The way people bank has fundamentally changed. Customers expect seamless, intuitive, and hyper-personalised experiences.

Yet many traditional banks are still operating with a mindset rooted only in physical branches and legacy systems.

At the same time, their digital counterparts are gaining a competitive advantage and moving faster.

To remain relevant and competitive, you need to do more than digitise existing services. You need to understand the full scope of digital banking.

Read on to learn about different types of digital banking so you can identify where the opportunities lie and how to modernise your bank accordingly.

What is digital banking?

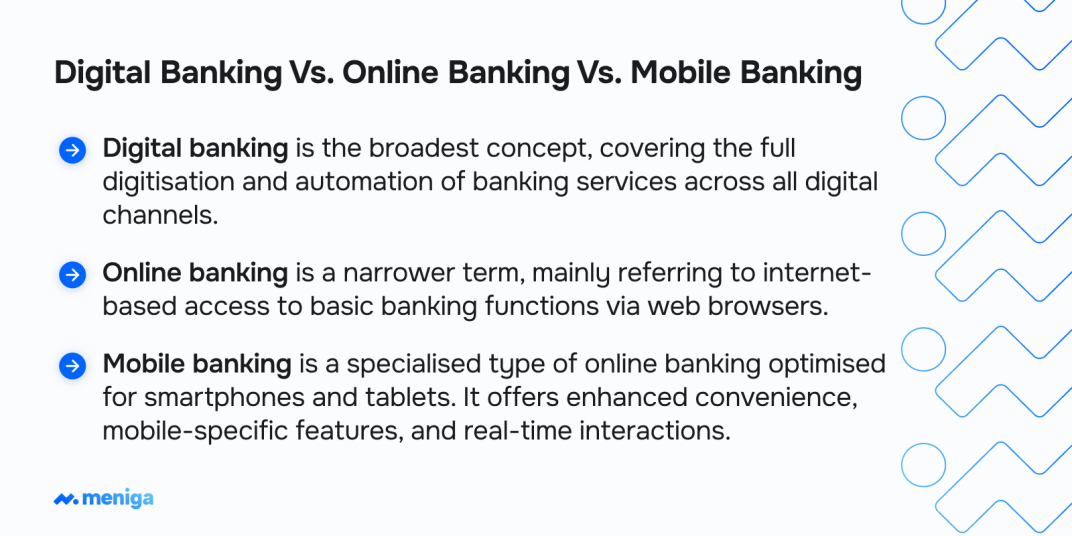

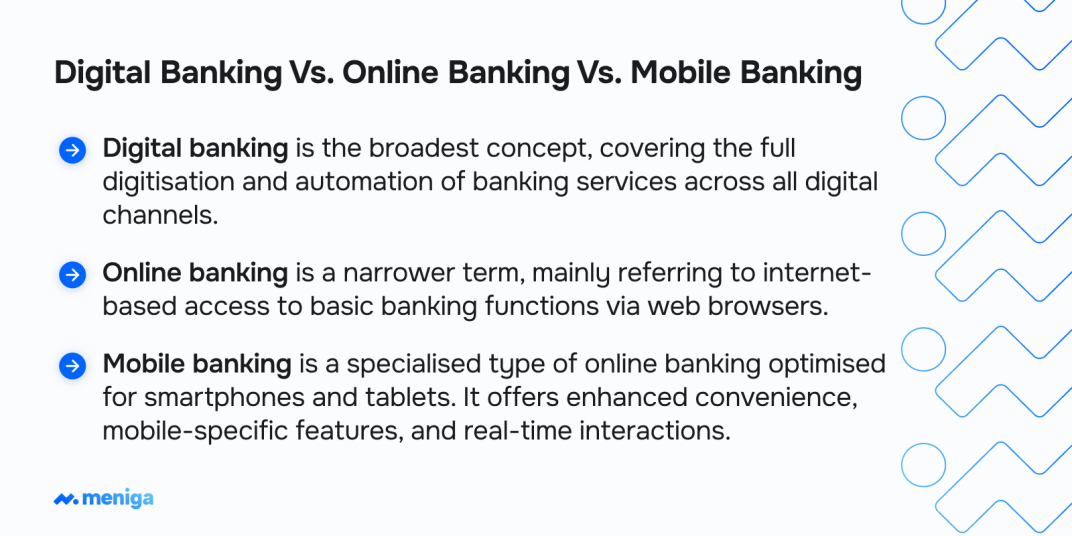

Digital banking is the delivery of banking products and services exclusively through digital channels, such as mobile apps, online platforms, and banking APIs, without the need for physical branch visits.

