and sales platform so you can use the same campaign on multiple channels and automate it, get business analytics insights, etc.

6. Array

Array is an embedded fintech platform that specialises in helping financial institutions, fintechs, and digital brands launch consumer-focused financial products quickly.

It focuses on driving revenue and engagement through tailored financial tools.

Key features:

-

My Credit Manager — Provides users with real-time access to their credit scores and reports from major bureaus. This tool encourages users to engage with their credit health regularly.

-

Offers Engine — Leveraging data from My Credit Manager, the tool delivers personalised financial product recommendations, such as credit cards, pre-approved loans, and investment accounts.

-

BuildCredit Loan — Enables users to establish or improve their credit scores by reporting on-time payments to credit bureaus.

Identity protect — A white-label identity protection tool that helps users monitor for potential fraud and safeguard their personal information. It includes features like credit monitoring, dark web scanning, and alerts for suspicious activity.

7. Tapix

Tapix is a payment data enrichment API that helps banks and financial institutions transform raw payment data into actionable insights.

It aims to improve customer engagement, reduce disputes, and build smarter financial products.

Key features:

-

Transaction data enrichment — Provides accurate recognition of merchant names, logos, GPS location, business category, Google Place ID, website URL, and verified contact phone numbers for a deeper understanding of customers.

-

Categorisation — Assignment of transactions to specific categories to provide users with clear spending insights.

-

Store-Level Details — Granular information down to the specific store level for more in-depth data analysis.

-

Customised solutions — You can build tailored financial tools and apps on top of enriched data sets via a cloud-based REST API.

8. Bud Financial

Bud Finacial is an AI-powered data intelligence platform that enables financial institutions to deliver hyper-personalised digital banking experiences.

It offers innovative tools to transform raw transaction data into actionable insights.

Key features:

-

Transaction enrichment — Transforms customer transactional data into transactions with categorisation, identifying merchant details, transaction regularity, location, and spending habits.

-

Intelligent Search — Uses Bud's proprietary language models to understand and contextualise user queries and provide answers about transactions, spending habits, and financial behaviours.

-

Agentic AI banking capability — Autonomously manages personal finances and optimises savings, moves money between accounts, prevents overdraft fees, and helps users maximise interest earnings

-

Drive: AI-Powered Data Analytics and Marketing Suite — Uncovers real-time patterns within customer data, facilitating targeted marketing and tracking outcomes.

9. Strands

Strands is a global fintech specialising in AI-driven digital money management solutions for banks and financial institutions.

It combines machine learning, open banking, and open finance to enhance customer engagement and help you generate new revenue streams through digital channels.

Key features:

-

AI Copilot — Helps you enrich and analyse transactional data, leading to more accurate customer profiling and better customer retention with tailored financial solutions and real-time insights.

-

Strands Engager — Focuses on delivering personalised, actionable insights to users and recommends banking products aligned with user needs.

-

Strands Compass — Tailored for SMEs, it predicts future cashflow based on real-time data. It also streamlines the creation and tracking of invoices.

-

Strands PMF — Offers users a comprehensive view of their finances by aggregating data across multiple accounts. It includes budgeting tools, spending analysis, etc.

10. Moneythor

Moneythor is a personalisation engine for financial services, delivering highly data-driven and personalised experiences across all digital banking channels.

Its platform supports financial institutions in enhancing customer acquisition, activation, and engagement through real-time insights and tailored financial management tools.

Key features:

-

Advanced referral management — Facilitates standard, tiered, and agent/staff referrals to incentivise customer growth.

-

Gamified onboarding — Allow you to introduce challenges and rewards, such as real-time vouchers, gift cards, cashback, and points, to engage new users.

-

Automated contributions — Help users define savings objectives and automate contributions towards them.

-

Personalised nudges — Encourage positive financial behaviours through timely and relevant money management prompts.

Why should Meniga be your optimal Personetics alternative?

Trusted by over 30 leading financial institutions across 30+ countries and serving over 100 million customers, Meniga has a strong global footprint and a proven track record in boosting digital banking experiences.

We combine:

-

Comprehensive transaction enrichment to offer detailed spending insights and actionable advice.

-

Advanced AI-driven personalisation to segment customers based on unique spending habits, cash flow status, and financial goals.

-

Dynamic customer engagement to provide relevant financial insights and product suggestions tailored to customers’ changing life circumstances, and

-

A user-friendly, scalable platform to help you deliver highly contextualised financial advice.

Enticed to know more?

Contact us today to discover how to deepen customer relationships and drive digital growth.