It leverages advanced technologies to provide seamless, real-time financial services to individuals and businesses, focusing on convenience, personalisation, and security.

Core services that digital banking provides include:

1. Account management

-

Opening and closing accounts online.

-

Real-time balance checks and transaction history.

-

Digital statements and notifications.

2. Payments and Transfers

-

Domestic and international money transfers.

-

Peer-to-peer (P2P) payments.

-

Bill payments and recurring payment setup.

-

Mobile wallet integration.

3. Lending and credit

-

Digital loan applications and approvals (personal, auto, mortgage, etc.)

-

Instant credit scoring and risk assessment using AI

-

Management of credit cards and lines of credit

4. Savings and investments

-

High-yield digital savings accounts.

-

Automated investment portfolios (robo-advisors).

-

Access to stocks, ETFs, cryptocurrencies, and other investment products.

5. Financial planning and analytics

-

Budgeting tools and expense tracking.

-

Personalised financial advice powered by AI.

-

Goal-based savings features.

6. Security and authentication

-

Biometric login (face and fingerprint recognition).

-

Real-time fraud detection and alerts.

-

Two-factor authentication and advanced encryption.

7. Additional services

-

Embedded digital banking finance: banking features within non-bank apps, such as eCommerce, ride-sharing, etc.

-

Banking-as-a-Service (BaaS): APIs for third-party fintech integration.

-

ESG and sustainable investment products.

4 types of digital banking you should know about

Here are the main types of digital banking services that deliver financial services without the traditional physical branch model.

| Type | Description | Key features & examples | Examples |

| Neobank | -

Digital-only banks operating entirely online, often without a full banking license. -

They partner with licensed banks to provide services. | | -

Revolut, -

Chime, -

N26, -

Monzo, -

Starling Bank |

| Challenger Bank | | | -

Aldermore, -

Secure Trust (UK), -

Co-operative Bank, -

TSB |

| New Bank | | | -

Revolut, -

Monzo, -

Starling Bank |

| Nonbank | | | |

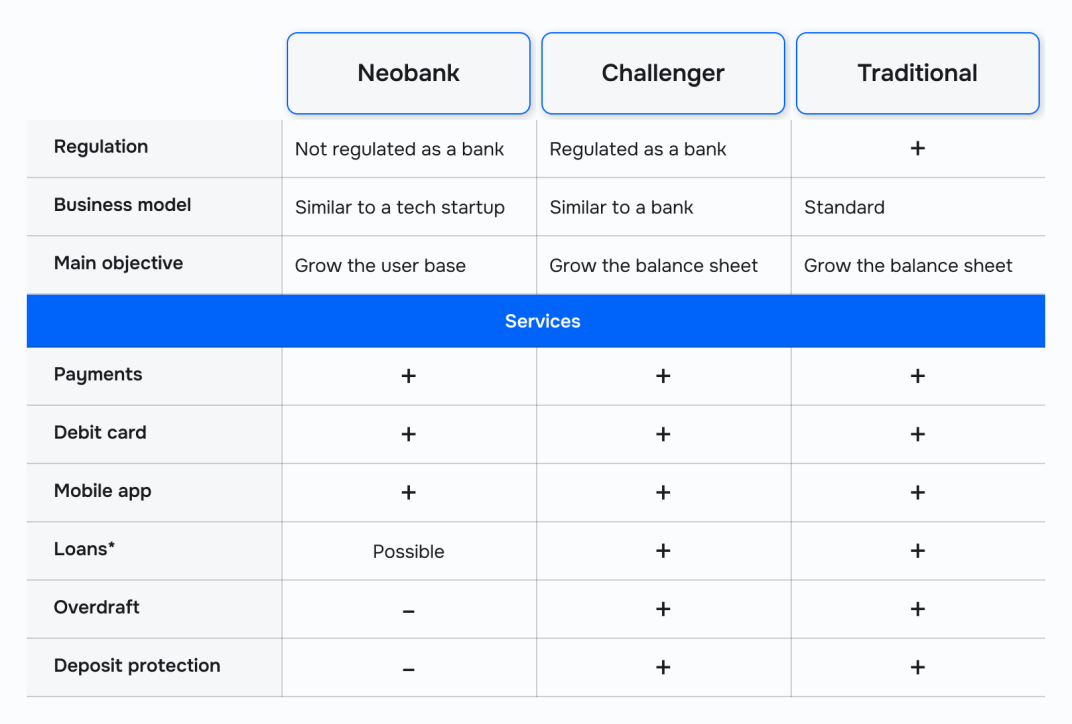

1. What are neobanks? Overview and characteristics

The neobank market is rapidly expanding and is expected to grow to $1,228.17 billion by 2029 at a compound annual growth rate (CAGR) of 47.1%.

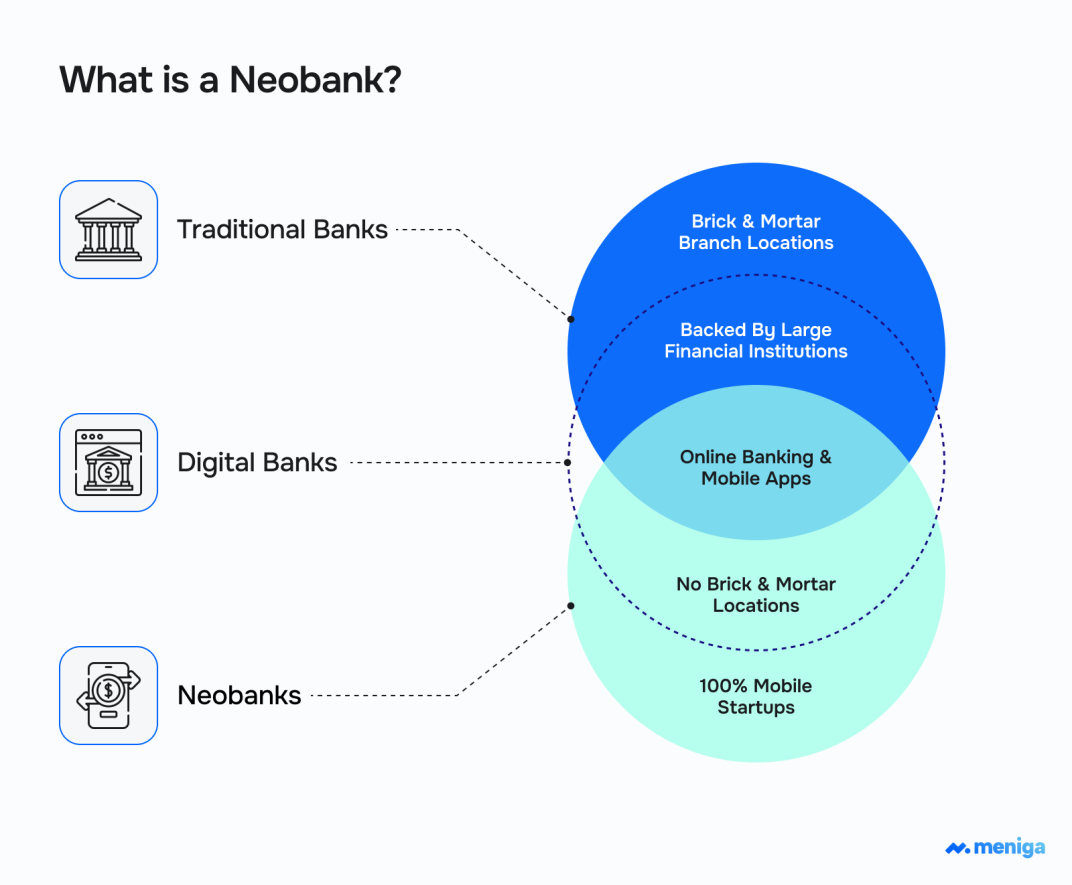

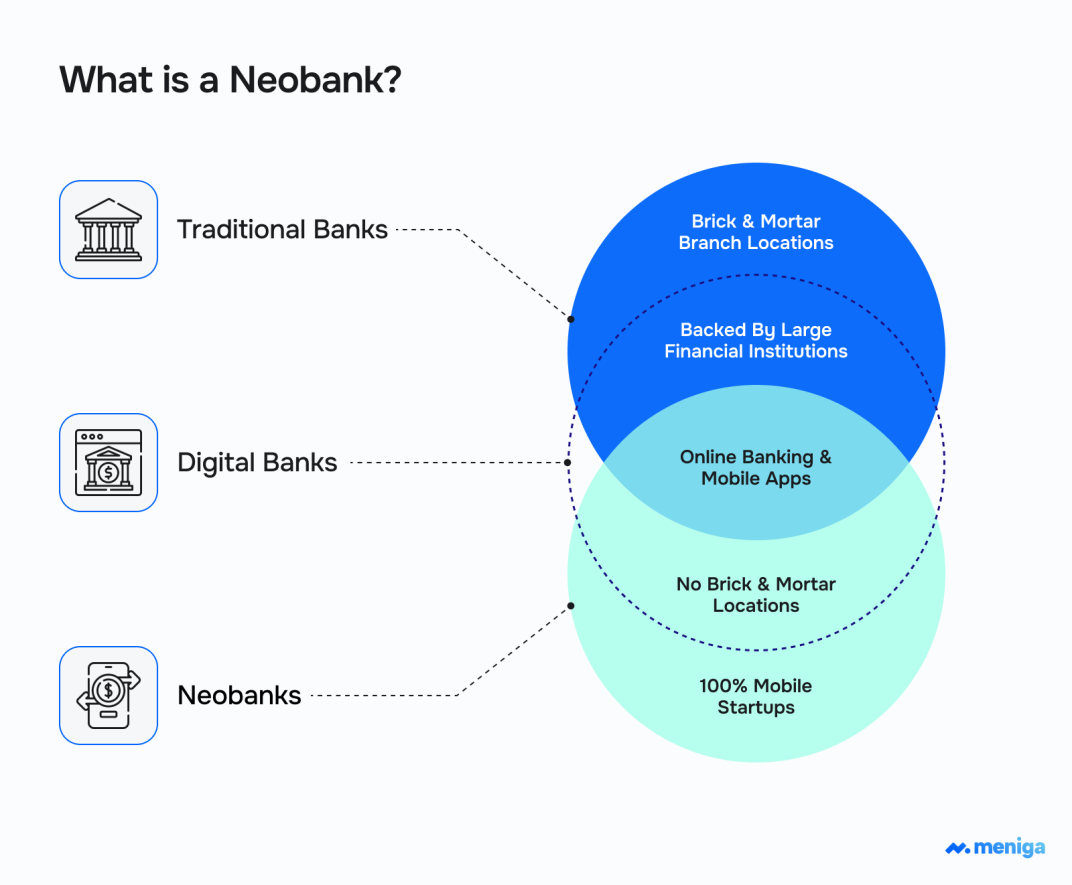

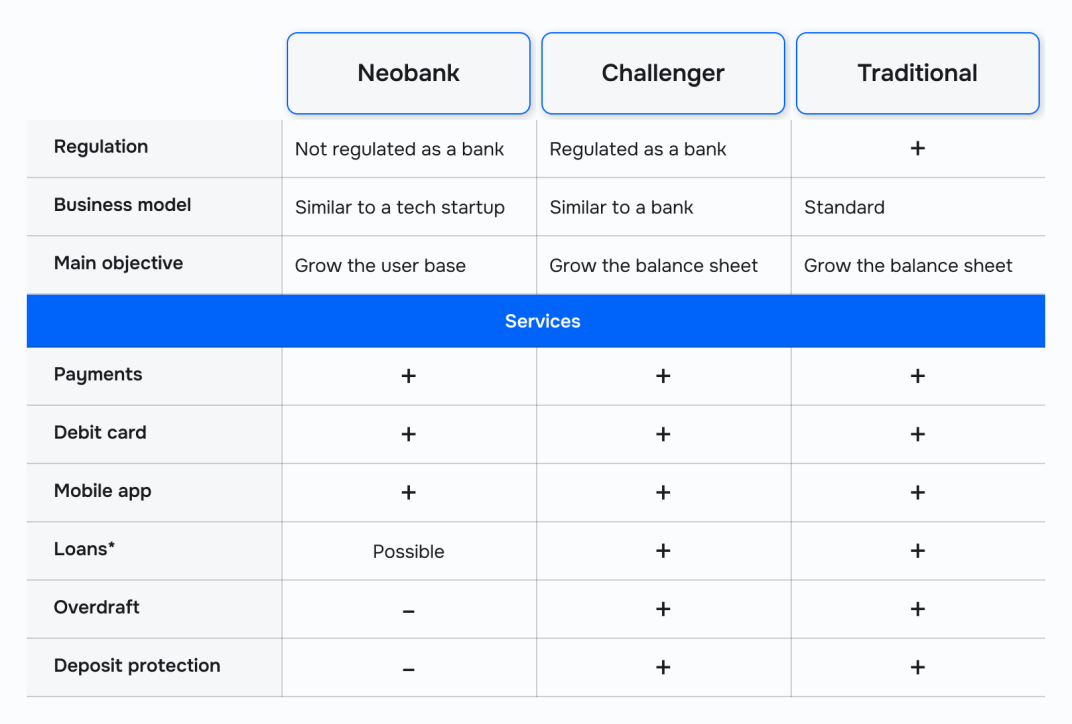

A neobank is a digital-only financial institution that operates exclusively through online platforms such as mobile apps and websites, without any physical branches.

They offer a range of banking services, including savings and checking accounts, debit cards, money transfers, bill payments, and often lending products such as personal loans or credit cards, all of which are accessible remotely.

Key characteristics:

-

Branchless model: They don’t have physical branches, which allows them to reduce overhead costs and offer lower fees and higher interest rates compared to traditional banks.

-

Mobile-first experience: Their core platform is an advanced, user-friendly mobile app that supports account opening, identity verification, deposits, transfers, payments, and real-time transaction monitoring.

-

Seamless onboarding: New customers can open accounts entirely digitally within minutes, including identity verification through biometric scans or photo IDs.

-

Innovative features: Neobanks provide spending analytics, budgeting tools, personalised financial insights, and instant peer-to-peer (P2P) and account-to-account (A2A) transfers.

-

Partnerships: Many neobanks collaborate with traditional banks to ensure regulatory compliance and deposit insurance, while focusing on delivering a digital customer experience.

-

Revenue models often rely on interchange fees, premium subscriptions, lending products, and interest on deposits to generate revenue.

Best for: eCommerce, freelancers, and remote-first companies.

Neobanks: Main advantages and challenges

Neobanks offer a compelling alternative to traditional banks, especially for tech-savvy users looking for convenience, lower costs, and innovative features.

But if you are wondering whether neobanks are safe, check our full article about the pros and cons of neobanks.

| Advantage | Disadvantage/Challenge |

| Lower fees and higher interest rates | Limited range of services |

| 24/7 digital access and convenience | No physical branches for support |

| Innovative, user-friendly features | Technology and outage risks |

| Financial inclusion for the underserved | Trust and security concerns |

| Rapid product innovation | Regulatory and compliance hurdles |

| Personalised experience via AI | Profitability and sustainability |

2. What are challenger banks? Overview and characteristics

A challenger bank is a digital-first bank that offers more agile, customer-centric, and technology-driven banking services than traditional banks.

Unlike legacy banks with extensive physical branch networks, challenger banks typically operate primarily or entirely online through mobile apps and web platforms, enabling faster, more convenient, and often more affordable banking experiences.

Key features:

-

Digital-native and agile: Challenger banks leverage modern fintech technologies to provide seamless user experiences, including instant notifications, integrated budgeting tools, and fee-free international transfers.

-

Lower fees and transparency: They often offer reduced or no fees on basic banking services, competitive interest rates, and transparent pricing models, appealing to cost-conscious customers.

-

Customer-centric: Challenger banks prioritise intuitive interfaces, rapid onboarding, personalised financial management tools, and innovative features tailored to specific customer segments such as freelancers, immigrants, or small businesses.

-

Regulated and licensed: Unlike some neobanks that may operate under partner banks, challenger banks usually hold full banking licenses and comply with regulatory standards similar to traditional banks, ensuring deposit protection and trust.

-

Market disruption: They challenge the dominance of established banks by embracing open banking regulations, such as PSD2 in the European Union.

Challenger banks have a few categories:

-

Digital-only banks: Fully online banking platforms without physical branches.

-

Specialist banks: Focus on niche lending or services with limited physical presence.

-

Mid-sized banks with blended models: Banks with some physical presence but challenger-like innovation.

-

Non-bank brands: Financial arms of large non-banking companies.

Best for: SMEs planning growth, Retail stores, restaurants, construction, and cash-intensive businesses (challenger banks with blended models).

Challenger banks: Main advantages and challenges

Despite their agile, customer-focused, and technology-driven services, challenger banks must continually innovate and evolve strategically to sustain their growth.

| Advantages | Challenges |

| Agile, digital-first customer experience | Profitability and customer retention pressure |

| Lower fees and transparent pricing | Market saturation and slowing growth. They must shift focus from customer acquisition to deepening relationships through new products and services. |

| Personalised, innovative financial tools | Competition from Big Tech, such as Apple and Google, entering financial services due to their vast resources and existing user bases |

| Full banking licenses and regulatory compliance | Regulatory complexity in global expansion |

| Rapid market penetration and brand growth | Limited physical presence and in-person support |

| Enhanced efficiency via AI and automation | Operational risks from technology dependence ( outages or cyberattacks can severely impact service availability and customer trust. |

| Opportunities in embedded finance | Must evolve beyond basic banking services to become platforms offering embedded finance and 3rd-party integrations, which requires strategic partnerships and technical capabilities. |

3. What are New Banks? Overview and characteristics

A New Bank is a fully licensed digital bank that operates entirely online, offering a complete range of banking services similar to traditional brick-and-mortar banks but without physical branches.

The key distinction of new banks is that they combine the full regulatory status and comprehensive product offerings of traditional banks with a fully digital mode of operation.

Key characteristics:

| Aspect | Description |

| Definition | Fully licensed banks operating entirely online without physical branches |

| Services | Full range of banking services: accounts, payments, loans, wealth management |

| Regulatory Status | Hold their own banking licenses, ensuring deposit protection and compliance |

| Technology Focus | Mobile-first, AI-driven personalisation, seamless onboarding, paperless transactions |

| Market Role | Combine traditional banking security with digital convenience and innovation |

1. Full banking license: Unlike some neobanks that rely on partner banks, new banks hold their own banking licenses, allowing them to offer various products, including deposits, loans, mortgages, and payment services.

2. Comprehensive service range: They provide all traditional banking services digitally: checking and savings accounts, digital payments, lending, wealth management, and more.

3. Digital-only operations: New banks operate exclusively through mobile apps and online platforms, eliminating the need for physical branches, which reduces costs and improves customer convenience.

4. Customer-centric and innovative: They emphasise user-friendly interfaces, fast onboarding, personalised financial tools, and the integration of AI-driven insights to enhance the customer experience.

Best for: Startups and tech-driven companies with international operations.

New Banks: Main advantages and challenges

New banks offer customers the best of traditional and digital banking, but not without challenges.

| Advantages | Challenges |

| Comprehensive digital banking services | Customer trust issues without physical branches |

| Lower costs enable competitive pricing | Technology dependence and cyber risks |

| 24/7 convenience and fast onboarding | Intense competition from incumbents and Big Tech, making customer acquisition and retention difficult. |

| AI-driven personalisation and financial tools | High customer acquisition costs and the need to continuously innovate put pressure on new banks to achieve sustainable profitability |

| Full regulatory compliance and deposit protection | Complex, costly regulatory compliance |

| Large and growing user base | New banks often rely heavily on small retail deposits and online distribution, which can increase vulnerability to rapid withdrawals or bank runs compared to more diversified traditional banks. |

4. What are nonbanks? Overview and characteristics

A nonbank or non-banking financial institution (NBFI) is a financial entity that provides banking-related services but doesn’t have a full banking license.

Also, it isn’t regulated as a traditional bank.

These institutions operate outside the conventional banking system yet play a significant role by offering services such as lending, investment, risk pooling, and payment facilitation.

Key characteristics:

-

No full banking license: Nonbanks can’t accept traditional demand deposits, such as checking accounts, but may accept other types of deposits or issue securities that act as deposit substitutes.

-

Diverse entities: Includes investment funds, insurance companies, pension funds, payday lenders, microloan organisations, currency exchanges, hedge funds, and finance companies.

-

Alternative financing: NBFIs offer alternatives to traditional bank financing, especially for underserved sectors or customers.

-

Regulatory frameworks: They are subject to different, often lighter, regulatory policies compared to banks, which can vary widely by jurisdiction.

Best for: Middle-market companies and SMEs, Investment and Wealth Management, and others.

Nonbanks: Main advantages and challenges

Nonbanks provide alternative, innovative financial services and expand access to credit.

However, their rapid growth and regulatory gaps pose significant challenges that require better oversight and risk management to ensure financial stability.

| Advantages | Challenges and risks |

| Alternative sources of credit and finance | Nonbanks often engage in leveraged activities and face liquidity mismatches, which can increase market shocks and contagion risks |

| Innovation and faster adaptation | Subject to less comprehensive and fragmented regulation compared to banks, leading to incomplete transparency and oversight. |

| Growing market share and diversification | Rely heavily on market-sensitive funding sources without access to central bank liquidity facilities. As a consequence, this exposes them to funding disruptions during periods of financial stress, increasing default risks. |

| Specialisation in niche markets | Often operate with thinner margins and higher industry risks than banks, facing challenges in maintaining stable earnings during economic uncertainties and rising credit risks. |

| Contribution to financial ecosystem diversity | Limited transparency and data for regulators |

| Complement traditional banks by financing | Increased interconnectedness with banks leading to contagion risks |

4 different types of digital banking: Which one should you adopt?

If you’re considering which type of digital banking to adopt, the decision depends on your bank’s strategic goals, existing capabilities, and market positioning.

| Digital banking type | Suitability for traditional banks | Key reasons |

| Neobank | Limited | |

| Challenger Bank | High | |

| New Bank | High | |

| Nonbank | Complementary | -

Specialised services -

Not full banking -

Good for partnerships |

However, regardless of the type of digital banking, it’s about adopting and implementing the following key strategies:

-

Modernise IT Infrastructure: Virtualise and migrate to hybrid cloud environments to enable faster innovation cycles and operational flexibility.

-

Elevate tech-business collaboration: Treat technology as a strategic partner, integrating AI, data analytics, and automation to enhance customer experiences and risk management.

-

Focus on customer-centric digital journeys: Implement seamless onboarding, personalised product bundling, and mobile-first interfaces to meet evolving customer expectations.

-

Pursue open innovation and partnerships: Collaborate with fintechs and digital-only banks to expand service offerings and reach underserved markets effectively.

-

Ensure regulatory compliance and security: Leverage existing compliance investments to build resilient, secure platforms aligned with regulations.

With Meniga, you can check all of the boxes above and modernise your banking system without starting from scratch or undergoing an overhaul.

How can you modernise your banking system with Meniga?

Meniga offers modular, API-driven digital banking solutions, allowing you to modernise your services efficiently and cost-effectively without overhauling your core systems.

Key benefits we bring to traditional banks:

1. Advanced transaction enrichment: Automatically categorises and cleans transaction data, transforming raw banking data into clear, actionable insights for customers.

2. AI-powered personalisation and Insights: Delivers tailored nudges, financial advice, and product recommendations based on individual spending patterns and behaviour. As a result, it boosts customer satisfaction, loyalty, and revenue through micro-targeted offers.

3. Automated savings and financial wellness: Our tools help your customers save more efficiently through flexible rules and gamified experiences.

Additionally, the Cashflow Forecasting tool provides customers with accurate projections of their available funds, taking into account current balances and upcoming transactions.

4. Open Banking and Compliance: We support PSD2 and open banking standards with secure, ready-to-integrate APIs, enabling seamless connection with 3rd-party services and compliance with regulations.

5. Modular and scalable architecture: Enables you to adopt new functionalities incrementally, reducing risk and cost while scaling digital capabilities as you see fit.

Interested to find out more?

Contact us today to learn how to modernise your banking and secure your competitive edge.